Federal

Reserve Money Printing Is The Real Reason Why The Stock Market Is Soaring

http://theeconomiccollapseblog.com

http://albertpeia.com/fedmoneyprinting.htm

‘You can thank the reckless money printing

that the Federal Reserve has been doing for the incredible bull market that we

have seen in recent months. When the Federal Reserve does more

"quantitative easing", it is the financial markets that benefit the

most. The Dow and the S&P 500 have both hit levels not seen since 2007

this month, and many analysts are projecting that 2013 will be a banner year

for stocks. But is a rising stock market really a sign that the overall

economy is rapidly improving as many are suggesting? Of course not.

Just because the Federal Reserve has inflated another false stock market bubble

with a bunch of funny money does not mean that the U.S. economy is in great

shape. In fact, the truth is that things just keep getting worse for average Americans.

The percentage of working age Americans with a job has fallen from 60.6% to 58.6% while Barack Obama has been

president, 40 percent of all American workers are

making $20,000 a year or less, median household income has declined for four years in a row, and poverty in the United

States is absolutely exploding. So quantitative

easing has definitely not made things better for the middle class. But

all of the money printing that the Fed has been doing has worked out

wonderfully for Wall Street. Profits are soaring at Goldman Sachs and luxury estates in

the Hamptons are selling briskly. Unfortunately, this is how things

work in America these days. Our "leaders" seem far more

concerned with the welfare of Wall Street than they do about the welfare of the

American people. When things get rocky, their first priority always seems

to be to do whatever it takes to pump up the financial markets.

‘You can thank the reckless money printing

that the Federal Reserve has been doing for the incredible bull market that we

have seen in recent months. When the Federal Reserve does more

"quantitative easing", it is the financial markets that benefit the

most. The Dow and the S&P 500 have both hit levels not seen since 2007

this month, and many analysts are projecting that 2013 will be a banner year

for stocks. But is a rising stock market really a sign that the overall

economy is rapidly improving as many are suggesting? Of course not.

Just because the Federal Reserve has inflated another false stock market bubble

with a bunch of funny money does not mean that the U.S. economy is in great

shape. In fact, the truth is that things just keep getting worse for average Americans.

The percentage of working age Americans with a job has fallen from 60.6% to 58.6% while Barack Obama has been

president, 40 percent of all American workers are

making $20,000 a year or less, median household income has declined for four years in a row, and poverty in the United

States is absolutely exploding. So quantitative

easing has definitely not made things better for the middle class. But

all of the money printing that the Fed has been doing has worked out

wonderfully for Wall Street. Profits are soaring at Goldman Sachs and luxury estates in

the Hamptons are selling briskly. Unfortunately, this is how things

work in America these days. Our "leaders" seem far more

concerned with the welfare of Wall Street than they do about the welfare of the

American people. When things get rocky, their first priority always seems

to be to do whatever it takes to pump up the financial markets.

When QE3 was announced, it was

heralded as the grand solution to all of our economic problems. But the

truth is that those running things knew exactly what it would do.

Quantitative easing always pumps up the financial markets, and that overwhelmingly

benefits those that are wealthy. In fact, a while back a CNBC

article discussed a very interesting study from the Bank of England which

showed a clear correlation between quantitative easing and rising stock

prices...

It said that the Bank of England’s policies of quantitative

easing – similar to the Fed’s – had benefited mainly the wealthy.

Specifically, it said that its QE program had boosted the value

of stocks and bonds by 26 percent, or about $970 billion. It said that about 40

percent of those gains went to the richest 5 percent of British households.

Many said the BOE's easing added to social anger and unrest.

Dhaval Joshi, of BCA Research wrote that “QE cash ends up overwhelmingly

in profits, thereby exacerbating already extreme income inequality and the

consequent social tensions that arise from it."

So

should we be surprised that stocks are now the highest that they have been in

more than 5 years?

Of

course not.

And

who benefits from this?

The

wealthy do. In fact, 82 percent of all individually held

stocks are owned by the wealthiest 5 percent of all Americans.

