20-Apr (USAGOLD) — Gold is narrowly

confined, despite a softer dollar tone. The euro was boosted by a German Ifo beat and the likely misplaced

hope that the latest G20 meeting, commencing today, will provide some sort of

global solution to the resurgent eurozone debt

crisis.

Along similar lines, the IMF seems

confident it will receive a $400 bln boost to its

firepower, based on commitments from more than a dozen countries. The

However, it’s now

This series of MoneyGame

charts from earlier in the week pretty clearly illustrate the severity of the

problems in

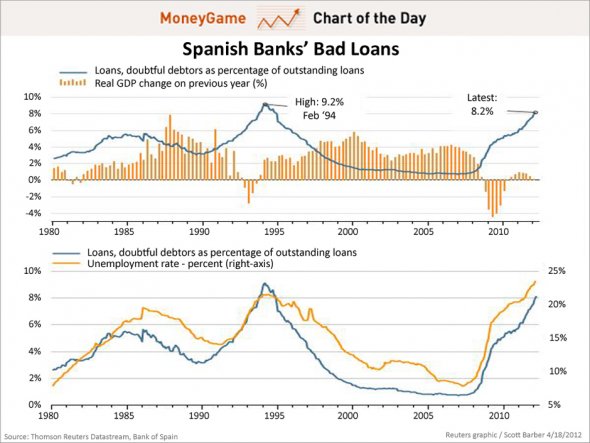

The percentage of

bad loans at Spanish banks continue to rise. Note that while the pace

slowed during last year’s tepid economic recovery, the trend remained

disturbingly positive.

[source]

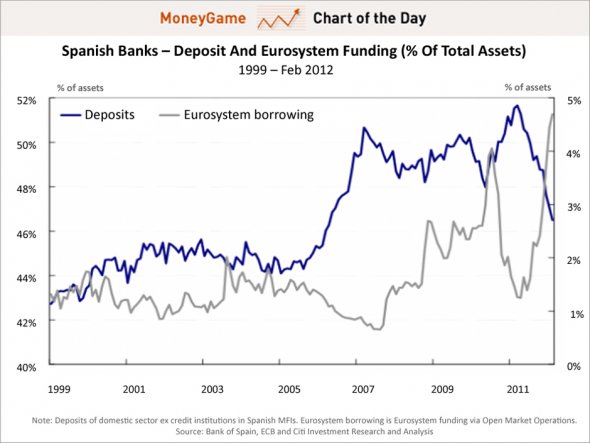

Exacerbating problems for the Spanish

banks is the good old fashion bank run reflected in this chart. Depositors are

fleeing in droves, forcing the banks to borrow from the Eurosystem

to maintain solvency. It is becoming increasingly clear, that even in the wake

of the massive ECB liquidity operations, Spanish banks may well need to be

bailed out.

[source]

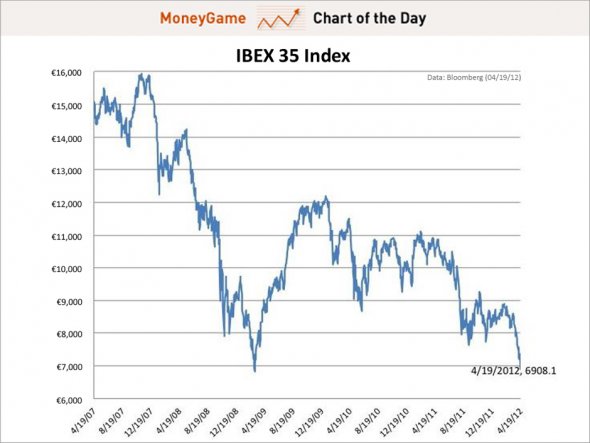

Spain’s IBEX35 stock index is down

nearly 20% this year alone and even with today’s rebound, off about 56% since

the 15,945.70 peak from late-2007. Ouch.

[source]

So what’s the G20 to do? Well the

first thing they’re going to do apparently is to echo the sentiments of the ECB

and tell the European politicians that the responsibility

for the debt crisis lies with them. Not exactly the initial confidence

builder the market was hoping for, and Spanish and Italian bonds in particular

are back under pressure.

With Spain’s economy already getting

crushed by austerity, unemployment on the rise, the banks under severe duress

and its stock market plummeting, I’m wondering what exactly the G20 and the ECB

see as the options available to the Spanish government. Perhaps this is just

further retribution for Prime Minister Mariano Rajoy’s

rejection of the agreed to deficit reduction target. Maybe the not so subtle

message here is get back on the more severe austerity track, or we’ll let you

wither on the vine.

However, as we discussed in

commentary earlier in the week, this is a dangerous game to be playing, as

austerity measures have a tendency to insight civil unrest and the downfall of

governments. On the other hand,

Such a decision would unquestionably

come with its own form of pain, and not necessarily just for