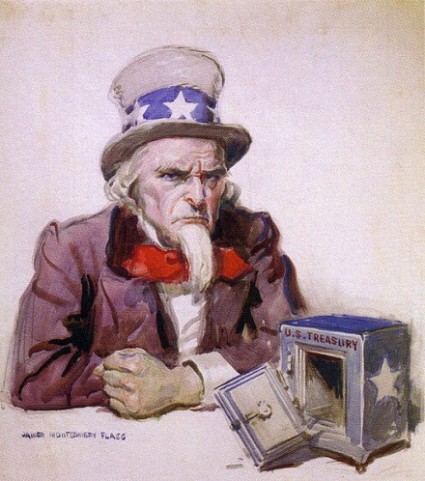

100 Years Old And Still Killing Us: America Was Much Better

Off Before The Income Tax

http://theeconomiccollapseblog.com

http://albertpeia.com/incometaxkillingus.htm

’Did

you know that the greatest period of economic growth in American history was

during a time when there was absolutely no federal income tax? Between

the end of the Civil War and 1913, there was an explosion of economic activity

in the United States unlike anything ever seen before or since.

Unfortunately, a federal income tax was instituted in 1913, and this year it

turned 100 years old. But there was no fanfare, was there? There

was no celebration because the federal income tax is universally hated.

Sadly, most Americans just assume that there is no other option to an income

tax. Most Americans just assume that it has always been with us and that

it will always be with us. This year, the American people will shell out

approximately $4.22 trillion in state and federal

income taxes. That amount is equivalent to approximately 29.4 percent of

all income that Americans will bring in this year, and that does not even take

into account the dozens of other taxes that Americans pay each year. At

this point, the U.S. tax code is about 13 miles long, and those that are

honest and pay their taxes every year are being absolutely shredded by this

system. But wouldn't the federal government go broke if we didn't have a

federal income tax? No, actually the truth is that the federal government

did just fine before there was an income tax. In fact, the U.S. national

debt has gotten more than 5000 times larger since the federal

income tax and the Federal Reserve were created by Congress back in 1913.

As I have written about previously, the Federal Reserve system was actually

designed to trap the United States in a debt spiral from which it could never

possibly escape, and the federal income tax was needed to greatly expand the

size of the federal government and to soak the American people of the funds

necessary to service that debt. But it doesn't have to be this way.

America was once much better off before the income tax and the Federal Reserve

were created, and we could easily go to such a system again.

’Did

you know that the greatest period of economic growth in American history was

during a time when there was absolutely no federal income tax? Between

the end of the Civil War and 1913, there was an explosion of economic activity

in the United States unlike anything ever seen before or since.

Unfortunately, a federal income tax was instituted in 1913, and this year it

turned 100 years old. But there was no fanfare, was there? There

was no celebration because the federal income tax is universally hated.

Sadly, most Americans just assume that there is no other option to an income

tax. Most Americans just assume that it has always been with us and that

it will always be with us. This year, the American people will shell out

approximately $4.22 trillion in state and federal

income taxes. That amount is equivalent to approximately 29.4 percent of

all income that Americans will bring in this year, and that does not even take

into account the dozens of other taxes that Americans pay each year. At

this point, the U.S. tax code is about 13 miles long, and those that are

honest and pay their taxes every year are being absolutely shredded by this

system. But wouldn't the federal government go broke if we didn't have a

federal income tax? No, actually the truth is that the federal government

did just fine before there was an income tax. In fact, the U.S. national

debt has gotten more than 5000 times larger since the federal

income tax and the Federal Reserve were created by Congress back in 1913.

As I have written about previously, the Federal Reserve system was actually

designed to trap the United States in a debt spiral from which it could never

possibly escape, and the federal income tax was needed to greatly expand the

size of the federal government and to soak the American people of the funds

necessary to service that debt. But it doesn't have to be this way.

America was once much better off before the income tax and the Federal Reserve

were created, and we could easily go to such a system again.

