Note: I’m here in San Diego County in my new/old

39 foot Chevy Motorhome. I can’t get a signal for my Verizon LG smartphone

(I’ll be taking a spin in my Ford Explorer in search of a signal; my VOIP

phone, magicjack requiring a broadband connection, is currently not up except

for voicemail). The radio reception is also limited which led me to ‘sample’

some limited AM offerings which included shallow sean hannity the hallmark of

insanity, and ‘rush revere’ [limbaugh… he’s totally burnt out (the consequence of

his being ‘tired of carrying the water for the republican party’? - his own

words), relegated now to authoring children’s illustrated books of a simplistic

nature]. Shallow sean’s latest ‘crusade’ (beyond the same note/key obvious

debacle of wobamacare) was defense of the indefensible mobster but friend of

sean’s, donald trump (trump should be in jail). In defense of t_rump, he offers

up the itsy-bitsy, teeny weeny wohlman skating rink project as evidence of

t_rump’s contribution to NYC (too small for high new york priority given the

magnitude of New York substantial problems, some largely the result of trumpish

tastes, ie., solid gold trump tower fixtures, etc., that trump’s ‘pre-packaged

bankrupcies’ seem to fail to touch, and which extravagance must be paid for by

someone, but not him). Shallow sean’s excoriation of new york city never seems

to link the obviousness of t_rump’s grandstanding responsibility for same.

After all, someone ultimately has to pay for trump’s disproportionate

non-value-added livin’ large. No talk of trump’s ingratiating bribe strategy

for protection ( ie., retainer’s to law firms linked to state attorney

generals, viz., {kimmelman} wolf and sampson, chris droney’s brother, his

sister’s protection/corruption and quid pro quo from the federal bench, etc.,

and as well, protection of drug-money laundering through his now nominal only

casinos … See, ie., http://www.albertpeia.com/112208opocoan/ricosummarytoFBIunderpenaltyofperjury.pdf

http://www.albertpeia.com/112208opocoan/PeiavCoanetals.htm http://albertpeia.com/fbimartinezcongallard.htm .

Trump’s a fraud! I won’t be listening to ‘rush revere’ or shallow sean

prospectively. They’re a waste of time and preposterous given their unbridled

support of war criminals bush, cheney, etc., and the failed debacles they

created, etc……

Today’s

Current Topics/Articles/News

The

Cat recommends the following video:

http://www.youtube.com/watch?feature=player_embedded&v=DBNYwxDZ_pA

{

The Cat dispatching this archaic reptilian remnant of an extinct species. Yet,

doesn’t the ill-fated croc seem to be smiling a typically wide grin as if to

say, ‘he’s glad to be done-in by such a noble creature as the Cat’ (as opposed

to lesser species including all forms of apes and their progeny, potentially

even winding up as a pocket-book, belt, or pair of shoes). Yes, there’s a place

in the universe for Cats! }

Posted

by : williambanzai7

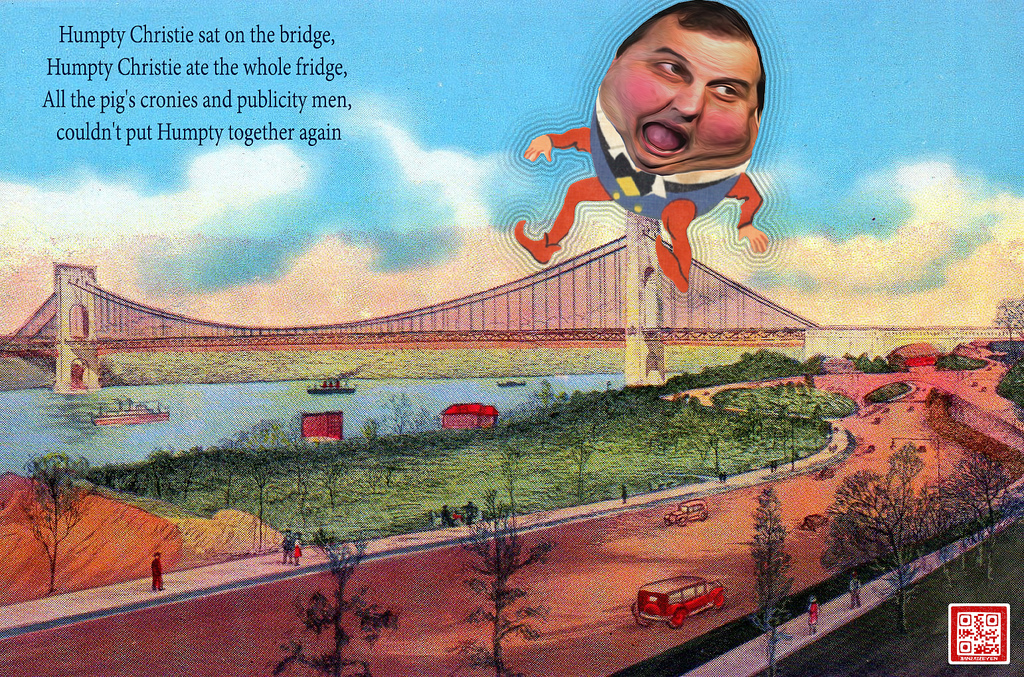

Feds

form grand jury to probe Chris Christie's role in Bridgegate...

HuMPTY CHRiSTiE HaD A GReaT

FaLL... Posted by: williambanzai7 Post date: 03/30/2014

- 19:38 FOOD AND BEVERAGE NOT RECOMMENDED

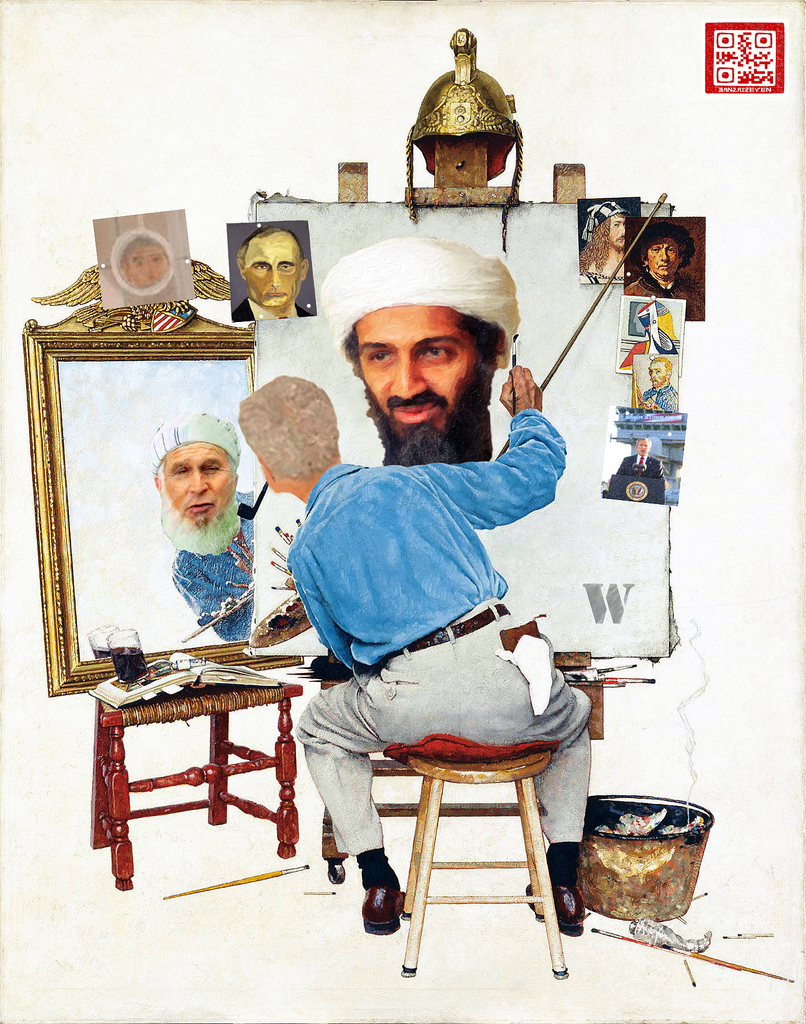

GeoRGe W BuSH SeLF

PoRTRaIT...

Posted

by: williambanzai7

Post

date: 04/06/2014

The fine art of

Presidential shlock...

THe

VoMiT...

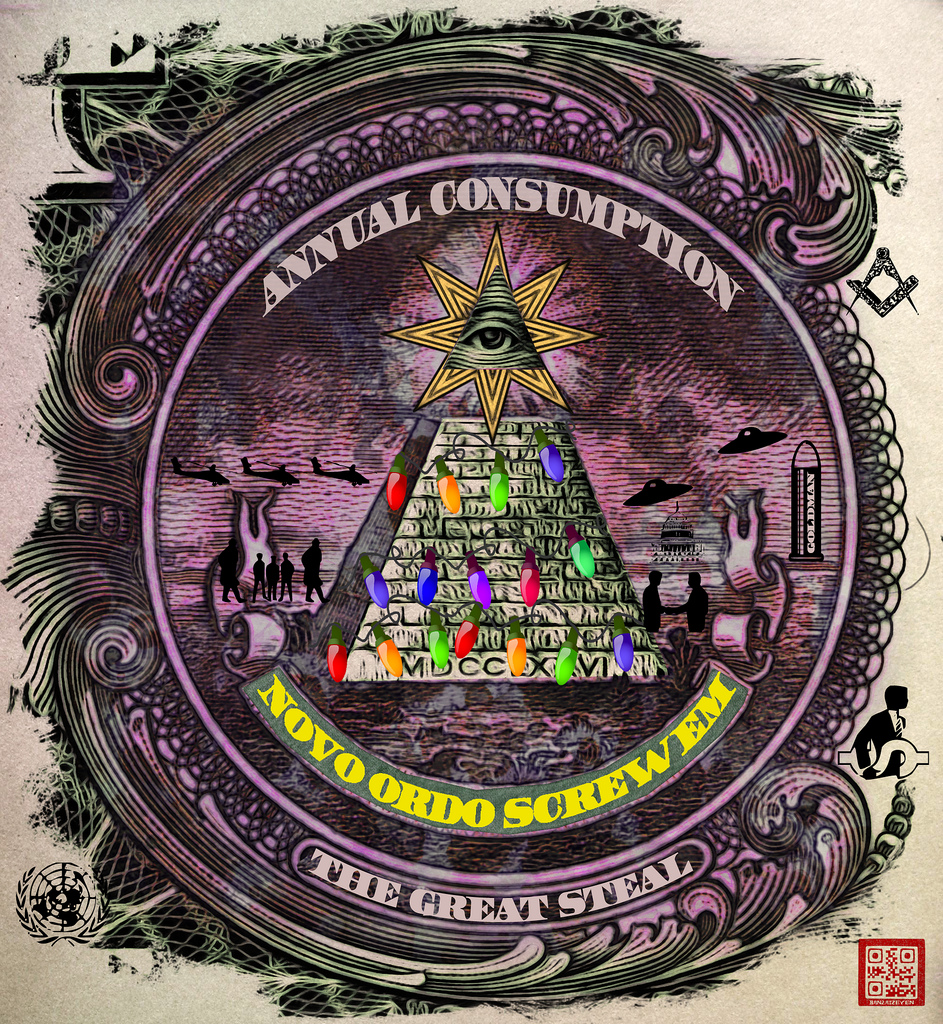

Submitted by williambanzai7 on 12/01/2013

Commemorative

Prints Now Available: [email protected]

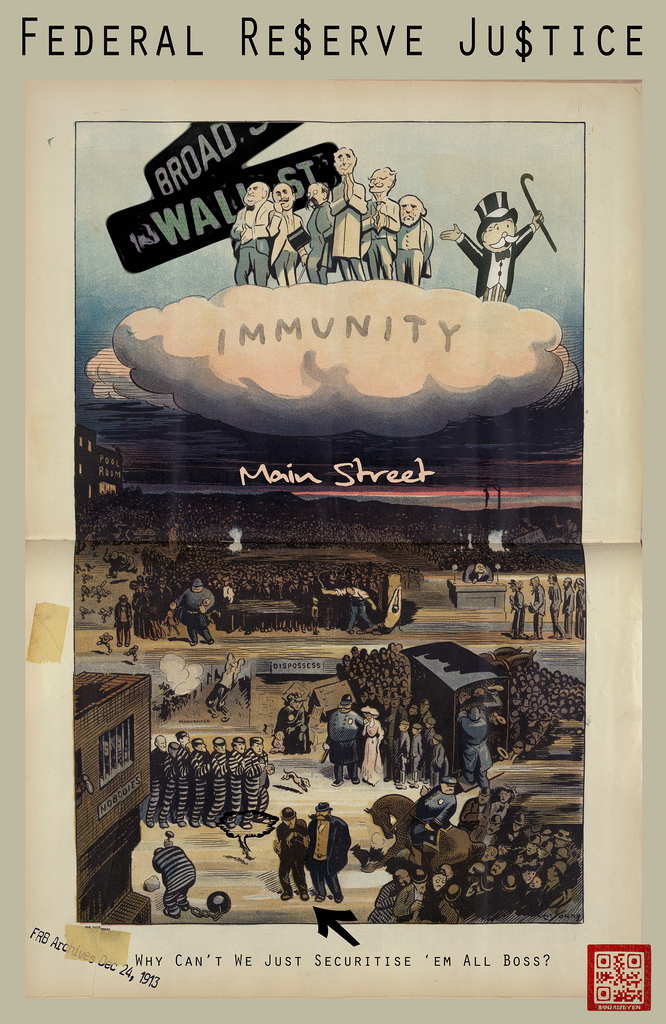

The

Hidden Motives Behind The Federal Reserve Taper

Submitted by Tyler

Durden on 12/21/2013

"The powers of financial capitalism had (a) far-reaching

aim, nothing less than to create a world system of financial control in private

hands able to dominate the political system of each country and the economy of

the world as a whole. This system was to be controlled in a feudalist fashion

by the central banks of the world acting in concert, by secret agreements

arrived at in frequent meetings and conferences. The apex of the systems was to

be the Bank for International Settlements in Basel, Switzerland; a private bank

owned and controlled by the world's central banks which were themselves private

corporations. Each central bank... sought to dominate its government by its

ability to control Treasury loans, to manipulate foreign exchanges, to

influence the level of economic activity in the country, and to influence

cooperative politicians by subsequent economic rewards in the business

world."

- Carroll Quigley, member of the Council on Foreign Relations

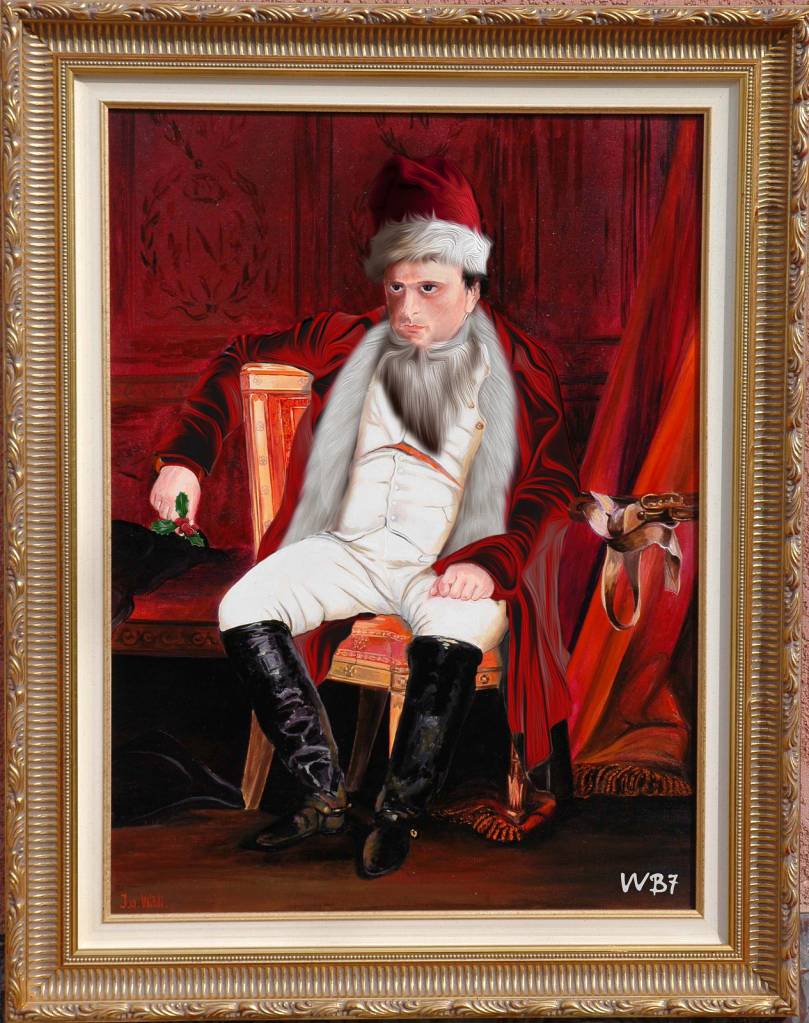

The

Emperor At Christmas...

