A

View on Inflation & Keynesian Talking Points

03/29/2012 - 23:38

The ponzi will fail, and the economy will reset - the only

question is when.

![]() Submitted by CrownThomas on 03/29/2012

Submitted by CrownThomas on 03/29/2012

†ĎAs the world spins helplessly into

insolvency, central banks are becoming more and more active in helping to

"solve" the crisis (although some would argue it's odd to have those

who helped create it be counted on to help solve it). As this is taking

place, the Keynesians (MMT'ers) and Austrians are

renewing their rivalry, and are once again going after each other for their

thoughts on the situation (note: it really doesn't matter what the Austrians

believe, as the Keynesians are currently in charge of the decision making).

†ĎAs the world spins helplessly into

insolvency, central banks are becoming more and more active in helping to

"solve" the crisis (although some would argue it's odd to have those

who helped create it be counted on to help solve it). As this is taking

place, the Keynesians (MMT'ers) and Austrians are

renewing their rivalry, and are once again going after each other for their

thoughts on the situation (note: it really doesn't matter what the Austrians

believe, as the Keynesians are currently in charge of the decision making).

Volumes can and have been written on

these two schools of economic thought - what I'd like to focus on is inflation.

Austrians are always sounding the

alarm on inflation, and the Keynesians always laugh and point to the monthly

CPI figures the BLS publishes. They say that it's in the 2%-3% range,

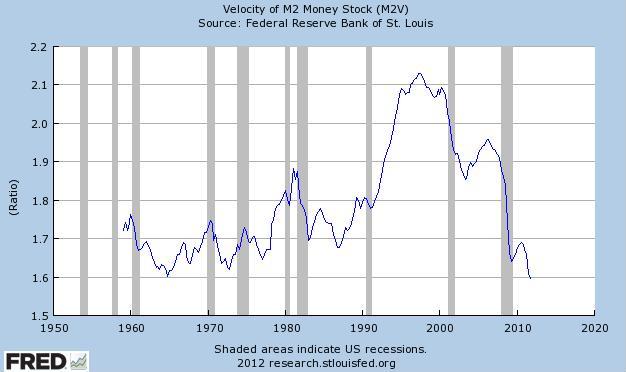

everything is fine. And besides, the velocity of money is down significantly,

so the Austrians need to be quiet and take their "crazy" somewhere

else.

That's one way to look at it. I would

argue that inflation is all around us, we just choose not to look.

Some context: Say you were buying

apples at your local store. What if you thought that there were only a dozen

apples in the store you were in, with no chance of more apples being delivered. You'd place a higher value on each

apple right? Now what if you knew there was a truck load of apples being

delivered shortly - you'd place a little less value on each apple, knowing that

the supply of apples will be increasing shortly.

This is the same way Austrians view

the value of money. They believe that individuals

value money based on both quantity, and QUALITY. If

the Federal Reserve can just print money and increase the money supply,

creating more dollars to chase a similar amount of goods, why would you

value each dollar the same as you would before the money supply was

increased? And in regards to velocity of money, the velocity of money does not create inflation,

it is a symptom of

inflation. Think about it, if you knew there were more and more dollars chasing

the same amount of goods around, you'd begin to draw on your account &

borrow to purchase goods now instead of in the future, thus increasing the

velocity of money. But the inflation was already there when the money supply

increased arbitrarily.

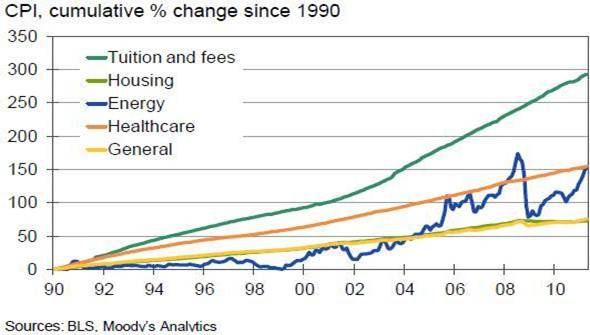

Inflation is all around us. I don't

need to get into things like WTI or Brent, you feel

the effects of those each time you get gas. What I'd like to point

out are things like healthcare, energy as a whole, housing prices, and

student loans. Do you not see the inflation in those areas? -- As an aside, I

recommend reading this

piece ZH published on student loans.

