What

you are about to see is based on information obtained from a little-known

government document called FT900.

It's

published by a non-descript Federal office located at 1401 Constitution Avenue

in Washington, D.C., less than one mile from the White House.

The

following presentation reveals evidence of a political scandal that will

destroy Obama's political career and ruin the retirement of millions of

unprepared Americans.

It

also reveals four easy steps you can take to protect yourself and your family.

***

Hello. My name is Jeff Opdyke.

As a former investigative

reporter for the Wall Street Journal, I’ve seen a lot of swindles, scams and

financial scandals throughout my career.

The Obama scandal I’m going to

reveal to you today is not just the biggest of all—it will also be the most

devastating.

I’m sure you’ve heard about the

major scandals that have broken over the Obama administration.

The Bengazi cover-up… the IRS

targeting conservatives… the bugging of Associated Press reporters… and the

National Security Agency secretly collecting data from ordinary citizens.

Well, if these events have

shocked you… you’ve seen nothing yet.

The scandal I’m talking about

will dwarf the Enron, WorldCom, and Madoff scandals not only in dollar value,

but also in the sheer level of dishonesty.

It will trigger a virtually

unstoppable chain reaction that will destroy the way of life of millions of

unprepared Americans.

Historians will recognize this

as the biggest political and financial event of our century.

Ironically, details of this

scandal are buried inside this little-known government document called FT-900

In short, this document reveals a major

cover up from the most powerful financial institution in the world.

While this is a public document, only a handful of

people have figured out its implications. 99.9% of Americans have yet to

connect the dots.

The truth is this scandal is not

obvious. Only those who know where to look, and are willing to investigate

decades of data have been able to piece together this major cover up.

And that’s exactly what I’ve

done. I’ve spent the last nine months researching this topic, collecting

evidence and contacting experts.

I’m confident after you see what

I’m about to show you, you’ll agree that a major crisis is not only inevitable,

but imminent… and that your wealth and your way of life are at risk.

The good news, is that this

scandal will also result in the biggest wealth transfer in the history of our

nation. For those of us who start preparing now, this will be the opportunity

of a life-time.

In a minute, I will show you

exactly all the steps you need to take to put yourself on the right side of

this wealth transfer.

But for those who ignore this

message? Well, let’s just say it won’t be pretty.

401ks and IRAs will shrink by

40% or more… millions of Americans will fall into poverty overnight …

unemployment will skyrocket… markets around the globe will drop at least 50%.

I expect we’ll see some

politicians indicted… people will riot in the streets… some of our closest

allies will break agreements with us.

The government will have no

choice but to suspend Social Security checks and all forms of welfare payments,

including food stamps and unemployment insurance.

And when all is said and done,

the U.S. may even look like a third world country.

You will need to reevaluate who

you do business with, where you bank, and how you invest for retirement.

This event will even have a huge

impact on the lifestyle of your children and grandchildren…

I know all this sounds pretty

daunting, but believe me… I have no interest in trying to scare you.

As the executive editor of The

Sovereign Investor, it’s my duty to sound the alarm bell loud and clear.

The independent financial

research team I head has been doing just that for years now.

We were one of the first

financial research groups to warn investors about the dangers in the

derivatives market, and the threat they posed to the global financial system.

Many economic experts claimed

the 2008 financial crisis was unpredictable – that it was a Black Swan

event no one could expect. Yet, in 2005 we mailed a report to our subscribers

and to influential decision makers in the U.S. on this very crisis.

We published this report long

before the word “derivatives” ever hit the front pages. And it predicted with

uncanny accuracy the global financial meltdown.

We also warned our readers on

the dollar crisis of 2004 and 2005 ... the meltdown in the private equity

markets in 2007 ... the collapse of Lehman Brothers in 2008… and the European

debt crisis.

And now I’m here to warn you of

another looming crisis…one that could soon trump them all.

I’ve already taken some drastic

steps to prepare for this event. Because I know once the mainstream media

starts reporting on this, it will be far too late for anyone to act.

And I hope you will do the same.

I hope you will act to protect

your family and your wealth from the coming upheaval.

That’s why I’ve created this

presentation.

To show you exactly what steps

you can take today to protect your family and which investments will be on the

winning side of this great wealth transfer.

But before I do that, let me

first tell you why I believe this political event will topple one of the

greatest pillars upon which our American empire was built.

I’m talking about trust…

Trust in the U.S. government and

its institutions.

America is

About to Lose its Most Valuable Asset

In recent years many analysts

have predicted that America’s out-of-control debt would destroy our country.

And yet, our economy seems to be

doing ok.

Why? Why hasn’t this ticking

time bomb exploded?

It all comes down to one

seemingly simple, but very important concept: Trust.

We all know that trust is the

most important glue in any relationship, either in business or in our personal

lives. This is also true in our global financial system.

Most of us take this for

granted, but trust in the U.S. government is a big reason why America has

become such a dominant force over the past century.

It’s because of trust in our

government that the U.S. has been able to borrow at the lowest interest rates

available in the world for years.

Even in 2008, in the midst of

the worst financial crisis in 80 years, our federal government was able to

borrow vast sums of money at an interest rate close to 1%.

It was trust that allowed our

government to bailout major banks and prevent the collapse of our financial

system.

And it’s that trust that has

allowed our government to get away with a spending spree of historic

proportions… for far longer than anyone might reasonably expect.

But the government isn’t the

only one that benefits from this trust. We all do.

Because of widespread trust in

our currency across the globe, we pay a relatively low price for food, energy,

clothing, electronics and other products.

Since our currency is accepted

everywhere around the world, we can pay for all of our imports in dollars.

We’ve been able to buy everything we need with paper money that we can print willy-nilly.

In other words, America has been

able to exchange paper dollars that are produced at almost no cost for valuable

goods.

So, trust in America has made it

easier for us to import more than we export, to consume more than we produce,

and to spend more than we earn.

It’s a huge benefit that has

allowed us to live in McMansions, drive luxury cars, pay far cheaper gasoline

prices, buy 3D HDTVs, load our pantries with cheap food, and so much more.

Trust in the U.S. government and

its institutions, it turns out, has given us the greatest standard of living

the world has ever seen… it’s what has made the American dream possible.

If this trust is shattered,

however… well, our way of life is over.

I recently talked about this

with my friend and legendary investor Jim Rogers. His take is that once trust

in America is broken, it will “lead to a huge decline in the standard

of living of U.S. citizens like nothing we’ve seen in nearly a century.”

Unfortunately, that’s exactly

what will happen once the public finds out the details inside this little-known

government document…

Details that reveal…

“The Biggest

Cover-up in U.S. Financial History”

Most

Americans have never heard about this document. But it hides undeniable

evidence of a major cover-up.

Most

Americans have never heard about this document. But it hides undeniable

evidence of a major cover-up.

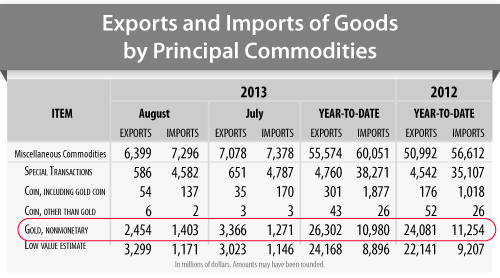

Every month, the U.S. Commerce

Department’s Bureau of Economic Analysis publishes this document called FT-900.

It shows official U.S.

international trade data. … everything from how much barley we exported to how

much glassware we imported.

But it’s the section labeled

Miscellaneous Commodities that holds my interest. It’s there that you find a

category called Gold.

This line basically reveals how

much gold the U.S. has been exporting and importing.

For example, in 2012, the U.S.

exported about $24 billion worth of gold and imported $11.2 billion. On a net

basis, that means we exported $12.8 billion worth of gold last year.

Based on the average price of

gold during 2012, our country exported about 217 tons of gold on a net basis.

How about this year?

Well, in 2013,

America exported a bit more than $26 billion worth of gold and imported

almost $11 billion. This means that, on a net basis, we’ve exported $15.4

billion worth of gold.

Based on this year’s average

price of gold so far, we’ve exported just over 300 tons of gold.

It was surprising to see that

America was exporting so much gold. So I decided to investigate how far back in

time this gold-export trend extended.

The results were so shocking

that it took me a moment to wrap my head around it. I knew I had uncovered

something big.

Here’s what I found out: Since

1991, the U.S. has been consistently exporting large

quantities of gold on a net basis.

And the amount of gold the U.S.

has exported is well above and beyond what the US should be capable of

exporting.

Let me show you what I mean…

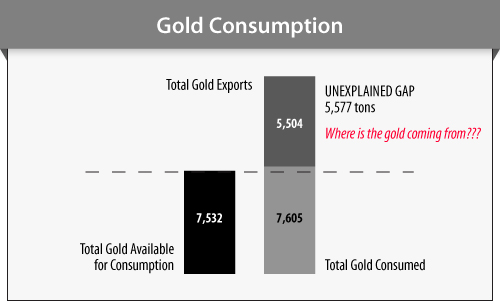

Using data from the Gold Fields

Mineral Services, the US Census Bureau, the US Mint and Bloomberg, I was able

to determine the U.S. total demand and supply of gold during those 20 years.

During that time, the U.S. had a

total amount of 7,532 tons of gold available for consumption… but the U.S.

consumed 7,605 tons.

So, we consumed more than we had

available to us. That implies we should have been a net importer of gold.

But oddly enough, we were not.

In fact, we exported a massive 5,504 tons .

How could we have possibly

exported more than 5,500 tons of gold after we had already consumed all the

gold we had available, plus a little more? The math makes no sense.

Where is all that gold we

exported coming from? It had to come from somewhere.

That’s how I reached this

shocking conclusion: There’s an unexplained supply gap of 5,577 tons of

gold. And there’s only one institution in the U.S. capable of

secretly supplying such large amount of gold: the Federal Reserve.

And I’m not the only one who has

now figured this out.