Northern

Koreans are queer

The

life that they live draws a tear

Games

are all banned

Except

Missile Command

They

need it to fire their gear

The

Limerick Cat is King

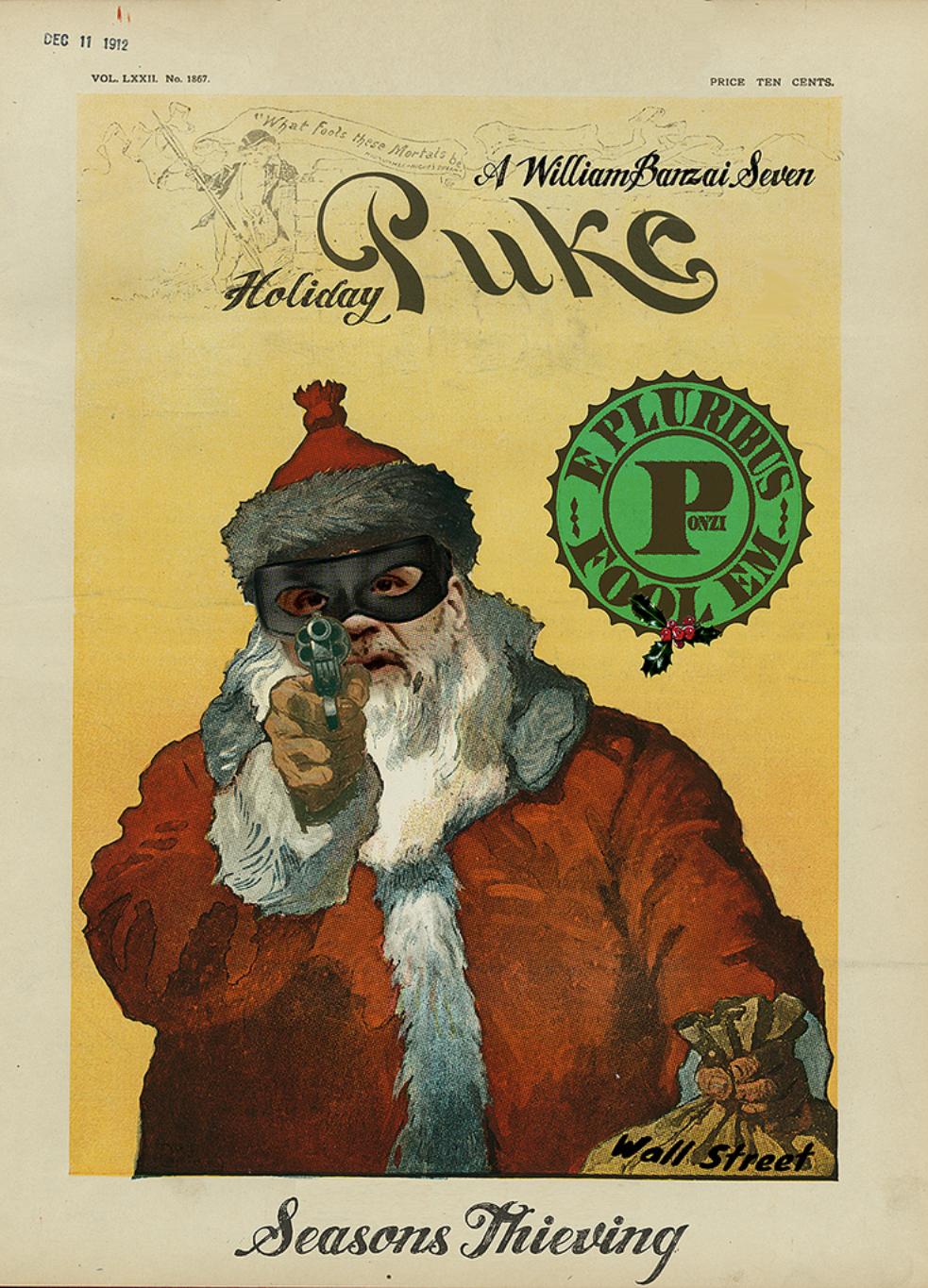

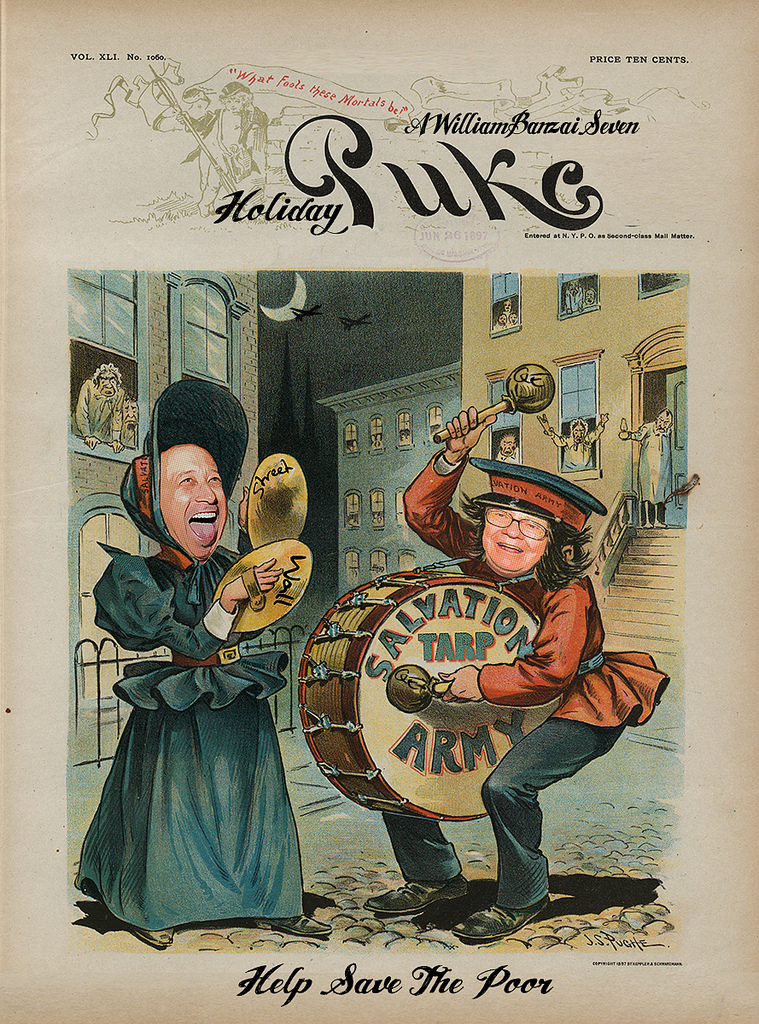

HoLiDaY

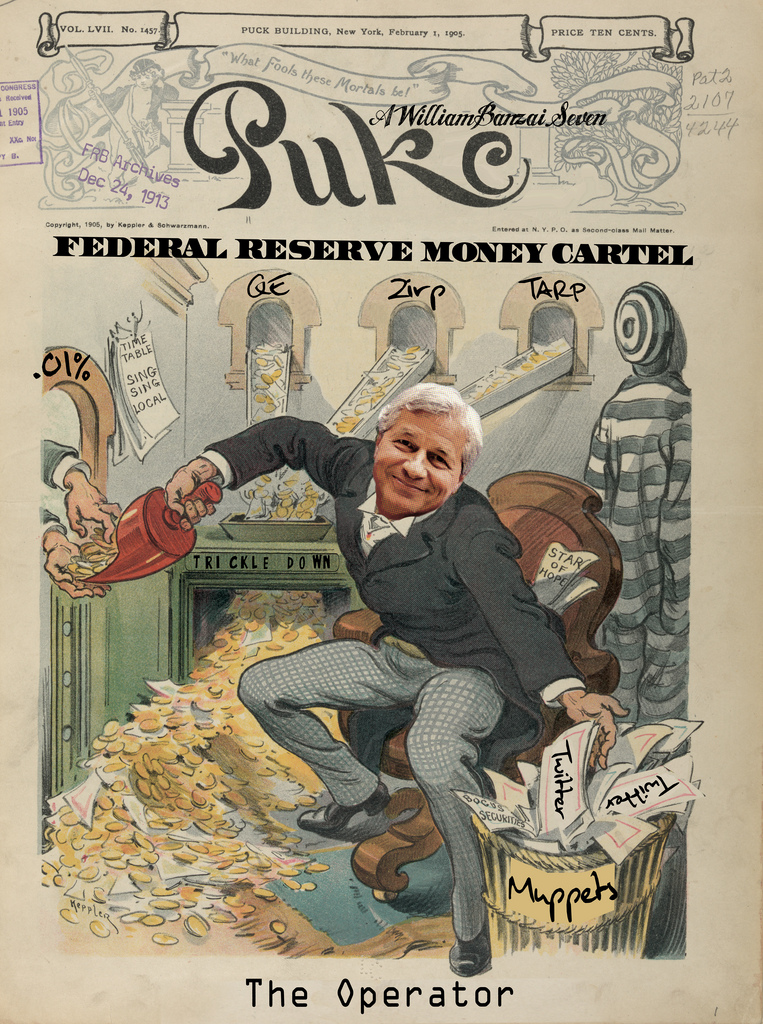

TaPeRS...

Submitted by williambanzai7 on 12/18/2013

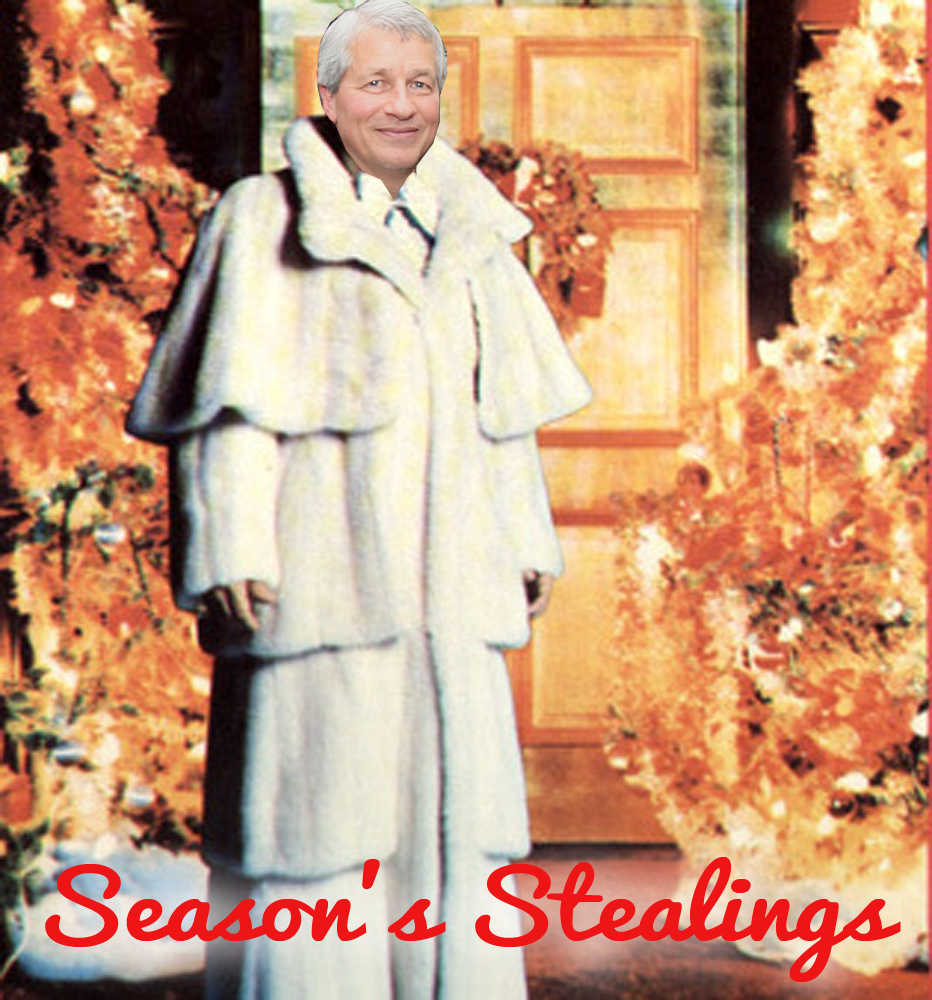

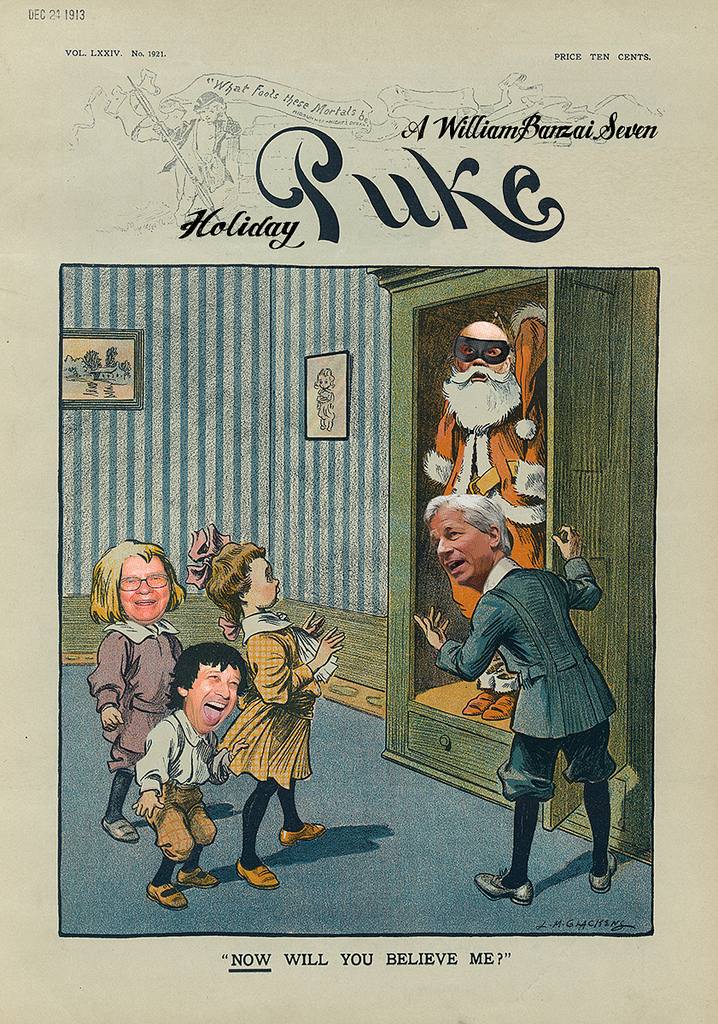

HoLiDaY

GreeTiNGS FRoM THe DiMoN FaMiLY...

Submitted by williambanzai7 on 12/17/2013

BaBuSHCaiN...