Here's the case I lay out for those

reading to make up their own minds. The Federal Reserve prints money,

"buying" treasuries & increasing the money supply, thus devaluing

the dollar. The Government then subsidizes all of the aforementioned areas,

which means more dollars are available to purchase those goods & services.

And this is how the game is played (also, banks net income swells as a

result).

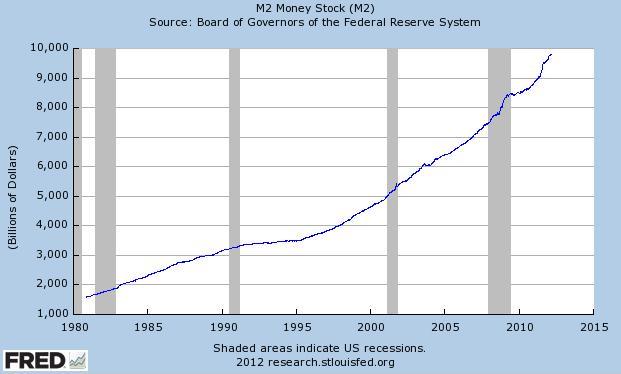

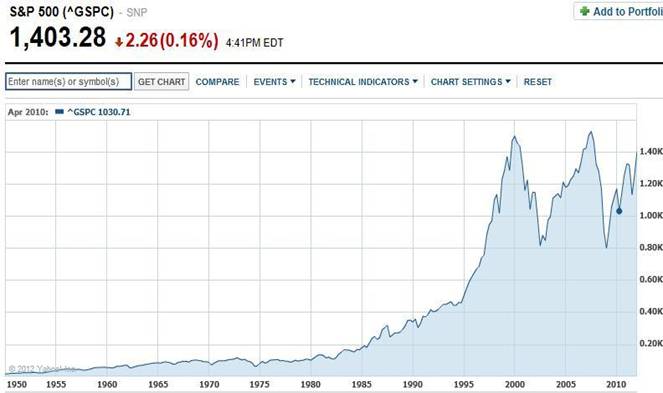

A. M2 (Money Supply) skyrockets

(Fed printing)

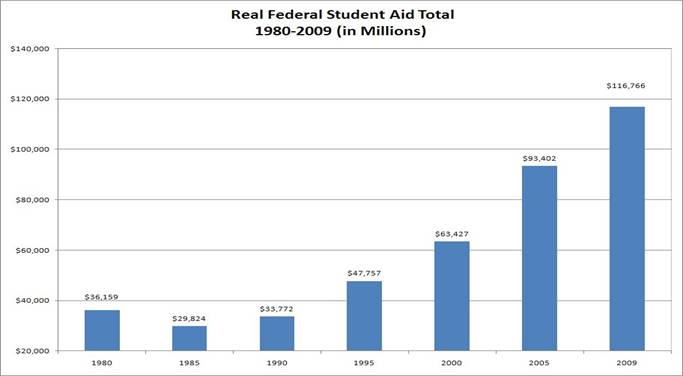

B. An Example of Government

Subsidies in Student Loans

C. Here's Your Inflation (that

nobody can seem to find)

D. All with a declining velocity

of money

E. The USD is losing value at a

rapid pace (but who wants the paper tied to something of value, that's

crazy) -- Also, you can

look at DXY, but you'd only be looking at how the

And may I present to you the only

reason money is printed - so everyone can consume all those iPads

and sweet big screen tv's:

Eventually the game will be up folks,

and I strongly recommend you learn to live below your means before you're

forced to. The ponzi will fail, and the economy will reset - the

only question is when.

In the spirit of the Zero Hedge

Mob