Krugman's

"Smoot-Hawley Moment"

Submitted by Bruce Krasting on

03/25/2013 13:04

‘I'm

constantly amazed at the things Paul Krugman has to say. This guy is on the top

of the list of global economic thinkers. He has all of the credentials, and a huge

platform to spin his views of what's good and bad, and what should be done

next. PK's OpEd in the Times today is another example. (Link)

PK

does a summary of Cyprus. I believe he has all of the facts straight, and I

agree with him when he says:

Global capitalism is, arguably, on track to become

substantially less global.

The

broader story of Cyprus is about capital controls. It's not just the harsh new

controls on the Island, it's all over Europe. There is not a country on the

globe that has not established some form of controls the past few years.

America has done it in subtle ways, using ZIRP, QE, Dodd-Frank and the

Department of Justice to contain the free flow of money. I think a big

clampdown in China on money is right around the corner. This trend scares the

crap out of me. Krugman is on the other side of the spectrum. He loves capital

controls. He wants to see more of them:

The bad old days when it wasn’t that easy to move lots of money

across borders are looking pretty good.

"Looking pretty good?" OMG!

Given

that big shots like Krugman want to see more controls of money, its a good bet

that more controls will come. I think the likes of Krugman are ignoring the

realities of 2013. They are doing so very much at the peril of the global

economy.

The

CIA keeps track of global cross border debt. The numbers are huge, and growing

fast:

-

Total World External Debt was $69T in 2012. In 2011 it was $63.6T. In one year

it grew by $5.4T. World GDP growth was 3% while cross border debt rose by 8.5%.

-

In 2004 World External Debt was $43T, or 65% of World GDP. In 2012 total

External debt was 85% of GDP.

-

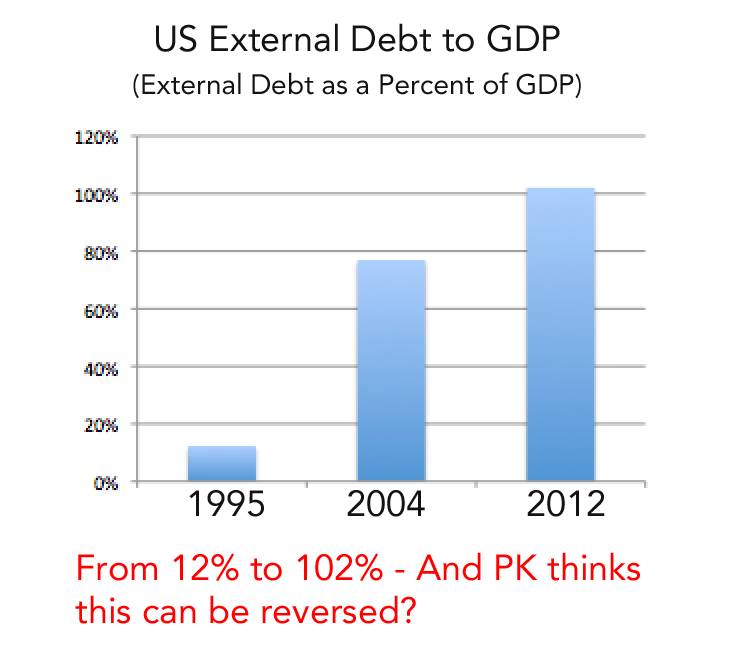

The External Debt numbers for the USA are worth noting. Yes, 1995 is a long

time ago, and the world is a different place today. I still find these results

troubling:

In

his typical style, Krugman establishes what is "true" and what is

"false".

The truth, hard as it may be for ideologues to accept, is that

unrestricted movement of capital is looking more and more like a failed

experiment.

Krugman's

conclusion is that a cornerstone of global activity is a failed experiment and

that the solution is to install more capital controls. Mr. K will get what he

wants. More controls are coming - that's certain now. The entire house of cards

that is Global GDP is at risk. The failed experiment that PK thinks is the rise

in external debt, could easily morph into the failed experiment of the global

economy.

I

wonder if PK (and all the others who are pushing for more controls) are not

having a "Smoot-Hawley Moment". In 1929 tariffs and other

restrictions on trade were established. A global depression followed. In 2013

the tariffs and restrictions are on money, not goods. But if the result of

those controls is a reduction (or even stability) of the external debt numbers,

then the global economies will fall with it.

And

this is what the world's "smartest" economist is calling for.’