Canadian billionaire Eric

Sprott, founder of Sprott Asset Management, says:

“The only US

seller that would be capable of supplying such an astonishing amount is the US

Government, with a reported gold holding of 8,133 tonnes.”

Bill Gross, founder of Pimco,

the world’s largest bond fund, calls this scandal “the Fort Knox Fairy Tale”,

referring to the Army base where the gold is supposedly being held.

Here’s what he said:

“$54 trillion

of credit in the U.S. financial system based upon trusting a central bank with

nothing in the vault to back it up. Amazing!”

These are not some wackos who

believe in crazy conspiracy theories. They’re highly respected professionals

who have made hundreds of millions in the financial markets.

And like me, they know the jig

is up.

Still, I know some people will

find it hard to believe our government would sell off our gold.

But the truth is this has

happened before.

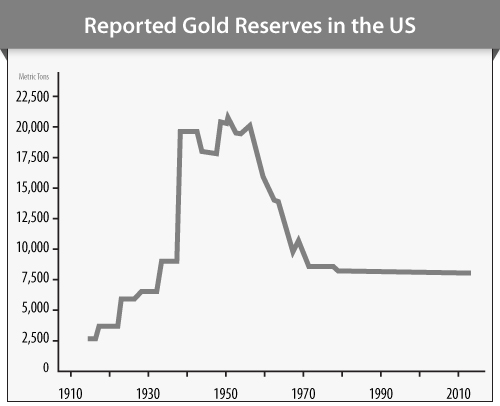

Take a look at this chart. It

shows the official reserves reported by the U.S. government. Notice that

America accumulated a massive amount of gold during World Wars I and II.

At one point, in the 1950s, the

U.S. had 20,500 tons. At that time, this represented HALF of all gold ever

mined. It was the largest accumulation of wealth the world had ever seen.

This shocking concentration of

wealth was a hallmark of the all-powerful and wealthy America other nations

envied. But in the last four decades our government squandered all that wealth.

In the late 1950s, the U.S.

government started selling most of our gold to various European nations. From

1957 to 1972, our holdings went from 20,500 tons to 8,500, a decline of almost

60%.

Since the late 1970s, America’s

officially reported gold reserves have remained at a constant 8,133 tons. So,

according to the Fed, the U.S. Treasury has not bought or sold a single

ounce of gold for more than three decades.

How is that possible? The

government’s own documents – the FT-900 reports – show the U.S. has been

exporting massive amounts of gold over the last 20 years.

Yet the Fed has been telling us

for more than 30 years that America’s gold reserves have never changed.

Again, the math simply doesn’t

add up.

Fort Knox is still viewed by

many as a golden beacon of global finance… a symbol of the American empire’s

super power status and strength.

It’s the world's most secure

vault... made of a 21-inch-thick material that's resistant to drills, torches

and explosives.

It’s contained on a 109,000-acre

U.S. army post, surrounded by video cameras, minefields, barbed wire, electric

fences, and armed guards.

But this is all a big

smokescreen.

This last remaining symbol of

American financial might is about to be exposed as nothing more than a monetary

mirage.

The FT-900 document suggests the

vaults are empty. But I understand why the Fed keeps reporting that it holds

8,133 tons.

The Fed knows that if it

disclosed most of our gold is gone, it would lead to a major crisis of

confidence in the dollar and U.S. government bonds.

Think about this for a minute…if

America’s gold reserves are a lie, then what else has been distorted, and

where, if anywhere, is the truth?

The “full faith and credit of

the U.S. government” would become worthless overnight. And that would lead to a

collapse of our economy and our way of life.

We would reach the tipping

point, where faith in America’s finances and confidence in its government are

lost.

Even the Treasury Department has

just published a new report admitting that this kind of loss of confidence

would have disastrous consequences for our nation. Here’s what the report said:

[It] has the potential to be

catastrophic: credit markets could freeze, the value of the dollar could

plummet, U.S. interest rates could skyrocket, the negative spillovers could

reverberate around the world, and there might be a financial crisis and

recession that could echo the events of 2008 or worse.”

That explains why the Fed

doesn’t want anyone to know our gold is gone.

But they won’t be able to hide

this from the public for much longer.

Because the truth is… the FT-900

document isn’t the only evidence I’ve uncovered that suggests the Fed has been

lying about America’s gold reserves.

In fact, the more I investigated

this story, the more convinced I became that something shady was afoot…

So let me tell you about:

“The 1992 Closed-Door Fed Meeting”

As the FT-900 document shows,

the U.S. has been exporting massive amounts of gold for the past two decades.

This is not a new phenomenon.

In fact, the export numbers were

already raising suspicion back in 1992.

That’s when former Fed chairman

Alan Greenspan raised the possibility that all the gold we’re exporting was

coming from the Fed itself.

Members of the Federal Reserve

meet eight times per year to discuss and set interest rate policy. Those

meetings are recorded and the minutes detail everything Fed board members

discuss behind closed-doors.

I managed to uncover the minutes

of a Fed meeting from December 22, 1992. It notes a conversation between Mr.

Greenspan and other members of the Fed.

CHAIRMAN GREENSPAN says:

Did I hear you correctly when you

said that the gold exports in October appear to have come from the coffers

of the Federal Reserve Bank of New York? Has anyone looked lately?

MR. TRUMAN responds:

Well, I didn’t want to tell too many

secrets in this temple!

Of course, the answer to Mr.

Greenspan question is no… nobody has looked. We’ve not checked the Fed’s

coffers for the last 60 years. And that brings me to…

The Fed’s

Constant Refusal to Audit the Vaults

The only way to prove once and

for all the Fed isn’t lying about America’s gold reserves is through a full

independent audit.

Shockingly, the last audit of

gold stored in Fort Knox took place in 1953, just after U.S. President Dwight

Eisenhower took office. So, there hasn’t been a comprehensive audit of Fort

Knox in more than 60 years.

A number of congressmen have

routinely requested a Fed audit to verify the vaults in Fort Knox aren’t empty.

But Fed officials have rebuffed every single request. Their response is

effectively: “trust us, the gold is all there.”

Three-time presidential

candidate, Ron Paul, even introduced an “Audit the Fed” bill in 2011, but it

never became law. His repeated calls for a full audit of the gold in Fort Knox

have fallen on deaf ears.

All these denials have raised

quite a few eyebrows.

Even a former insider at the

World Bank, ex-Senior Counsel Karen Hudes, said:

“I don’t

believe there’s any gold being held in Fort Knox.”

In 2011, CNBC asked for a tour

of Fort Knox to film the gold. An official at the U.S. Mint rejected their

request, saying “Fort Knox is a closed facility.”

Even the History Channel has

weighed in. In its series “America’s Book of Secrets,” the cable network

reported on the possibility that the U.S. government has been lying all these

years.

Here’s a short clip with the

introduction to their Fort Knox episode.

As you can see, all the Fed’s

secrecy has raised lots of suspicions.

The United States could put

these concerns to rest simply by auditing the gold and publicly reporting the

findings.

If the world’s publicly traded

companies must undergo annual audits, why should the Federal government be

immune? What are they hiding from us?

It would be extremely easy for

the government to audit the gold. According to a Treasury document, it would

cost only about $15 million to conduct an audit.

And yet the government has had

the audacity to deny all requests for an audit because of the costs involved.

That’s just ridiculous...

This lack of transparency is

also raising concerns among major central banks. And that brings me to another

piece of evidence I want to share with you.

“The German Gold is Gone”

The Fed has been able to fool a

lot of people so far, but some of our allies no longer trust the institution.

Several foreign central banks

store their gold in vaults controlled by the Fed.

According to the NY Federal

Reserve:

“Much of the

gold in the vault arrived during and after World War II as many countries

wanted to store their gold reserves in a safe location.”

The German Central bank, in

fact, keeps 1,536 tons of its gold in storage at the Federal Reserve’s vaults

in Manhattan, 80 feet below sea level.

Just last year, German auditors

demanded to inspect their country’s gold, just to make sure it was still there.

But guess what? The Fed

prohibited the Germans from inspecting their own gold!

Of course, that raised a lot of

eyebrows in Germany, with one leading member of the parliament, Heinz-Peter

Haustein, declaring:

“All the gold

has to be shipped back.”

Meanwhile, Carl-Ludwig Thiele, a

board member of the German central bank demanded “more transparency on the

issue.” He never got that transparency.

And the result was what you

would expect – the trust the German authorities had with the Fed has quickly

evaporated.

Germany’s central bank, the

Bundesbank, has announced it will start repatriating 300 tons of the country’s

gold from the vaults in Manhattan.

And get this…

The Fed said it would ship those

300 tons over a period of seven years…. SEVEN years.

And here’s what really

ridiculous: so far, one year later, the Fed has shipped only 5 tons. At that

pace, it will take the Fed 60 years to return all the German gold.

Why is returning just 300 tons

to Germany such a problem?

The repatriation of a country’s

gold reserves is supposed to be a smooth and quick affair. It isn’t supposed to

take seven years.

But once you start putting all

the pieces of the puzzle together, it’s easy to understand why…

The gold isn’t there. It’s gone.

As precious metals expert John

Embry says, “if the gold were actually there, they could put it on a couple of

cargo planes and get it back to Germany in a week.”

Where Has the

Gold Gone?

But if America’s gold isn’t

where it should be – inside the vaults controlled by the Federal Reserve – then

where is it?

There’s some data that shows a

tremendous amount of gold has moved into other countries in the East,

especially China.

