CNN

Tells Americans That The Stock Market Is Not Going To Crash

On

Wednesday we witnessed the third largest single day point gain for the Dow

Jones Industrial Average ever. That sounds like great news until you

realize that the two largest were in October 2008 right in the middle of

the last financial crisis. This is a perfect example of what I wrote

about yesterday. Every time the market crashes, there are

huge up days, huge down days and giant waves of market momentum. Even though

the Dow was up 619 points on Wednesday, overall we are still down more

than 2,000 points from the peak of the market. During the weeks

and months to come, we are going to see many more wild market swings, but the

overall direction of the market will be down. (Read More....)

On

Wednesday we witnessed the third largest single day point gain for the Dow

Jones Industrial Average ever. That sounds like great news until you

realize that the two largest were in October 2008 right in the middle of

the last financial crisis. This is a perfect example of what I wrote

about yesterday. Every time the market crashes, there are

huge up days, huge down days and giant waves of market momentum. Even though

the Dow was up 619 points on Wednesday, overall we are still down more

than 2,000 points from the peak of the market. During the weeks

and months to come, we are going to see many more wild market swings, but the

overall direction of the market will be down. (Read More....)

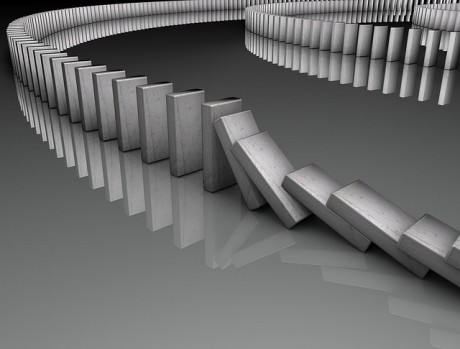

During

Every Market Crash There Are Big Ups, Big Downs And Giant Waves Of Momentum

This

is exactly the type of market behavior that we would expect to

see during the early stages of a major financial crisis. In every major

market downturn throughout history there were big ups, big downs and giant

waves of momentum, and this time around will not be any different. As I

have explained repeatedly, markets tend to go up when things are calm, and they

tend to go down when things get really choppy. During a market meltdown,

we fully expect to see days when the stock market absolutely soars. Waves

of panic selling are often followed by waves of panic buying. As you will

see below, six of the ten best single day gains for the Dow Jones Industrial

Average happened during the financial crisis of 2008 and 2009. So dont be fooled for a moment

by a very positive day for stocks like we are seeing on Tuesday. It is

all part of the dance. (Read More....)

This

is exactly the type of market behavior that we would expect to

see during the early stages of a major financial crisis. In every major

market downturn throughout history there were big ups, big downs and giant

waves of momentum, and this time around will not be any different. As I

have explained repeatedly, markets tend to go up when things are calm, and they

tend to go down when things get really choppy. During a market meltdown,

we fully expect to see days when the stock market absolutely soars. Waves

of panic selling are often followed by waves of panic buying. As you will

see below, six of the ten best single day gains for the Dow Jones Industrial

Average happened during the financial crisis of 2008 and 2009. So dont be fooled for a moment

by a very positive day for stocks like we are seeing on Tuesday. It is

all part of the dance. (Read More....)

BLACK

MONDAY: The First Time EVER The Dow Has Dropped By More Than 500 Points On Two

Consecutive Days

On

Monday, the Dow Jones Industrial Average plummeted 588 points.

It was the 8th worst single day stock market crash in U.S. history, and it was

the first time that the Dow has ever fallen by more than 500 points on two

consecutive days. But the amazing thing is that the Dow actually performed

better than almost every other major global stock market on Monday. In

the U.S., the S&P 500 and the Nasdaq both did worse than the Dow. In

Europe, almost every major index performed significantly worse than the

Dow. Over in Asia, Japanese stocks were down 895 points, and Chinese

stocks experienced the biggest decline of all (a whopping 8.46 percent). On

June 25th, I was not kidding around when I issued a red alert for the last six months of 2015. I had never issued a

formal alert for any other period of time, and I specifically stated that a major financial collapse is

imminent.

But you know what? As the weeks and months roll along, things will eventually

be even worse than what any of the experts (including myself) have been

projecting. The global financial system is now unraveling, and you better pack

a lunch because this is going to be one very long horror show. (Read More....)

On

Monday, the Dow Jones Industrial Average plummeted 588 points.

It was the 8th worst single day stock market crash in U.S. history, and it was

the first time that the Dow has ever fallen by more than 500 points on two

consecutive days. But the amazing thing is that the Dow actually performed

better than almost every other major global stock market on Monday. In

the U.S., the S&P 500 and the Nasdaq both did worse than the Dow. In

Europe, almost every major index performed significantly worse than the

Dow. Over in Asia, Japanese stocks were down 895 points, and Chinese

stocks experienced the biggest decline of all (a whopping 8.46 percent). On

June 25th, I was not kidding around when I issued a red alert for the last six months of 2015. I had never issued a

formal alert for any other period of time, and I specifically stated that a major financial collapse is

imminent.

But you know what? As the weeks and months roll along, things will eventually

be even worse than what any of the experts (including myself) have been

projecting. The global financial system is now unraveling, and you better pack

a lunch because this is going to be one very long horror show. (Read More....)

People Are Going Crazy

Have

you noticed that more Americans than ever seem to be going totally

insane? When even reporters start going on racially-motivated shooting

sprees, you know that things are getting crazy in this country. On

Wednesday, most Americans were absolutely stunned to learn that a former

WDBJ-TV reporter shot and killed a 24-year-old female reporter named Alison

Parker and a 27-year-old male cameraman named Adam Ward right as they were in

the middle of shooting a live news segment at 6:45 in the morning. As a

reporter, the shooter was known as Bryce Williams, but his legal name was Vester Lee Flanagan

II. He fled the scene, but was later tracked down by police. Before

they could take him into custody he shot himself, and he later died at a

hospital in northern Virginia. So what would cause a talented young man

to do such a thing? (Read More...)

Have

you noticed that more Americans than ever seem to be going totally

insane? When even reporters start going on racially-motivated shooting

sprees, you know that things are getting crazy in this country. On

Wednesday, most Americans were absolutely stunned to learn that a former

WDBJ-TV reporter shot and killed a 24-year-old female reporter named Alison

Parker and a 27-year-old male cameraman named Adam Ward right as they were in

the middle of shooting a live news segment at 6:45 in the morning. As a

reporter, the shooter was known as Bryce Williams, but his legal name was Vester Lee Flanagan

II. He fled the scene, but was later tracked down by police. Before

they could take him into custody he shot himself, and he later died at a

hospital in northern Virginia. So what would cause a talented young man

to do such a thing? (Read More...)