Submitted by williambanzai7 on 12/15/2013

"Just

as we did for the Occupy Wall Street protestors in Zucotti Park and the Snow

Park encampment in Oakland, we are here to support your just cause…"

WB7:

Just

sayin'

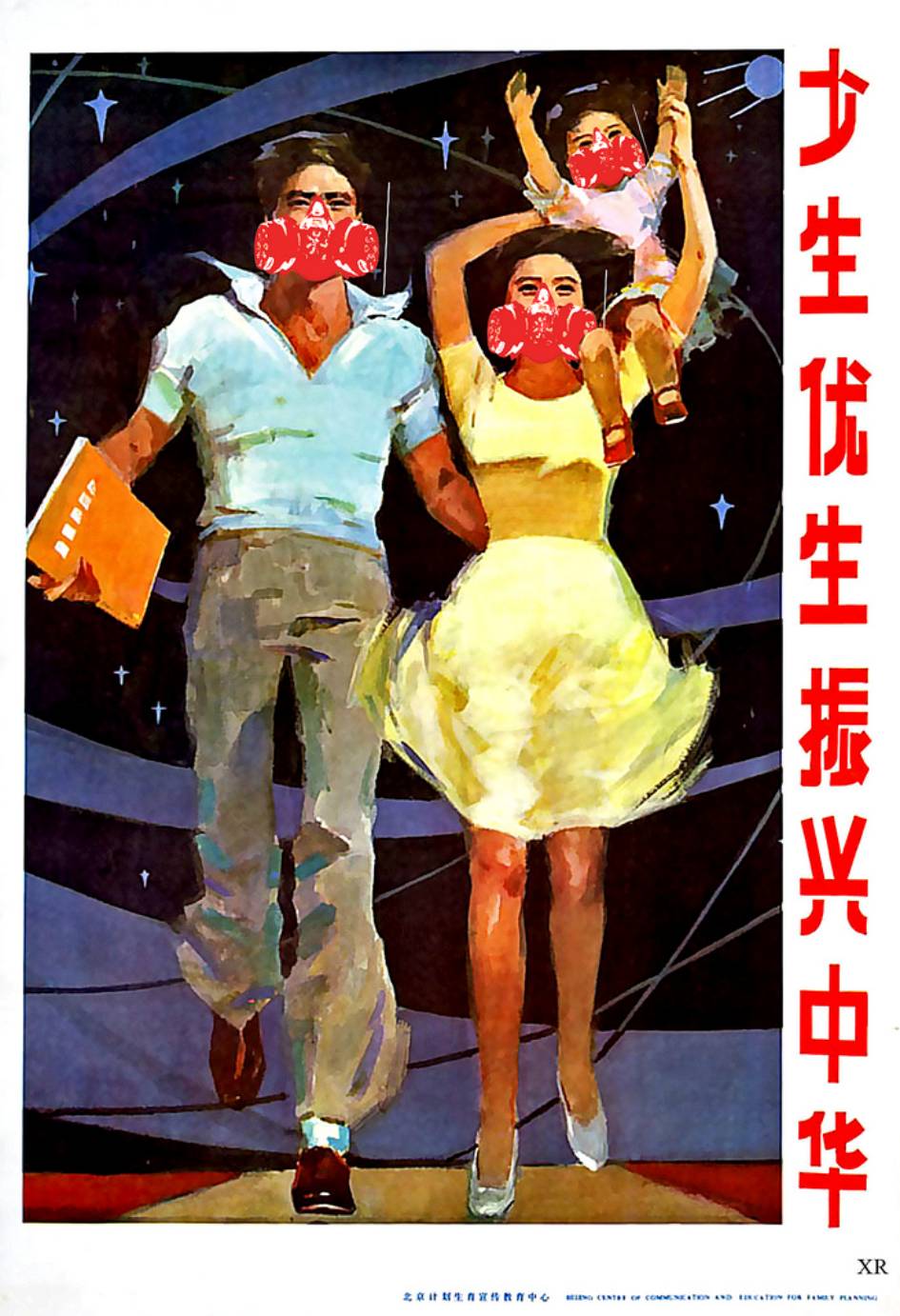

CHiNa

AiR...

Submitted by williambanzai7 on 12/14/2013

CHRiSTMaS

WiTH ED SNoWDeN...

Submitted by williambanzai7 on 12/12/2013

I'm dreaming of

a white noise Christmas

Just like the ones I used to know

Where the tower tops glisten

And spooks can't listen

To hear our data in the snow

I'm dreaming of a white noise Christmas

With every Christmas card emailed

May your days be merry and bright

And may all

Your Christmases be quiet...

MERRY

CHRISTMAS ED, wherever you are...

From

WilliamBanzai7 and the rest of the fringe low brows at Zero Hedge

THe

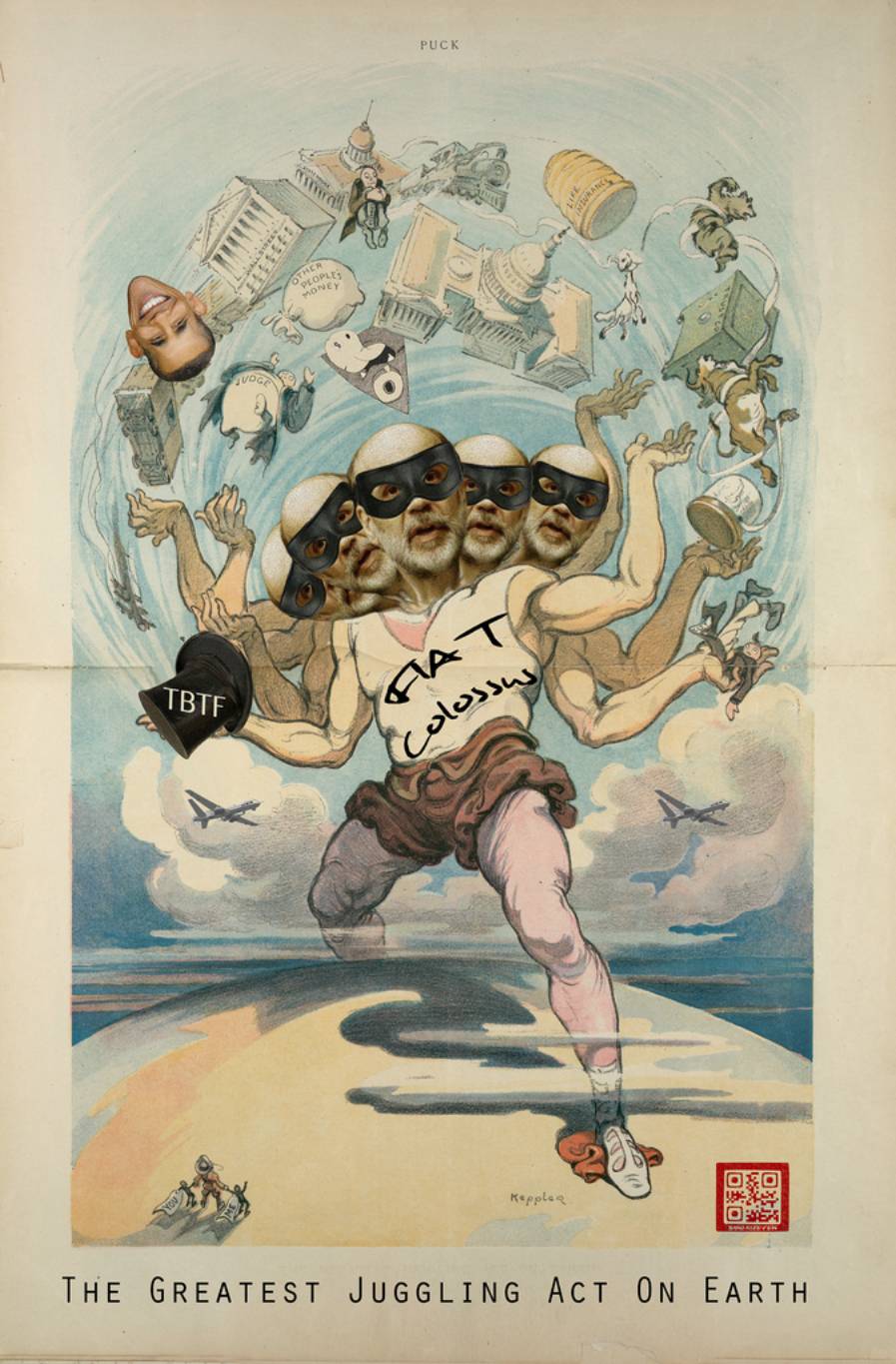

CeNTRaL PLaNNeR, THe JuGGLeR, THe OPeRaToR AnD THe BuST...

Submitted

by williambanzai7 on

12/09/2013

.

.

HaPPY

PeaRL HaRBoR DaY 2013

Submitted by williambanzai7 on 12/07/2013

The

slippery slope to Fascism is coated with radioactive wasabi...

CHRiSTMaS

GReeTiNGS FRoM THe CONTiNeNT...

Submitted by williambanzai7 on 12/06/2013

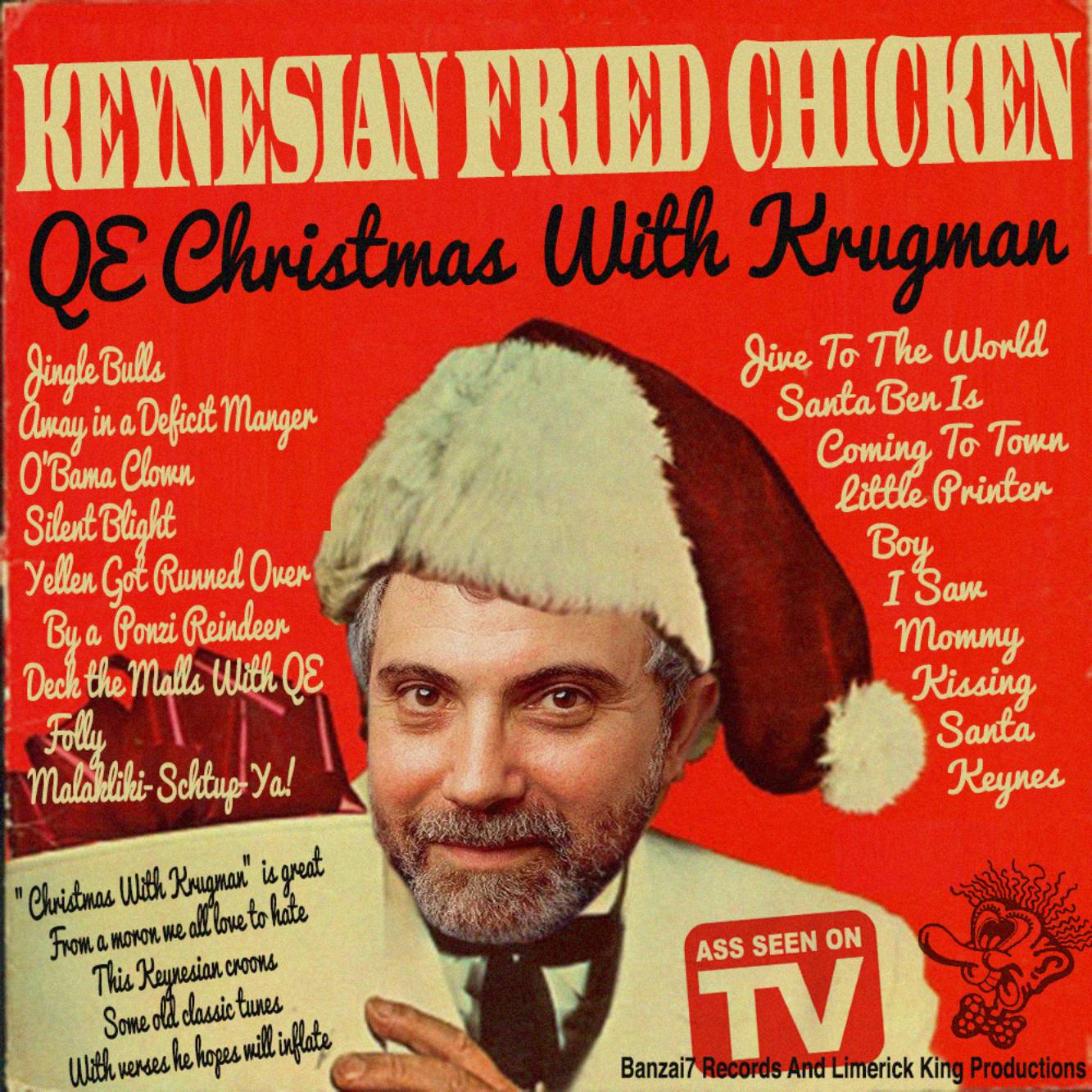

QE

CHRiSTMaS WiTH KRuGMaN...

Submitted by williambanzai7 on 12/03/2013

Weekend

Krugman

Another Hedge Fund Legend Returns Cash To Investors Due To

"Lack Of Investment Opportunities"

{

Wow! What a wise and intelligent money manager! }

Submitted by Tyler Durden on

12/04/2013 - 16:03

While hardly as spectacular as Hugh Hendry's supernova

flameout, or the far more boring, slow motion conversion of the

assorted other famous and less famous bears, a legendary hedge fund titan has

decided he too has no use for excess capital in this broken market. No surprise

then that Institutional Investors' Alpha

reports that Baupost's Seth Klarman is returning $4 billion

in capital to investors for only the second time in its history due to "a

lack of investment opportunities." And watching how the epic

farce that Bernanke's wealth effect known as the Stalingrad & Poorski

trades in the last 30 minutes of every day nobody can blame him. And no,

Klarman is not returning cash due to some hidden underperformance:

"Baupost’s many partnerships were up 13 percent, on average, through the

September quarter. Its annualized return since inception is in the high

teens." This happens to push it in the top decile of all hedge funds in

2013.

ONLY

FRoM OBaMCO...

Submitted by williambanzai7 on 12/02/2013

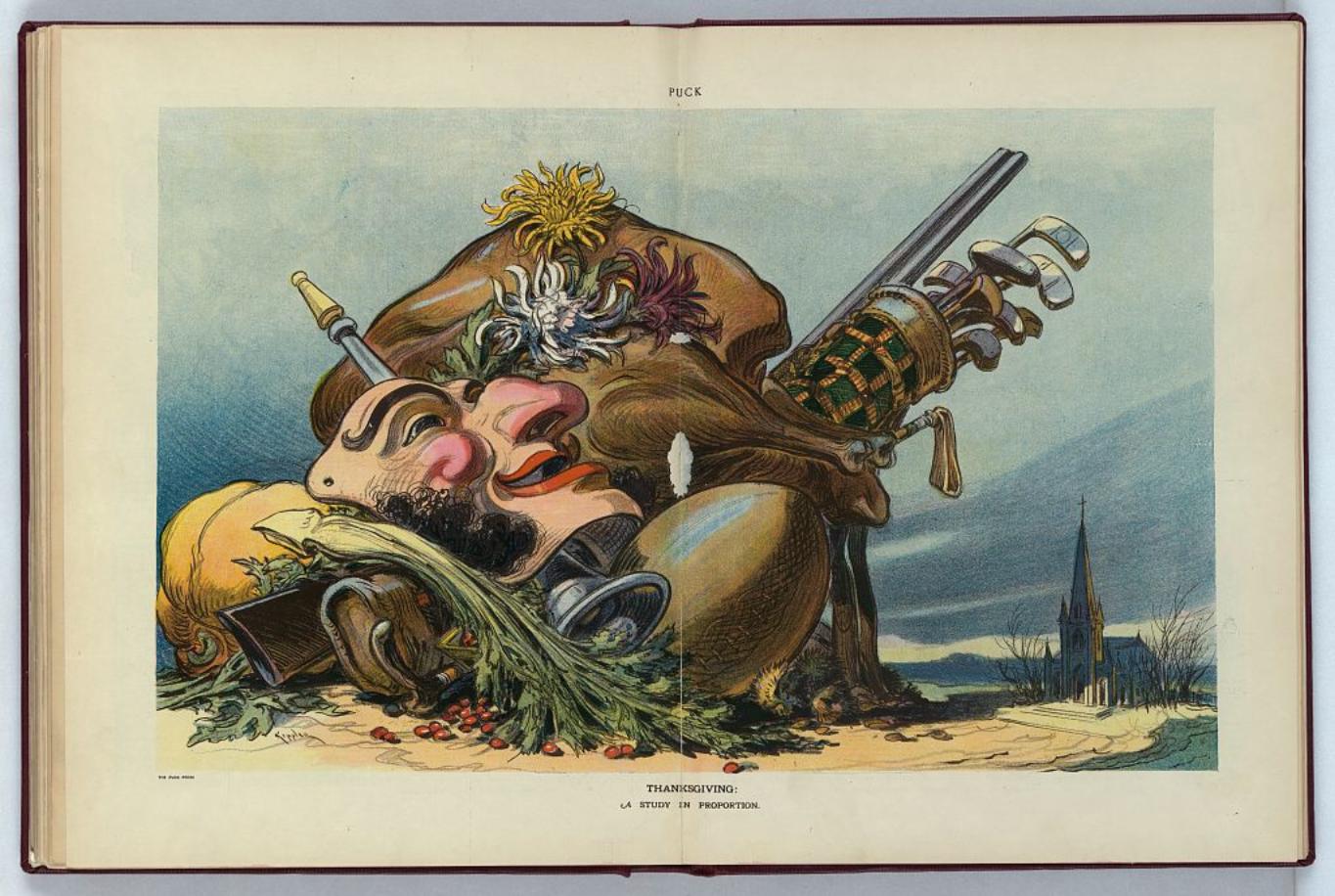

HaNK'S ReSTauRaNT...

