The Student Loan Delinquency Rate In The United States Has

Hit A Brand New Record High

http://theeconomiccollapseblog.com

http://albertpeia.com/studentdelinquents.htm

‘37 million Americans currently have

outstanding student loans, and the delinquency rate on those student loans has

now reached a level never seen before. According to a new report that was

just released by the U.S. Department of Education, 11 percent of all student loans are at

least 90 days delinquent. That is a brand new record high, and it is

almost double the rate of a decade ago. Total student loan debt exceeds a

trillion dollars, and it is now the second largest category of consumer debt

after home mortgages. The student loan debt bubble has been growing

particularly rapidly in recent years. According to the Federal Reserve,

the total amount of student loan debt has risen by 275 percent since 2003. That is a

staggering figure. Millions upon millions of young college graduates are

entering the "real world" only to discover that they are already

financially crippled for decades to come by oppressive student loan debt

burdens. Large numbers of young people are even putting off buying homes

or getting married simply because of student loan debt.

‘37 million Americans currently have

outstanding student loans, and the delinquency rate on those student loans has

now reached a level never seen before. According to a new report that was

just released by the U.S. Department of Education, 11 percent of all student loans are at

least 90 days delinquent. That is a brand new record high, and it is

almost double the rate of a decade ago. Total student loan debt exceeds a

trillion dollars, and it is now the second largest category of consumer debt

after home mortgages. The student loan debt bubble has been growing

particularly rapidly in recent years. According to the Federal Reserve,

the total amount of student loan debt has risen by 275 percent since 2003. That is a

staggering figure. Millions upon millions of young college graduates are

entering the "real world" only to discover that they are already

financially crippled for decades to come by oppressive student loan debt

burdens. Large numbers of young people are even putting off buying homes

or getting married simply because of student loan debt.

So why is this happening?

Well, a big part of the problem is that the cost of college tuition has gotten

wildly out of control. Since 1978, the cost of college tuition has risen even more rapidly then the cost

of medical care has. Tuition costs at public universities have risen by 27 percent over the past five years, and

there appears to be no end in sight.

We keep encouraging our young

people to take out all of the loans that are necessary to pay for college,

because a college education is supposedly the "key" to their futures.

But is that really the case?

Sadly, the reality of the matter

is that millions of young Americans are graduating from college only to

discover that the jobs that they were promised simply do not exist.

In fact, at this point about half of all college graduates are

working jobs that do not even require a college degree.

This is leading to mass

disillusionment with the system. One survey found that 70% of all college graduates wish that

they had spent more time preparing for the “real world” while they were still

in college.

And because so many of them

cannot get decent jobs, more college graduates then ever are finding that they

cannot pay back the huge student loans that they were encouraged to sign up

for. The following is from a recent Bloomberg article.

Eleven

percent of student loans were seriously delinquent -- at least 90 days past due

-- in the third quarter of 2012, compared with 6 percent in the first quarter

of 2003, according to the report by the U.S. Education Department.

Almost 30 percent of 20- to 24-year-olds aren’t employed or in school, the

study found.

Everyone

agrees that we are now dealing with an unprecedented student loan debt bubble,

but none of our leaders seem to have any solutions.

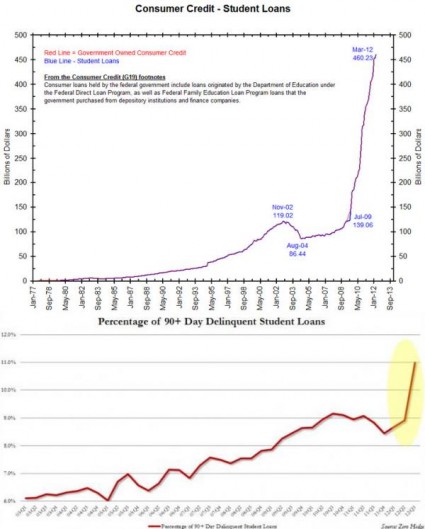

The

two charts posted below come from a recent Zero Hedge article, and they are

very illuminating. The first chart shows how the amount of student loan

debt owned by the federal government has absolutely exploded in recent years,

and the second chart shows how the percentage of student loan debt that is at

least 90 days delinquent has risen to a brand new record high...

How

is the economy ever going to recover if an increasingly large percentage of our

young college graduates are financially crippled by student loan debt?

And

things are about to get even worse.

If

Congress takes no action, the interest rate on federal student loans is going

to double to 6.8 percent on July 1st. That

rate increase would affect more than 7 million students.

And

debt burdens just continue to increase in size. In fact, according to one recent study, "70 per cent of the class

of 2013 is graduating with college-related debt – averaging $35,200 – including

federal, state and private loans, as well as debt owed to family and accumulated

through credit cards."

This

is one reason why there is so much poverty among young adults in America

today. As I mentioned in a previous article, families that have a head of

household that is under the age of 30 have a poverty rate of 37 percent. For much more on

the student loan debt bubble and how it is crippling an entire generation of

Americans, please see my recent article entitled "29

Shocking Facts That Prove That College Education In America Is A Giant Money

Making Scam".

And

of course delinquency rates remain very high on other forms of debt as

well. For example, delinquency rates on home mortgages have typically

been around 2 to 3 percent historically. But as you can see from the

chart below, the delinquency rate on single-family residential mortgages is

currently close to 10 percent...

So

are we really having an "economic recovery"?

Of

course not.

Things

are good for those that have lots of money in the stock market (for now), but

for the vast majority of Americans things continue to get worse.

And

we continue to forget the lessons that we should have learned from the

financial crisis of 2008. Right now, we are seeing a resurgence of cash

out financing. But this time, people are leveraging their inflated stock

portfolios instead of their home equity. The following is from a CNN report...

The

recent run-up in the market,

financial advisers say, has led to a resurgence of the type of loan not seen

since the end of the housing boom -- cash out financing. But this time, though,

people aren't tapping their inflated house for money. These days stock

portfolios appear to be the well of choice.

Financial

planners say in recent months clients have taken out so-called margin loans to

buy real estate, fund small business acquisitions, or to provide gap financing

before a traditional loan could be secured from a bank.

"No

one wants to be out of the market for 90 days," says Mark Brown, a

financial planner for Brown Tedstron in Denver. "People just don't want to

sell right now."

We

are a nation that is absolutely addicted to debt. We know that it is

wrong, but we just can't help ourselves.

We

are like the 900 pound man that recently

died. He knew that he was eating himself to death, but he just couldn't

stop.

In

the end, we are going to pay a great price for our gluttony. Everyone in

the world can see that we are killing the greatest economy that ever existed,

but we simply do not have the self-discipline to do anything about it.’