I Canít Take It Anymore! When Will The Government Quit

Putting Out Fraudulent Employment Statistics?

http://theeconomiccollapseblog.com

http://albertpeia.com/governmentfraudulentemploymentstats.htm

ĎOn Friday,

the entire financial world celebrated when it was announced that the

unemployment rate in the United States had fallen to 8.3 percent. That is the lowest

it has been since February 2009, and it came as an unexpected surprise for

financial markets that are hungry for some good news. According to the

Bureau of Labor Statistics, nonfarm payrolls jumped by 243,000 during the month

of January. You can read the full employment report right here.

Based on this news, pundits all over the world were declaring that the U.S.

economy is back. Stocks continued to rise on Friday and the Dow is

hovering near a 4 year high. So does this mean that our economic problems

are over? Of course not. A closer look at the numbers reveals just

how fraudulent these employment statistics really are. Between December

2011 and January 2012, the number of Americans "not in the labor

force" increased by a whopping 1.2 million. That

was the largest increase ever in that category for a single

month. That is how the federal government is getting the unemployment

rate to go down. The government is simply pretending that huge numbers of

unemployed Americans don't want to be part of the labor force anymore. As

you will see below, the employment situation in America is not improving.

Yet everyone in the mainstream media is dancing around as if the economic crisis has been cancelled. I

can't take it anymore! It is beyond ridiculous that so many intelligent

people continue to buy in to such fraudulent numbers.

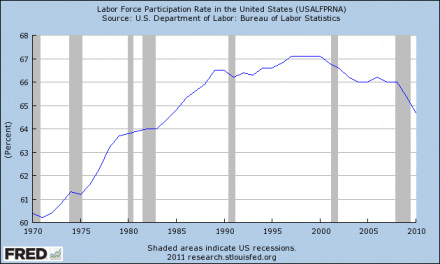

The truth is that the labor

force participation rate declined dramatically in January. For those

unfamiliar with this statistic, the labor force participation rate is the

percentage of working age Americans that are either employed or that are

unemployed and considered to be looking for a job.

As you can see from the chart

posted below, the labor force participation rate rose steadily between 1970 and

2000. That happened because large numbers of women were entering the

labor force for the first time.

The labor force participation

rate peaked at a little more then 67 percent in the late 90s. Between

2000 and the start of the recent recession, it declined slightly to about 66

percent.

Since then, it has been

dropping like a rock. The chart below does not even include the latest

data. In January, the labor force participation rate was only 63.7

percent. That is the lowest that is has been since May 1983. So

keep that in mind as you view the chart.

In reality, the percentage of

men and women in the United States that would like to have jobs is almost

certainly about the same as it was back in 2007 or 2008. There has been

no major social change that would cause large numbers of men or women to want

to give up their careers. So there is something very, very fishy with

this chart....

http://albertpeia.com/Labor-Force-Participation-Rate-440x264.png

The federal government has

been pretending that millions of unemployed Americans have decided that they

simply do not want jobs anymore.

This does not make sense at

all.

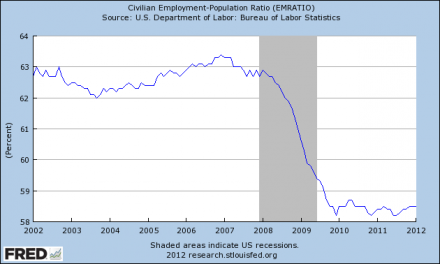

The truth is that unemployment

is not really declining at all. The percentage of Americans that are

working is not increasing. The civilian employment-population ratio

dropped like a rock during 2008 and 2009 and it has held very steady since that

time.

In January, the civilian

employment-population ratio once again held steady at 58.5 percent. This

is about where it has been for most of the last two years....

http://albertpeia.com/Employment-Population-Ratio-440x264.png

Does that chart look like an

"economic recovery" to you?

Of course not.

If the percentage of people

that are employed is about the same as it was two years ago, does that

represent an improvement?

Of course not.

If the employment situation in

America was getting better, the civilian employment-population ratio would be

bouncing back.

We should be thankful that our

economy is not free falling like it was during 2008 and 2009, but we also need

to understand why things have stabilized.

The federal government is spending money

like there is no tomorrow. During 2011, the Obama administration stole an

average of about 150 million dollars an hour from our children

and our grandchildren and pumped it into the economy. Even though the

Obama administration spent that money on a lot of frivolous things, it still

got into the pockets of average Americans who in turn went out and spent it on

food, gas, clothes and other things.

Without all of this reckless

government spending, we would not be able to continue to live way above our

means and our economic problems would be a lot worse.

But even with the federal

government borrowing and spending unprecedented amount of money, and even with

interest rates at record lows, our economy is still deeply struggling.

Just consider the following facts....

-New home sales in the United

States hit a brand new all-time

record low during 2011.

-The average duration of

unemployment in America is close to

an all-time record high.

-The percentage of Americans

living in "extreme poverty" is at an all-time high.

-The number of Americans on

food stamps recently hit a new all-time high.

-According to the Census

Bureau, an all-time record 49 percent

of all Americans live in a home that gets direct monetary benefits from the

federal government. Back in 1983, less than

a third of all Americans lived in a home that received direct

monetary benefits from the federal government.

So let's not get too excited

about the economy.

Yes, things have somewhat

stabilized. The percentage of Americans that have jobs is about the same

as it was two years ago. Considering how rapidly jobs are being shipped

out of the United States, that is a good thing.

Enjoy this false bubble of

hope while you can. Things are about to get a lot worse.

Do you remember how rapidly

things fell apart after the financial crisis of 2008?

Well, another major financial

crisis is on the way. This time it is going to be centered in Europe

initially, but it is going to spread all around the globe just like the last

one did.

As the charts above show, we

have never even come close to recovering from the last recession, and another

one is on the way.

So how bad are things going to

get after the next wave of the financial crisis hits us?

That is something that we

should all be thinking about.'