Submitted by williambanzai7

on 11/28/2013

HANK’S RESTAURANT

(Arlo Guthrie--Alice’s Restaurant)

Adapted by WilliamBanzai7

This song is called Hank’s Restaurant,

and it’s about Hank,

and the restaurant,

but Hank’s Restaurant is not the name of the restaurant,

that’s just the name of the song,

and that’s why I called the song Hank’s Restaurant.

You can take anything you want from Hank’s Bailout Restaurant

You can take anything you want from Hank’s Bailout Restaurant

Walk right in it’s around the back

Just a half a mile from the Federal Reserve Bank

You can take anything you want from Hank’s Bailout Restaurant

Now it all started Hanksgiving Day 2008

when my friend Fabulous Fab and I went up to visit Hank at the

restaurant,

but Hank doesn’t like sittin in there,

he likes sittin near a fella named Blankfein in Goldman Sachs’

Wall Street office,

in a big glass tower.

And being in a tower like that,

they got a lot of room downstairs.

Havin’ all that room,

they decided that they didn’t have to take out their subprime

garbage for a long time.

We got up there,

we found all the toxic subprime garbage in there,

and we decided it’d be a friendly gesture for us to take the

garbage down to the Federal Reserve shitty deal dump, Maiden Lane.

So my friend and I took the $700 billion tons of subprime

garbage,

put it in the back of a red Humvee stretch limo, including CDSs

and CDOs and other implements of financial

mass destruction and headed on toward the Maiden Lane shitty

deal dump.

Well we got there and there was a big sign and a chain across

across the dump saying,

"By order of Emperor Benron--No Dumping on

Hanksgiving."

And we had never heard of a shitty deal dump closed on

Hanksgiving before,

and with tears in our eyes we drove off into the sunset looking

for another place to put the toxic asset garbage.

We didn’t find one.

Until we came to a side road,

and off the side of the side road there was another financial

black hole hole and at the bottom of the hole there was

a big pile of Wall Street garbage, offering circulars, stress

tests, analyst reports, mortgage notes and such.

And we decided that one big pile is better than two little piles,

and rather than bring that one up we decided to throw our’s

down.

That’s what we did, and drove back to the restaurant,

had a Thanksgiving dinner that couldn’t be beat,

went to sleep and didn’t get up until the next morning,

when we got a phone call from Porn Commissioner Cox.

He said, "Kid, we found your name on an Abacus offering

circular at the bottom of a half a ton of shitty deals,

and just wanted to know if you had any information about

it."

And I said, "Yes, sir, Mr. Porn Commissioner,

I cannot tell a lie, I put that Abacus offering circular under

that garbage."

After speaking to Porn Commissioner Cox for about fourty-five

minutes on the telephone we finally arrived at

the truth of the matter and said that we had to go down and

pick up the subprime garbage,

and also had to go down and speak to him at the Porn

Commission’s NY Regional office.

So we got in the red Humvee Limo with the CDOs and CDSs and

implements of financial mass destruction and

headed on toward the Porn office upstairs at Score’s.

Now friends, there was only one or two things that the

Commissioner coulda done at the Porn office,

and the first was he could have shown us some hot porn tubes of

Mary Schapiro doin the deed,

which wasn’t very likely, and we didn’t expect it,

and the other thing was he could have bawled us out and told us

never to be seen driving toxic asset backed

garbage around the vicinity of Wall Street again,

which is what we expected,

but when we got to the Porn Commission’s office there was a

third possibility that we hadn’t even counted upon,

and we was both immediately arrested.

Handcuffed.

And I said Mr. Porn Commissioner sir, I don’t think I can pick

up the toxic garbage with these handcuffs on.

He said, "Shut up, kid. Get in the back of the car."

And that’s what we did, sat in the back of the car and drove to

the quote Scene of the Crime unquote.

I want tell you about Wall Street, where this happened here,

they got three Federal regulators, the SEC, the

CFTC and the FBI, but when we got to the Scene of the Crime

there was all kinds of Black Ops people running

around,

this being the biggest financial crime of the last five

consecutive Wall Street trading days,

and everybody wanted to get in the newspaper story about it.

And the TSA, they was using up all kinds of equipment that they

had hanging around the anti-traveler unit.

They was taking plaster tire tracks, finger prints, dog smelling

prints, and they took twenty seven eight-by-ten

glossy back scatter scans with circles and arrows and a

paragraph on the back of each one explaining what each

one was to be used as evidence against us.

Took scans of the approach, the getaway, the northwest corner

the southwest corner and that’s not to

mention the aerial drone photography.

After the ordeal, we went back to the jail.

Porn Commissioner Cox said he was going to put us in the cell.

Said,

"Kid, I’m going to put you in the cell, I want your wallet

and your belt."

And I said, "I can understand you wanting my wallet so I

don’t have any money to spend in the cell,

but what do you want my belt for?"

And he said, "Kid, we don’t want any hangings."

I said, "did you really think I was going to hang myself

for financial intermediation?"

Porn commissioner Cox said he was making sure,

and friends the Porn Commissioner was,

cause he took out the toilet seat so I couldn’t hit myself over

the head and drown,

and he took out the toilet paper so I couldn’t bend the bars

roll out the – roll the toilet paper out the window,

slide down the roll and have an escape.

The PornCommissioner was making sure,

and it was about four or five hours later that Hank (remember

Hank? It’s a song about Hank),

came by and with a few nasty words to Porn Commissioner Cox on

the side,

Bailed us out using Federal taxpayer money,

and we went back to the restaurant,

had a another Hanksgiving dinner that couldn’t be beat!!

You can take anything you want, from Hank’s Bailout Restaurant

You can take anything you want, from Hank’s Bailout Restaurant

Walk right in it’s around the back

Just a half a mile from the Federal Reserve Bank

You can take anything you want, from Hank’s Bailout Restaurant

WB7: This is my favorite Thanksgiving song. It is also the only

one I know.

Arlo Authrie, if you don’t know him, is the son of Woody

Guthrie, a famous folk singer who was no friend of Wall Street.

I originally did this version of Alice’s Restaurant in September

2008. This is my updated version, which is really an excuse for me to play this

song for you and to once again say…

HAPPY HANKSGIVING ALL!!

WB7

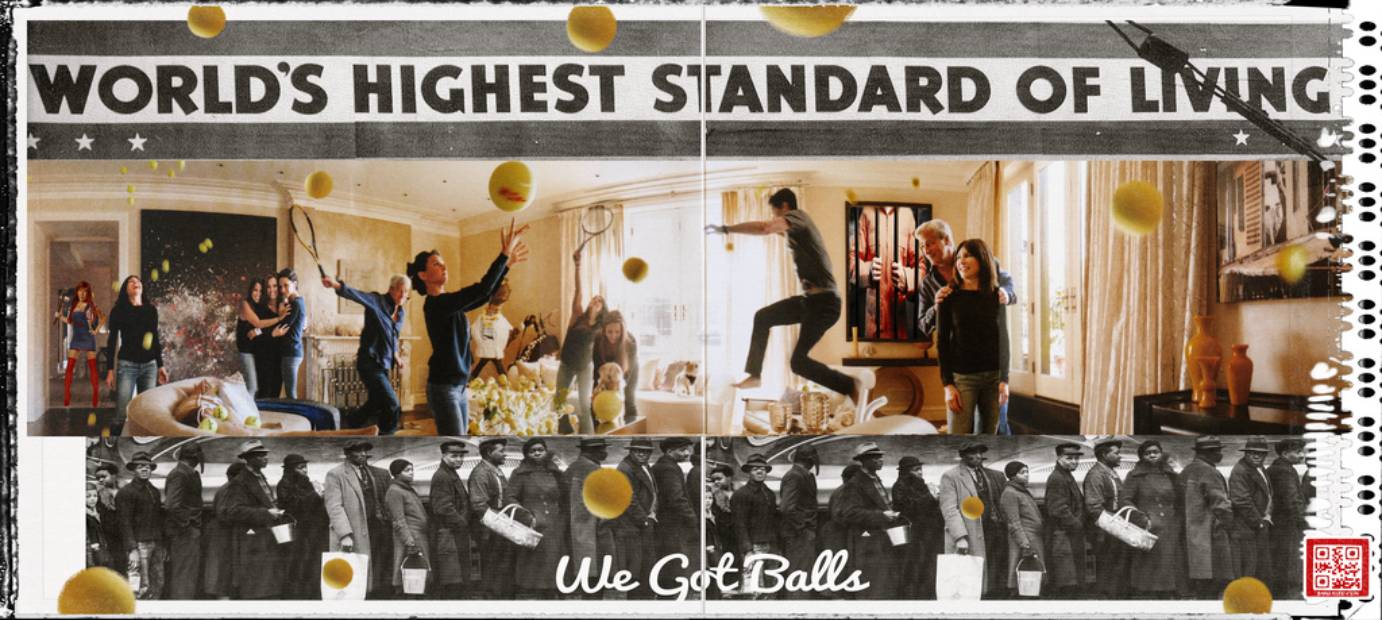

BLaCK

FRiDaY MaLL CaM...

Submitted by williambanzai7 on 11/29/2013

Animal studies made famous by John Calhoun (1962)

show that crowding in the animal world results in what he calls the

"behavioral sink."

Human studies made famous by Dr Satoshi Nakamura

show that intensive rounds of Keynesian money printing in the financial

world result in what he calls the "Walmart sink" and what Dr Ben

Bernanke calls the "Kitchen Sink".

BaKe A BoNe...

Submitted by williambanzai7 on 11/25/2013

.

Bernanke is printing out bones

His favorite's the one for Dow Jones

Her Keynesian schooling

Has Old Yellen drooling

As she licks her androgynous zones

The Limerick King

THe WReCK OF THe USS OBaMaCaRe...

Submitted by williambanzai7 on 11/18/2013 13:45 -0500

LiaR OF THe JeKYLL...

Submitted by williambanzai7 on 11/19/2013

“TO BIT OR NOT

TO BIT”

WilliamBanzaiShakespeare

To Bit, or not

to Bit: that is the question:

Whether ’tis nobler in the mind to suffer

The slings and arrows of outrageous fiat distortions,

Or to take arms against a sea of endless bubbles,

And by opposing end them? To die: to sweep;

No more; and by a sweep to say we end

The heart-ache and the thousand Wall Street schtupps

That insolvent flesh is heir to, ’tis a con-flagellation

Devoutly to be dish’d. To die, to sweep;

To sweep: perchance to scream: ay, there’s the hubub;

For aft that sweep of bankster dregs what new reams may come?

When we have shuffled off the immoral coinage,

Must give us pause: there’s the hazard of moral neglect

That makes calamity of sound money life;

For who would bear the whips and scorns of fiat debasement ,

The oppressor’s wrong, the borrowing idiot's contumely,

The pangs of despised austerity, the law of gravity's delay,

The insolence of central banking office and the spurns

That impatient murmur of money changing snakes,

When he himself might his quietus make

With a Benjamin Bernankin? who would QE fardels bear,

To grunt and sweat under a weary life of indebtured servitude,

But that the dread of something after redemption prior to maturity,

The undiscovered monetary wasteland from whose bourn

Are no asset returns, puzzles the will

And makes us rather bear those monetary ills we have

Than fly to others that we know not much of?

Thus risk avoidance does make cowards of us all;

And thus the creative hue of fiscal revolution

Is sicklied o’er with the pale cast of doubt,

And genius enterprises of great pith and moment

With this regard alternative currencies turn awry,

And lose the name of action.–Soft you now!

And now the Bitcoin hysteria…

While Banksta pimps 'r in thy orfices

Be all our financial sins and cowardices priced in.

Fake

Employment Numbers – And 5 More Massive Economic Lies The Government Is Telling

You

According to a whistleblower that has recently

come forward, Census employees have been faking and manipulating U.S.

employment numbers for years. In fact, it is being alleged that this

manipulation was a significant reason for why the official unemployment rate

dipped sharply just before the last presidential election. What you are

about to read is incredibly disturbing. The numbers that the American

people depend upon to make important decisions are being faked. But

should we be surprised by this? After all, Barack Obama has been caught telling dozens of major

lies over the past five years. At this point it is incredible that

there are any Americans that still trust anything that comes out of his

mouth. And of course it is not just Obama that has been lying to

us. Corruption and deception are rampant throughout the entire federal

government, and this has been the case for years. Now that some light is

being shed on this, hopefully the American people will respond with overwhelming

outrage and disgust. (Read More....)

