ALERT: All Of The Money In Your Bank Account Could

Disappear In A Single Moment

http://theeconomiccollapseblog.com

http://albertpeia.com/bankaccountswipedout.htm

’What

would you do if you logged in to your bank account someday and it showed that

you had a zero balance and your bank had no record that you ever had any money

in your account? What would you do if all of the money in your bank

account suddenly disappeared in a single moment? If you had not kept any

paper records, which most Americans do not, it would be exceedingly difficult

to prove to the bank that you actually had any money in the bank. If you

don't think that something like this could ever happen in the United States,

you might want to think again. Cyber attacks against major banks in the

United States are becoming more powerful and more sophisticated with each

passing month. In fact, major U.S. bank websites have been offline for a

total of 249 hours over the past six weeks. And just

last month, thousands upon thousands of Chase customers logged into their bank

accounts only to discover that their balances had all been reset to zero. Anyone that

would want to cause complete and total economic chaos in the United States

could accomplish it very easily by wiping out all of our bank account

records. So please do not keep all of your money in a single bank, and

from now on please keep a paper copy of all of your bank account

statements. At some point it is likely that one of these cyber attacks

will cause permanent damage to our banking system, and you want to be

protected.

’What

would you do if you logged in to your bank account someday and it showed that

you had a zero balance and your bank had no record that you ever had any money

in your account? What would you do if all of the money in your bank

account suddenly disappeared in a single moment? If you had not kept any

paper records, which most Americans do not, it would be exceedingly difficult

to prove to the bank that you actually had any money in the bank. If you

don't think that something like this could ever happen in the United States,

you might want to think again. Cyber attacks against major banks in the

United States are becoming more powerful and more sophisticated with each

passing month. In fact, major U.S. bank websites have been offline for a

total of 249 hours over the past six weeks. And just

last month, thousands upon thousands of Chase customers logged into their bank

accounts only to discover that their balances had all been reset to zero. Anyone that

would want to cause complete and total economic chaos in the United States

could accomplish it very easily by wiping out all of our bank account

records. So please do not keep all of your money in a single bank, and

from now on please keep a paper copy of all of your bank account

statements. At some point it is likely that one of these cyber attacks

will cause permanent damage to our banking system, and you want to be

protected.

The mainstream media has

generally been very quiet about the massive cyber attacks against our major

banks, but behind the scenes authorities are truly alarmed. They don't

know how to stop these attacks, and they just keep getting more intense and

more sophisticated.

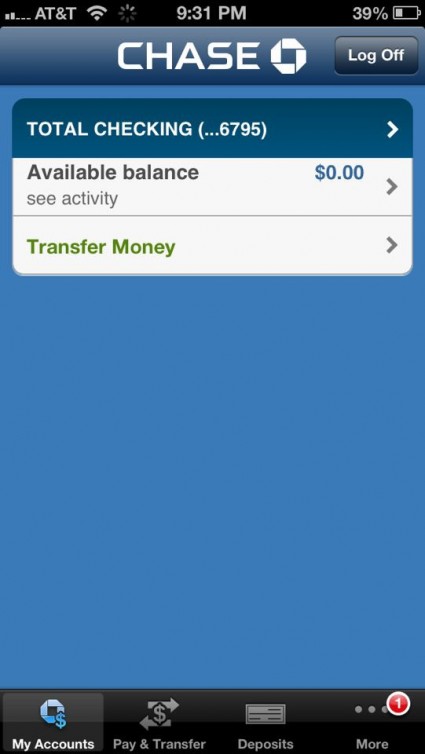

Could you imagine how you would

feel if you logged in to your bank account and all of your money was

gone? That is exactly what happened to some Chase customers last

month. The following is from a recent CNET article...

JP

Morgan Chase denied this evening that it had suffered a hack that many

customers claimed had suddenly reduced their checking account balances to zero.

After

discovering the apparently empty accounts via the Internet or mobile devices,

many Chase banking customers turned to Twitter to express their frustration and

show screen shots of zero balances. Other users were greeted with messages that

their bank account balances were unavailable.

But

this was most definitely not an isolated incident. That same article

noted that Chase and many of our other large banks have had their websites

taken down for extended periods of time lately...

Customers'

suspicions about a possible security breach are natural, with the zero balances

appearing less than a week after a massive distributed-denial-of-service attack

rendered

Chase's Web sites useless for many hours. Customers trying to use the

site's tools were instead greeted with a note that the site was

"temporarily down."

Hackers

have ratcheted up their assaults on financial institutions in recent months,

using DDoS attacks to take down Wells Fargo, Bank of America, Chase, Citigroup,

HSBC, and others.

In

fact, as I mentioned above, major U.S. bank websites have been offline for an

astounding 249 hours over the last six weeks alone. The

attacks just keep getting larger and bank officials are becoming very alarmed

about the power of these cyber attacks. The following is from an article

that was posted on CNBC this week...

Major

U.S. bank websites have been offline a total of 249 hours in the past six

weeks, perhaps the clearest indication yet that American companies are prime

targets in an unrelenting, global cyber conflict.

