IN CaSe You ARe WoNDeRiNG

WHaT JuST HaPPeNeD AT AP...

Submitted by williambanzai7 on

04/23/2013

……………

The Sentiment Trader

risks associated with social

media - hackers trick wall street

risks associated with social media

While many people believe there are huge benefits of using social media, today

we were witness to the darker side of social media, and also the many risks

associated with social media especially to do with the online trading world.

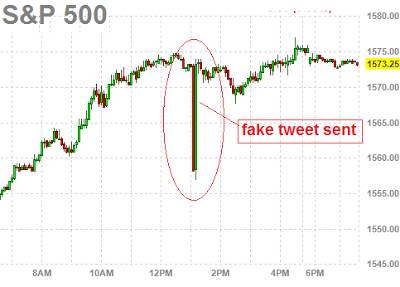

US stocks ended a tumultuous day with strong gains after a false tweet briefly

sent financial markets veering, underscoring technology's role in tightly

linking global markets.

The fake tweet

sent the stock market scurrying down, and

had Authorities panicked Tuesday not knowing what to do. (see

below)

In 2013, many profitable traders use social media to share ideas, pass around

charts, and link to sites that could increase there chances of profiting in and

around the global markets. However we must understand that there is a darker

side to social media, that is not getting much attention at all. This mishap,

or what is being termed a vulnerable social media aspect to the market should

be a "wake-up call" to regulators that social media presents a major

threat to not only the general public, but also to the investing communities

and other traders who use social media as a way to communicate during

their trading day.

Today's event brought back horrific memories of the FLASH CRASH that occurred

back in May 2010, after a hacker allegedly accessing the Associated

Press Twitter account and posted a fake message about bombs

and explosions going off at the white house.

As you can see the market skid down instantly, and fortunately social

media was powerful enough to correct this mistake via the news networks, that

this message was indeed a fake tweet sent by a malicious hacker.

In 2013 we understand and realize the true power in social media, but if

social media has the power to affect wild swings on the stock market

at what point do we stop and say "who did this, and why is there not

some authoritative figure regulating this?" These are valid

questions!

While there is no quick fix, or easy answers here, today was surely a wake up

call for WALL STREET professionals, and traders to stop and think about those

who do use social media in harmful way.

We have to understand there are some traders and data houses that are purely

using social media feeds and tweets to organize large algorithms and

lightning fast high volume trades that can slam the market down hundreds of

points very quickly.

The market is an environment that is fast paced, and an entity unto itself. Its

a stressful environment for traders at times, and these sorts of added

risks should not thrown into the mix and on traders minds as they go about

their trading day.

Kevin Ferry, president of Cronus Futures Management, said odd movement earlier

in the day by the Standard & Poor's 500 mini futures contract suggested

that the AP tweet was planted by a trader looking to make money off it.

You may be skeptical about all this being planned by a trader, however if this

were true, it would have been a good day on the market for this tweeter. He

only did it because he knew he could get away with it so easily.

We have seen the risks that hackers and social media can have, this problem is

not going to go away anytime soon. They are yet to find the person that carried

out this attack (fake tweet) however if they were even caught

what would happen to them? have they even broke any major laws? At

the moment no one really knows?

As you can see there are many risks associated with social media even in the

trading world, and we saw a good example of that today. The dangers of social

networking sites are really only now being exposed as these stories are coming

to light.

Why is it, that every time we see the darker side of social media

sites, like facebook, twitter, linkdin people seem to throw up their hands and

say the problems is too hard to deal with and the problem is not easy to

navigate a probable solution. Isn't that what these hackers want? To know they

hold almighty power at their finger tips, by sending out a 100 character tweet,

have the ability to wipe billions off the stockmarket in a matter of seconds

and not get into trouble.

Authorities better be thankful that this problem was resolved fast, because

next time someone with more advanced skills could do much worse, and no one

would be prepared for the aftermath.

Maybe this is a wake call that we all needed, to try and put a stop to more of

these outside market influences that threaten the online trading world. Traders

have enough on their plate each week than to have to worry about the threat of

hackers and fake tweets that could implicate their profits and losses each day.

The market is already manipulated enough and traders do not need the worry and

hassle of having these sorts of problems in the back of their minds while they

are simply trying to get in there and make some money, and then get out.

The hackers had their day in the sun today, they probably did this for fun.

YES! They tricked wall street, I will admit it, however we need to understand

this situation a little better and learn to put in place solutions so this NEVER

happens AGAIN!