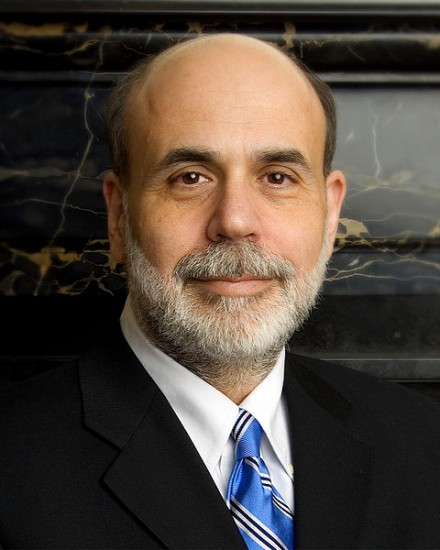

Ben

Bernanke Tries To Convince America That The Federal

Reserve Is Good And The Gold Standard Is Bad

http://theeconomiccollapseblog.com

http://albertpeia.com/benbsshalombernankesellsfedpansgoldstandard.htm

‘Ben Bernanke has decided that he needs to

teach all of us why the Federal Reserve is good for America and about why the

gold standard is bad. On Tuesday, Bernanke delivered the first of four

planned lectures to a group of students at

‘Ben Bernanke has decided that he needs to

teach all of us why the Federal Reserve is good for America and about why the

gold standard is bad. On Tuesday, Bernanke delivered the first of four

planned lectures to a group of students at

The entire event was staged to make

Bernanke and the Federal Reserve look as good as possible. Prior to his

arrival, the students gathered for the lecture were actually instructed to applaud Bernanke....

The

30 undergraduates at

But as noted above, this lecture was

not for the benefit of those students. A USA Today article even admitted

that "addressing the public directly" was one of the real goals of

this lecture....

For

Bernanke, the GW lectures serve a dual function:

They

give him a chance to reprise the role of professor he played for more than two

decades, first at Stanford and then at

And

they give him a way to expand his mission of demystifying the Fed. As part of

that campaign, Bernanke became the first Fed chief to hold regular news

conferences and conduct town-hall meetings.

In

addressing the public directly, Bernanke has also sought to neutralize attacks

on the Fed, some of them from Republican presidential candidates.

So what did Bernanke actually say

during the lecture?

Well, you can read all of the slides right here, but the following are some

of the highlights....

On page 6 of the presentation,

Bernanke makes the following claim....

"A

central bank is not an ordinary commercial bank, but a government agency."

Well, that is quite interesting

considering the fact that the Federal Reserve has argued in court that the Federal

Reserve Bank of

So did the Federal Reserve lie to the

court or is Ben Bernanke lying to us?

And what other "agency" of

the federal government is owned by private banks?

It is even admitted that the

individual member banks own shares of stock in the various Federal Reserve

banks on the Federal Reserve

website....

The

twelve regional Federal Reserve Banks, which were established by Congress as

the operating arms of the nation's central banking system, are organized much

like private corporations--possibly leading to some confusion about

"ownership." For example, the Reserve Banks issue shares of stock to

member banks. However, owning Reserve Bank stock is quite different from owning

stock in a private company. The Reserve Banks are not operated for profit, and

ownership of a certain amount of stock is, by law, a condition of membership in

the System. The stock may not be sold, traded, or pledged as security for a

loan; dividends are, by law, 6 percent per year.

The Federal Reserve always talks

about how it must be "independent" and "above politics",

but when they start getting criticized they always want to seek shelter under

the wing of the federal government.

It really is disgusting.

On page 7 of the presentation, the

following statement is made....

"All

central banks strive for low and stable inflation; most also try to promote

stable growth in output and employment."

Well, on both counts the Federal Reserve has failed miserably.

Right now, if inflation was measured

the same way that it was back in 1980, the annual rate of inflation would be more than 10 percent.

And when you take a longer view of

things, the inflation that the Federal Reserve has manufactured has been

absolutely horrific.

Even using the doctored inflation

numbers that the Federal Reserve gives us, the U.S. dollar has still lost 83

percent of its value since 1970.

The truth is that inflation is a

"hidden tax" that is constantly destroying the value

of every single dollar that you and I hold. Those that attempt to save

money for the future or for retirement are deeply penalized under such a

system.

As far as employment goes, the total

number of workers that are "officially" unemployed in the

The average duration of unemployment

is hovering near an all-time record high and almost every measure of government dependence is at an all-time

record high.

So the Federal Reserve is failing at

the exact things that Bernanke claims that it is supposed to be doing.

But instead of directly addressing

many of the specific criticisms that have been leveled at the Fed, Bernanke

instead chose to spend much of his lecture talking about the problems with

adopting a gold standard. The following are statements that were pulled

directly off of the slides he used during his speech....

-"The gold standard sets the

money supply and price level generally with limited central bank

intervention."

-"The strength of a gold

standard is its greatest weakness too: Because the money supply is determined

by the supply of gold, it cannot be adjusted in response to changing economic

conditions."

