Why

the ECB Expanded Its Balance Sheet By Over $1 trillion

in Less Than Nine Months

April 5, 2012 By gpc1981

http://gainspainscapital.com

http://albertpeia.com/ecbexpandsbalsheetover1trilllessthan9mos.htm

Between July 2011 and today, the ECB

has expanded its balance sheet by an incredible $1+ trillion: more than the Fed’s

QE 2 and QE lite combined (and in just a nine month

period).

This rapid and extreme expansion of

the ECB’s balance sheet (again it was greater than QE

lite and QE2 combined… in nine months) indicates the severity of the banking

crisis in

The two largest interventions were

the ECB’s LTRO 1 and LTRO 2, which saw the ECB

handing out $645 billion and $712 billion to 523 and 800 banks respectively.

As a result of this, the ECB’s balance sheet exploded to nearly $4 trillion in size,

larger than the GDPs of

So why did the ECB do this?

Simple… because everyone (even German banks)

is lying about their true exposure to the PIIGS. And the European banking system is literally on the verge of systemic

collapse.

Let’s consider the PIIGS’ exposure of

German powerhouse Deutsche Bank (DB) widely considered to be

one of the strongest banks in the EU.

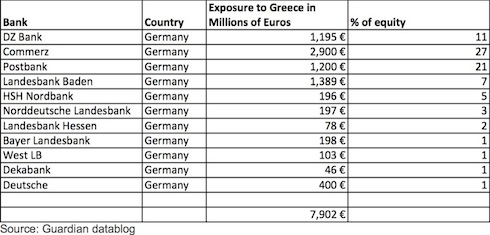

According to the Bank of

International Settlements German bank exposure to

This is a bit odd as according to The Guardian German banks

have nearly 8 billion Euros’ worth of exposure to Greek debt. And they only

include 11 German banks in their analysis. However, of those 11 banks, THREE of

them have Greek exposure equal to more than 10% of their total outstanding

equity.

Let’s consider Commerzbank

as an example. Let’s say

Mind you, I’m just doing back of the

envelope analysis here. But based on this brief analysis right off the bat we

know the following:

1) The Bank of

International Settlements is either completely

clueless about the risks posed to the financial system by PIIGS’

debt OR intentionally downplays those risks (neither is good).

2) The Guardian’s datablog (which obtains all of its data from publicly

accessible records) somehow comes up with numbers that are dramatically

different (and higher) from those published by the Bank of International

Settlements.

Now let’s take our analysis a step

further.

Deutsche Bank trades on US stock

exchanges and so has to publish SEC filings on its balance sheet risk. Well,

according to Deutsche Bank’s own

filings, it had 1.6 billion Euros’ worth of credit exposure to

More interesting that this, the term “

So it’s a bit odd that Deutsche Bank’s

2010 416-page annual report would only mention the term “

This time around, the term “

By the way, Deutsche Bank has only 59

billion Euros’ worth of shareholder equity, so this position alone is worth

roughly 1.5% of the banks’ equity. True, this is not a huge percentage, but if

Greek creditors take a 70-80% haircut, Deutsche Bank would need to raise capital.

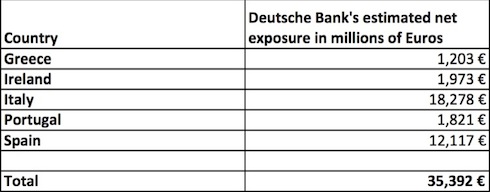

On a side note, I want to point out

that we’re completely ignoring the fact that if Greece defaults so will Italy

and Spain whose sovereign debt and financial institutions Deutsche Bank has 14.8 BILLION EUROS worth exposure to: an

amount equal 23% of Deutsche Bank’s TOTAL EQUITY.

But let’s just focus on Deutsche Bank’s

exposure to

So… having taken our analysis one

step further, we find that one single German bank, one of the alleged strongest

I might add, has in fact, far, far more exposure to Greece and its economy than

both the Bank of International Settlements and

the mainstream financial press indicates.

Bear in mind, the numbers presented

in Deutsche Bank’s are simply those that Deutsche Bank’s executives have told

the company’s accountants are acceptable for public disclosure (we have no clue

about the banks off-balance sheet risk).

It’s also worth noting that in 2010

Deutsche Bank claimed to have only 1.6 billion Euros’ worth of credit exposure

to Greece, whereas by late 2011 the number has swelled to 2.8 billion Euros.

I have to ask… how exactly does a

bank, which is supposedly managing its risk levels and adjusting its exposure

accordingly, manage to increase its credit exposure to something as

financially toxic as Greece by 75% in a nine month period?

This hardly strikes me as good risk

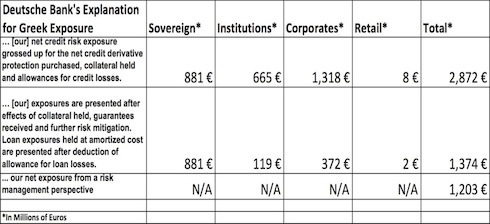

management. But here’s how Deutsche Bank’s accountants try to explain that none

of this (even the 2.8 billion Euros’ worth of exposure) is actually a big deal.

If the above chart sounds like it’s

written in obfuscating language, let me translate it for you. According to

Deutsche Bank’s accountants, once you include collateral held (likely garbage

assets valued at mark to model fantasy land valuations), guarantees received

(from GREEK

institutions!?!?!), and “risk mitigation”, Deutsche Bank’s “actual”

exposure to

So… this is a bank whose credit

exposure to

Ok, well if we’re going to play by

those rules, let’s consider that when we include the rest of the PIIGS

countries, Deutsche Bank’s “actual” exposure (as downplayed as it might be) is

still 35 BILLION Euros, an amount equal to 60% of the banks’ total equity.

At these levels, and using the

currently proposed Greek 50% haircuts as a model for future defaults in the EU,

Deutsche Bank could very easily see 10-15 billion in write-downs from its PIIGS’

exposure. This would wipe out 16%-25% of the bank’s entire equity and

render it borderline insolvent.

Thus, by our own analysis we find

that even the German powerhouse of DB has PIIGS exposure that could easily wipe out a quarter of its equity, if not more.

By extension, if this is how exposed

a German bank is

to the PIIGS, how bad do think the rest of the EU banking system is?

BAD.

This

is why the ECB has been

freaking out and pumping so much money into the EU banking system. You don’t

spend over $1 trillion in nine months unless something very very

bad is coming down the pike. That something “BAD” is the collapse of

If you’re not already taking steps to

prepare for the coming collapse, you need to do so now.

With that in mind, I’m already

positioning subscribers of Private

Wealth Advisory for the upcoming collapse. Already we’ve

seen gains of 6%, 9%, 10%,

even 12% in less than two weeks by placing well-targeted shorts

on a number of European financials.

And we’re just getting started.

So if you’re looking for the means of

profiting from what’s coming, I highly suggest you consider a subscription to Private

Wealth Advisory. We’ve locked in 44 straight winning

trades since late July (thanks to the timing of our trades), and haven’t closed

a single losing trade since that time.

Because of the level of my analysis

as well as my track record, my work has been featured in Fox Business,

CNN Money, Crain’s

To learn more about Private

Wealth Advisory and how we make money in any market

environment…

Best,

Graham Summers, Chief Market Strategist,