What we desperately need to do

is to teach the American people a little history lesson. The truth is

that the greatest period of economic growth in U.S. history was between the

Civil War and 1913 when there was no federal income tax at all. The

following is from Wikipedia...

The

Gilded Age saw the greatest period of economic growth in American history.

After the short-lived panic of 1873, the economy recovered with the advent of

hard money policies and industrialization. From 1869 to 1879, the US economy

grew at a rate of 6.8% for real GDP and 4.5% for real GDP per capita, despite

the panic of 1873. The economy repeated this period of growth in the

1880s, in which the wealth of the nation grew at an annual rate of 3.8%, while

the GDP was also doubled.

Sadly,

most Americans cannot even conceive of an economy like that. Most

Americans cannot even imagine having a nation without a massively bloated

federal government and without an unelected central bank centrally planning our

financial system.

But

you know what?

It

worked. In fact, it worked fantastically well.

The

period between the Civil War and 1913 propelled the United States to

greatness. Just check out all of the good things that Wikipedia says happened for the U.S.

economy during those years...

The

rapid economic development following the Civil War laid the groundwork for the

modern U.S. industrial economy. By 1890, the USA leaped ahead of Britain for

first place in manufacturing output.

An

explosion of new discoveries and inventions took place, a process called the

"Second Industrial Revolution." Railroads greatly expanded the

mileage and built stronger tracks and bridges that handled heavier cars and

locomotives, carrying far more goods and people at lower rates. Refrigeration

railroad cars came into use. The telephone, phonograph, typewriter and electric

light were invented. By the dawn of the 20th century, cars had begun to replace

horse-drawn carriages.

Parallel

to these achievements was the development of the nation's industrial

infrastructure. Coal was found in abundance in the Appalachian Mountains from

Pennsylvania south to Kentucky. Oil was discovered in western Pennsylvania; it

was mainly used for lubricants and for kerosene for lamps. Large iron ore mines

opened in the Lake Superior region of the upper Midwest. Steel mills thrived in

places where these coal and iron ore could be brought together to produce

steel. Large copper and silver mines opened, followed by lead mines and cement

factories.

In

1913 Henry Ford introduced the assembly line, a step in the process that became

known as mass-production.

But

if we didn't have an income tax, how did we fund the government? Well, we

mostly did it with tariffs and excise taxes. The following is from a

recent article by Thomas R. Eddlem...

Prior

to ratification of the 16th (income tax) Amendment in February 1913, the

federal government managed its few constitutional responsibilities without an

income tax, except during the Civil War period. During peacetime, it did so largely

— or even entirely — on import taxes called “tariffs.” Congress could afford to

run the federal government on tariffs alone because federal responsibilities

did not include welfare programs, agricultural subsidies, or social insurance

programs like Social Security or Medicare. After the Civil War, tariff revenues

sometimes suffered under a protectionist policy ushered in by the Republican

Party that supplemented federal income via excises on alcohol, tobacco, and

inheritances. But before the war, the need for tariff revenue to finance the

federal government generally kept the tariff at reasonable levels. During

wartime throughout early American history, the Founding Fathers were able to

raise additional revenue employing a different method of direct taxation

authorized by the U.S. Constitution prior to the 16th Amendment. These

alternative taxing methods gave the young American nation embarrassing

peacetime budget surpluses that several times came close to paying off the

national debt.

So

why didn't we stick with that system?

Well,

early in the 20th century the "progressives" and the social planners

started to take control in Washington.

And

one of the things that "progressives" and social planners love is an

income tax. In fact, the second plank of the Communist Manifesto is a

"heavy progressive or graduated income tax".

Of

course they promised us that income tax rates would always remain low.

And at first they were quite low. The following is from an article by

Adam Young...

The

presidential election of 1912 was contested between three advocates of an

income tax. The winner, Woodrow Wilson, after the ratification of the Sixteenth

Amendment, called a special session of Congress in April 1913, which proceeded

to pass an income tax of 1% on incomes above $3,000 and applied surcharges

between 2% and 7% on income from $20,000 to $500,000.

