Quantitative Easing Did Not Work For The Weimar Republic

Either

http://theeconomiccollapseblog.com

http://albertpeia.com/qedidnotworkforweimarrepubliceither.htm

[ http://albertpeia.com/moreqesayfraudsonwallstreet.htm

{ Riiiiight! Anything but reality that would thwart their daily fraud,

churn-and-earn national debacle. Actually, I think it’s more for the ‘sell the

sizzle’ part of their ubiquitous fraud; that fraud inducing ‘hopium thing’ that’s

been great for their high frequency algo trade frauds that the rest of the

nation/world pays for. What’s really required is prosecution of these huge

frauds, incarceration of and disgorgement and fines for the perps, without

exception! } ]

‘Did printing vast quantities of money work for

the Weimar Republic? Nope. And it won't work for us either.

If printing money was the secret to economic success, we could just print up a

trillion dollars for every American and be done with it. The truth is

that making everyone in America a trillionaire would not mean that we would all

suddenly be wealthy. There would be the same amount of "real

wealth" in our economy as before. But what it would do is render our

currency meaningless and totally destroy faith in our financial system.

Sadly, we have not learned the lessons that history has tried to teach

us. Back in April 1919, it took 12 German marks to get 1 U.S.

dollar. By December 1923, it took approximately 4 trillion German marks

to get 1 U.S. dollar. So was the Weimar Republic better off after all of

the "quantitative easing" that they did or worse off? Of course

they were worse off. They destroyed their currency and wrecked all

confidence in their financial system. There was an old joke that if you

left a wheelbarrow full of money sitting around in the Weimar Republic that

thieves would take the wheelbarrow and they would leave the money behind.

Will things eventually get that bad in the United States someday?

‘Did printing vast quantities of money work for

the Weimar Republic? Nope. And it won't work for us either.

If printing money was the secret to economic success, we could just print up a

trillion dollars for every American and be done with it. The truth is

that making everyone in America a trillionaire would not mean that we would all

suddenly be wealthy. There would be the same amount of "real

wealth" in our economy as before. But what it would do is render our

currency meaningless and totally destroy faith in our financial system.

Sadly, we have not learned the lessons that history has tried to teach

us. Back in April 1919, it took 12 German marks to get 1 U.S.

dollar. By December 1923, it took approximately 4 trillion German marks

to get 1 U.S. dollar. So was the Weimar Republic better off after all of

the "quantitative easing" that they did or worse off? Of course

they were worse off. They destroyed their currency and wrecked all

confidence in their financial system. There was an old joke that if you

left a wheelbarrow full of money sitting around in the Weimar Republic that

thieves would take the wheelbarrow and they would leave the money behind.

Will things eventually get that bad in the United States someday?

Of course we are not going to

see hyperinflation in the U.S. this week or this month.

But don't think that it will

never happen.

The people of Germany never

thought that it would happen to them, but it did.

The following is an excerpt from

a Wikipedia article about the

Weimar Republic. Take note of the similarities between what the Weimar

Republic experienced and what we are going through today....

The cause of the immense

acceleration of prices that occurred during the German hyperinflation of

1922–23 seemed unclear and unpredictable to those who lived through it, but in

retrospect was relatively simple. The Treaty of Versailles imposed a huge debt

on Germany that could be paid only in gold or foreign currency. With its gold

depleted, the German government attempted to buy foreign currency with German

currency, but this caused the German Mark to fall rapidly in value, which

greatly increased the number of Marks needed to buy more foreign currency. This

caused German prices of goods to rise rapidly which increase the cost of

operating the German government which could not be financed by raising taxes.

The resulting budget deficit increased rapidly and was financed by the central

bank creating more money. When the German people realized that their money was

rapidly losing value, they tried to spend it quickly. This increase in monetary

velocity caused still more rapid increase in prices which created a vicious

cycle. This placed the government and banks between two unacceptable

alternatives: if they stopped the inflation this would cause immediate

bankruptcies, unemployment, strikes, hunger, violence, collapse of civil order,

insurrection, and revolution. If they continued the inflation they would

default on their foreign debt. The attempts to avoid both unemployment and

insolvency ultimately failed when Germany had both.

When the Weimar Republic first

started rapidly printing money everything seemed fine at first. Economic

activity was buzzing and unemployment was very low.

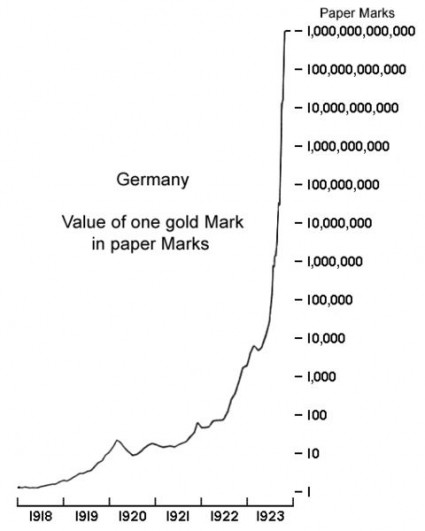

But as the following chart

shows, when hyperinflation kicks in, it can happen very quickly. By late

1922, the effects of all of the money printing were really starting to hit the

German economy....

Once

you start printing money it is really, really hard to stop.

By late 1922, inflation was

officially out of control. An article in The Economist described what happened next....