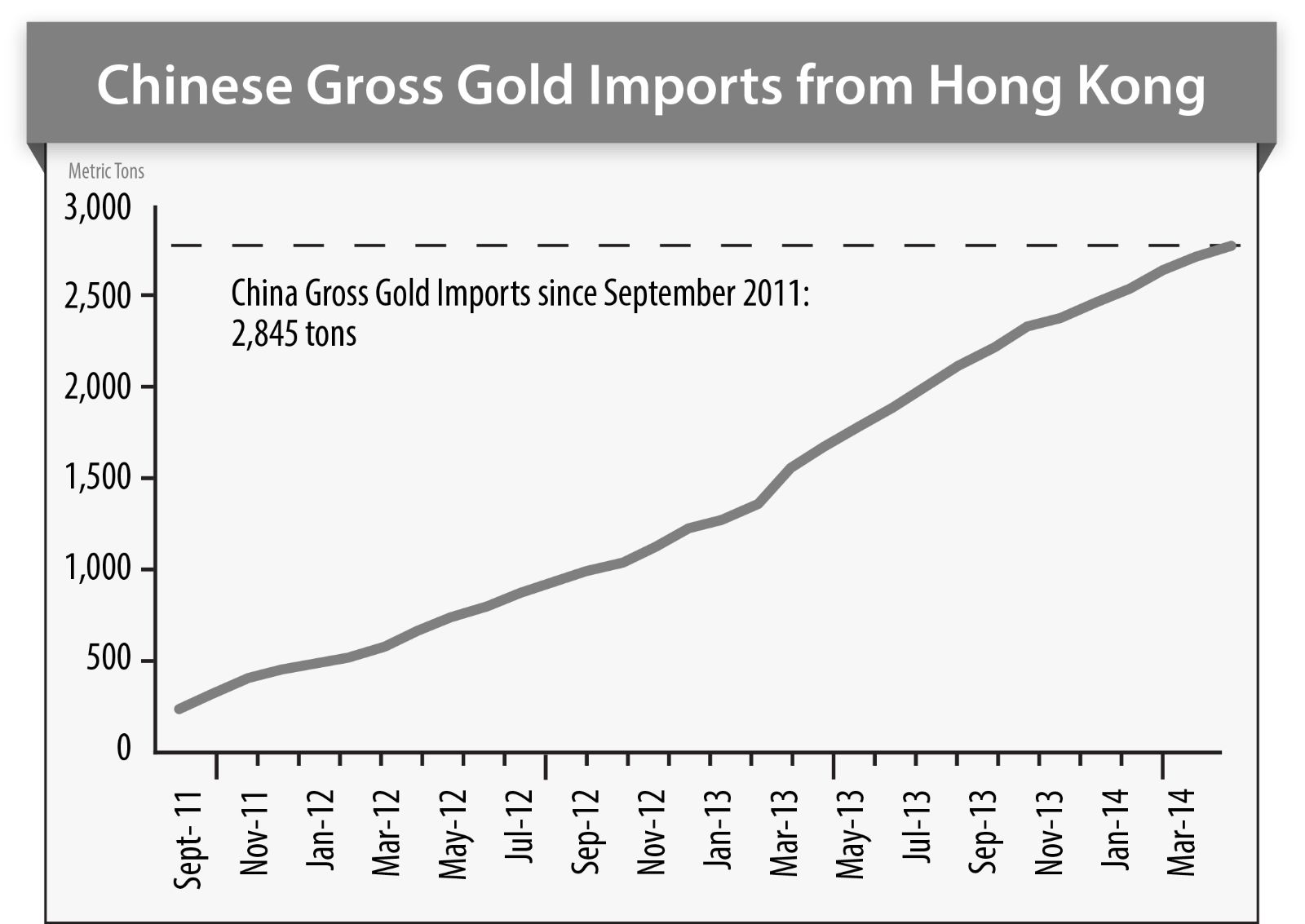

Take a look at this data

released by the Hong Kong Census and Statistics Department. It shows that over

the last couple of years alone, China has imported 2,845 tons of gold.

That’s why Bloomberg reported:

“There are

signs that gold is moving from West to East.”

And it’s why precious metals

expert John Embry says:

“Western gold

is headed East and the Western hoards are being hollowed out.”

Forbes also weighted in, and

concluded that:

“the yellow

metal may be in a transition stage from so-called “weak hands” in the West to

“strong hands” in the East.”

That might very well explain why

the Fed needs a ridiculously long seven years to meet the German gold

repatriation request. The gold is gone. Now the Fed needs time to try to buy

some of it back.

The problem is the Fed is

running out of time…

Because any day now China is

about to make an announcement that will rock the world and help expose the

Fed’s lie. And...

Our House of

Cards Will Collapse

China tends to announce its

official gold holdings every five years or so.

The last time the Chinese

officially announced the size of the country’s gold reserves was on April 24,

2009.

The People’s Bank of China, the

Chinese version of our Federal Reserve, told the world that China’s gold

reserves had grown to 1,054 tons from just 600 tons five years earlier.

And that’s the last official

word from the Chinese. So, the market still operates under the assumption that

the Chinese central bank controls 1,054 tons of gold.

But it’s about time for China to

make a new announcement - one that is now overdue.

And that announcement will shock

the world.

According to my research, China

has a gold hoard of at least 5,000 tons.

Jim Rickards, hedge fund manager

and author of the best-selling book Currency War, has come to the same

conclusion. He said:

“Come

2014, China will announce that they own 5,000 tons of gold. That should

be an earthquake. I have spoken to a number of sources in Asia. I've spoken

to a number of people who are very close to the physical [gold] market, I've

done my own investigations, etc. Every time I have an estimate and try to

verify it, what I get back is that I'm wrong on the low side."

A local newspaper, the Shanghai

Daily, recently confirmed that “China may soon announce an increase in its

official gold reserve.”

And the Financial Times recently

published an article saying:

“We

would not be surprised to hear the People's Bank of China announce a new,

significantly higher figure.”

This pending Chinese

announcement is the last missing piece of this big Fed puzzle.

Once China makes the official

announcement, our allies and lenders will all know the answer to the question:

What’s in Fort Knox? They will figure out most of the gold China is holding

must have come from the Fed.

After all, that’s what the

document FT-900 implies… it shows our government has been exporting massive

amounts of gold.

Think about this for a minute…

the Fed claims to hold the largest gold reserve in the world: 8,133 tons.

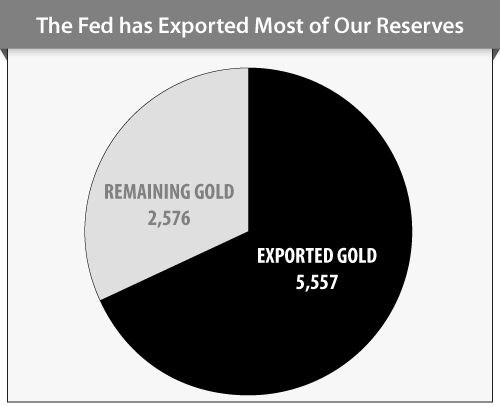

But my research shows the Fed has supplied all the 5,557 tons the U.S. has

exported in the last twenty years. This means the Fed now has less than 2,600

tons in reserve, and not the 8,133 tons it claims to hold.

Famous investor Richard Russell,

publisher of the Dow Theory Letters, recently warned: Once the news of the US

gold reserves being depleted is out, this will result in an unbelievable

scandal.

With the Chinese announcement,

the world will realize the Federal Reserve has been lying all these years. And

everyone will know China’s gold reserve is larger than the Fed’s.

I’ll also show you the best ways

to make sure you end up on the right side of this transfer. But first,

it’s vital you grasp this important concept...

“Gold IS a Big Deal”

You would think the Fed would be

smart enough not to sell off America’s gold reserves.

But it’s clear from recent

commentary that the Fed has no interest in gold. On July 18, 2013, Fed Chairman

Ben Bernanke testified to Congress that “nobody really understands gold prices,

and I don't pretend to understand them either.” And when former congressman Ron

Paul asked Bernanke why, then, the Fed holds gold, he said it did so only

because of “tradition.”

For the Fed, giving away our

gold is no big deal.

But I think that’s a mistake of

historical proportions.

Throughout history gold has

always flown to where wealth was being created… from Athens to Rome to the

Byzantine Empire.

Our huge gold holdings after the

World War II were a clear reflection of our unique economic power.

Just look at what happened to

Britain when it started selling off its gold…

The country was on the gold

standard for nearly 200 years, from 1717 until 1914. That was a prosperous

period for British Empire.

During that time, the country

gave birth to the industrial revolution and ruled one fourth of the earth and

its people.

The British pound was the

reserve currency of the world…and this looked like it would last forever.

But Britain abandoned the gold

standard in 1914 to start printing money. And it sold 30% of its gold from 1928

to 1931. That was the beginning of the end for the British pound as the world’s

reserve currency.

Pretty soon the country was flat

broke.

At one point in 1967 the British

currency lost 14% of its value overnight. Inflation got out of control,

reaching 27% a few years later.

There were endless strikes in

nearly every sector, including grave diggers, trash collectors, and hospital

workers. Things got so bad at one point mothers giving birth had to bring their

own linens to the hospital.

In short, Britain’s whole

economic system and society collapsed.

And now we’re on the cusp of

reliving a similar history. We’re about to learn – the hard way – what the

British discovered:

Empires Don’t

Last Forever

If the U.S. still was a

manufacturing superpower… if we still had one of the fastest growing economies…

if we still had a thriving middle class, we’d be fine.

If our country was in great

financial shape, having no gold reserves wouldn’t be a problem.

But we all know that’s not the

case today.

Back in 1980, the U.S. national

debt was less than $1 trillion. Today, it’s more than $17 trillion, which is

the greatest debt in the history of the world.

And this doesn’t even account

for our unfunded liabilities, which our government keeps off the federal

balance sheet. But Laurence Kotlikoff, a well-known Boston University

economist, has estimated our total debt. Here’s what he told me:

“I estimate the

US fiscal gap at US$200 trillion. The US is arguably in worst fiscal shape than

any other developed country. Six decades of “take as you go” has led us to a

cliff. This is effectively a nuclear economic bomb. Our country is broke. It’s

not broke in 50 years or 30 years or 10 years. It’s broke today.”

Even a report from the

nonpartisan Congressional Budget Office has used such language as

“unsustainable” and “train wreck” to describe the future of America’s finances.

So our country is not exactly a

fortress of financial health. Far from it. For all practical purposes, the

country’s only true collateral is its gold reserves.

But most of that is now gone.