But

once the "progressives" and the social planners get their feet in the

door, they always want more.

And

we have seen how things have worked out. Today, the American people are being taxed into oblivion.

In

a previous article entitled "Show This To

Anyone That Believes That Taxes Are Too Low", I listed dozens of other

taxes that the American people pay each year in addition to federal and state

income taxes...

![]() #1 Building Permit Taxes

#1 Building Permit Taxes

![]() #2 Capital Gains Taxes

#2 Capital Gains Taxes

![]() #3 Cigarette Taxes

#3 Cigarette Taxes

![]() #4 Court Fines (indirect taxes)

#4 Court Fines (indirect taxes)

![]() #5 Dog License Taxes

#5 Dog License Taxes

![]() #6 Drivers License Fees (another form of

taxation)

#6 Drivers License Fees (another form of

taxation)

![]() #7 Federal Unemployment Taxes

#7 Federal Unemployment Taxes

![]() #8 Fishing License Taxes

#8 Fishing License Taxes

![]() #9 Food License Taxes

#9 Food License Taxes

![]() #10 Gasoline Taxes

#10 Gasoline Taxes

![]() #11 Gift Taxes

#11 Gift Taxes

![]() #12 Hunting License Taxes

#12 Hunting License Taxes

![]() #13 Inheritance Taxes

#13 Inheritance Taxes

![]() #14 Inventory Taxes

#14 Inventory Taxes

![]() #15 IRS Interest Charges (tax on top of tax)

#15 IRS Interest Charges (tax on top of tax)

![]() #16 IRS Penalties (tax on top of tax)

#16 IRS Penalties (tax on top of tax)

![]() #17 Liquor Taxes

#17 Liquor Taxes

![]() #18 Luxury Taxes

#18 Luxury Taxes

![]() #19 Marriage License Taxes

#19 Marriage License Taxes

![]() #20 Medicare Taxes

#20 Medicare Taxes

![]() #21 Medicare Tax Surcharge On High Earning

Americans Under Obamacare

#21 Medicare Tax Surcharge On High Earning

Americans Under Obamacare

![]() #22 Obamacare Individual Mandate Excise Tax (if

you don't buy "qualifying" health insurance under Obamacare you will

have to pay an additional tax)

#22 Obamacare Individual Mandate Excise Tax (if

you don't buy "qualifying" health insurance under Obamacare you will

have to pay an additional tax)

![]() #23 Obamacare Surtax On Investment Income (a

new 3.8% surtax on investment income that goes into effect next year)

#23 Obamacare Surtax On Investment Income (a

new 3.8% surtax on investment income that goes into effect next year)

![]() #24 Property Taxes

#24 Property Taxes

![]() #25 Recreational Vehicle Taxes

#25 Recreational Vehicle Taxes

![]() #26 Toll Booth Taxes

#26 Toll Booth Taxes

![]() #27 Sales Taxes

#27 Sales Taxes

![]() #28 Self-Employment Taxes

#28 Self-Employment Taxes

![]() #29 School Taxes

#29 School Taxes

![]() #30 Septic Permit Taxes

#30 Septic Permit Taxes

![]() #31 Service Charge Taxes

#31 Service Charge Taxes

![]() #32 Social Security Taxes

#32 Social Security Taxes

![]() #33 State Unemployment Taxes (SUTA)

#33 State Unemployment Taxes (SUTA)

![]() #34 Tanning Tax (a new Obamacare tax on tanning

services)

#34 Tanning Tax (a new Obamacare tax on tanning

services)

![]() #35 Telephone Federal Excise Taxes

#35 Telephone Federal Excise Taxes

![]() #36 Telephone Federal Universal Service Fee

Taxes

#36 Telephone Federal Universal Service Fee

Taxes

![]() #37 Telephone Minimum Usage Surcharge Taxes

#37 Telephone Minimum Usage Surcharge Taxes

![]() #38 Telephone State And Local Taxes

#38 Telephone State And Local Taxes

![]() #39 Tire Taxes

#39 Tire Taxes

![]() #40 Tolls (another form of taxation)

#40 Tolls (another form of taxation)

![]() #41 Traffic Fines (indirect taxation)

#41 Traffic Fines (indirect taxation)

![]() #42 Utility Taxes

#42 Utility Taxes

![]() #43 Vehicle Registration Taxes

#43 Vehicle Registration Taxes

![]() #44 Workers Compensation Taxes

#44 Workers Compensation Taxes

Yet

even with all of these taxes, our local governments, our state governments and

our federal government are all absolutely drowning in debt.

