The US Student Loan Bubble Broken

Down By State, And Why Washington D.C. Sticks Out Like A Sore Thumb

Submitted by Tyler Durden

‘Curious

how the student loan bubble, just shy of $1 trillion, and now the largest debt

portion of the US household non-mortgage wallet, bigger than credit card

and auto loan debt - affects your state? Then the following three charts just

out from the NY Fed are

for you.

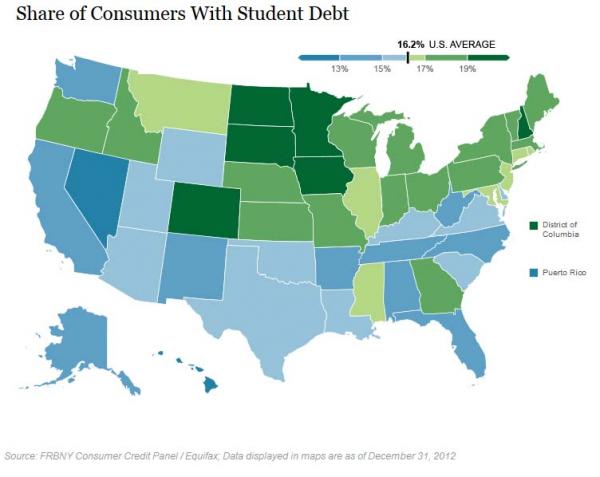

What

the data shows is that less than 12% of the population in Hawaii has student

loans, while the record is in D.C. at over 25%. All those

"students" in the nation's capital. Really?

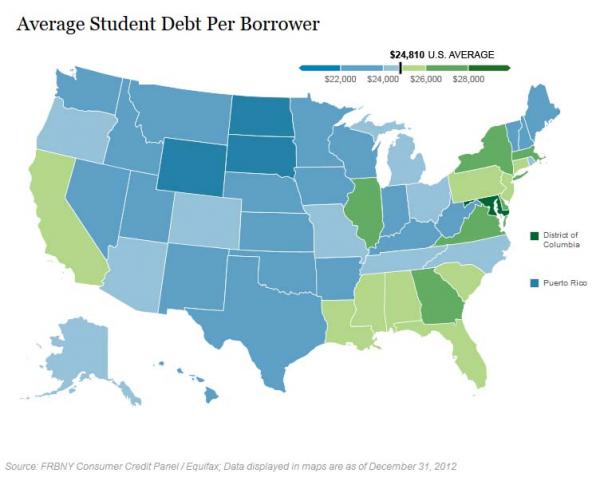

But

that's not all. While the average loan balance is under $21,000 in Wyoming, it

is once again highest in D.C., with the average loan balance over

$40,000. It is almost as if D.C. "students" have learned

how to game the system.

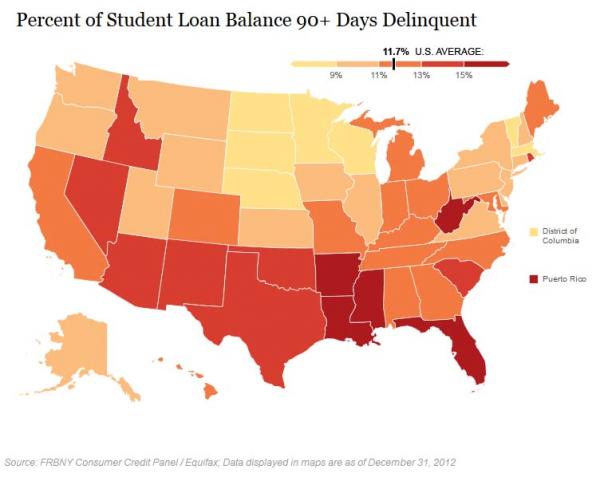

Yet

where the very "studious" population in the capital city truly excels

is in the amount of delinquency: here it is all West Virginia at the top with

over 18% of all loans delinquent 3 months and over, while DC is not even in the

top 10 - must be all those well-paying jobs for interns and college grads in

the beltway. It is almost as if someone is closing their eyes when it comes to

the delinquencies of DC borrowers. But that would be yet another preposterous

conspiracy theory of course...

Borrowers

as share of population:

Student

loans balances per borrower:

Percentage

of 90+ day delinquent:

The

supporting

detail.

![]() Student loan borrowers as a

share of the population. The population with active student loan

debts, or “SL borrowers,” as a share of the population with a credit record

varies substantially over space. For example, in Hawaii, less than 12 percent

of people with a credit report have student debt, while in the District

of Columbia over 25 percent do.

Student loan borrowers as a

share of the population. The population with active student loan

debts, or “SL borrowers,” as a share of the population with a credit record

varies substantially over space. For example, in Hawaii, less than 12 percent

of people with a credit report have student debt, while in the District

of Columbia over 25 percent do.

![]() Student loan balances per SL

borrower. Student indebtedness is significant for SL borrowers in

virtually all states. Educational indebtedness per SL borrower ranges from a

low of just under $21,000 in Wyoming to a high of over $28,000 in Maryland. Again,

Washington, D.C., stands out: the average SL borrower there owes over $40,000. In

general, we find SL-borrower debt levels are highest in California and along

the Atlantic and Gulf coasts.

Student loan balances per SL

borrower. Student indebtedness is significant for SL borrowers in

virtually all states. Educational indebtedness per SL borrower ranges from a

low of just under $21,000 in Wyoming to a high of over $28,000 in Maryland. Again,

Washington, D.C., stands out: the average SL borrower there owes over $40,000. In

general, we find SL-borrower debt levels are highest in California and along

the Atlantic and Gulf coasts.

![]() Percent of balance ninety-plus

days delinquent. Delinquency rates show a distinct regional

pattern, with states in the south and southwest having generally higher rates

than those in the north. The lowest delinquency rate is South Dakota, at just

over 6.5 percent, while the highest is in West Virginia, at nearly 18 percent.

Percent of balance ninety-plus

days delinquent. Delinquency rates show a distinct regional

pattern, with states in the south and southwest having generally higher rates

than those in the north. The lowest delinquency rate is South Dakota, at just

over 6.5 percent, while the highest is in West Virginia, at nearly 18 percent.