And once the world discovers the

truth about the Fort Knox fairytale…once it realizes our gold is gone and all

we have to show for are trillions of debt that can never be repaid…

Trust in U.S. bonds and the dollar

will be shattered in an instant, catching millions of Americans unprepared.

After that, our American psyche

will never be the same again. Our nation will no longer be the world’s

financial and economic powerhouse.

Because, whether you realize it

or not, the “the full faith and credit” of our government is really the only

thing backing the dollars in your wallet. Without trust, the dollar is

worthless.

Most Americans don’t know this,

but our paper dollars used to be freely convertible into gold coins. Take a

look at this $20 dollar bill from 1905:

Its inscription reads:

"This

certifies that there have been deposited in the Treasury of The United States

of America twenty dollars in gold coin payable to the bearer on demand."

In and of itself, the paper

money had no more value than any other piece of paper. It was the fact that

this piece of paper could be converted directly into gold coins that gave

confidence to our paper currency.

Of course, that’s no longer the

case.

Pull any dollar bill from your

wallet and take a closer look at it. Today’s Federal Reserve Notes are not

backed by any real asset, and they omit any promise that they’re redeemable for

anything.

Before 1971, at least the dollar

was backed by gold. But since then, our entire monetary system has been based

on nothing but trust.

The bottom line is this: if

the “full faith and credit” of the U.S. government isn’t worth much, our money

isn’t worth much.

Sadly, that’s exactly what is

about to happen.

Once that trust is lost, we will

have nothing to fall back on. Demand for the U.S. dollar will fall off a cliff,

driving the value of our currency much lower.

Remember, over the last three

decades we’ve printed and exported a lot of dollars. It’s estimated that $3.7

trillion are held outside the U.S.

As trust in the dollar

disappears around the globe, all the currency we’ve exported will race back

into the country. The increased supply of money will bid up prices seemingly

overnight.

Everything we consume will get

much more expensive… all the gadgets, shoes and shirts we import from China…

all the beer, wine and furniture we import from Europe…. and all the coffee,

fruits and vegetables we buy from South America.

We can say goodbye to “everyday

low prices.” We will no longer be able to find cheap electronics, toys and food

in the shelves of Wal-Mart or any other retailer.

Oil will shoot toward $300 a

barrel, pushing the price of gasoline towards $9.50 per gallon…things like

corn, wheat, milk will skyrocket.

The standard of living of

millions of people will collapse almost overnight… pension funds will be

devalued, ruining the retirement plans of millions of Americans…global markets

will plunge, as investors bail out of stocks.

Interest rates across the board

will rise dramatically. Mortgage rates will climb up to 10%, killing the

recovery in the housing market.

Higher borrowing costs will also

kill consumer demand, sending our economy into a deep recession, much worse

than the “great recession” of 2008.

With consumers spending less,

businesses will be forced to initiate a cycle of massive layoffs. The

unemployment rate will double- or worse.

Because of higher borrowing

costs, our government will have to print even more money just to meet its

obligations. This will only accelerate the run on the dollar.

And when all is said and done,

when the shakeout finally settles, the global financial system will no longer

be centered on the United States.

Most of us have lived our entire

lives under the dollar-reserve monetary system that built and funded the

American Empire. So the majority believes that’s just the way the world works.

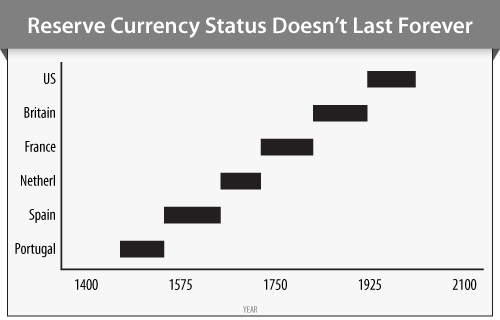

But history shows that:

“Monetary

Systems Change Every 40 Years or So”

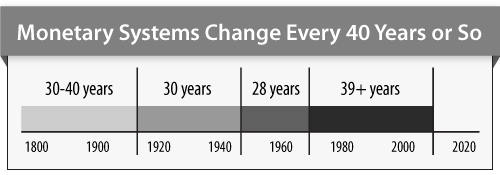

Before 1914, our global monetary

system was based on the classical gold standard. The dollar was backed 100% by

gold.

But in 1914, the monetary system

changed into a Gold Exchange Standard, in which the dollar was only partially

backed by gold. A $50 bill, for example, was backed by just $20 in gold.

Then came 1945, and a new

monetary system known as Bretton Woods. Under that system, world leaders

established the dollar as the global reserve currency and linked it to gold at

the rate of $35 per ounce.

Finally, in 1971 Nixon canceled

the direct convertibility of the US dollar to gold. For the first time in

American history, the dollar was totally fiat… totally without backing in gold.

Today, our fiat monetary system

is 42 years old.

But notice that all the monetary

systems we’ve used in America since late-1800s have each lasted about 30 to 40

years. Seems to me like it’s about time for a new system.

And it’s closer than anyone

thinks.

Act Now…

Before it’s Too Late

Sadly, I know that less than 2%

of the people who view this presentation will take action. Many viewers will

choose to wait and see what happens.

The problem is that this is not the

kind of crisis that happens in slow motion. We’re talking about a crisis of

trust. Because of the fickle nature of confidence, this crisis will unfold very

quickly once it begins.

I’m talking matter of weeks, not

years… and that will catch most Americans by surprise.

Economists Carmen Reinhart and

Ken Rogoff explained this phenomenon in their best-selling book “This Time is

Different”, in which they examined hundreds of confidence crises. They call it

the “bang” moment. Here’s how they explain it:

“Perhaps more

than anything else, failure to recognize the precariousness and fickleness of

confidence is the key factor that gives rise to the “this-time-is-different”

syndrome. Highly indebted governments can seem to be merrily rolling

along for an extended period, when bang – confidence collapses, lenders

disappear, and a crisis hits.”

Just look at what happened to

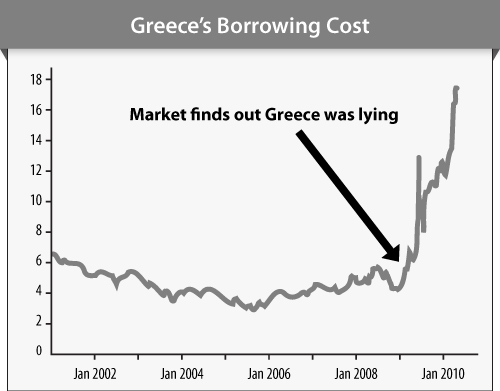

Greece.

For years, nations around the

globe had no problem trusting the Greeks. Lenders were all too happy to lend

money to Greece at interest rates of between 4% and 6%.

Then, in 2010, the market

realized the Greeks had been lying. They country’s deficit was 12% of GDP, not

the 3% the Greeks had long claimed. Once the market discovered that Greece had

been using derivatives to hide the true amount of its debt, everything changed

in an instant.

Interest rates jumped from 4% to

16% in less than six months. Almost overnight, the government lost the ability

to borrow… the country’s unemployment rate tripled to nearly 30%... the economy

fell into a depression… and the Greek society collapsed.

This was Greece’s “bang” moment.

Scientists have explained why

these crises of confidence happen so fast. They call it the “critical state.”

As they define it, critical states occur when any momentary flicker of hope or

doubt can be magnified beyond all proportion. Here’s how American physicist

Mark Buchanan explains the phenomenon:

“Financial

markets share the tumultuous and ever shifting character of the critical state.

As a result, a change in the mood of a single investor may trigger a spreading

wave of effects that leads to a fluctuation in the moods of all investors.”

That change is happening now. Trust

in the U.S. is waning fast.