In

another previous article entitled "24

Outrageous Facts About Taxes In The United States That Will Blow Your Mind",

I listed a number of reasons why our federal income tax system has become a

complete and utter abomination that can never be fixed...

![]() 1 - The U.S. tax code is now 3.8 million words long. If you took all of

William Shakespeare's works and collected them together, the entire collection

would only be about 900,000 words long.

1 - The U.S. tax code is now 3.8 million words long. If you took all of

William Shakespeare's works and collected them together, the entire collection

would only be about 900,000 words long.

![]() 2 - According to the National Taxpayers

Union, U.S. taxpayers spend more than 7.6 billion hours

complying with federal tax requirements. Imagine what our society would

look like if all that time was spent on more economically profitable activities.

2 - According to the National Taxpayers

Union, U.S. taxpayers spend more than 7.6 billion hours

complying with federal tax requirements. Imagine what our society would

look like if all that time was spent on more economically profitable activities.

![]() 3 - 75 years ago, the instructions for Form

1040 were two pages long. Today, they are 189 pages long.

3 - 75 years ago, the instructions for Form

1040 were two pages long. Today, they are 189 pages long.

![]() 4 - There have been 4,428 changes to the tax code over the last

decade. It is incredibly costly to change tax software, tax manuals and

tax instruction booklets for all of those changes.

4 - There have been 4,428 changes to the tax code over the last

decade. It is incredibly costly to change tax software, tax manuals and

tax instruction booklets for all of those changes.

![]() 5 - According to the National Taxpayers

Union, the IRS currently has 1,999 different publications, forms, and

instruction sheets that you can download from the IRS website.

5 - According to the National Taxpayers

Union, the IRS currently has 1,999 different publications, forms, and

instruction sheets that you can download from the IRS website.

![]() 6 - Our tax system has become so complicated

that it is almost impossible to file your taxes correctly. For example,

back in 1998 Money Magazine had 46 different tax

professionals complete a tax return for a hypothetical household. All

46 of them came up with a different result.

6 - Our tax system has become so complicated

that it is almost impossible to file your taxes correctly. For example,

back in 1998 Money Magazine had 46 different tax

professionals complete a tax return for a hypothetical household. All

46 of them came up with a different result.

![]() 7 - In 2009, PC World had five of the most

popular tax preparation software websites prepare a tax return for a

hypothetical household. All five of them came up with a different result.

7 - In 2009, PC World had five of the most

popular tax preparation software websites prepare a tax return for a

hypothetical household. All five of them came up with a different result.

![]() 8 - The IRS spends $2.45 for every $100 that it collects in

taxes.

8 - The IRS spends $2.45 for every $100 that it collects in

taxes.

![]() 9 - According to The Tax Foundation, the average

American has to work until April 17th just to pay

federal, state, and local taxes. Back in 1900, "Tax Freedom

Day" came on January 22nd.

9 - According to The Tax Foundation, the average

American has to work until April 17th just to pay

federal, state, and local taxes. Back in 1900, "Tax Freedom

Day" came on January 22nd.

![]() 10 - When the U.S. government first

implemented a personal income tax back in 1913, the vast majority of the

population paid a rate of just 1 percent, and the highest marginal tax rate was just 7 percent.

10 - When the U.S. government first

implemented a personal income tax back in 1913, the vast majority of the

population paid a rate of just 1 percent, and the highest marginal tax rate was just 7 percent.

![]() 11 - Residents of New Jersey pay $1.64 in taxes for every $1.00 of federal

spending that they get back.