HeaLTHCaRe BDSM

Submitted by williambanzai7 on 11/15/2013 10:28 -0500

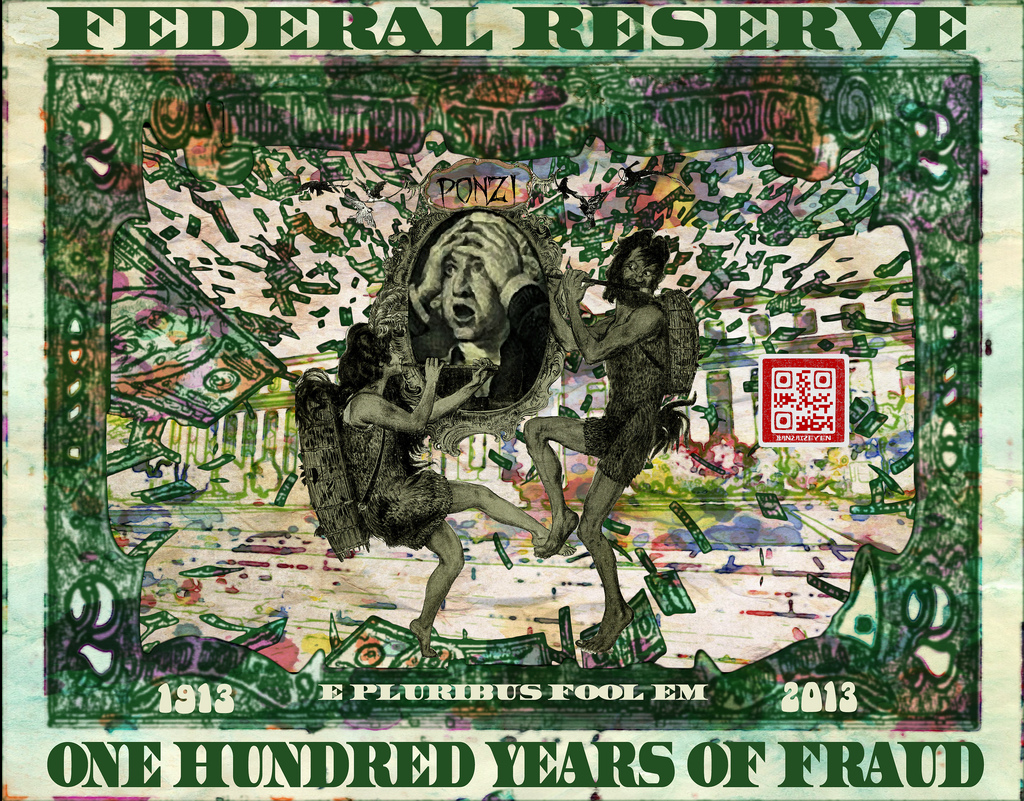

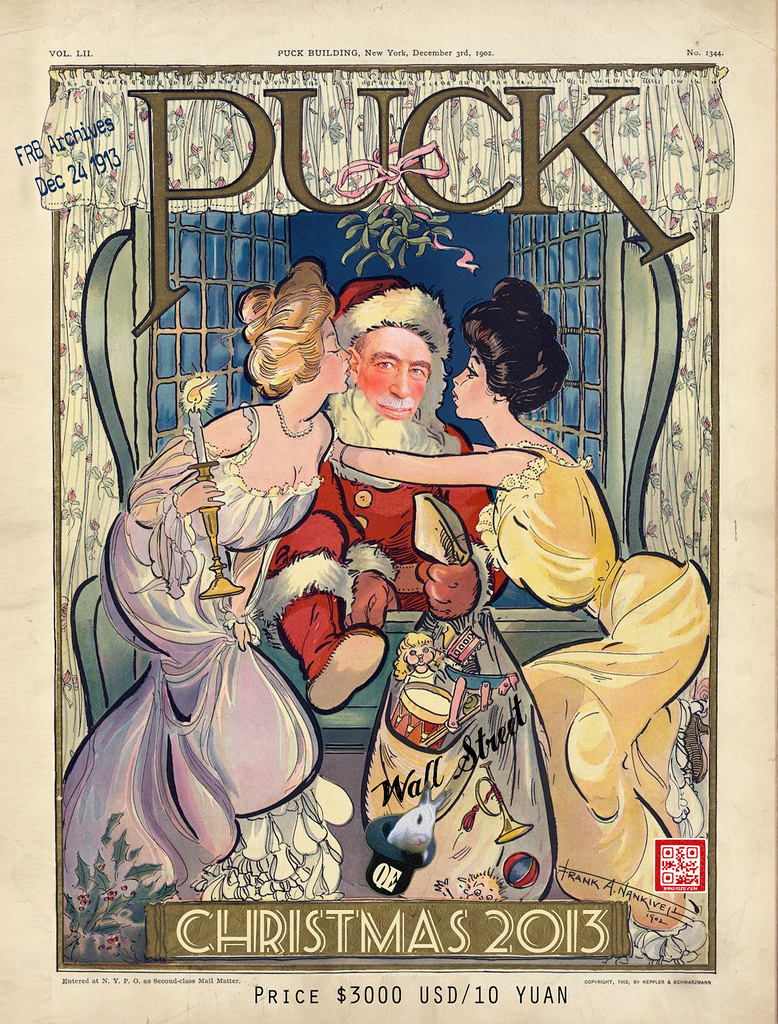

INTRoDuCiNG WiLLiaMBaNZai7'S SPeCiaL EDiTioN oF

HoLiDaY PuKeS...

Submitted by williambanzai7 on 11/13/2013 14:47

Here they are. WilliamBanzai7's Special Holiday

Puke Fine Art Print Editions just in time for the Christmas Holidays…

.

.

Dear Friends,

Here before you is a truly historic series of

images that I have painstakingly adapted to the current state of sordidly

odiferous political/financial affairs.

Years from now, there will be little doubt over

what the artist was seeing and thinking contemporaneously in the year 2013.

I am not going to oversell these pictures. They

speak for themselves.

They also demonstrate how history truly rhymes on

Wall Street.

I have all of these in very large high resolution

files. So every print will match the highest standards of fine art print

production.

As you can see, I have departed from normal

practice by offering these prints in an assortment of sizes. I have done this

solely to maximize your

participation by spreading price points. Bear in

mind that the amount of personal time and effort involved is the same

irrespective of print size.

Each print will be signed, numbered and dated

December 25, 2013.

I know that many of you are suffering various

levels of economic hardship in these trying times. As is always the case, you

are free to print these off for your own personal use.

I truly appreciate all the the moral and

financial support that I receive from all of you.

As you know, the primary reason that I am doing

these prints is to signify my gratitude in return for your generous support for

my endeavors.

It is my sincerest wish that the situation will

turn sooner than later so that each and everyone of us can return to

personal prosperity.

Best wishes to you all,

And Fuck You Ben Bernanke!

WB7

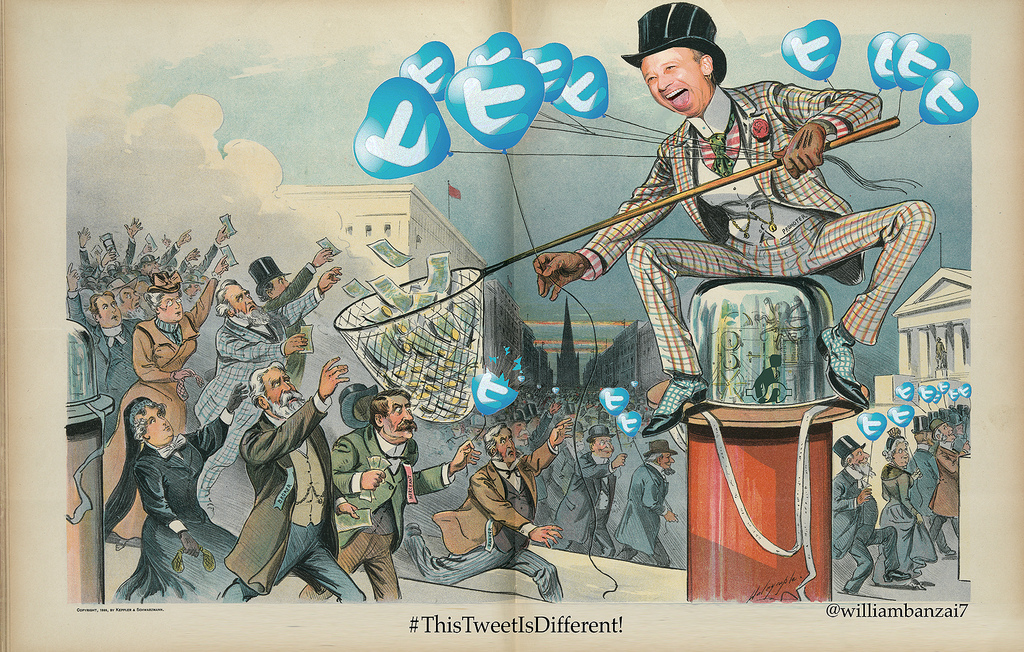

THiS TWeeT Is DiFFeReNT!

Submitted by williambanzai7

on 11/12/2013

A

List Of 23 Famous Obama Quotes That Turned Out To Be Broken Promises Or

Cold-Hearted Lies

How

many lies can one president tell and still retain any credibility? What

you are about to see is absolutely astounding. It is a long list of

important promises that Barack Obama has broken since he has been

president. If he had only told a few lies, perhaps the American people

would be willing to overlook that. After all, pretty much all of our

politicians our liars. Unfortunately, many of the lies that Obama has

told appear to have been quite cold-hearted in nature. For example,

Barack Obama repeatedly made the promise that “you will be able to keep

your health care plan” under Obamacare. But now we are learning that

he knew that this was a lie all along. Not only that, the Democrats in

Congress knew that this was a lie all along too. In fact, U.S. Senator

Kirsten Gillibrand, a Democrat, said the following when she was

asked about Obama’s promise to the American people recently: “He should’ve just

been specific. No, we all knew.” You can see video of her making this

statement right here. The truth is that they

all knew that millions upon millions of Americans would lose their current

health care policies under Obamacare. They deliberately lied just so that

they could get the law passed.

And

of course this is far from the only major lie that Obama has told in recent

years. The following is a list of 23 famous Obama quotes that turned out

to be broken promises or cold-hearted lies…

#1 “If you like your doctor, you

will be able to keep your doctor. Period. If you like your health care plan,

you will be able to keep your health care plan. Period. No one will take it

away. No matter what.”

#2 “My administration is committed

to creating an unprecedented level of openness in government.”

#3 “We agree on reforms that will

finally reduce the costs of health care. Families will save on their premiums…”

#4 “I don’t want to pit Red America

against Blue America. I want to be the president

of the United States

of America.”

#5 “We’ve

got shovel-ready projects all across the country that governors and

mayors are pleading to fund. And the minute we can get those investments

to the state level, jobs are going to be created.”

#6 “And we will pursue the housing

plan I’m outlining today. And through this plan, we will help between 7 and 9

million families restructure or refinance their mortgages so they can

afford—avoid foreclosure.”

#7 “I will sign a universal

health-care bill into law by the end of my first term as president that will

cover every American and cut the cost of a typical family’s premium by up to

$2,500 a year.”

#8 “We reject the use of national

security letters to spy on citizens who are not suspected of a crime.”

#9 “For people with insurance, the

only impact of the health-care law is that their insurance is stronger, better,

and more secure than it was before. Full stop. That’s it. They don’t have to

worry about anything else.”

#10 “We will close the detention camp

in Guantanamo Bay, the location of so many of the worst constitutional abuses

in recent years.”

#11 “Allow Americans to buy their

medicines from other developed countries if the drugs are safe and prices are

lower outside the U.S.”

#12 “We will revisit the Patriot Act

and overturn unconstitutional executive decisions issued during the past eight

years.”

#13 “Will ensure that federal

contracts over $25,000 are competitively bid.”

#14 “We reject sweeping claims of

‘inherent’ presidential power.”

#15 “Will eliminate all income

taxation of seniors making less than $50,000 per year. This will eliminate

taxes for 7 million seniors — saving them an average of $1,400 a year– and will

also mean that 27 million seniors will not need to file an income tax return at

all.”

#16 “We support constitutional

protections and judicial oversight on any surveillance program involving

Americans.”

#17 “If we have

not gotten our troops out by the time I am president, it is the first thing I

will do. I will get our troops home, we will end this war. You can

take that to the bank.”

#18 “Will not sign any non-emergency

bill without giving the American public an opportunity to review and comment on

the White House website for five days.”

#19 “The President does not have

power under the Constitution to unilaterally authorize a military attack in a

situation that does not involve stopping an actual or imminent threat to the

nation.”

#20 “We have a choice in this

country. We can accept a politics that breeds division and conflict and

cynicism…. That is one option. Or, at this moment, in this election, we can

come together and say, ‘Not this time….’”

#21 “We’ve got to spend some money

now to pull us out of this recession. But as soon as we’re out of this

recession, we’ve got to get serious about starting to live within our

means, instead of leaving debt for our children and our grandchildren and our

great-grandchildren.”

#22 “[T]oday I’m pledging to cut the

deficit we inherited in half by the end of my first term in office. This will

not be easy. It will require us to make difficult decisions and face challenges

we’ve long neglected. But I refuse to leave our children with a debt that they

cannot repay – and that means taking responsibility right now, in this

administration, for getting our spending under control.”

#23 “I, Barack Hussein Obama, do

solemnly swear that I will execute the office of president of the United States

faithfully, and will to the best of my ability, preserve, protect, and defend

the constitution of the United States.”

About

the author: Michael T. Snyder is a former

Washington D.C. attorney who now publishes The

Truth. His new thriller entitled “The Beginning Of The End”

is now available on Amazon.com.

By

Unilaterally Changing Obamacare, Obama Is Making A Mockery Of The Constitution

Since when can a president change a law all by

himself? By unilaterally declaring that certain provisions of Obamacare

will not be enforced, Barack Obama is making a mockery of the U.S.

Constitution. For those that have not read it, the U.S. Constitution says

that the president “shall

take Care that the Laws be faithfully executed“. So when Obama

declares that he will not enforce certain provisions of Obamacare for a year,

he is directly violating the Constitution. And as Stanford Law School

Professor Michael McConnell wrote back in July, the Office of Legal

Counsel for the Justice Department “has always insisted that the president has

no authority, as one such memo put it in 1990, to ‘refuse to enforce a statute

he opposes for policy reasons.’” This is an open and shut case. If

the U.S. Congress still had a shred of respect for the Constitution, they would

immediately demand that Obama enforce the law as written. If Obama

refused, they should immediately impeach him. We are a country that is

run by the rule of law, and just because Obama’s new law completely screws up

one-sixth of the economy does not mean that he can unilaterally change

it. In our system, Congress makes the laws and the president enforces

them. If we allow any president to unilaterally change laws whenever he

does not like them, then that puts us dangerously close to having a dictator in

the White House. (Read More.....)

