Current Recession Is Tracking the 1930s Bear Market

May

17, 2009 | about stocks: DIA / SPY

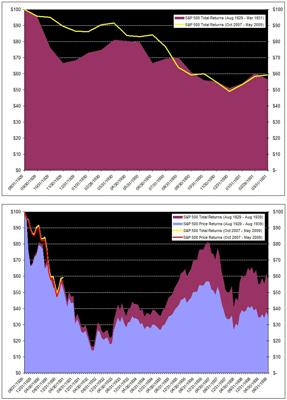

The following is a simple comparison of today's market

to that of the 1930s...no economic analysis here...

Today we’re 19 months from the S&P 500 peak in October

2007. How does the past 19 months compare to the 19 months after the S&P

500 peak in 1929?

The first graph below shows that today’s 19-month decline

from market peak is almost identical to the 19-month decline from market peak

after 1929 (down about 40% in both cases). Interestingly, the ‘recovery’ of the

last couple months is almost identical to the recovery during the first couple

months of 1931.

The second graph below extends the 1930s historical

comparison to include a full 10 years of data after the 1929 market peak. It

turns out the first 19 months of decline after 1929 was nothing.

Markets subsequently fell another 67% or so. Could this happen again today?

Also, in the second graph I included both total returns and

price returns for the S&P 500. Just a nice illustration

to show how the power of reinvested dividends helped investors recover some of

their money over time.