http://theeconomiccollapseblog.com

http://albertpeia.com/financialworriesabouteurope.htm

‘The recent elections in France and in Greece have thrown the global

financial system into an uproar. Fear and worry are everywhere and nobody

is quite sure what is going to happen next. All of the financial deals

that Greece

has made over the past few years may be null and void. Nobody is going to

know for sure until a new government is formed, and at this point it looks like

that is not going to happen and that there will need to be new elections in

June. All of the financial deals that France has made over the past few

years may be null and void as well. New French President Francois Hollande seems determined to take France on a

path away from austerity. But can France really afford to keep

spending money that it does not have? France has already lost its AAA

credit rating and French bond yields have started to move up toward dangerous

territory. And Greek politicians are delusional if they think they have

any other choice other than austerity. Without European bailout money

(which they won't get if they don't honor their current agreements), nobody is going

to want to lend Greece

a dime.

‘The recent elections in France and in Greece have thrown the global

financial system into an uproar. Fear and worry are everywhere and nobody

is quite sure what is going to happen next. All of the financial deals

that Greece

has made over the past few years may be null and void. Nobody is going to

know for sure until a new government is formed, and at this point it looks like

that is not going to happen and that there will need to be new elections in

June. All of the financial deals that France has made over the past few

years may be null and void as well. New French President Francois Hollande seems determined to take France on a

path away from austerity. But can France really afford to keep

spending money that it does not have? France has already lost its AAA

credit rating and French bond yields have started to move up toward dangerous

territory. And Greek politicians are delusional if they think they have

any other choice other than austerity. Without European bailout money

(which they won't get if they don't honor their current agreements), nobody is going

to want to lend Greece

a dime.

And

all of this talk about "austerity" is kind of silly anyway. It

isn't as if either France or

Greece

was going to have a balanced budget any time soon. Both nations were

still running up huge amounts of debt even under the "austerity"

budgets.

But

the citizens of both nations have sent a clear message that they are not going

to tolerate even a slowdown in government spending. They want to go back

to the debt-fueled prosperity of the last several decades, even if it makes

their long-term financial problems a lot worse.

Unfortunately,

as I mentioned earlier, Greece

does not have that option. Without the bailout money that they are

scheduled to get, Greece

does not have a prayer of avoiding a disorderly default. Private

investors would have to be insane to lend Greece money if the bailout deal

falls apart. Greece desperately needs the help of the EU, the ECB and the

IMF and the only way they are going to get it is if they abide by the terms of

the agreements that have already been reached.

The

only way that Greece

can avoid austerity at this point would be to leave the euro. Nobody

would want to lend money to Greece

under that scenario either, but Greece

could choose to print huge amounts of their own national currency if they

wanted to.

The

situation is different in France.

Investors are still willing to lend to France

at reasonable interest rates, but if France

chooses to run up huge amounts of additional debt at some point they will end

up just like Greece.

What

is even more important in the short-term is the crumbling of the French/German alliance on

European fiscal matters. Angela Merkel and Nicolas Sarkozy

were a united front, but now Merkel and Hollande are

likely to have conflict after conflict.

Instead

of moving in one clear direction, the eurozone is now

fractured and tensions are rising.

So

what comes next?

Well,

investors are not certain what comes next and that has

many of them deeply concerned.

The

following are 11 quotes that show how worried the financial world is about Europe right now....

#1 Tres Knippa of Kenai Capital

Management: "What is going on in Europe

is an absolute disaster…the risk-on trade is not the place to be. I want to be

out of equities and very, very defensive because the situation in Europe just got worse after those elections."

#2 Mark

McCormick, currency strategist at Brown Brothers Harriman: "We’re

going to have higher tensions, more uncertainty and most likely a weaker

euro."

#3 Nick Stamenkovic,

investment strategist at RIA Capital Markets in Edinburgh:

"Investors are questioning whether Greece will be a part of the single

currency at the end of this year."

#4 Jörg Asmussen, a European Central Bank executive board

member: "Greece

needs to be aware that there is no alternative to the agreed reform program if

it wants to remain a member of the eurozone"

#5 Tristan Cooper, sovereign debt

analyst at Fidelity Worldwide Investment: "A Greek eurozone

exit is on the cards although the probability and timing of such an event is

uncertain."