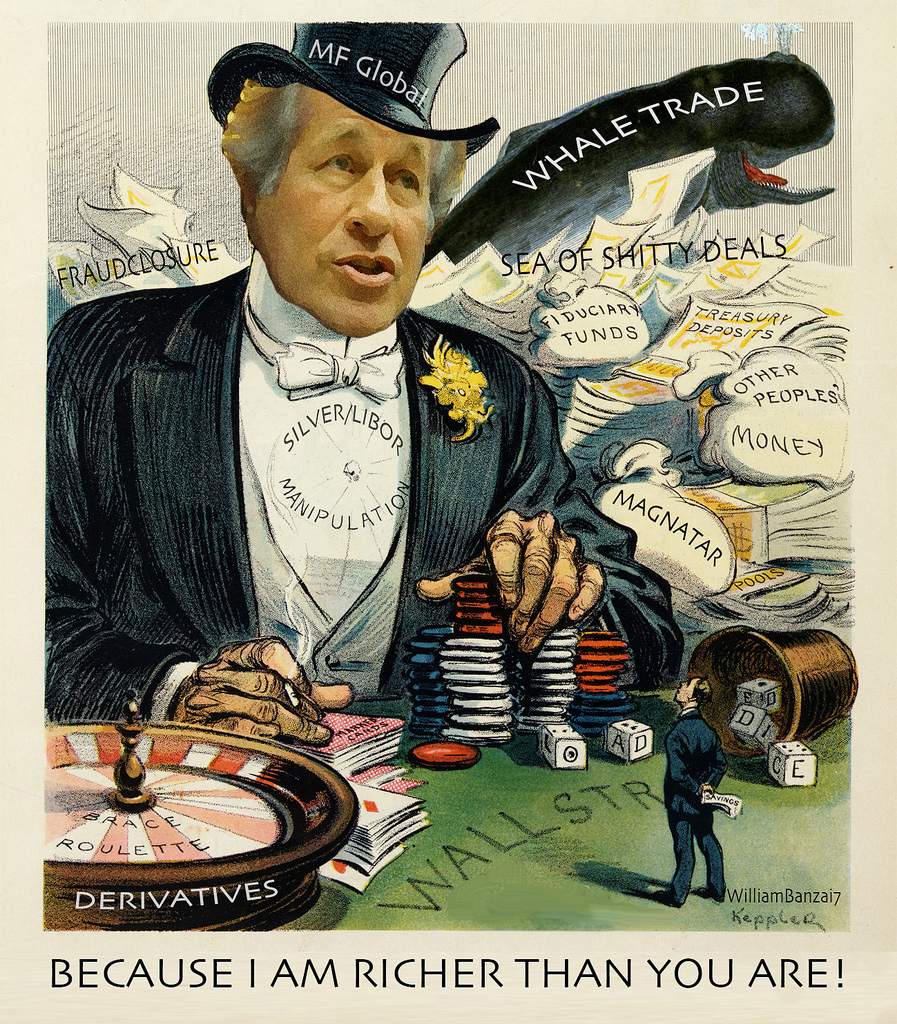

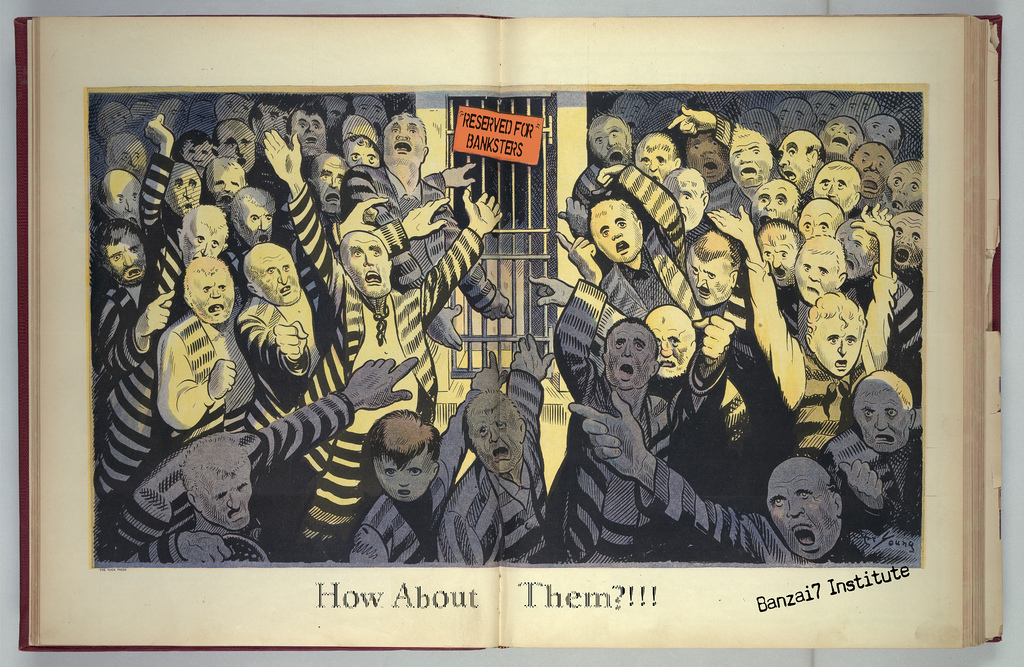

Too BiG To JaiL...

Submitted by williambanzai7 on

11/20/2013

The

Law demands that we atone

When

we take things that we don't own;

But

leaves the lords and ladies fine

Who

take things that are yours and mine...

Anonymous,

circa 1764

.

.

The dice of this moron are loaded

All trust in our system's eroded

But still he plays on

A Kleptocrat Con

He'll play till the world has exploded

The Limerick King

.

.

.

.

.

.

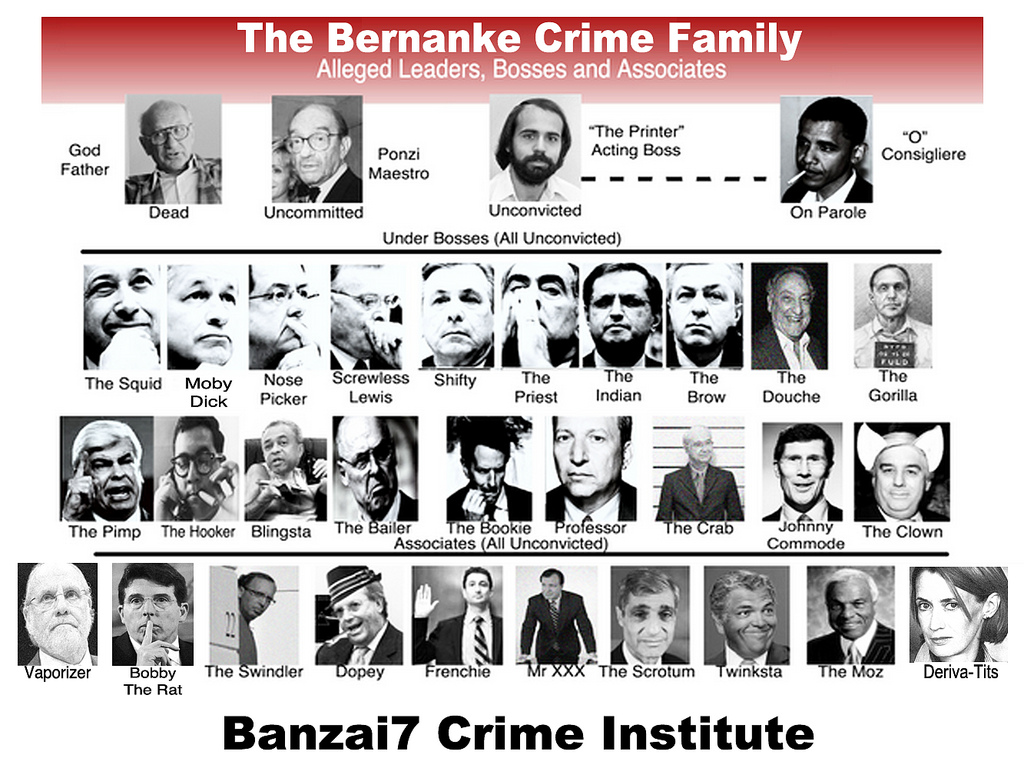

Commemorating 100 Years of Central Bankster

Schtupping

[I am just too stupid to figure out why this

picture won't center. It's not that I haven't spent 15 minutes staring at the

damned HTML code]

WB7

We Americans are basically a very simple people.

Our formula for past successes has essentially

been distilled as follows: maintain a "can-do" attitude, believe in

the "American way", honest hard work will be rewarded, abundant

opportunity and upward mobility for all.

Those who play the prosperity game correctly may

look forward to retirement in a spleniferous life of leisure and

Obamacare.

Once upon a time, this is is what American

Thanksgiving was supposed to look like...

Most Americans desperately cling to the foolish

Ponzi pipe dream of a notion that this Thanksgiving dream is still possible.

And for some PhD morons who evidently borrow

subprime QE money to purchase shitty American vehicles made principally of

plastic components sourced in Shenzen, the dream has been fullfilled.

Unfortunately, for reasons far to numerous to

enumerate in this post, this is all just a Ponzi Pilgrim's delusion.

There is one big kahuna of a fucking reason so

very plainly obvious.

When it comes to ridding our fucking system of

finance, the "fucking system" if you will, of all the learned fucking

thieves sitting the top of the fucking Ponzi pyramid, we are hopelessly screwed

up each and every one of our Holland and Lincoln Tunnels.

The same cheap fucking QE paper that buys those

shitty vehicles will also pay the much ballyhooed $13 Billion JPM shyster fine.

Half of JPM's profits in 2013.

Gobble fucking Goebbels.

I won't insult anyone's fringe low brow

intelligence by asking who has been convicted.

In any event, such a scenario is far to fetched

to even consider.

Instead I will pose the following question:

The biggest most egregious case of financial

fraud and chicanery by a US banking institution measured by the fiat of the

fine.

The biggest fine ever!

"Hoooly Cow!"--Phil Rizutto

Have the regulators who are in charge of the whole

JP Clusterfuck (you know the ones who keep getting reappointed, promoted or

hired by private equity firms) applied their very substantial leverage to force

the Shyster in Chief of JP Cesspool to cede his shysterly position by

resigning?

Is this something that could have happened? Of

course it is.

Don't believe me?

Go and ask our distinguished colleague Bill

Black, Esq what he thinks.

Does the fact that the same schlemiel will remain

in charge of the old JP Cesspit send the rest of us a message?

You better believe it does...

Whatcha are you gonna do sisters and brothers?

Sadly, for most of the rest of America it all

boils down to this...

Goebbel, Goebbel, Goebbel!

![]()

Atheist

'mega-churches' take root across US, world { They are intellectually dishonest, disingenuous, and most importantly,

absolutely wrong. Quite simply, atheists are pathetic! }

![]()

![]()

![]()

Knox's

knife DNA casts doubt on murder weapon

![]()

![]()

{ I’ve had occasion to

read the well-written book ‘Murder in Italy’ by award-winning italian-american

author, Candace Dempsey, which documents the horrific travesty called ‘italian justice’

(actually blatant injustice) torturously imposed upon Amanda Knox et als (rudy

guede excepted). So outrageous but typical of these typical italians ( like

packs of the rabid dogs they are pre-disposed to be). (Parenthetically, my

grandparents, both of whom I loved and respected – Elsie/Nanny, Bari, Italy and

Martin/Mario/PopPop (Peia), Lake Como, Italy – were not typical as such; but

rather, thoroughly modern in all respects relative to time and extremely

civilized in a manner to be emulated … although, truth be told, I found

italians with mob/mafia links/connections/sympathies to be like those rabid

perugians/italians who outrageously pilloried Amanda Knox, See, ie., http://www.albertpeia.com/112208opocoan/ricosummarytoFBIunderpenaltyofperjury.pdf

http://www.albertpeia.com/112208opocoan/PeiavCoanetals.htm

http://albertpeia.com/fbimartinezcongallard.htm ) }

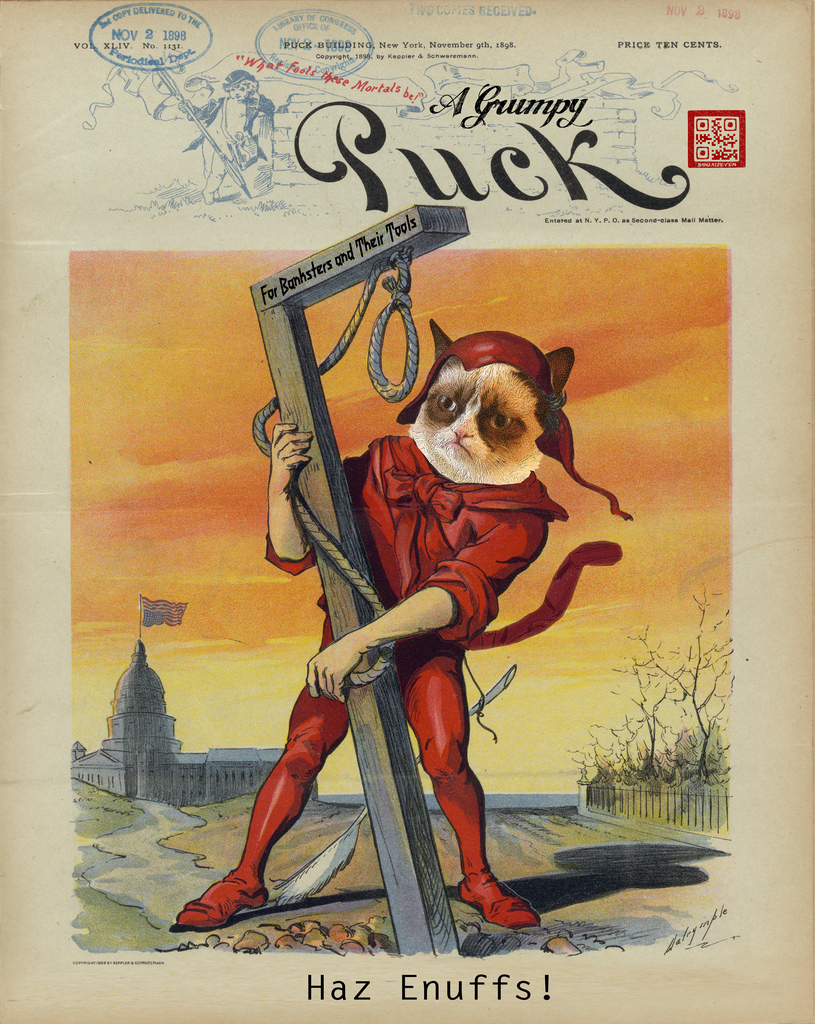

I HaVe HaZ ENuFFS!!!

Submitted by williambanzai7 on 11/16/2013 22:04 -0500

.

Collecting

Donations For Wal-Mart Employees That Cannot Afford Thanksgiving Dinner?

You may find what is happening at

one Wal-Mart in Ohio very hard to believe. At the Wal-mart on Atlantic

Boulevard in Canton, Ohio employees are being asked to donate food items so

that other employees that cannot afford to buy Thanksgiving dinner will be able

to enjoy one too. You can see a photo of the donation bins that has been

posted on Twitter right

here. On the one hand, it is commendable that someone at that

Wal-Mart is deeply concerned about the employees that are so poor that they

cannot afford to buy the food that they need for Thanksgiving. On the

other hand, this is a perfect example that shows how the quality of the jobs in

this country has gone down the toilet. Wal-Mart is the largest employer

in the United States and it had operating income of 26.5

billion dollars last year. Wal-Mart is not required to pay their

employees a decent wage, and it is very unlikely that anyone will force them

to. But they should. Because Wal-Mart does not pay

decent wages to their employees, the rest of us end up with the bill. As

you will see below, huge numbers of Wal-Mart employees end up on Medicaid and

other government assistance programs. Meanwhile, those that control

Wal-Mart continue to enjoy absolutely massive profits. (Read

More....)

You may find what is happening at

one Wal-Mart in Ohio very hard to believe. At the Wal-mart on Atlantic

Boulevard in Canton, Ohio employees are being asked to donate food items so

that other employees that cannot afford to buy Thanksgiving dinner will be able

to enjoy one too. You can see a photo of the donation bins that has been

posted on Twitter right

here. On the one hand, it is commendable that someone at that

Wal-Mart is deeply concerned about the employees that are so poor that they

cannot afford to buy the food that they need for Thanksgiving. On the

other hand, this is a perfect example that shows how the quality of the jobs in

this country has gone down the toilet. Wal-Mart is the largest employer

in the United States and it had operating income of 26.5

billion dollars last year. Wal-Mart is not required to pay their

employees a decent wage, and it is very unlikely that anyone will force them

to. But they should. Because Wal-Mart does not pay

decent wages to their employees, the rest of us end up with the bill. As

you will see below, huge numbers of Wal-Mart employees end up on Medicaid and

other government assistance programs. Meanwhile, those that control

Wal-Mart continue to enjoy absolutely massive profits. (Read

More....)

Obamacare:

The Final Nail In The Coffin For The Middle Class

If

there were any shreds of hope left that the stunning decline of the middle

class could be turned around, Obamacare has absolutely destroyed them.

Over the past decade or so, the middle class in the United States has been absolutely eviscerated. The number of

working age Americans without a job has increased by 27 million since the year 2000, median household

income in the U.S. has fallen for five years in a row, and the poverty

numbers in this country are spiraling out of control. And now

here comes Obamacare. As you will see below, Obamacare is causing

millions of Americans to lose their current health insurance policies, it is

causing health insurance premiums to explode to absolutely ridiculous levels,

and it is systematically killing jobs even though the employer mandate has been

delayed for a while. All of this is creating a tremendous amount of

stress for millions of middle class families that are already stretched

extremely thin financially. According to CNN, a survey that was conducted earlier this year found that 76

percent of all Americans are living paycheck to paycheck. Most of those

families simply cannot afford to pay much higher health insurance premiums for

new policies that also come with much larger deductibles and significantly increased

out-of-pocket costs. Millions of those families will ultimately end up

choosing to do without health insurance altogether, and that will create a

whole host of new problems. This is a disaster that is so enormous that

it is really hard to put into words. If the U.S. health care system was a

separate country, it would be the 6th largest economy on the entire globe all

by itself. And now Obamacare is going to bring the entire U.S. health

care system to its knees. (Read More....)