Many nations have already

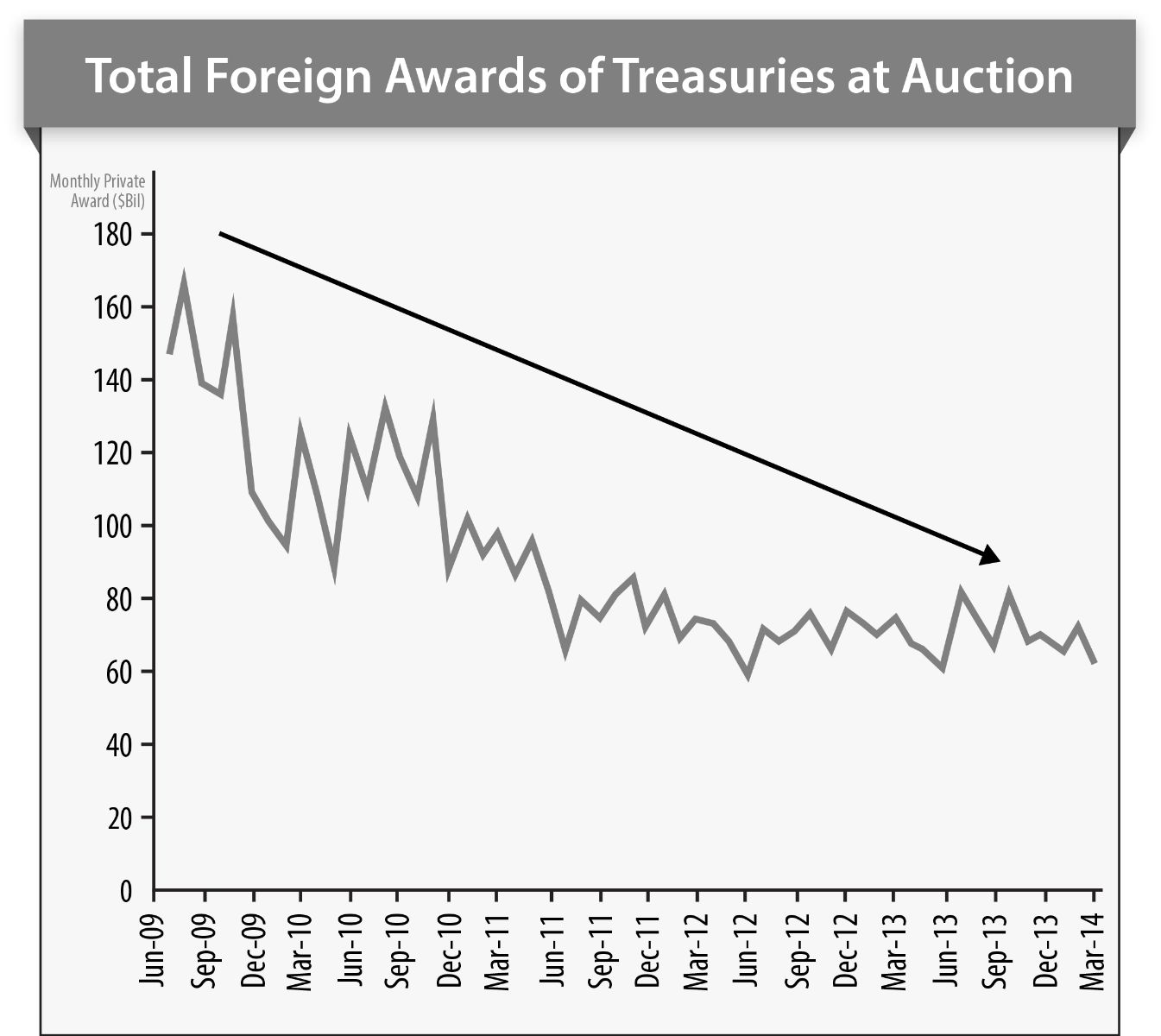

started to abandon U.S. bonds. Take a look…

In June of last year, our

two biggest creditors, China and Japan, dumped nearly $41 billion of their

Treasury holdings. That was the largest net foreign decline on record.

They’re losing trust in

America’s ability to manage its finances. For them, U.S. bonds are no longer

risk-free assets.

In recent years, even companies

such as Berkshire Hathaway, Proctor and Gamble and Johnson & Johnson have

been able to borrow money at a lower interest rate than the U.S. government.

In other words, investors feel

more confident lending money to certain companies than to our government. That

has never happened before…. never.

Lenders have also started

demanding a higher interest rate on American debt. This is another indication

that our creditors are losing faith in our government. Take a look at this

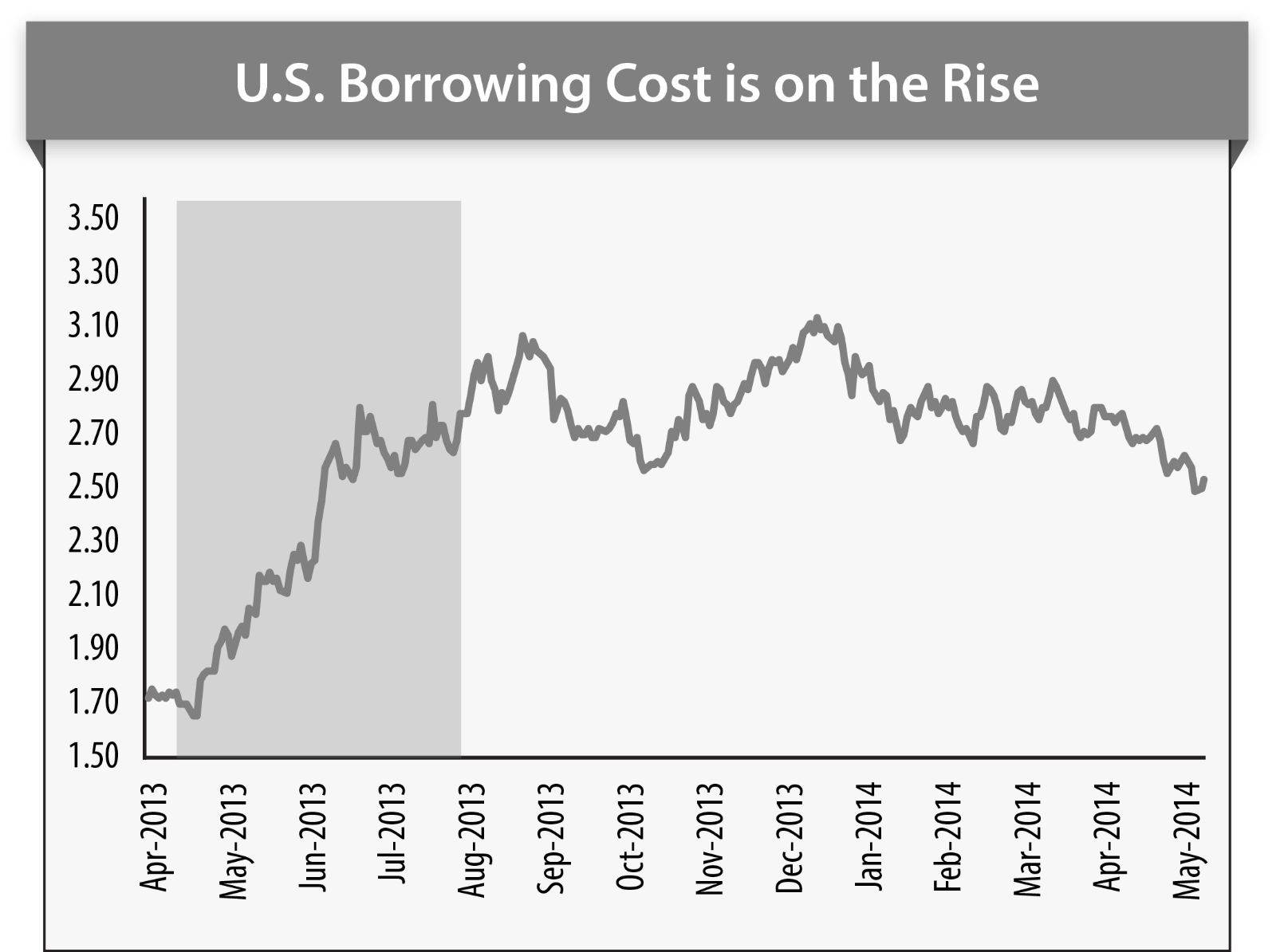

chart. Our borrowing costs have skyrocketed.

In the span of five months, the

yield on the U.S. Treasury benchmark bond – the 10-year note – went from 1.65%

to almost 3%, one of the largest jumps in the history of our nation.

A few months ago investors were

willing to lend money to our government for almost nothing.

But today nobody is willing to

lend us money at such a low interest rate. Now our creditors are demanding some

of the highest rates in recent history.

Last year's debt ceiling

debate, meanwhile, tarnished our credibility even more. Following that debacle,

a leading Chinese rating agency downgraded our debt, saying:

“The U.S.

government maintains its solvency by repaying its old debts through raising new

debts, which constantly aggravates the vulnerability of the federal

government’s solvency. Hence the government is still approaching the verge of

default crisis.”

Besides dumping U.S. bonds,

other nations are also actively reducing their exposure to the U.S. dollar in

other ways.

Many countries have made

agreements that allow them to settle their trades in their own currencies,

cutting the dollar out of the transaction completely. China, for example, has

signed international currency agreements with 22 countries worldwide.

Because of these agreements, 18%

of global trade in 2013 was completed using the Chinese currency, instead

of the dollar.

Over the past couple of years,

numerous global leaders have publicly criticized our currency. Chinese central

bank governor Zhou Xiaochuan, for example, said the world needs “a sweeping

overhaul of global finance to replace the dollar as the world's standard.” And

during our recent debt ceiling debate, China's state-run news agency issued

perhaps its most dire warning to date on the subject:

“As U.S.

politicians of both political parties are still shuffling back and forth

between the White House and the Capitol Hill without striking a viable deal to

bring normality to the body politic they brag about, it is perhaps a good time

for the befuddled world to start considering building a de-Americanized world.”

Russian leader Putin, meanwhile,

has said that “the world has gotten itself into trouble with its heavy reliance

on the dollar.” While members of OPEC have repeatedly raised the idea that

“maybe we can price oil in euros.”

The UK’s newspaper The

Telegraph published the following article: (SHOW Headline and highlighted

sections) “The Sun is Setting on Dollar Supremacy, and with it, American Power”

The article pointedly concludes

that:

“Rarely before

has international dissatisfaction with the dollar's role as reserve currency to

the world been as great as it is now. A steady erosion of trust which began

with the financial crisis five years ago has reached apparent breaking point.

The search for long-term alternatives to the dollar is on as never before.”

As you can see, confidence in

America’s fiscal state and the dollar is already eroding very quickly. It

wouldn’t take much to flush the “full faith and credit” of the U.S. down the

toilet.

And that’s exactly what the

Fed’s big cover up will do.

A tipping point looms just

over the horizon. And it’s much closer than you think.

I believe we’ll have our “bang”

moment once China makes the announcement and the market realizes the Fed has

been lying all these years.

The biggest financial cover up

in the history of our nation will take an already declining trust in the U.S.

and destroy it completely.

Don’t wait any longer to take

action…

Take These

Four Steps to Protect your Family and Wealth NOW

For unprepared Americans, this

will be a cataclysmic crisis that will make the 2008 collapse look like a

little hiccup.

It will be a messy transition to

a new global monetary system. Historians will recognize this moment as the

End of the American Empire.

But it doesn’t mean you have to

get crushed by it. In fact, for those who take the right steps today, this will

be a once-in-a-generation opportunity to build wealth.

And here’s the best part: even

in the remote chance that other nations continue to trust us and we’re able to

somehow avoid this major crisis, you can still profit by taking the actions I’m

recommending. You could even make three to five times your money over the next

few years.

So here’s what I recommend:

Step #1: Buy 1 Ounce Gold

Bars and 10 Ounce Silver Bars

In the 1970s, nobody made more

money than Harry Browne and those who followed his prediction.

You may be old enough to remember

him. In 1970, Harry published his first book, “How to Profit from the Coming

Devaluation.”