Unfortunately,

all of this reckless money printing has a very negative impact on all the rest

of us. When the Fed floods the financial system with money, that causes

inflation. That means that the cost of living has gone up even though

your paycheck may not have.

If

you go to the supermarket frequently, you know exactly what I am talking

about. The new "sale prices" are what the old "regular

prices" used to be. They keep shrinking many of the package sizes in

order to try to hide the inflation, but I don't think many people are

fooled. Our food dollars are not stretching nearly as far as they used

to, and we can blame the Federal Reserve for that.

For

much more on rising prices in America, please see this article: "Somebody Should

Start The ‘Stuff Costs Too Much’ Party".

Sadly,

this is what the Federal Reserve does. The system was designed to create inflation.

Before the Federal Reserve came into existence, the United States never had an

ongoing problem with inflation. But since the Fed was created, the United

States has endured constant inflation. In fact, we have come to accept it

as "normal". Just check out the amazing chart in the video posted below...

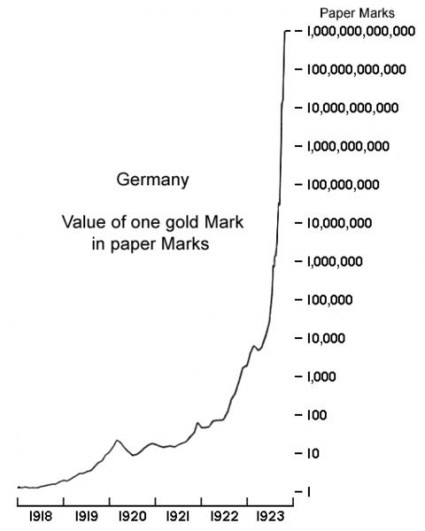

The chart in that video kind of

reminds me of a chart that I shared in a previous article...

Not

that I expect the United States to enter a period of hyperinflation in the near

future.

Actually,

despite all of the reckless money printing that the Fed has been doing, I

expect that at some point we are going to see another wave of panic hit the

financial markets like we saw back in 2008. The false stock market bubble

will burst, major banks will fail and the financial system will implode.

It could unfold something like this...

1

- A derivatives panic hits the "too big to

fail" banks.

2

- Financial markets all over the globe crash.

3

- The credit markets freeze up.

4

- Economic activity in the United States starts to grind to a halt.

5

- Unemployment rises above 20 percent and mortgage defaults soar to

unprecedented levels.

6

- Tax revenues fall dramatically and austerity measures are implemented by the

federal government, state governments and local governments.

7

- The rest of the globe rapidly loses confidence in the U.S. financial system

and begins to dump U.S. debt and U.S. dollars.

I

write about derivatives a lot, because they are one of the greatest

threats that the global financial system is facing. In fact, right now a

derivatives scandal is threatening to take down the oldest bank in the

world...

Banca

Monte dei Paschi di Siena, the world’s oldest bank, was making loans when

Michelangelo and Leonardo da Vinci were young men and before Columbus sailed to

the New World. The bank survived the Italian War, which saw Siena’s surrender

to Spain in 1555, the Napoleonic campaign, the Second World War and assorted

bouts of plague and poverty.

But

MPS may not survive the twin threats of a gruesomely expensive takeover gone

bad and a derivatives scandal that may result in legal action against the

bank’s former executives. After five centuries of independence, MPS may have to

be nationalized as its losses soar and its value sinks.

So

when you hear the word "derivatives" in the news, pay close

attention. The bankers have turned our financial system into a giant

casino, and at some point the entire house of cards is going to come crashing

down.

In

response to the coming financial crisis, I believe that our "leaders"

will eventually resort to money printing unlike anything we have ever seen

before in a desperate attempt to resuscitate the system. When that

happens, I believe that we will see the kind of rampant inflation that so many

people have been warning about.

So

what do you think about all of this?

Do

you believe that Federal Reserve money printing is the real reason why the

stock market is soaring?

Please

feel free to post a comment with your thoughts below...’