The

heavier-than-usual outages are the result of a remarkable, sustained attack

that began seven months ago and repeatedly knocks banks offline for hours at a

time, frustrating consumers and bank security professionals alike.

"Literally,

these banks are just in war rooms, sitting at controls trying to stop (the

attacks)," said Avivah Litan, a bank security analyst with Gartner Group,

a consulting firm. "The frightening thing is (the attackers) are not using

as much resources as they have on call. The attacks could be bigger."

So

who is behind these attacks?

Some

are blaming Chinese hackers, others believe that Iran is behind the attacks,

and yet others are convinced that it is the work of Islamic terrorists.

It

is kind of frightening that they cannot positively identify who is behind these

attacks. Whoever it is, they sure do seem to have a tremendous amount of

resources and they are very sophisticated.

And

in the future, it may not be hackers on the other side of the globe that are

attacking our banks. In fact, if someone wanted to "recapitalize the

banks", all they would have to do is wipe out all of our bank account

records (including all backup records). Suddenly trillions of dollars of

"unsecured liabilities" (that is what our bank accounts are) would be

wiped out and the banks would suddenly be solvent again. Anyone that

could not produce evidence that they actually had money in the banks would be

in a lot of trouble. It would be the largest single wealth transfer in

the history of the world, and it would throw the U.S. economy into utter

chaos. This is a scenario that I am exploring in my new novel which will

be coming out later this month.

In

addition, there is the constant threat that a massive EMP burst could fry all

of our electronics (including the banking records), but that is a topic that I

have covered in a previous article.

And

of course another way that your bank account could be wiped out in a single

moment is if the government decides to "legally" steal it. We

just witnessed this happen in

Cyprus. In February, the Central Bank of Cyprus swore that such a

thing could never possibly happen, but then one month later it did

happen. The politicians will lie to your face until the very day comes

when they steal your money.

Sadly,

a very similar thing could easily happen in the United States someday. As

I wrote about yesterday, the big banks are making incredibly reckless

bets with our money. When those bets go bad, our money could

very well be used to cover those bets.

One

way this could be accomplished is by using a practice known as

"rehypothecation". It sounds complicated, but it really

isn't. Basically, the banks use money that clients have entrusted to them

to cover their own gambling debts. This is how rehypothecaton is defined by Investopedia...

"The

practice by banks and brokers of using, for their own purposes, assets that

have been posted as collateral by their clients."

An

excellent article by Jeff Nielson detailed how this

could result in the big banks grabbing our money when their trillions of

dollars of reckless bets go bad...

1) Our

banking regulators knowingly allow financial institutions to engage in

recklessly misleading (if not outright fraudulent) contracts with their

clients, through the use of complex “small print” in their account contracts

with clients.

2) The

three largest U.S. “banks” by deposit (JP Morgan, Bank of America, Citigroup)

have made bets in their own rigged casino, which total well in excess

of $100 trillion, an amount which completely dwarfs their total, combined

deposits (and assets).

3) A

large portion of those bets occur in the $60+ trillion credit default

swap market. Pay-outs in these markets can (and do) exceed 300 times the amount of

the original bet. It is bets in this market which “blew up” AIG, requiring

more than $150 billion in immediate government aid.

4) Following

the Crash of ’08; these same banks mooched a package of hand-outs, tax-breaks

and “guarantees” (i.e. future hand-outs) from the Bush regime in excess

of $15 trillion, the last time their gambling debts went bad on them – and

all of these banks have been allowed to dramatically increase the

total amount of their gambling since then.

5) It

would take only a minor change in the gambling contracts in which these bankers

engage to allow their creditors to seize funds out of ordinary bank

accounts.

6) The

existing language for the bank accounts of these U.S. banks is possibly already

so vague (and prejudicial to clients) that it would allow these banks

to reinterpret the terms of these bank accounts – and allow

rehypothecation to be used to rob the holders of ordinary bank accounts, people

who themselves make no “bets” in markets whatsoever. Alternately, customers

could be blitzed with an offer for “new and improved” bank accounts, where

terms allowing rehypothecation are slipped into the contract, with the

banks knowing that the “regulators” will do nothing to warn account-holders of

the gigantic risk they are taking.

But

we are all covered by deposit insurance, right?

That

is what the people of Cyprus thought too.

As

we just saw in Cyprus, when there is a "banking crisis" sometimes

government steps in and suddenly changes all of the rules overnight even though

the vast majority of the population is against it.

Hopefully

you can see that no bank account will ever truly be "safe" ever

again.

Your

money may be safe today, and your money may be there next week, but someday it

could disappear in a single moment.

And

the general public is definitely starting to lose faith in the banking

system. Google searches for the term "bank

run" have been absolutely spiking recently. Just check out this chart

which shows that searches for "bank run" are now the highest that

they have ever been.

So

what should we all do to protect ourselves?

As

I mentioned earlier, it is important to not have all of your money in one bank,

and from now on you will want to permanently keep paper copies of all of your

bank account statements.

Someday

you may need those statements in order to prove that you actually had money in

the bank.

Our

world is becoming increasingly unstable, and at some point financial disaster

is going to strike.

By

taking prudent precautions now, hopefully you will be able to minimize the

damage to your family.’