In it, he predicted that the

Bretton-Woods monetary system would collapse. Our government had simply printed

too much money. As a result, other central banks started to unload dollars in

exchange for gold. But Harry knew the US Treasury was running out of gold,

which would force the government to cancel the Bretton-Woods agreement.

In his book, he recommended

people invest in physical gold and silver.

His prediction became true a

year later, when Nixon closed the gold window. His book hit number one on the

New York Times best-seller list. And those who followed his recommendation made

fortunes.

43 years later, here we are…

facing a similar situation.

The last time we had a huge

change in the monetary system was 1971. During that transition, the dollar lost

two thirds of its value.

There was a huge transfer

of wealth from those who held fiat paper to those who held real money, gold and

silver.

I believe history will repeat

itself this time around.

Once the monetary system based

on a dollar-reserve currency collapses, we’ll see a great global gold rush the

likes of which we’ve never seen before.

I believe when the dollar

collapse hits the mainstream media… and when gold becomes as popular as

Internet stocks were in the 1990s… when everyone from your neighbors to cab

drivers starts talking about buying gold… the price will explode in a parabolic

move.

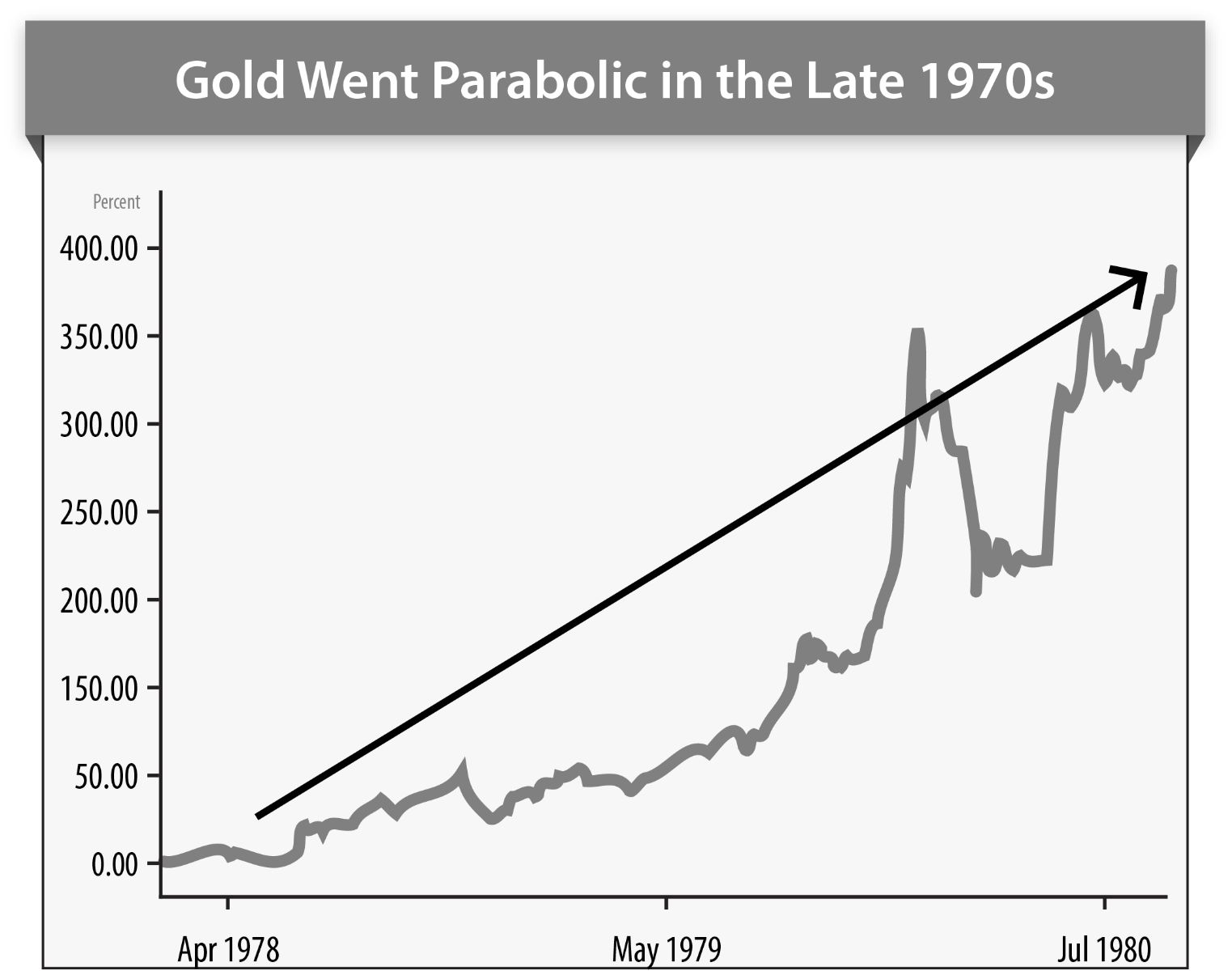

That’s exactly what happened in

the late 1970s, the last time we saw a crisis of confidence in the dollar. From

1978 to 1980 gold went up 400% in parabolic fashion.

A similar move of 400% today

would take gold towards $6,350.

That’s why Citigroup strategist

and technical expert Tom Fitzpatrick published a report saying:

“We see no

reason why this gold trend cannot perform as well as the last bull market in

gold between 1970 and 1980. If you replicated that move exactly, it will take

gold to $6,300.”

Michael Pento, president and

Founder of Pento Portfolio Strategies, thinks gold will go even higher. Here’s

what he said recently:

"When the

US dollar loses its world reserve currency status and the US bond market collapse

is in full swing, a $10,000 gold price may prove to be very conservative.”

And when I asked my friend Jim

Rogers how high gold could go, he told me:

“There is no

“fair price” if the dollar becomes confetti. You can make up any price you wish

at that point.”

In short, when trust in the

dollar disappears, gold price projections of $3,000, $4,000, even $5,000 an

ounce that some people laugh at today will look conservative by comparison …

So what is the best gold

investment you can make?

Well, today many investors are

shoveling their money into the wrong kind of gold investment. The gold ETF

under the symbol GLD, for example, is very popular among retail investors. But

that’s the worst possible way to invest in gold.

Investments like GLD are called

paper gold because they don’t really give you ownership of physical bars.

During a monetary crisis, these paper claims could quickly become worthless.

The fund’s prospectus even notes

that: “the gold bars allocated to the [fund] may be different from the reported

fineness or weight required by the London Good Delivery Standards.”

There’s no guarantee the fund is

holding high quality gold bars. And there are significant concerns about

counter-party risk if gold prices explode to the upside. Because of the way

that ETF is structured, shares of GLD could fall even as gold prices soar.

To me, you should invest in

physical gold bullion, not paper gold.

So, I recommend buying and

taking possession of 1 ounce gold coins and bars.

But there’s an even better way

to profit from the rise of a new monetary system. It’s a gold investment few

people know exist.

A small group of investors have

figured out a unique way to profit from gold. They’re striking special deals

with certain companies involved in the gold industry.

Nolan Watson, for example,

started using this strategy back in 2008. So far, he’s already increased his

investment by 809%. That’s enough to turn a small investment of $25,000 into

almost a quarter million dollars.

Gold expert John Doody has

increased his portfolio by more than 1,200% with this strategy. And many

consider him one of the best gold investors of our time.

Here’s what he said:

“I love [this

investment]. You just make these deals and move on to the next one.”

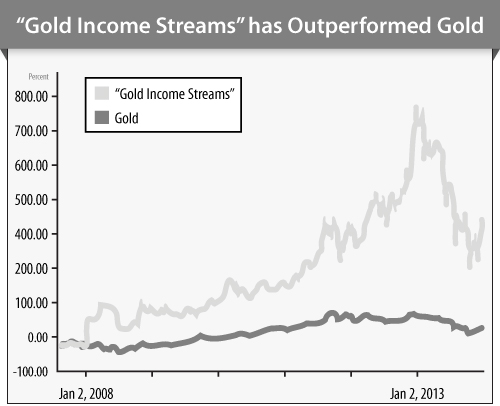

I call this strategy “Golden

Streams.” And it has performed much better than the metal in recent years. Take

a look…

While gold is up 45% since 2008,

the “Golden Streams” investment is up 669%. The good news is you can also

participate in these deals right from any brokerage account.

And what’s really amazing is

this special class of gold investment has nothing to do with ETFs, bars, coins,

options, mutual funds or investing directly in gold miners. And yet, it has

managed to beat all those types of gold investments.

While “Golden Streams” have

performed extremely well in recent years, I expect them to go parabolic once

investors lose faith in the dollar.

Even if gold moves to just

$3,000 an ounce, I expect this investment will move more than 700%. That’s

enough to turn each $20,000 into a little more than $165,000.

If you're interested in getting

the full details of this investment, I’d like to give you FREE access to my

Research Report on the subject called Golden Streams: Precious Metals

Industry's Best Kept Secret.

This Research Report details

everything you need to know about this unconventional way to profit from a

higher gold price. It also includes my top three “Golden Streams.”

I’ve posted all the information

online. And in a minute, I will show you how to access it, free of charge. But

first I want to move on to another investment you should consider. As much as I

like gold, silver will do even better in this transition to a new monetary

system.

Relative to gold today, silver

is extremely cheap.

For most of history, gold has

traded at a 16 to 1 ratio to silver. In other words, the price of gold

historically has been 16 times greater than the price of silver. Incredibly,

that ratio right now is 58 to 1.

I believe we’ll see that

historic ratio of 16 to 1 again because that’s what happens during monetary

crises.

That’s what happened in the

1970s, when people lost trust in the U.S. dollar. The gold-to-silver ratio

moved from 42-to-1 all the way to 15-to-1. That’s what made silver rally 1,762%

during that decade.

With the ratio now at 58 to 1,

we could see similar gains.

If gold moves to $3,000 and the

gold-to-silver ratio returns to 16, silver will be trading at $187. That’s a

return of almost 700% from today’s price.