11 - Residents of New Jersey pay $1.64 in taxes for every $1.00 of federal

spending that they get back.

![]() 12 - The United States is the only nation on the

planet that tries to tax citizens on what they

earn in foreign countries.

12 - The United States is the only nation on the

planet that tries to tax citizens on what they

earn in foreign countries.

![]() 13 - According to Forbes, the 400 highest

earning Americans pay an average federal income tax rate of just 18 percent.

13 - According to Forbes, the 400 highest

earning Americans pay an average federal income tax rate of just 18 percent.

![]() 14 - Warren Buffett had an effective tax rate

of just 17.4 percent for 2010.

14 - Warren Buffett had an effective tax rate

of just 17.4 percent for 2010.

![]() 15 - The top 20 percent of all income earners

in the United States pay approximately 86 percent of

all federal income taxes.

15 - The top 20 percent of all income earners

in the United States pay approximately 86 percent of

all federal income taxes.

![]() 16 - Sadly, as Bill Whittle has shown, you could take

every single penny that every American earns above $250,000

and it would only fund about 38 percent of the federal budget.

16 - Sadly, as Bill Whittle has shown, you could take

every single penny that every American earns above $250,000

and it would only fund about 38 percent of the federal budget.

![]() 17 - The United States has the highest

corporate tax rate in the world (35 percent). In Ireland, the corporate

tax rate is only 12.5 percent.

This is causing thousands of corporations to move operations out of the United

States and into other countries.

17 - The United States has the highest

corporate tax rate in the world (35 percent). In Ireland, the corporate

tax rate is only 12.5 percent.

This is causing thousands of corporations to move operations out of the United

States and into other countries.

![]() 18 - Some tax havens are doing a booming business

in setting up sham headquarters for U.S. corporations. For example, the

city of Zug, Switzerland only has a population of 26,000 people but it is the

headquarters for 30,000 companies.

18 - Some tax havens are doing a booming business

in setting up sham headquarters for U.S. corporations. For example, the

city of Zug, Switzerland only has a population of 26,000 people but it is the

headquarters for 30,000 companies.

![]() 19 - In 1950, corporate taxes accounted for

about 30 percent of all federal revenue.

In 2012, corporate taxes will account for less than 7 percent of all federal revenue.

19 - In 1950, corporate taxes accounted for

about 30 percent of all federal revenue.

In 2012, corporate taxes will account for less than 7 percent of all federal revenue.

The

wealthy have become absolute masters at avoiding taxes, and the poor are not

able to pay much.

So

who always gets squeezed?

The

middle class does.

No

matter what our politicians promise us, the hammer is always brought down on

the middle class.

And

now, according to The Huffington Post, the IRS

says that it can even read our old emails without a warrant to make sure that

we are paying all of the taxes that we should be...

The

IRS apparently interprets that authority very broadly, the documents show: as

long as you've stored your email in a cloud service like Google Mail, and as

long as those emails haven't been deleted after a few months, the agency thinks

it doesn't need a warrant to read them.

The

idea of IRS agents poking through your email account might sound at the very

least creepy, and maybe unconstitutional. But the IRS does have a legal leg to

stand on: the Electronic Communications Privacy Act of 1986 allows government

agencies to in many cases obtain emails older than 180 days without a warrant.

That's

why an internal 2009 IRS document claimed that "the government may obtain

the contents of electronic communication that has been in storage for more than

180 days” without a warrant.

It

should be noted that the IRS is claiming that it does not use emails

"to target" specific taxpayers, but notice that they are not

promising not to use old emails against taxpayers once they are officially

being audited or investigated...

"Contrary

to some suggestions, the IRS does not use emails to target taxpayers. Any

suggestion to the contrary is wrong."

In

any event, the truth is that we have one of the most complicated and one of the

most intrusive tax systems in the history of the world.

Don't

the American people deserve better?

What

do you think?

Should

America go back to a system where there is no income tax and no Federal

Reserve?

Please

feel free to share what you think by leaving a comment below...’