Prices roared up. So did

unemployment, modest as 1923 began. As October ended, 19% of metal-workers were

officially out of work, and half of those left were on short time. Feeble

attempts had been made to stabilise prices. Some German states had issued their

own would-be stable currency: Baden's was secured on the revenue of state

forests, Hanover's convertible into a given quantity of rye. The central

authorities issued what became known as “gold loan” notes, payable in 1935.

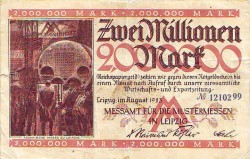

Then, on November 15th, came the Rentenmark, worth 1,000 billion paper marks,

or just under 24 American cents, like the gold mark of 1914.

Hyperinflation hurts the poor,

the elderly and those on fixed incomes the worst. The following is an

excerpt from a work by Adam Fergusson....

The rentier classes who

depended on savings or pensions, and anyone on a fixed income, were soon in

penury, their possessions sold. Barter often took over from purchase. By law

rents could not be raised, which allowed employers to pay low wages and

impoverished landlords in a country where renting was the norm. The professional

classes -- lawyers, doctors, scientists, professors -- found little demand for

their services. In due course, the trade unions, no longer able to strike for

higher wages (often uncertain what to ask for, so fast became the mark's fall

from day to day), went to the wall, too.

Workers regularly got wage

increases during this time, but they never seemed to keep up with the horrible

inflation that was raging all around them. So they steadily became poorer

even though the amount of money they were bringing home was steadily

increasing.

People started to lose all faith

in the currency and in the financial system. This had an absolutely

devastating effect on the German population. American author Pearl Buck

was living in Germany at the time and the following is what she wrote about what she saw....

"The cities were

still there, the houses not yet bombed and in ruins, but the victims were

millions of people. They had lost their fortunes, their savings; they were

dazed and inflation-shocked and did not understand how it had happened to them

and who the foe was who had defeated them. Yet they had lost their

self-assurance, their feeling that they themselves could be the masters of

their own lives if only they worked hard enough; and lost, too, were the old

values of morals, of ethics, of decency."

Of course not everyone in

Germany was opposed to the rampant inflation that was happening. There

were some business people that became very wealthy during this time. The

hyperinflation rendered their past debts meaningless, and by investing paper

money (that would soon be worthless) into assets that would greatly appreciate

thanks to inflation, many of them made out like bandits.

The key was to take your paper

money and spend it on something that would hold value (or even increase in

value) as rapidly as possible.

The introduction of the Rentenmark brought an end to hyperinflation, but

the damage to the stability of the German economy had been done. The

German economy went through several wild swings which ultimately resulted in

the rise of the Nazis. The following description of this time period is

from an article by Alex Kurtagic....

The post-hyperinflationary

credit crunch was, not surprisingly followed by a credit boom: starved of money

and basic necessities for so long (do not forget the hyperinflation had come

directly after defeat in The Great War), many funded lavish lifestyles through

borrowing during the second half of the 1920s. We know how that ended, of

course: in The Great Depression, which eventually saw the end of the Weimar

Republic and the beginning of the National Socialist era.

By the end of the decade

unemployment really started to take hold in Germany as the following statistics

reveal....

September 1928 - 650,000

unemployed

September 1929 - 1,320,000

unemployed

September 1930 - 3,000,000

unemployed

September 1931 - 4,350,000

unemployed

September 1932 - 5,102,000

unemployed

January 1933 - 6,100,000

unemployed

By the end of 1932, over 30 percent of all German workers were

unemployed. This created an environment where people were hungry for

"change".

On January 30th, 1933 Hitler was

sworn in as chancellor, and the rest is history.

So where will all of this money

printing take America?

As I wrote about in a previous article, the amount of excess

reserves that banks have stashed with the Federal Reserve has risen from about

9 billion dollars on September 10th, 2008 to about 1.5 trillion dollars

today....

What is going to happen to

inflation when all of those excess reserves start flowing out into the regular

economy?

It won't be pretty.

Just consider the ominous words

that Philadelphia Fed President Charles Plosser used earlier this week....

"Inflation is going

to occur when excess reserves of this huge balance sheet begin to flow

outside into the real economy. I can't tell you when that's going to

happen."

"When that does begin

if we don't engage in a fairly aggressive and effective policy of

preventing that from happening, there's no question in my mind that that

will lead to lots of inflation."

Oh great.

And so what is Bernanke doing?

He is printing up lots more

money.

But isn't this supposed to help

the economy?

I wouldn't count on it.

According to USA Today, the following is what Plosser

says about the effect that QE3 is likely to have on our economy....

"We are unlikely to

see much benefit to growth or to employment from further asset purchases."

But we will get more inflation,

so our monthly budgets will not go as far as they did before.

The other day I was going to the

supermarket, and my wife told me that she wanted some croissants. When I

got to the bakery section I discovered that it was $4.49 for just four

croissants.

If it had just been for me, I

would have never gotten them. I am the kind of shopper that doesn't even

want to look at something unless there is a sale tag on it.

But I did get the croissants for

my wife.

Unfortunately, thanks to Federal

Reserve Chairman Ben Bernanke soon none of us may be able to afford to

buy croissants.

I still remember the days when I

could fill up my entire shopping cart for 20 bucks.

And it was not that long ago - I

am talking about the late 90s.

But paying more for food is not

the greatest danger we are facing. Bernanke is destroying the credibility

of our currency and he is destroying faith in our financial system.

Bernanke may believe that he is

preventing the next great collapse from happening, but the truth is that what

he is doing is going to make the eventual collapse far worse.

Better get your wheelbarrows

ready.