I’m not the only one who

believes this will happen. Resource guru Eric Sprott said:

“I think silver

will be the investment of this decade and will trade down to a 16:1 ratio to

gold. Your return will be 300% or more. Silver will by far be the better

investment going forward.”

That’s why I also recommend

buying 10 ounce silver bars and coins.

But there’s an even better way

to profit from the rise of silver. In fact, I’ve isolated the three best silver

investments for the coming crisis. These plays could double or even triple your

returns from silver.

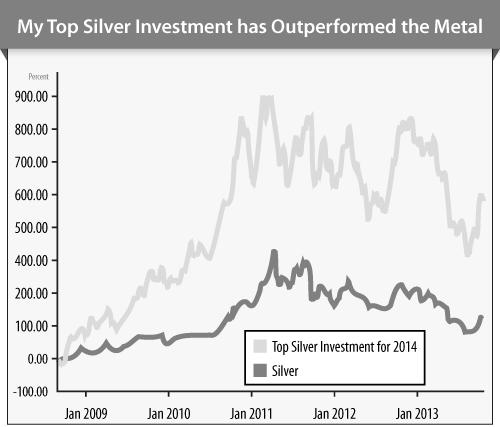

In this chart, you can see how

one of my top silver plays has performed much better than silver in recent

years. While silver has gone up 144%, this investment has gone up 523%. That’s

enough to turn $15,000 into almost $100,000.

Of course, that’s nothing

compared to the gains this investment will see when the whole world finds out

the Fed holds no gold.

You’ll discover all the details

about this investment in my special report: The Three Top Silver Investments

for the Coming Crisis.

This report features the three

best ways to take advantage of the world’s most promising precious metal.

You’ll also discover how to buy real, physical silver at a 25% discount.

Others have paid $75 to access

this research. But in a minute, I will show you how you can get access to this

valuable information, free of charge.

But first, I want to move on to

the second step you need to take. It involves one of the biggest dangers

investors are facing today.

Step #2: Get Out of Bond

Funds with Maturities Greater than Five Years

As I said, once the market

discovers the Fed has been lying all these years, confidence in the U.S.

government will evaporate. Investors will start dumping treasury bonds, driving

their price lower.

Many investors who have reached

or are quickly approaching retirement are desperately looking for investment

income. And most of them have parked their cash in what they assume are safe

bond funds.

But that’s a dangerous belief.

Bonds are just another form of paper money. When confidence disappears,

institutional bond investors will rush to the exits. And retail investors still

holding bond funds will be trapped.

It’s already happening.

Even legendary bond trader Bill

Gross, arguably the best bond investor ever, said: “The bond bull market is

over.”

If you’re heavily invested in

bond funds, you need to take action now. I recommend getting out of bond

funds with maturities greater than five years.

Those are the funds that will

suffer the biggest losses.

But you don’t even need to take

that kind of risk to generate income. There’s a much safer way to get the

retirement income you need.

It’s an investment that lets you

collect hundreds and even thousands of dollars at a time, almost instantly. And

it can generate 5 to 10 times more money than dividend stocks or bonds.

The majority of investors don’t

know about this unique investment. But it’s starting to get more attention in

the mainstream press.

As the Wall Street

journal reported:

“At a time when

investors are caught between meager interest rates on savings accounts and

worries about whether the recent stock-market run-up can continue, funds using

[this investment] to generate extra income are gaining attention.”

Surprisingly, this secret has

nothing to do with buying bonds, mutual funds, ETFs, options or dividend

stocks. And yet, it allows you to collect anywhere from $515 to $3,525 or more…

every single month.

And the best thing is this

investment works in any kind of market environment. You’ll collect instant

income even during the coming monetary crisis.

In fact, the cash this

investment pays increases when there’s market turmoil. In some occasions, the

payouts go up 100% in times of crisis.

It’s the perfect strategy for

those who are looking for safe ways to generate income every single month. It’s

a shame that every American doesn’t know about it.

I also wrote a special report to

show you exactly how to use this strategy yourself. It’s called How to Turn

Your Brokerage Account into an ATM. It gives all the

details on how you can begin collecting hundreds and even thousands of dollars

right from your brokerage account, every single month.

Once you learn this secret,

you’ll never again have to worry about running out of money. If you’re

interested, I’ll give you full access to this report in the next few minutes.

But first, let’s move on to the

third step you need to take to protect your wealth.

Step #3: Move Some of Your

Wealth Outside the U.S. Financial System

All the investment secrets I’ve

mentioned so far will allow you to grow your wealth during this coming crisis.

But if you don’t have a safe

place to stash your cash… BEFORE the government comes knocking on your door

looking for handouts... you're screwed.

Once trust in the U.S. is

destroyed, our government will lose the ability to borrow money at extremely

low rates.

Our government will become

desperate. And we all know desperate governments do desperate things.

Lawmakers will do anything to

get their hands on your wealth…. just like they’ve done it in the past.

When President Roosevelt came

into office in 1933, he inherited an economic depression. Desperation settled

over the government.

Under the threat of 10-years

imprisonment and fines of $10,000, it ordered Americans to turn in all their

gold coins.

Aside from confiscating your

personal wealth, the government may also try to stop you from moving your money

out of the country or investing it abroad. That’s what President Johnson did in

1968, when he implemented mandatory controls on foreign investments.

I know many Americans think this

could never happen again.

But did you know this kind of

government abuse is already being discussed?

The Obama administration has

quietly been hatching a plan to nationalize private 401k and IRA accounts, and

replace them with government sponsored retirement annuities.

President Obama calls this plan

“MyRA”. He even talked about it during his latest State of the Union address.

Here’s what he said:

“Tomorrow, I will direct the Treasury

to create a new way for working Americans to start their own retirement

savings: MyRA.”

The prospect of government

invading our retirement savings is so troublesome that National Seniors Council

Director Robert Crone warned that:

“This whole

issue is moving forward very quickly. Already there is a bill requiring all

businesses to automatically enroll their employees in IRA plans in which part

of every employee’s paycheck would be automatically deducted and deposited into

this account. If this passes, the government will be just one step away from

being able to confiscate all these retirement accounts.”

Keep in mind, the Treasury

Department has already tapped federal retirement programs to prevent the

government from hitting the debt ceiling in 2011 and 2013.

On both occasions, the Treasury

took “extraordinary measures” to stay under the debt limit. Here’s how the

Washington Post reported the action:

“The Obama

administration will begin to tap federal retiree programs to help fund

operations after the government lost its ability Monday to borrow more money

from the public, adding urgency to efforts in Washington to fashion a

compromise over the debt.”

This is a step towards full

confiscation of private pension funds, at some point.

Make no mistake…when the

government runs out of money, it will come for the $19.4 trillion Americans

hold in retirement accounts.

That’s why Jim Rogers recently

told me:

“I would be

very worried about having an IRA or retirement account in the U.S.”

The writing is on the wall. The

small creeping steps are already happening.

You must learn how to legally

protect some of your wealth. You’ll find all the information you need in

another report I prepared called: How to Keep Your Wealth Out of Uncle

Sam’s Hand.

In this report I’ll show you how

to legally move your money out of harm’s way. You’ll learn about:

![]() The only way to legally avoid all, or

nearly all, U.S. taxes on personal and business income, including most capital

gains and estate taxes… without having to renounce your citizenship. You

could pay nearly zero taxes- as in never having to pay taxes to the IRS again.

The only way to legally avoid all, or

nearly all, U.S. taxes on personal and business income, including most capital

gains and estate taxes… without having to renounce your citizenship. You

could pay nearly zero taxes- as in never having to pay taxes to the IRS again.

![]() A special retirement account that will

not only protect your nest egg against a government attack, but that could also

give a big boost to your portfolio.

A special retirement account that will

not only protect your nest egg against a government attack, but that could also

give a big boost to your portfolio.

![]() A little-known income-generating

investment called DVA, which increases its payouts every time the dollar falls.

This is a great way to ensure your retirement income doesn’t lose purchasing

power. Plus, it’s not subject to confiscation.

A little-known income-generating

investment called DVA, which increases its payouts every time the dollar falls.

This is a great way to ensure your retirement income doesn’t lose purchasing

power. Plus, it’s not subject to confiscation.

![]() The single best place to store your

physical gold to make sure it’s out of reach from government confiscation.

The single best place to store your

physical gold to make sure it’s out of reach from government confiscation.

Remember,

in a monetary breakdown the government will do anything to get its hands on

your wealth. Don’t let that happen.

I

strongly recommend you take action now… before the government confiscates part

or all of your retirement savings. Because after the rules take effect, it will

be too late.

Again,

I’ve made my research available online. And I’ll show you how to get easy

access to it in just a minute.

But

before I do that, there’s another investment I want to recommend.

Step #4: Buy Real Estate in One of These Three Countries

One

of the best ways to hedge against Washington’s coming cash-grab is foreign real

estate.

After

all, land is hard to repatriate. And since it’s a hard asset priced in a

foreign currency, it’s likely to maintain its value when the dollar collapses.

Plus, it can offer rental income.

Many

of the real-estate projects I’ve evaluated – and liked the most – tend to be in

all-cash markets where mortgages are rare. That’s important because cash buyers

dramatically reduce price speculation fueled by easy bank credit.

In

turn, that reduces the risk of overpaying for a particular plot of land or a

beachfront condo.

I'll

tell you about the three American-friendly safe-havens I've uncovered in

another report I've just completed. It’s called The Top 3 Foreign Real

Estate Opportunities.

In

this report, I’ll tell you about:

![]() A South American Paradise that

Welcomes Foreigners. This place offers a zero tax rate on foreign

income. You’ll also have the freedom to open bank accounts that pay sharply

higher interest rates than you can find anywhere in the U.S. banking system.

And citizenship is attainable in just three years.

A South American Paradise that

Welcomes Foreigners. This place offers a zero tax rate on foreign

income. You’ll also have the freedom to open bank accounts that pay sharply

higher interest rates than you can find anywhere in the U.S. banking system.

And citizenship is attainable in just three years.

![]() The True Galt's Gulch.

