A

Cashless Society May Be Closer Than Most People Would Ever Dare To Imagine

http://theeconomiccollapseblog.com

http://albertpeia.com/cashlesssocietynear.htm

{ I personally would never allow myself to

be ‘chipped’; nor would I ever get a tattoo. Not that I’m against tattoos;

within ‘reasonable limits’, I think they’re rather cool on some girls for

example, etc.. }

Most people think of a

cashless society as something that is way off in the distant future.

Unfortunately, that is simply not the case. The truth is that a cashless

society is much closer than most people would ever dare to imagine. To a

large degree, the transition to a cashless society is being done

voluntarily. Today, only 7 percent of all transactions in the

Most people think of a

cashless society as something that is way off in the distant future.

Unfortunately, that is simply not the case. The truth is that a cashless

society is much closer than most people would ever dare to imagine. To a

large degree, the transition to a cashless society is being done

voluntarily. Today, only 7 percent of all transactions in the

Those are very important questions,

but most of the time both sides of the issue are not presented in a balanced

way in the mainstream media. Instead, most mainstream news articles tend

to trash cash and talk about how wonderful digital currency is.

For example, a recent CBS News article declared that

soon we may not need "that raggedy dollar bill" any longer and that

the "greenback may soon be a goner"....

It's

what the wallet was invented for, to carry cash. After all, there was a time

when we needed cash everywhere we went, from filling stations to pay phones.

Even the tooth fairy dealt only in cash.

But

money isn't just physical anymore. It's not only the pennies in your piggy

bank, or that raggedy dollar bill.

Money

is also digital - it's zeros and ones stored in a

computer, prompting some economists to predict the old-fashioned greenback may

soon be a goner.

"There

will be a time - I don't know when, I can't give you a date - when physical

money is just going to cease to exist," said economist Robert Reich.

So will we see a completely cashless

society in the near future?

Of course not. It would be wildly unpopular for the

governments of the world to force such a system upon us all at once.

Instead, the big banks and the

governments of the industrialized world are doing all they can to get us to

voluntarily transition to such a system. Once 98 or 99 percent of all

transactions do not involve cash, eliminating the remaining 1 or 2 percent will

only seem natural.

The big banks want a cashless society

because it is much more profitable for them.

The big banks earn billions of

dollars in fees from debit cards and they make absolutely enormous profits from credit cards.

But when people use cash the big

banks do not earn anything.

So obviously the big banks and the

big credit card companies are big cheerleaders for a

cashless society.

Most governments around the world are

eager to transition to a cashless society as well for the following reasons....

-Cash is expensive to print, inspect,

move, store and guard.

-Counterfeiting is always going to be

a problem as long as paper currency exists.

-Cash if favored by criminals because

it does not leave a paper trail. Eliminating cash would make it much more

difficult for drug dealers, prostitutes and other criminals to do business.

-Most of all, a cashless society

would give governments more control. Governments would be able to track

virtually all transactions and would also be able to monitor tax compliance

much more closely.

When you understand the factors

listed above, it becomes easier to understand why the use of cash is

increasingly becoming demonized. Governments around the world are increasingly

viewing the use of cash in a negative light. In fact, according to the

This disdain of cash has also grown

very strong in the financial community. The following is from a recent Slate article....

David

Birch, a director at Consult Hyperion, a firm specializing in electronic

payments, says a shift to digital currency would cut out these hidden costs. In

Birch’s ideal world, paying with cash would be viewed like drunk driving—something

we do with decreasing frequency as more and more people understand the negative

social consequences. “We’re trying to use industrial age money to support

commerce in a post-industrial age. It just doesn’t work,” he says. “Sooner or

later, the tectonic plates shift and then, very quickly, you’ll find yourself

in this new environment where if you ask somebody to pay you in cash, you’ll

just assume that they’re a prostitute or a Somali pirate.”

Do you see what is happening?

Simply using cash is enough to get

you branded as a potential criminal these days.

Many people are going to be scared

away from using cash simply because of the stigma that is becoming attached to

it.

This is a trend that is not just

happening in the

Up in Canada, they are looking for ways to

even eliminate coins so that people can use alternate forms of payment for all

of their transactions....

The

Royal Canadian Mint is also looking to the future with the MintChip,

a new product that could become a digital replacement for coins.