-"All countries on the gold

standard are forced to maintain fixed exchange rates. As a result, the effects

of bad policies in one country can be transmitted to other countries if both

are on the gold standard."

-"If not perfectly credible, a

gold standard is subject to speculative attack and ultimate collapse as people

try to exchange paper money for gold."

-"The gold standard did not

prevent frequent financial panics."

-"Although the gold standard

promoted price stability over the very long run, over the medium run it

sometimes caused periods of inflation and deflation."

-"In the second half of the 19th

century, a global shortage of gold reduced the

Bernanke spent more time on the gold

standard during his speech than on anything else. At one point during the

lecture, Bernanke made the following

statement....

"To

have a gold standard, you have to go to South Africa or someplace and dig up

tons of gold and move it to New York and put it in the basement of the

Federal Reserve Bank of New York and that's a lot of effort and work"

Bernanke even blamed the gold

standard for the Great Depression. On a slide entitled "Monetary

Policy in the Great Depression", Bernanke made the following claims....

•The Fed’s tight monetary policy led

to sharply falling prices and steep declines in output and employment.

•The effects of policy errors here and abroad were transmitted globally through

the gold standard.

•The Fed kept money tight in part because it wanted to preserve the gold

standard. When FDR abandoned the gold standard in 1933, monetary policy became

less tight and deflation stopped.

Bernanke seems to want to frame the

debate over monetary policy is such a way that the American people are given

only two alternative systems to consider: the Federal Reserve and a gold

standard.

But the truth is that there are a vast array of both "hard money" and

"soft money" systems that would not include a central bank or a gold

standard at all.

So the truth is that the American

people would have many different systems to choose from if they wanted to shut

down the Federal Reserve and set up something new.

In the past the

But in his lecture, Bernanke did not

even mention how the Federal Reserve creates money or how whenever new money is

created more debt is created.

Under the Federal Reserve system, the money supply is designed to continually

increase, and whenever more money is created more debt is also created.

In a previous article I discussed how more money is

created on the federal level....

For

example, whenever the

So

where does the Federal Reserve get the Federal Reserve Notes?

It

just creates them out of thin air.

Wouldn't

you like to be able to create money out of thin air?

Instead

of issuing money directly, the

Talk

about stupid.

The designers of the Federal Reserve system intended to trap the

So has their design worked?

Well, just look at the chart

below....

Today, the

So I guess you could say that the

results have been spectacular.

The Federal Reserve system also greatly favors the big Wall Street banks that it

is designed to serve.

When those big banks get into

trouble, the Federal Reserve snaps into action.

According to a limited GAO audit of

Fed transactions during the last financial crisis, $16.1 trillion in secret loans were

made by the Federal Reserve to the big Wall Street banks between December 1,

2007 and July 21, 2010.

The following list is taken directly

from page 131 of the GAO audit report and it

shows which banks received money from the Fed....

Citigroup - $2.513 trillion

Morgan Stanley - $2.041

trillion

Merrill Lynch - $1.949

trillion

Bank of America - $1.344

trillion

Barclays PLC - $868

billion

Bear Sterns - $853 billion

Goldman Sachs - $814

billion

Royal Bank of Scotland - $541

billion

JP Morgan Chase - $391

billion

Deutsche Bank - $354

billion

UBS - $287 billion

Credit Suisse - $262

billion

Lehman Brothers - $183

billion

Bank of Scotland - $181

billion

BNP Paribas - $175 billion

Wells Fargo - $159 billion

Dexia - $159

billion

Wachovia - $142 billion

Dresdner Bank - $135

billion

Societe Generale - $124 billion

"All Other Borrowers" - $2.639

trillion

What about all the rest of us?

Did we get bailed out?

No, we were told that if Wall Street

was rescued that the benefits would trickle down to the rest of us.

Unfortunately, that has not exactly

worked out. In article, after article, after article I have detailed the horrible economic suffering that

the American people are still going through.

But what Bernanke and the Fed have

done is create inflation in commodities such as oil which is affecting the

household finances of nearly everyone in

The average price of a gallon of

gasoline in the

So far in 2012, the price of gasoline

in the

Thanks Bernanke.

Over the past several decades, every

time there has been a major spike in gasoline prices in the

So will we soon see another recession?

If we are lucky. Hopefully the next downturn will not

be a full-blown depression.

The truth is that the Federal Reserve

does not help us avoid booms and busts. Rather, it creates them.

The Fed was at the heart of the housing bubble which helped bring on the last

financial crisis when it crashed, and the current ultra-low interest rate

policies of the Fed are creating more bubbles which will have devastating

long-term consequences.

So Bernanke does not have anything to

be proud of, and his track record has been absolutely nightmarish.

Hopefully the American people will

not believe the propaganda and will take an honest look at the Federal Reserve.

When you take an honest look at the

Federal Reserve, there is only one rational conclusion: Congress should shut it

down, lock the doors and throw away the key.