This new 1,500 acre self-sustained community of gorgeous stone, stucco and

tile-roofed homes is surrounded by a working vineyard and a beautiful 18-hole

golf course set against a mountain backdrop. This is the place for affordable,

off-the-grid living at a level you've grown accustomed to in the States.

The True Galt's Gulch.

This new 1,500 acre self-sustained community of gorgeous stone, stucco and

tile-roofed homes is surrounded by a working vineyard and a beautiful 18-hole

golf course set against a mountain backdrop. This is the place for affordable,

off-the-grid living at a level you've grown accustomed to in the States.

![]() The Pacific Ocean Right Outside

Your Front Door. At this 2,700 acre community you can find leafy lots

with sweeping ocean views for $150,000 or less. It's very close to the U.S.,

the cost of living is one of the world’s cheapest, and the caliber of amenities

is first-rate.

The Pacific Ocean Right Outside

Your Front Door. At this 2,700 acre community you can find leafy lots

with sweeping ocean views for $150,000 or less. It's very close to the U.S.,

the cost of living is one of the world’s cheapest, and the caliber of amenities

is first-rate.

Plus,

I’ll share my personal list of contacts in each of these countries who can

provide you with everything you need to know about the local real estate

market.

You'll

learn more about these American-friendly destinations if you choose to claim

your FREE copy of The Top 3 Foreign Real Estate Opportunities.

So

how can you begin taking these simple steps, right away?

“Must-have Information”

Well,

my company has been publishing financial research for the past 15 years.

We

publish our best ideas in a one-of-a-kind monthly newsletter called The

Sovereign Investor. During that time, we’ve helped a lot of individuals

like you protect and grow their wealth. The Sovereign Investor readers

put it best...

Darren

Anderson tells us:

“Thanks to you I took the necessary steps to

prepare myself for the upcoming crisis. My portfolio has increased 80%.”

Kelly

W. says:

“I have been a subscriber to this newsletter

for a long time and it is wonderful. Great investment advice. The economic

perspective is way ahead of the curve and tells things the TV talking heads

never tell you!”

Ira

Weston, from Naples, FL writes:

“I’m making better than 20% on what I’m

investing in… [and] it gives me peace of mind to know I have assets that people

don’t know about.”

Ross

Fink, of San Diego, CA, says The Sovereign Investor provides

“must-have information.”

Karen

W. raves

“The Sovereign Investor, like no other

publication, has opened my eyes to what is really happening in this country. I

only wish I had known sooner! Fantastic!”

And

just the other day I got this note from Jonathan R. saying:

“I get excited just thinking about each

issue. I eat it up, I can’t leave my desk, I return to it time and again for

rereads. You guys are outstanding. I must tell you I have turned many heads

with comments and knowledge I have gained from your letters and reports. Thank

you. Just don’t stop please.”

It’s

rewarding to get letters like those. I’m happy to know that my research is

helping thousands of subscribers survive and thrive through market crashes and

government boondoggles.

But

I have to tell you, right now, I fear a lot of folks will simply ignore my

warnings.

There

are just too many people who believe America is still the exceptional country

she was in the 20th century. They believe America can do no wrong and that,

somehow, our nation is exempt from historical forces that have affected other

countries.

Please,

don’t get me wrong.

I

love my country.

It

has given us the greatest standard of living the world has ever seen.

No

other nation has built so much wealth or attracted so many immigrants over the

last 250 years.

No

other nation has demonstrated an equivalent track record for sustained innovation

and productivity improvements.

But

at the same time… no government has ever borrowed anywhere near as much as

America has.

Let

me ask: Do you truly believe that, no matter what we do, nothing can ever

destroy our currency and our standard-of-living?

Are

we so exceptional that, as a country, we are immune to basic economic laws?

Are

we so exceptional that we won’t suffer any consequences from our reckless

borrowing spree?

Or

that we can get away with the biggest cover up in financial history?

Sorry,

but I don’t believe we’re that exceptional.

Every

empire throughout history has collapsed, and they all shared that same “nothing

can defeat us” mentality. The U.S. will be no exception.

I

know that admitting the truth can be hard sometimes… but we can no longer

ignore the reality that we have become nothing more than a nation addicted to

money-printing and debt.

The

only thing that has prevented a major collapse of our way of life is trust…

trust in the U.S. government and its institutions.

But

as I showed you in this presentation, that’s about to change in a significant

way.

Those

who continue to blindly believe in American exceptionalism are in for a rude

awakening--and much sooner than they might imagine.

I

sincerely hope you won’t be among the many Americans who will get caught

totally by surprise when trust evaporates and our monetary system collapses.

That’s

why I created this presentation. And it’s why I’d like to give you access to

all the five reports I’ve mentioned here, at absolutely no risk or obligation.

Simply let me know you'd like to take a

trial subscription to my monthly research, The Sovereign Investor, and

I’ll immediately give you access to:

|

Research Report #1: Golden

Streams: Precious Metals Industry's Best Kept Secret. Research Report #2: The

Three Top Silver Investments for the Coming Crisis. Research Report #3: How to

Turn Your Brokerage Account into an ATM. Research Report #4: How to

Keep Your Wealth Out of Uncle Sam’s Hand. Research Report #5: The

Top 3 Foreign Real Estate Opportunities |

Also,

each month, I'll send you my private research letter, The Sovereign

Investor.

I’ll

keep you up to date on how this crisis in unfolding and show you all the

measures you must take to protect your wealth. I’ll give you specific

investment recommendations, wealth protection strategies and offshore banking

solutions.

These

are strategies that you won’t find on the pages of The Wall Street Journal

or The Economist…This print and online

research will be sent right to your physical and virtual

mail-box once a month!

So

how much does my work cost... and how can you get started?

Well,

as I mentioned before, trust is key in every relationship.

I

know that in order for me to earn your trust and your business, I need to

deliver on everything that I’ve promised.

So,

I want to make it as easy and hassle-free as possible for you to try my work

today.

That’s

why I’ve asked my publisher to give you a special discount of 67%. So instead

of paying our regular rate, today you can pay less than your phone bill and

receive EVERYTHING I mentioned here.

That

includes:

![]() Report #1: Golden Streams:

Precious Metals Industry's Best Kept Secret.

Report #1: Golden Streams:

Precious Metals Industry's Best Kept Secret.

![]() Report #2: The Three Top Silver

Investments for the Coming Crisis.

Report #2: The Three Top Silver

Investments for the Coming Crisis.

![]() Report #3: How to Turn Your

Brokerage Account into an ATM.

Report #3: How to Turn Your

Brokerage Account into an ATM.

![]() Report #4: How to Keep Your

Wealth Out of Uncle Sam’s Hand.

Report #4: How to Keep Your

Wealth Out of Uncle Sam’s Hand.

![]() Report #5: The Top 3 Foreign

Real Estate Opportunities

Report #5: The Top 3 Foreign

Real Estate Opportunities

![]() 12 issues of The Sovereign

Investor

12 issues of The Sovereign

Investor

![]() Urgent Investment Alerts… notifying

you immediately of any buy/sell recommendation I make in our model Portfolios.

I’ll also send you important news bulletins and instant alerts on any political

or Black Swan event that could impact our portfolio. This is the kind

of detailed research that others would likely pay $1000 - $5000 for. But

you’ll receive all these powerful benefits as a subscriber to The Sovereign

Investor.

Urgent Investment Alerts… notifying

you immediately of any buy/sell recommendation I make in our model Portfolios.

I’ll also send you important news bulletins and instant alerts on any political

or Black Swan event that could impact our portfolio. This is the kind

of detailed research that others would likely pay $1000 - $5000 for. But

you’ll receive all these powerful benefits as a subscriber to The Sovereign

Investor.

![]() 24/7 Access to our

Sovereign Archives — Once you sign up, you’ll get password-protected

access to all our past and current special reports, issues and recommendations.

24/7 Access to our

Sovereign Archives — Once you sign up, you’ll get password-protected

access to all our past and current special reports, issues and recommendations.

What’s

more, I’ve asked that if at any time in the next 4 months

you decide The Sovereign Investor is not for you, that you are allowed

to cancel and receive a FULL refund.

I

want you to be safe (and profitable) through the era ahead, without making any

long-term commitment.

By

taking action today, you won’t be among the millions of Americans caught by

surprise when the trust dies.

Remember,

China could announce its gold holdings anytime. When they do, everyone will

connect the dots and figure out the Fed has been lying all these years.

I

want you to be fully prepared when that happens. So, I’ve also asked my

publisher to allow you to keep all the special reports you’ll have received as

my gift to you – just for giving The Sovereign Investor a try.

Essentially

we’ve made it risk-free to try. You really have nothing to lose. You’re

agreeing only to TRY my work to see if you like it.

Simply

take the next four months to check out my research and access all the 5

valuable reports I’ve mentioned here.

And

even if you decide AFTER four months that my work is not for you, you can still

get a prorated refund for any time remaining on your subscription.

I

hope you will take these simple steps to safeguard your family, your wealth and

your retirement assets.

Please,

keep in mind there’s not much time left. This coming collapse will be

devastating and swift! I urge you to take action today.

Just

because our monetary system hasn’t collapsed yet, many people think it will

never happen.

People

tend to make that mistake over and over again. They tend to extrapolate recent

events into the future indefinitely.

Think

back to the late-1990s… stocks were rising just about every year. So, many

investors assumed stocks could only go up. But they found out just how wrong

they were when their wealth evaporated in the stock-market crash of 2000.

And

because housing prices went up throughout the 1970s, 80s and 90s, everyone

thought real estate prices couldn't fall. As a result, the housing crash caught

most Americans by surprise.

Today

there’s something similar going on. Just because foreigners have been buying

U.S. bonds for decades, everyone assumes that will continue.

And

the same applies to the dollar-centric monetary system. Just because the dollar

has been the world reserve currency since 1945, everyone assumes that will

continue forever.

But

make no mistake…the dollar is not the world’s first reserve currency and it

certainly will not be the last. In the last 2,500 years, other currencies have