Why

A Greek Exit From The Euro Would Mean The End Of The Eurozone

http://theeconomiccollapseblog.com

http://albertpeia.com/endofeurozone.htm

What

was considered unthinkable a few months ago has now become probable.

All over the globe there are headlines proclaiming that a Greek exit from the

euro is now a real possibility. In fact, some of those headlines make it

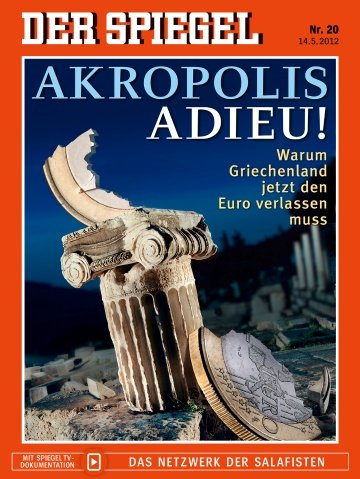

sound like it is practically inevitable. For example, Der

Spiegel ran a front page story the other day with the following startling

headline: "Acropolis, Adieu! Why

What

was considered unthinkable a few months ago has now become probable.

All over the globe there are headlines proclaiming that a Greek exit from the

euro is now a real possibility. In fact, some of those headlines make it

sound like it is practically inevitable. For example, Der

Spiegel ran a front page story the other day with the following startling

headline: "Acropolis, Adieu! Why

As I have written about previously,

New York Times economist Paul Krugman is wrong about a whole lot of things, but in a

blog post the other day he absolutely nailed what is likely

to soon unfold in Greece....

1.

Greek euro exit, very possibly next month.

2.

Huge withdrawals from Spanish and Italian banks, as depositors try to move

their money to

3a.

Maybe, just possibly, de facto controls, with banks forbidden to transfer

deposits out of country and limits on cash withdrawals.

3b.

Alternatively, or maybe in tandem, huge draws on ECB credit to keep the banks

from collapsing.

4a.

4b.

End of the euro.

By itself,

If one country is allowed to leave

the euro, that means that other countries will be

allowed to leave the euro as well. This is the kind of uncertainty that

drives financial markets crazy.

When the euro was initially created,

monetary union was intended to be irreversible. There are no provisions

for what happens if a member nation wants to leave the euro. It simply

was not even conceived of at the time.

So we are really moving into

uncharted territory. A recent Bloomberg article attempted to

set forth some of the things that might happen if a Greek exit from the euro

becomes a reality....

A

Greek departure from the euro could trigger a default-inducing surge in bond

yields, capital flight that might spread to other indebted states and a

resultant series of bank runs. Although

In fact, yields on Spanish debt and

Italian debt are already rising rapidly thanks to the bad news out of

What makes things worse is that a new

government has still not formed in

Meanwhile, the Greek government is

rapidly running out of money. The following is from a Bank of

"If

no government is in place before June when the next installment (of loan money)

from the European Union and International Monetary Fund is due, we estimate

that Greece will run out of money sometime between the end of June and

beginning of July, at which point a return to the drachma would seem

inevitable"

In the recent Greek elections,

parties that opposed the bailout agreements picked up huge gains. And

opinion polls suggest that they will make even larger gains if another round of

elections is held.

The Coalition of the Radical Left,

also known as Syriza, surprised everyone by coming in

second in the recent elections. Current polling shows that Syriza is likely to come in first if new elections are

held.

The leader of Syriza,

Alexis Tsipras, is passionately against the bailout

agreements. He says that

A spokesman for Syriza,

Yiannis Bournos, recently told the Telegraph the

following....

"Mr Schaeuble [

So

Who will blink first?

Will either of them blink first?

Syriza is trying to convince the Greek people

that they can reject austerity and

stay in the euro. Syriza insists that the rest

of

And most Greeks do actually want to

stay in the euro. One recent poll found that 78.1 percent of all Greeks want

But a majority of Greeks also do not

want anymore austerity.

Unfortunately, it is not realistic

for them to assume that they can have their cake and eat it too. If

And if

Outgoing deputy prime minister of

"We

will be in wild bankruptcy, out-of-control bankruptcy. The state will not be

able to pay salaries and pensions. This is not recognised

by the citizens. We have got until June before we run out of money."

If

In fact, there are rumblings that the

European financial system is already making preparations for all this.

For example, a recent Reuters article had the

following shock headline: "Banks

prepare for the return of the drachma"

But a new drachma would almost

certainly crash in value almost immediately as a recent article in the Telegraph described....

Most

economists think that a new, free-floating drachma would immediately crash by

up to 50 percent against the euro and other currencies, effectively halving the

value of everyone's savings and spelling catastrophe for those on fixed

incomes, like pensioners.

A Greek economy that is already experiencing a depression

would get even worse. The Greek economy has contracted by 8.5 percent over the past 12 months and

the unemployment rate in

But the consequences for the rest of

Unfortunately, at this point it is

hard to imagine a scenario in which the eventual break up of the euro can be avoided.

Germany would have to become willing

to bail out the rest of the eurozone indefinitely, and that simply is not going to happen.

So there is a lot of pessimism in the financial world right

now. Nobody is quite sure what is going to happen next and the number of

short positions is steadily rising as a recent CNN article detailed....

After

staying quiet at the start of the year, the bears have come roaring back with a

vengeance.

Short

interest -- a bet on stocks turning lower -- topped 13 billion shares on the

If the eurozone

is going to survive,

Instead of removing the weakest link

from the chain, the reality is that a Greek exit from the euro would end up

shattering the chain.

Confidence is a funny thing. It

can take decades to build but it can be lost in a single moment.

If

A common currency in

As the eurozone

crumbles, it is likely that

So what do you think?

Do you think that I am right or do

you think that I am wrong?

Please feel free to post a comment

with your thoughts below....