The

Federal Reserve Is Monetizing A Staggering Amount Of U.S. Government Debt

The

Federal Reserve is creating hundreds of billions of dollars out of thin air and

using that money to buy U.S. government debt and mortgage-backed securities and

take them out of circulation. Since the middle of 2008, these purchases

have caused the Fed's balance sheet to balloon from under a trillion dollars to

nearly four trillion dollars. This represents the greatest central bank

intervention in the history of the planet, and Janet Yellen says that she does

not anticipate that it will end any time soon because "the recovery is

still fragile". Of course, as I showed the other day, the truth is

that quantitative easing has done essentially nothing for the average person on

the street. But what QE has done is that it has sent stocks soaring to

record highs. Unfortunately, this stock market bubble is completely and

totally divorced from economic reality, and when the easy money is taken away

the bubble will collapse. Just look at what happened a few months ago

when Ben Bernanke suggested that the Fed may begin to "taper" the

amount of quantitative easing that it was doing. The mere suggestion that

the flow of easy money would start to slow down a little bit was enough to send

the market into deep convulsions. This is why the Federal Reserve cannot

stop monetizing debt. The moment the Fed stops, it could throw our

financial markets into a crisis even worse than what we saw back in 2008. (Read More....)

The

Federal Reserve is creating hundreds of billions of dollars out of thin air and

using that money to buy U.S. government debt and mortgage-backed securities and

take them out of circulation. Since the middle of 2008, these purchases

have caused the Fed's balance sheet to balloon from under a trillion dollars to

nearly four trillion dollars. This represents the greatest central bank

intervention in the history of the planet, and Janet Yellen says that she does

not anticipate that it will end any time soon because "the recovery is

still fragile". Of course, as I showed the other day, the truth is

that quantitative easing has done essentially nothing for the average person on

the street. But what QE has done is that it has sent stocks soaring to

record highs. Unfortunately, this stock market bubble is completely and

totally divorced from economic reality, and when the easy money is taken away

the bubble will collapse. Just look at what happened a few months ago

when Ben Bernanke suggested that the Fed may begin to "taper" the

amount of quantitative easing that it was doing. The mere suggestion that

the flow of easy money would start to slow down a little bit was enough to send

the market into deep convulsions. This is why the Federal Reserve cannot

stop monetizing debt. The moment the Fed stops, it could throw our

financial markets into a crisis even worse than what we saw back in 2008. (Read More....)

Americans

Are Disgusted By BOTH Republicans and Democrats Posted by : George Washington Post date: 10/11/2013 - 60% of Americans Want a Third Party Candidate

for 2016 { Make that a ‘Second

Party Candidate’ since there seems to be a morphed one party which could be

aptly called the repdemolicansocrats which has supported failure, obama’s

failure, ultimately at every turn, though contraindicated, favoring that 1%

with their ‘non-plan plan’ which has somewhat obfuscated wobama’s unequivocal

failure in terms of selling the sizzle ( like Zimbabwee, soaring

inflation/asset bubbles/paper share prices, etc.) … Bob Woodward did not mince

words in positing blame with wobama …

Yet, the incompetence/corruption is pervasive which is my direct

observation and experience … http://www.albertpeia.com/112208opocoan/ricosummarytoFBIunderpenaltyofperjury.pdf http://www.albertpeia.com/112208opocoan/PeiavCoanetals.htm http://albertpeia.com/fbimartinezcongallard.htm }

China

Announces That It Is Going To Stop Stockpiling U.S. Dollars

China

just dropped an absolute bombshell, but it was almost entirely ignored by the

mainstream media in the United States. The central bank of China has

decided that it is "no longer in China’s favor to accumulate

foreign-exchange reserves". During the third quarter of 2013,

China's foreign-exchange reserves were valued at approximately $3.66 trillion. And of course

the biggest chunk of that was made up of U.S. dollars. For years, China

has been accumulating dollars and working hard to keep the value of the dollar up

and the value of the yuan down. One of the goals has been to make Chinese

products less expensive in the international marketplace. But now China

has announced that the time has come for it to stop stockpiling U.S.

dollars. And if that does indeed turn out to be the case, than many U.S.

analysts are suggesting that China could also soon stop buying any more U.S.

debt. Needless to say, all of this would be very bad for the United

States. (Read More....)

China

just dropped an absolute bombshell, but it was almost entirely ignored by the

mainstream media in the United States. The central bank of China has

decided that it is "no longer in China’s favor to accumulate

foreign-exchange reserves". During the third quarter of 2013,

China's foreign-exchange reserves were valued at approximately $3.66 trillion. And of course

the biggest chunk of that was made up of U.S. dollars. For years, China

has been accumulating dollars and working hard to keep the value of the dollar up

and the value of the yuan down. One of the goals has been to make Chinese

products less expensive in the international marketplace. But now China

has announced that the time has come for it to stop stockpiling U.S.

dollars. And if that does indeed turn out to be the case, than many U.S.

analysts are suggesting that China could also soon stop buying any more U.S.

debt. Needless to say, all of this would be very bad for the United

States. (Read More....)

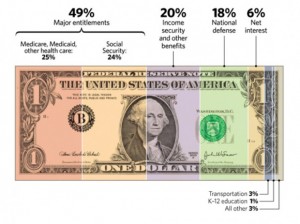

Obamacare

Is Going To Be The Biggest Expansion Of The Welfare State In U.S. History

Can

the U.S. government afford to pay for the health care of 38 million more

people? As you will see below, Obamacare is going to be the biggest

expansion of the welfare state in U.S. history. It is being projected

that a decade from now 17 million Americans will be receiving Obamacare

subsidies and an additional 21 million Americans will have been added to the

Medicaid rolls. At a time when we are already running trillion dollar

deficits, is this really something that the government should be taking

on? In addition, it is being projected that bringing millions upon

millions of new people into the Medicaid program will also cause enrollment in

many other federal welfare programs such as food stamps to surge. Right

now, the percentage of Americans that are financially dependent on the U.S.

government is already at an all-time high, and Obamacare is going to cause the

level of government dependence to go much, much higher. But how much

weight can the “safety net” actually carry before it breaks entirely? (Read

More.....)

Can

the U.S. government afford to pay for the health care of 38 million more

people? As you will see below, Obamacare is going to be the biggest

expansion of the welfare state in U.S. history. It is being projected

that a decade from now 17 million Americans will be receiving Obamacare

subsidies and an additional 21 million Americans will have been added to the

Medicaid rolls. At a time when we are already running trillion dollar

deficits, is this really something that the government should be taking

on? In addition, it is being projected that bringing millions upon

millions of new people into the Medicaid program will also cause enrollment in

many other federal welfare programs such as food stamps to surge. Right

now, the percentage of Americans that are financially dependent on the U.S.

government is already at an all-time high, and Obamacare is going to cause the

level of government dependence to go much, much higher. But how much

weight can the “safety net” actually carry before it breaks entirely? (Read

More.....)

10 Obamacare Horror Stories That Are

Almost Too Crazy To Believe

The

more Americans learn about Obamacare, the less they like it. They were

promised that under Obamacare they would be able to keep their current health

insurance plans, that health insurance premiums would be lower, and that

millions more Americans would be able to get coverage. But none of those

promises are turning out to be true. Right now, millions of Americans are

receiving cancellation notices from their health insurance companies –

including many Americans that are in a life or death battle with cancer.

By the end of next year, it is being projected that up

to 100 million more Americans could have their health insurance policies

canceled. Meanwhile, large numbers of Americans are discovering that their

“new plans” are going to cost them two, three, four or even five times as much

as their old plans cost them. You are about to see some shocking examples

of this. And now that the reality of Obamacare is really starting to sink

in for the American people, the popularity of the law is starting to drop like

a rock. According to a brand new

CBS News poll that was just released, only 31 percent of all Americans

still approve of Obamacare while an astounding 61 percent of all Americans now

disapprove of it. Perhaps if we get that number to 70 or 80 percent, the

politicians in Washington D.C. will cave in and we can get this law

repealed. So please share this article with as many people as you

possibly can. The following are 10 Obamacare horror stories that are

almost too crazy to believe… (Read

More.....)

The

more Americans learn about Obamacare, the less they like it. They were

promised that under Obamacare they would be able to keep their current health

insurance plans, that health insurance premiums would be lower, and that

millions more Americans would be able to get coverage. But none of those

promises are turning out to be true. Right now, millions of Americans are

receiving cancellation notices from their health insurance companies –

including many Americans that are in a life or death battle with cancer.

By the end of next year, it is being projected that up

to 100 million more Americans could have their health insurance policies

canceled. Meanwhile, large numbers of Americans are discovering that their

“new plans” are going to cost them two, three, four or even five times as much

as their old plans cost them. You are about to see some shocking examples

of this. And now that the reality of Obamacare is really starting to sink

in for the American people, the popularity of the law is starting to drop like

a rock. According to a brand new

CBS News poll that was just released, only 31 percent of all Americans

still approve of Obamacare while an astounding 61 percent of all Americans now

disapprove of it. Perhaps if we get that number to 70 or 80 percent, the

politicians in Washington D.C. will cave in and we can get this law

repealed. So please share this article with as many people as you

possibly can. The following are 10 Obamacare horror stories that are

almost too crazy to believe… (Read

More.....)

Edie Littlefield Sundby: “My grievance

is not political; all my energies are directed to enjoying life and staying

alive, and I have no time for politics. For almost seven years I have fought

and survived stage-4 gallbladder cancer, with a five-year survival rate of less

than 2% after diagnosis. I am a determined fighter and extremely lucky. But

this luck may have just run out: My affordable, lifesaving medical insurance

policy has been canceled effective Dec. 31.

My

choice is to get coverage through the government health exchange and lose

access to my cancer doctors, or pay much more for insurance outside the

exchange (the quotes average 40% to 50% more) for the privilege of starting

over with an unfamiliar insurance company and impaired benefits.”

Patricia in North Carolina:”I am a 62

year old woman who has an individual policy with BCBS of North Carolina.

My premiums are $249.50 per month. I bought the policy when I retired and

moved to NC to be closer to my aging parents. The policy is a high

deductible one with a $2700 deductible, $5000 out of pocket maximum. BCBS

has told me my plan is no longer offered due to Obamacare and that my new plan

will cost $600.55 per month and has a required an out of pocket maximum of

$6350.”

Jacqueline Proctor: Take, for

example, Jacqueline Proctor of San Francisco. She and her husband are in their

early 60s. They have been paying $7,200 a year for a bare-bones Kaiser

Permanente health plan with a $5,000 per person annual deductible. “Kaiser told

us the plan does not comply with Obamacare and the substitute will cost more

than twice as much,” about $15,000 per year, she says.

This

new plan, Kaiser’s cheapest offering for 2014, would consume about 25 percent

of their after-tax income. The new plan still has a $5,000 deductible but

provides coverage for things her current policy does not, such as maternity

care, healthy child visits and coverage for dependents up to age 26. Proctor

has no use for such coverage, since her son is 30.

Gloria Cantor: Gloria Cantor

of Florida has cancer — five brain tumors and tumors in her bones — but she

won’t have the health insurance she has relied on for her treatment for much

longer.

Mrs.

Cantor and her husband, Jay, told WFTV in Orlando that their insurance is being

dropped in order to comply with Obamacare regulations.

“The

Cantors received [a] letter in the mail [that] explains Gloria’s health

insurance will end next summer due to the Affordable Care Act,” reporter Lori

Brown says. “But after promises by President Obama … the Cantors now feel

betrayed. After the insurance company drops them, it will offer them a

different plan that it admits will be more expensive. The Cantors are

especially worried because their doctors cannot assure them that [the MD

Anderson Cancer Center] will still accept the new plan.”

A Zero Hedge Reader: My company,

based in California, employs 600. We used to insure about 250 of our employees.

The rest opted out. The company paid 50% of their premiums for about

$750,000/yr.

Under

obamacare, none can opt out without penalty, and the rates are double or

triple, depending upon the plan. Our 750k for 250 employees is going to $2

million per year for 600 employees.

By

mandate, we have to pay 91.5% of the premium or more up from the 50% we used to

pay.

Our

employees share of the premium goes from $7/week for the cheapest plan to

$30/week. 95% of my employees were on that plan. Remember, we used to pay

50% now we pay 91.5% and the premiums still go up that much!!

The

cheapest plan now has a deductible of $6350! Before it was $150. Employees

making $9 to $10/hr, have to pay $30/wk and have a $6350 deductible!!! What!!!!

They

can’t afford that to be sure. Obamacare will kill their propensity to seek

medical care. More money for less care? How does that help them?

Ashley Dionne: I graduated

from The University of Michigan in 2009. In my state, this used to mean

something, but even with a bachelor’s I was told I was too educated and wouldn’t

stay. I watched as kids with GEDs and high school diploma’s took the low-paying

jobs for which I applied.

I

went back to school and got a second degree and finally found work at a gym. I

work nights and only get 32 hours a week for eight dollars an hour. I’m unable

to find a second job at this time.

I

have asthma, ulcers, and mild cerebral palsy. Obamacare takes my monthly rate

from $75 a month for full coverage on my “Young Adult Plan,” to $319 a month.

After $6,000 in deductibles, of course.

Liberals

claimed this law would help the poor. I am the poor, the working poor, and I

can’t afford to support myself, let alone older generations and people not

willing to work at all.

This law has raped my future.

It

will keep me and kids my age from having a future at all.

This

is the real face of Obamacare and it isn’t pretty.

George Schwab: George

Schwab, 62, of North Carolina, said he was “perfectly happy” with his plan from

Blue Cross Blue Shield, which also insured his wife for a $228 monthly premium.

But this past September, he was surprised to receive a letter saying his policy

was no longer available. The “comparable” plan the insurance company offered

him carried a $1,208 monthly premium and a $5,500 deductible.

A Middle Class Texas Family: Obamacare is

named the “Affordable Care Act,” after all, and the President promised the

rates would be “as low as a phone bill.” But I just received a confirmed letter

from a friend in Texas showing a 539% rate increase on an existing policy

that’s been in good standing for years.

As

the letter reveals (see below), the cost for this couple’s policy under Humana

is increasing from $212.10 per month to $1,356.60 per month. This is for a

couple in good health whose combined income is less than $70K — a middle-class

family, in other words.

Michael Cerpok: “I’ve worked

hard because I’ve had to, and I’ve had to, because cancer runs in my family,”

says Cerpok, who picked his current health insurance based on that family

history. His monthly premium is just about half of his monthly take-home pay.

Back

in 2006, he found out he had an incurable form of leukemia that requires

ongoing treatment until he dies.

In

2012, his treatment bill was more than $350,000. But because of his insurance,

his out-of-pocket was only $4,500.

That’s

about to change because Michael just got a letter from his insurance carrier

saying as of January 1, he would be dropped from coverage because of new

regulations under Obamacare.

Bill

Elliot: Fox News host Megyn Kelly shared a heart

rendering story Thursday night of a South Carolina man with cancer who is being

forced to make what he sees as a life or death decision after his health

insurance plan was cancelled because of Obamacare.

Bill

Elliot, who voted for President Obama, contacted “The Kelly File” via Facebook

and said he can no longer afford to pay his medical bills and does not want to

take on the new costs because he does not want to put a “burden” on his family,

according to Fox News.

Saying

he feels “misled,” Elliott told Kelly his new insurance will cost him $1,500

per month with a $13,000 deductible, adding that he will opt to pay the minimal

fine for not having health insurance and “will just let nature take its

course.”

—–

So

what do you think about Obamacare? Please feel free to share your

thoughts by posting a comment below…

13 Nephilim

Skulls Found In Mexico?

So

much of what we have been taught about ancient history is simply not

true. According to Mexico’s National Institute of Anthropology and

History, a team of archaeologists working close to the Mexican village of

Onavas has made an amazing discovery. They reportedly found 13 ancient

human specimens that had grossly elongated skulls. You can find original

photographs of this discovery right here, but the descriptions of the

photos are in Spanish. The Mexican scientists are telling us that these

skulls are approximately 1,000 years old, and that no skulls of this nature have

ever been found in this region of Mexico before. So exactly what is going

on here? Are these elongated skulls simply the product of an ancient

technique known as “cradle-boarding”, or is there another explanation?

