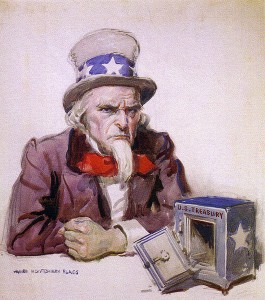

One

Nation Under Debt With Endless Debt Slavery For All

http://endoftheamericandream.com

http://albertpeia.com/anddebtslaveryforall.htm

Debt

is a "soft" form of slavery. In

Debt

is a "soft" form of slavery. In

When most Americans think of the

"

The chart posted below shows the

growth of total debt in the

Our entire economy is now based on

debt. We are told that we have to go into debt for everything.

Just think about it.

Most young adults start their lives

by going into huge amounts of student loan debt. Young people are told

that they won't be able to get a good job without a college education,

and most of them can't get a college education without taking out huge loans.

Unfortunately, a college education just keeps getting more and

more expensive. At this point, college students in the

Sadly, about two-thirds of all

college graduates leave school with student loan debt these days. The

average student loan debt burden at graduation is approximately $25,000.

So before they even start their

lives, these young people are drowning in debt. Recently, total student

loan debt in the

That is absolute insanity.

Okay, so once our young people

graduate from college they need to get a car so that they can get to work (if they

are fortunate enough to find a job).

In most cases, that is going to

involve more debt.

In the

In order to make car payments

affordable in a world of stagnating paychecks, auto lenders just keep extending

the length of auto loans. Right now, the average length of an auto

loan in

And just like we saw with housing, a

lot of these loans are being made to "subprime" borrowers.

Sadly, 45 percent of all auto loans are being made to subprime

borrowers at this point.

That is certainly not going to end

well.

Once young adults start working, they

are encouraged to buy a home.

In the vast majority of cases, that

is going to involve even more debt.

Homes certainly cost a whole lot more

than they did in the old days, and most Americans really have to stretch to be

able to afford the homes that they live in.

In fact, mortgage debt as a

percentage of GDP has more than tripled since

1955.

That is not economic progress.

Many Americans may be living in

beautiful homes, but the truth is that the bankers own a bigger share of our

homes than ever before.

Only in the past few years has it

gotten to the point where the bankers actually have more equity in our homes than we do.

This is unprecedented in American

history.

Today, homeowners are only holding about 40 percent of all home

equity.

Back in 1952, that figure was above 80

percent.

One nation under

debt indeed.

Once our young adults have a home,

they have to fill it up with stuff.

So that is where credit cards and

other forms of consumer debt come in.

Overall, consumer debt in

Sadly, most Americans have been told

about how poisonous credit card debt is and yet they continue to rack up huge

amounts of it anyway.

Today, 46% of all Americans carry a

credit card balance from month to month.

That isn't very smart.

Overall, Americans are carrying a

grand total of $798 billion in credit card debt, and

all of that credit card debt is making the Wall Street bankers very, very

wealthy.

Credit card debt is one of the worst

forms of debt slavery, and yet millions upon millions of Americans cannot kick

the habit. In fact, one out of every seven Americans has at least 10 credit

cards.

When will we all learn?

Debt does not build up the middle

class. Debt destroys the middle class.

Once Americans start getting older

and their bodies start breaking down, medical debt starts becoming a problem.

One study found that approximately 41 percent

of all working age Americans either have medical bill problems or are currently

paying off medical debt.

Even if you go out and get a

"really good" health insurance policy, that still does not mean that

you are going to be able to avoid medical debt. According to the American

Journal of Medicine, medical bills are a major factor in more than 60 percent of all

personal bankruptcies in the

So what is the lesson?

Don't get sick.

You may not be able to afford it.

Government debt is also a major

national crisis.

As I have written about previously, state and local governments all over the

nation are on the verge of bankruptcy. In the years ahead we are going to

see unprecedented financial implosions all over the nation.

And the worst debt problem of all is

the federal government debt problem.

Since Barack Obama took office, the

During the Obama administration, the

That is really, really bad.

At this point, the

So yes, we are in a massive amount of

trouble and yet our politicians are wasting money on some of the most

insane things you could possibly imagine.

For example, the federal government

is actually spending money to determine how rats respond to jazz music when they are high on

cocaine.

I am afraid that the history books

are not going to be too kind to us.

We were the wealthiest nation in the

history of the world, but that was not good enough for us.

We just kept borrowing and borrowing

and borrowing and now we have destroyed our future.

How could we have been so stupid?