'Massive Wealth Destruction' Is About to Hit

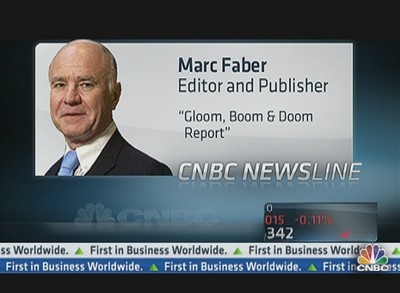

Investors: Faber

Published: Monday, 2 Apr

2012 ‘Runaway government debts have triggered uncontrolled money

printing that in turn will lead to inflation that will decimate portfolios,

according to the latest forecast from "Dr. Doom" Marc Faber.

|

Axel Griesch | ASFM | Getty Images Dr. Marc Faber |

Investors, particularly those in the

"well-to-do" category, could lose about half their total wealth in the

next few years as the consequences pile up from global government debt

problems, Faber, the author of the Gloom

Boom & Doom Report, said on CNBC.

Efforts to stem the debt problems have

seen the Federal Reserve ![]() expand

its balance sheet to nearly $3 trillion and other central banks implement

aggressive liquidity programs as well, which Faber

sees producing devastating inflation

expand

its balance sheet to nearly $3 trillion and other central banks implement

aggressive liquidity programs as well, which Faber

sees producing devastating inflation ![]() as

well as other consequences.

as

well as other consequences.

"Somewhere down the line we will

have a massive wealth destruction that usually happens either through very high

inflation or through social unrest or through war or credit market

collapse," he said. "Maybe all of it will happen, but at different

times."

Noted for his pessimistic forecasts and

gold

advocacy, Faber nonetheless lately has been telling investors

that stocks are a good choice as central bank policies pump up asset prices.

He reiterated both his commitment to

stocks and gold, but said investors also can find value in other hard assets,

particularly in distressed

properties in the

"In Georgia, in Arizona, in Florida their property values will not collapse

much more and will stabilize, so I think to own some land and some property,

not necessarily in the financial centers but in the secondary cities, these are

desirable investments relatively speaking," Faber said.

As for stocks, Faber said Fed Chairman

Ben Bernanke's policies will be friendly toward equity investors, at least for

now.

The stock

market is in the middle of an aggressive bull run

that has seen the major indexes rise more than 25 percent from their October

lows.

"I think that people should own

some gold and I think that people should own some equities, because before the

collapse will happen, with Mr. Bernanke at the Fed, they're going to print

money and print and print and print," he said. "So what you can get

is a bad economy with rising equity prices." ‘