#6 Art Cashin:

"Here’s the outlook on Greece

from Wall Street watering holes. If a coalition government is formed or looks

to be formed, global markets may rally. Any coalition is unlikely to make

progress on goals, since austerity is political suicide. There will likely be

another election around June 10/17. A workable majority/plurality remains

unlikely, so back to square one. Therefore, Greece will be unable to attain

goals by the deadline (June 30). Lacking aid funds, pensions are suspended and

government workers are laid off. Protestors take to the streets and government

is forced to revert to drachma to avoid social chaos. Pass the peanuts,

please."

#7 John

Noonan, Senior Forex Analyst with Thomson Reuters

in Sydney:

"Sentiment is very bearish, The euro is under a

lot of pressure right now. I get the feeling that it’s going to be a nasty move

lower for the euro finally"

#8 Kenneth S. Rogoff,

a professor of economics at Harvard: "A Greek exit would underscore that

there’s no realistic long-term plan for Europe,

and it would lead to a chaotic endgame for the rest of the euro zone."

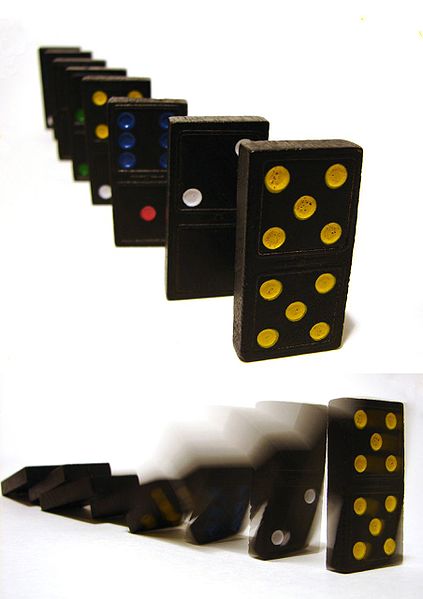

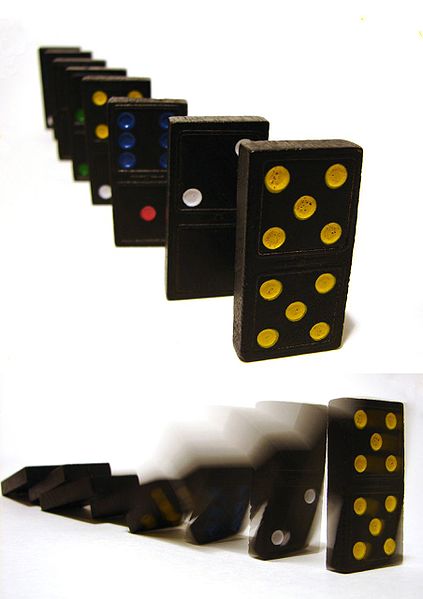

#9 Chris Tinker of Libra Investment Services: "It’s a

binary decision. If Greece

gets itself to the point where the European administration says, ‘We can’t play

this game anymore,’ that starts a domino effect"

#10 Nicolas Véron,

a senior fellow at Bruegel: "France has very

limited fiscal space and actually has to engage in fiscal consolidation"

#11

80-year-old Greek citizen Panagiota Makri: "I'm confused. I feel numb and confused.

Only God can save us now"

All

of this comes at a time when much of Europe is

already descending into a new recession. Economies all over Europe are contracting and unemployment rates are

skyrocketing. Until things start improving, there is going to continue to

be a lot of civil unrest across Europe.

Meanwhile,

things are not so great in the United

States either.

JPMorgan

Chase CEO Jamie Dimon claims that the U.S. economy is

holding a "royal straight flush",

but the only part of that he got right was the "flush" part.

There

are 100 million working age Americans that do not have

jobs, the middle class continues to shrink, the rising cost of

food and the rising cost of gas are severely stretching the budgets of millions

of American families and the federal government continues to run up gigantic amounts of debt.

When

Europe descends into financial chaos, the United States is not going to

escape it. The financial crisis of 2008 deeply affected the entire globe,

and so will the next great financial crisis.

Let

us hope that we still have a little bit more time before the next great

financial crisis strikes, but things in Europe

are rapidly unraveling and at some point the dominoes are going to begin to

fall.

‘The recent elections in

‘The recent elections in