Could these actually be Nephilim skulls that prove that an ancient race of

hybrids once roamed the planet? You might want to hold on to your hat –

because the (Read More....)

CoNSPiRaCY MeMe...

Submitted by williambanzai7 on 11/22/2013 10:01 -0500

TIN CAT

Obamacare

Is Going To Be The Biggest Expansion Of The Welfare State In U.S. History

Can

the U.S. government afford to pay for the health care of 38 million more

people? As you will see below, Obamacare is going to be the biggest

expansion of the welfare state in U.S. history. It is being projected

that a decade from now 17 million Americans will be receiving Obamacare

subsidies and an additional 21 million Americans will have been added to the

Medicaid rolls. At a time when we are already running trillion dollar

deficits, is this really something that the government should be taking

on? In addition, it is being projected that bringing millions upon

millions of new people into the Medicaid program will also cause enrollment in

many other federal welfare programs such as food stamps to surge. Right

now, the percentage of Americans that are financially dependent on the U.S.

government is already at an all-time high, and Obamacare is going to cause the level

of government dependence to go much, much higher. But how much weight can

the “safety net” actually carry before it breaks entirely? (Read More.....)

Can

the U.S. government afford to pay for the health care of 38 million more

people? As you will see below, Obamacare is going to be the biggest

expansion of the welfare state in U.S. history. It is being projected

that a decade from now 17 million Americans will be receiving Obamacare

subsidies and an additional 21 million Americans will have been added to the

Medicaid rolls. At a time when we are already running trillion dollar

deficits, is this really something that the government should be taking

on? In addition, it is being projected that bringing millions upon

millions of new people into the Medicaid program will also cause enrollment in

many other federal welfare programs such as food stamps to surge. Right

now, the percentage of Americans that are financially dependent on the U.S.

government is already at an all-time high, and Obamacare is going to cause the level

of government dependence to go much, much higher. But how much weight can

the “safety net” actually carry before it breaks entirely? (Read More.....)

Oprah

Winfrey: Obama is victim of racism; racists ‘just have to die’ (453 comments) { Former

Secret Service Agent: Holder Justice Dept 'Travesty'... The race card? Again? That dog don’t hunt

nomore! … Mayor

Throws Racial Tirade After Drunk Driving Arrest; 'You F*****g Crackers'... Who are the racists? … UPDATE:

MORE CLAIMS OF RACE BIAS AT JUSTICE... ‘ignore

cases that involve black defendants and white victims’

POLICE: Black teenagers light 13-year-old on fire;

'You get what you deserve, white boy'...Typical

n*****s! Come on! People are tired of making making up excuses for the blacks.

It’s always the same story with them, no matter where. http://www.albertpeia.com/whitesvictimizedbyblacks.htm http://www.albertpeia.com/whitesvictimizedbyblacks.htm Drudgereport: 'Mob' beatings at WI state fair... 'Hundreds of young black people beating white

people'... [ Typical n*****s! Good thing there are food

stamps; otherwise they’d be reverting to their inherent proclivity for

canabalism (send them back to africa … even give them a lump sum for an

irrevocable repatriation incentive … a huge cost-saving beyond the first year

with substantial salutary effects for the nation, the economy, and the

remaining civilized non-blacks). The other major crimes they do anyway. It’s

their nature. You’ll never change the nigger … they evolved only to ‘a point’

and no further. ] Fairgoers 'pulled out of cars'... 'They were just going after white people'... Heightened security... [ I refrained from using the ‘n word’ (or

even blacks / negroes) in referring to the culprits in the following two

incidents (those tender sensibilities) but I’m sure you’ve guessed that they

were niggers and I include same here in light of the foregoing incident (and

yes, the victims were white), which is typical. ‘.. while walking through

Military Park (a sliver of a “park” - more a pedestrian thoroughfare/cement

walks) in newark, new jersey on the way to the bank during lunch hour, I heard

the clearly audible screams/cries of what turned out to be an old lady on the

ground with blood streaming from her mouth. I ran toward the sound of the

cries, the source of which I could not see because there were so many people in

and about this thoroughfare so as to block any vision of the source of the cries.

When I came to the woman, on the ground, blood streaming from her mouth, I

asked what happened, to which she responded she had been hit in the mouth and

knocked to the ground, her purse stolen/put inside her shopping bag, and she

pointed out the criminal casually now walking across the main street. Nobody

stopped to help her, many having passed her by. I slammed the thug to the

ground so hard that, in light of all the blood and confusion (limbic system /

adrenalin flow) I thought I had been stabbed (the blood was from his elbows

hitting the pavement so hard - no one helped / a crowd gathered / an undercover

cop happened along). When I testified at the Grand Jury Proceeding I made sure

his threat on my life was set forth in prima facie fashion so as to maximize

the DA’s position with both felonies ( he went to prison – pled out ). The

other case I wrote about here ( This was included on my website in the

Psychology forum discussion of ‘bystander effect’ / diffusion of

responsibility. ) - Having had occasion to have run down a mugger in newark,

n.j. who apparently had followed a girl from the bank on her way to the bursar

to pay tuition, though in pretty good shape, I was astounded by how totally

exhausting such a pursuit was, how much like rubber my arms were when I traded

punches with the perpetrator, and truth be told, if I had a flashlight on my

belt, I have little doubt that I would have probably used it to subdue the perp

(a police officer here in California was the object of intense criticism for having

used a flashlight to subdue a criminal

/ nigger after a long chase so I included that here) . The girl was not

that seriously injured, did get her pocketbook and tuition back, and the

criminal / nigger went to jail (where they belong). The other thing about such

a pursuit that amazed me was that no one else assisted the girl or me despite

being in a position to do so. I was also mugged by 4 niggers and 2 hispanics in

an incident here in Los Angeles, CA. But, to be fair and balanced, the RICO

litigation involves those uncivilized who consider themselves ‘whites’ http://albertpeia.com/ricosummarytoFBIunderpenaltyofperjury.pdf

(predominantly but not exclusively jews / romans-italians / mobsters /

government slugs). ]

Black Serial/Mass/Spree Killer List:

1. Matthew Emanuel Macon

(Murdered and Raped 5 White Women in Lansing)

2. Jimmie Reed

(Murdered his wife and his 2 month old daughter and set them on fire)

3. Shelly Brooks

(Murdered 7 prostitutes in Detroit Cass Corridor)

4. Justin Blackshere (Stabbed two white cooks

at Cheli’s Chili downtown Detroit)

5. Jervon Miguel Coleman

(Murdered three people.)

6. Donell Ramon Johnson

(Murdered a mother and a daughter)

7. Brian Ranard Davis

(6 women known murdered by nigger)

8. Paul Durousseau

(Seven women)

9. Mark Goudeau “The Baseline Killer” (Eight

women and a man in 2005-2006)

10. Coral Eugene Watts

(11 women in Texas & 1 in Michigan)

11. Anthony McKnight

(Five girls and young women)

12. Derrick Todd Lee (8

Women)

13. Charles Lendelle Carter

(4 known murders; admits to ‘hunting’ Atlantans for 15 years!)

14. The Zebra Killings

(71 White people)

15. Chester Turner

(L.A.s most prolific killer 12 women killed.)

16. Lorenzo J. Gilyard

(Kansas City, MO.—13 victims)

17. Eugene Victor Britt

(Gary, IN.–3 known murder/rapes.)

18. Reginald and Jonathan Carr

(The Wichita Massacre–6 Whites murdered)

19. Ray Joseph Dandridge and his

uncle, Ricky Gevon Gray (Richmond, VA.–Murdered 7 people in 7 days,

including an entire White family.)

20. The Tinley Park Murderer

(Suspect hasn’t been found but has been described as black – murdered 5 women

in a store.)

21. Henry Louis Wallace

(Raped and strangled 5 women to death.)

22. Charles Johnston

(Murdered 3 unarmed white men in hospital)

23. Craig Price (Brutally murdered 3 women)

24. Harrison Graham

(Brually Murdered 3 women)

25. Charles Lee “Cookie” Thornton

(Murdered 6 Whites at the Kirkwood, MO. city council. )

26. & 27. Darnell Hartsfeld & Romeo

Pinkerton (Abducted and Murdered 5 from a restaurant)

28 &29. John Allen Muhammad & Lee Boyd Malvo (Sniped 11 people from a

car in DC, 9 died.)

30. George Russell (3 women, WA state)

31. Timothy W. Spencer (5 killed, Arlington, VA and Richmond, VA)

32. Elton M. Jackson (12 gay men killed, Norfolk, VA area)

33. Carlton Gary (3 killed in Columbus, GA)

34. Mohammed Adam Omar (16 women, Yemen. Omar is Sudanese.)

35. Kendall Francois (8 women, Poughkeepsie, NY and surrounding areas.)

36. Terry A. Blair (8 women, Kansas City area)

37. Wayne Williams (33 many of them children!, Atlanta, GA)

38. Vaughn Greenwood (11 killed in LA)

39. Andre Crawford (10 killed in Chicago – southside)

40. Calvin Jackson (9 killed possibley more in NY)

41. Gregory Klepper (killed 8, Chicago – southside)

42. Alton Coleman (Killed 8 in the Midwest)

43. Harrison Graham (killed 7+ in N. Philadelphia)

44. Cleophus Prince (6 killed in, San Diego

45. Robert Rozier (7 killed in, Miami)

46. Maurice Byrd (killed 20 + in St. Louis)

47. Maury Travis (17 and rising, St. Louis and possibly also Atlanta)

48. Hulon Mitchell, a.k.a. Yahweh Ben Yahweh (killed 20+ in Florida)

49. Lorenzo Fayne (killed 5 children in East St. Louis, IL)

50. Paul Durousseau, (killed 6, two of which were pregnant women, Jacksonville,

FL; Georgia.)

51. Eddie Lee Mosley (killed 25 to 30 women, south Florida)

52. Henry Lee Jones (killed 4 in, south Florida; Bartlett, TN)

53. Richard “Babyface” Jameswhite (15 killed in, New York; Georgia.)

54. Donald E. Younge, Jr. (killed 4), East St. Louis, IL; Salt Lake City, UT.

55. Ivan Hill (killed 6

in Los Angeles area).

56. Michael Vernon (Bronx, NY. Killed at least seven people – )

57. Chester Dewayne Turner (12 women killed in, Los Angeles)

ARREST MADE IN LOS ANGELES GRIM SLEEPER SERIAL KILLER CASE July

07, 2010 http://articles.cnn.com/2010-07-07/justice/grim.sleeper.arrest_1_lonnie-david-franklin-serial-killer-case-family-members?_s=PM:CRIME |By

Mallory Simon, CNN ‘Authorities in California said Wednesday they have arrested

a suspect in the Grim Sleeper serial killer case and will charge him with 10

counts of murder.Lonnie David Franklin Jr., 57, faces an additional count of

attempted murder, Capt. Kevin McClure with the Los Angeles Police Department

said.Franklin will arraigned in court Thursday morning, McClure said.The

California Attorney General's office attributed the arrest to DNA collected

from a relative of the suspect, in a controversial and rarely used practice

known as familial DNA search.’

Of Course There Are Black

Serial Killers by Lynette Holloway on July 15, 2010 The case of the "Grim

Sleeper" inspires a second look at the popular perception that serial

killing is the province of clever white men.

Serial Murderers' Row

July 16, 2010 The following black men are

among the most prolific serial killers in U.S. history. http://www.theroot.com/multimedia/gallery-meet-6-black-serial-killers Plus: Behind the myth

that only white men commit such crimes.

Black Serial Killers Not So Uncommon http://www.amren.com/news/news04/03/03/blackserial.html

200 Involved In Fights At Mall Of America After

Rumors That Rappers Are There...

Miami Heat Players Don Hoodies...

'Dead or Alive' Poster Issued by New Black Panther

Party... [ ‘Minority Report’ Division of Pre-Crime, Pre-Cogs say, ‘Dead

or Alive – all niggers’ … whatever the outcome in the investigative process,

the stark reality is that at least, unlike the niggers committing many more

‘black on white’ violent crimes,

Zimmerman (and this is no endorsement – I won’t be looking at this one

incident all that closely) was at least trying to do a good thing made

necessary by the ever increasing number of brutal crimes committed by the black

thugs in neighborhoods across the nation; then there’s somalian pirates, etc..

People domestically and internationally are suffering from nigger-fatigue and

are totally niggered out. Oh, yeah, there are some Hollywood types who feel

good about themselves having niggers around and helping niggers to help them

feel better than they really are, insecure as they are, by being better than at

least someone beyond fantasy. Loony george clooney is one. Dreadfully boring

and with that monotone, monotonous voice and not that bright, he’s not even

able to fake it on screen as an action hero (ie., batman, what a horrific

miscast) wimpy pussy in reality that he is; then there’s the ‘black (sean)

penn’ who cried like a baby while incarcerated for a couple of days not that

long ago. The atheist jolie, so fatherly troubled as she is, has let the

equally mentally troubled pitt (she so nutty she makes him feel somewhat sane

though still not too bright) and pendulum ‘backwoods bob’ be the closest she’s

gotten to her black projects. Let them live anonomously (in disguise) with the

niggers for some time for a real close look and then see what’s left of their

predisposed love for the nigger. Then there’s the italian scallion, booby

deniro; drug addled as his black wife high-tower, what a total embarrassment to

Italians everywhere; even as he tried to ingratiate himself recently with

niggers everywhere and particularly national embarrassment mammy michele with

the embarrassing pro-nigger first lady remark.. [ Send the niggers back to sub-saharan Africa! ]

'BLACK NIGGERS [ NOT WHITES BY NIGGERS THE

IMPLICATION DESPITE FACTUAL DATA TO THE CONTRARY ] ARE UNDER ATTACK [ SAYS NIGGER SHAKEDOWN ARTIST JACKSON] '

[ Hold on one cotton-pickin’ minute jesse, that’s not what the facts say Obama: ‘If I

had a son, he’d look like Trayvon.’ [ Yeah! He’d look just like any

other nigger. And, don’t worry about the black vote, failed president wobama

the b for b***s*** will get nearly if not all, 100% of the nigger vote!

Drudgereport: Farrakhan Threatens 'Retaliation'… [ Retaliation? Can

you imagine the number of blacks that would have to be retaliated against based

upon the hushed reality of the prevalence of black on white crime? The blacks

should be careful what they wish for in playing that game because the facts

don’t break in their favor. ] ...

People

have become weary of making up excuses for blacks (like obama, holder, etc.).

At some point, as now, people should not be timid about relating the cold,

unvarnished truth statistically / factually about blacks and, ie., black on white violent crime, etc..

From

Pat Buchanan: As for racism, its ugliest manifestation is in

interracial crime, and especially interracial crimes of violence. Is Barack

Obama aware that while white criminals choose black victims 3 percent of the

time, black criminals choose white victims 45 percent of the time? Is Barack

aware that black-on-white rapes are 100 times more common than the reverse,

that black-on-white robberies were 139 times as common in the first three years

of this decade as the reverse? We have all heard ad nauseam from the Rev. Al

about Tawana Brawley, the Duke rape case and Jena. And all turned out to be

hoaxes. But about the epidemic of black assaults on whites that are real, we

hear nothing.

http://albertpeia.com/blackonwhitecrime.htm

VIDEO: Black Student Becomes Enraged In Evolution Class,

Threatens To Kill Professor...

http://albertpeia.com/blackthreatenstokillprofessorstudentsoverhersimianancestry.htm

http://www.albertpeia.com/whitesvictimizedbyblacks.htm

The

reality is that blacks are an insoluble problem wherever they are. That’s not

going to ever change; not make-shift/make-work jobs; not programs; not anything

tried or to be tried; hence, they must be treated as exactly that – problems –

before a solution can be derived and fashioned. ] [ Send the niggers, including

niggerbama back to sub-saharan africa! ]

}

Obama: