Dave’s Daily: http://www.etfdigest.com

BULLS JUMP ON

EMPLOYMENT DATA

August 03, 2012

{ Dave’s Daily Summary with pics/charts – Dave is

always worth a look; a bit too bullish methinks, but realistic in light of the

preposterous churn-and-earn frauds/’valuations’ which folly has gone global and

will end quite badly! http://albertpeia.com/davesummary8312.htm }

‘The

Employment report was better than expected (163K jobs vs

100K expected but prior revised lower to 64K from 80K). Inside the numbers the

unemployment rate rose to 8.3% and it was estimated 195K people dropped from

rolls meaning the so-called U-6 rate jumped to 15%. But algos

chose to focus on the headline number driving stock prices higher for another

end-of-week “stick save” which we’ve seen before.

Perhaps

not so much in the headlines was a unique reevaluation of Draghi’s

comments from Thursday as noted by Bloomberg

whereby it was suggested he was just laying the framework for a bargain.

Further another late article from Bloomberg

noted some inferred weakening within the German ranks which might be more

supportive of Draghi’s efforts. And, this article points to a split

perhaps from the Bundesbank and politicians—always a

potential problem for the bank’s autonomy. Meanwhile economic data from the eurozone continued to decline with the PMI descending to

46.5 and the

Also

of note was the

first repo liquidity injection from the Fed to Primary Dealer’s (banks)

since December 2008. This was a small amount ($200M) but showed the Fed working

in a more subtle fashion to lubricate trading desks.

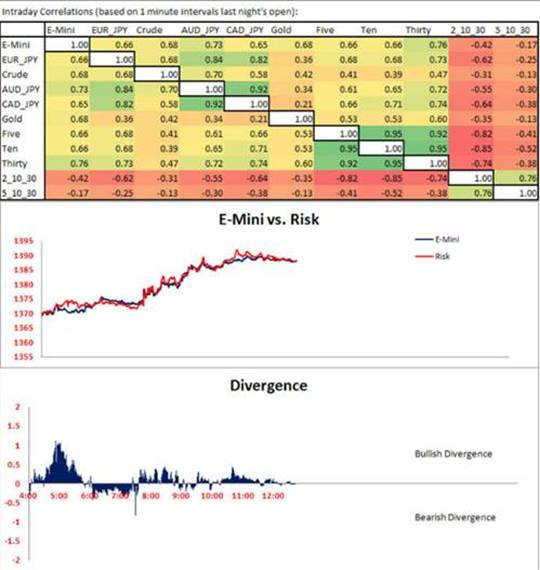

Stocks

were higher across the board and intra-market correlations were running almost

at 100% allowing for little in the way of diversification. Everything rallied

today except natural gas (UNG), bonds (IEF) and the dollar (UUP) and that’s the

easiest way to sum things up.

Now

you might think from our comments we’re bearish but we’re 60% long equities in

our active portfolio with the balance in cash. Sure, on days like this we’d

like greater exposure but you wouldn’t have said that the prior 4 days. The

bottom line is you can be a skeptic while remaining systematic. Staying with

longer term tech analytics (weekly & even monthly) avoids a lot of the

daily noise despite emotions. So when markets rally when news overall and fund

flows are this terrible that must be bullish or just another bout of

short-covering.

We’re

seeing markets (see SPY chart below) that very much resemble similar periods to

2010 & 2011. Those markets featured significant two-way action which made

for poor trend-following conditions for short-term investors. This is now

enhanced by the presence of HFTs and algos and a good explanation of how these work

which also makes it more appropriate to step away from shorter-term chart

views.

Despite

Friday’s good market action we still face trouble in the eurozone

and with global economic contraction not solved by one data point or rumors and

spin. Now we add elections and accompanying uncertainty to the mix.

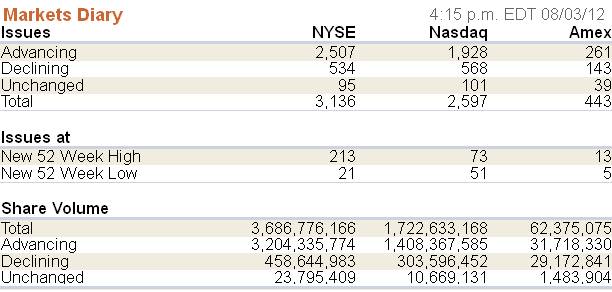

Volume

on Friday was light with most of it coming in the last 20 minutes on ETFs squaring up positions. Breadth per the WSJ was

positive but seemed short of a 90/10 day.

Follow our pithy comments on twitter and

join the banter with me facebook …’