In

In

most Swedish cities, public buses don’t accept cash; tickets are prepaid or

purchased with a cell phone text message. A small but growing number of

businesses only take cards, and some bank offices — which make money on

electronic transactions — have stopped handling cash altogether.

“There

are towns where it isn’t at all possible anymore to enter a bank and use cash,”

complains Curt Persson, chairman of

In

And that is how many governments will

transition to a cashless society. They will set a ceiling and then they

will keep lowering it and lowering it.

But is a cashless society really

secure?

Of course not.

Bank accounts can be hacked

into. Credit cards and debit cards can be stolen. Identity theft

all over the world is absolutely soaring.

So companies all

over the planet are working feverishly to make all of these cashless systems

much more secure.

In the future, it is inevitable that

national governments and big financial institutions will want to have all of us

transition over to using biometric identity systems in order to combat crime in

the financial system.

Many of these biometric identity

systems are becoming quite advanced.

For example, just check out what IBM

has been developing. The following is from a recent IBM press release....

You

will no longer need to create, track or remember multiple passwords for various

log-ins. Imagine you will be able to walk up to an ATM machine to securely

withdraw money by simply speaking your name or looking into a tiny sensor that

can recognize the unique patterns in the retina of your eye. Or by doing the

same, you can check your account balance on your mobile phone or tablet.

Each

person has a unique biological identity and behind all that is data. Biometric

data – facial definitions, retinal scans and voice files – will be composited

through software to build your DNA unique online password.

Referred

to as multi-factor biometrics, smarter systems will be able to use this

information in real-time to make sure whenever someone is attempting to access

your information, it matches your unique biometric profile and the attempt is

authorized.

Are you ready for that?

It is coming.

In the future, if you do not

surrender your biometric identity information, you may be locked out of the

entire financial system.

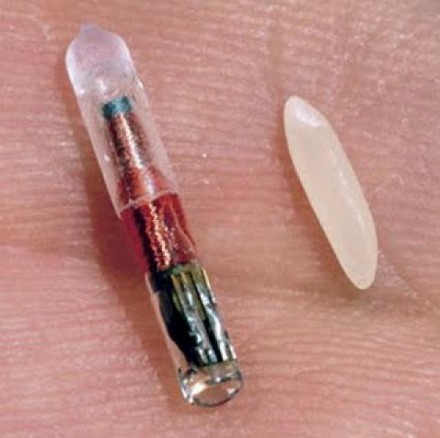

Another method that can be used to

make financial identification more secure is to use implantable RFID

microchips.

Yes, there is a lot of resistance to

this idea, but the fact is that the use of RFID chips in animals and in humans is rapidly

spreading.

Some

All over the

Increasingly, RFID chips are being

implanted in the upper arm of patients that

have Alzheimer's disease. The idea is that this helps health care

providers track Alzheimer's patients that get lost.

In some countries, microchips are now

actually being embedded into school uniforms to make

sure that students don't skip school.

Can you see where all of this is headed?

Some companies are even developing

RFID technologies that do not require an injection.

One company called Somark has developed chipless

RFID ink that is applied directly to the skin of an animal or a

human. These "RFID tattoos" are applied

in about 10 seconds using micro-needles and a reusable applicator, and they can

be read by an RFID reader from up to four feet away.

Would you get an

"RFID tattoo" if the government or your bank asked you to?

Some people out there are actually

quite excited about these new technologies.

For example, a columnist named Don

Tennant wrote an article entitled "Chip Me –

Please!" in which he expressed his

unbridled enthusiasm for an implantable microchip which would contain all of

his medical information....

"All

I can say is I’d be the first person in line for an implant."

But are there real dangers to going

to a system that is entirely digital?

For example, what if a devastating EMP attack wiped out our electrical grid

and most of our computers from coast to coast?

How would we continue to function?

Sadly, most people don't think about

things like that.

Our world is changing more rapidly

than ever before, and we should be mindful of where these changes are taking

us.

Just because our technology is

advancing does not mean that our world is becoming a better place.

There are millions of Americans that

want absolutely nothing to do with biometric identity systems or RFID implants.

But the mainstream media continues to

declare that nothing can stop the changes that are coming. A recent CBS News article made the

following statement....

"Most

agree a cashless society is not only inevitable, for most of us, it's already

here."

Yes, a cashless society is coming.

Are you ready for it?