Revisited:

Three Data Points That Prove Europe Cannot Be Saved

April 10, 2012 By gpc1981 http://gainspainscapital.com

[ I first published this article a few

weeks ago. Given the speed at which

‘I continue to see articles in the

media claiming that

Here are three data points that

GUARANTEE

Fact #1: EU Banks as a whole are

leveraged at 26 to1.

This is, of course, based on the

assets the banks are reporting. According to independent sources, the leverage

levels are in fact far, far greater than this (though 26 to 1 is already bordering on Lehman Brothers’ leverage levels).

Indeed, as far back as September

2011, PIMCO’s Co-CIO, Mohamed El-Erian

(one of the most connected of the financial elite) noted that French Banks were

running REAL leverage levels of almost 100-to-1.

El-Erian said

French banks are a particular cause for concern, noting that “credit markets

now put their risk of default at levels indicative of a BB rating, which is

fundamentally inconsistent with sound banking operations.” He adds that bank

equity now trades at a 50% discount to tangible book value on average, while the ratio of market capital to total assets

has fallen to 1%-1.5%, compared with 6%-8% for “healthier

banks.”

http://www.marketwatch.com/story/pimco-french-banks-could-tip-europe-to-recession-2011-09-22

So the “official” leverage level of

26 to 1 is definitely much, much lower than the REAL leverage levels. And we

all know how massively high leverage levels go: see the 2008 collapse.

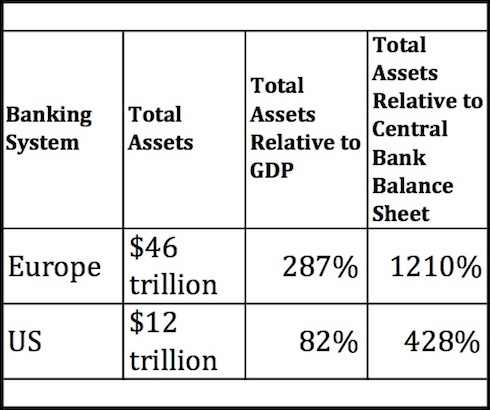

By the way, the EU’s banking system

is $46 trillion in size.

Fact #2: One Quarter of the ECB’s balance sheet is PIIGS debt

As part of its

moves to “save the system” the ECB has gorged on PIIGS debt. Today, one quarter of the ECB’s balance sheet is PIIGS debt. Care to take a guess at

what these assets are valued at? I guarantee it’s nothing near their real

market values.

The ECB managed to swap out its

ECB Balance Sheet Jumps Above €3 Trillion

The mix of bond purchases and loans

has exposed the ECB and the 17 national central banks that make up the euro to

losses in the event of defaults or bank failures. Last month, the ECB was

forced to swap its €50 billion Greek bond portfolio for new bonds to shield the

banks from potential losses in the event of any forced write-‐downs.

If banks that have borrowed from the

ECB can’t pay the money back and the collateral they have posted falls in value

or becomes worthless, the ECB would be on the hook for losses. Most of these losses would be spread across

national central banks according to their size, meaning

http://online.wsj.com/article/SB10001424052970203458604577265373668388122.html?mod=googlenews_wsj

So the ECB goes over

Hint:

Indeed,

Fact #3: Even after all of its

interventions and purchases, the ECB is far too small to contain this mess

(ditto for the Fed)

Have a look at the following chart

and tell me that the ECB or Fed could contain this mess.

I know many of you are thinking “the

ECB or Fed could just print money.” That answer is wrong. If the ECB chooses to

do this,

And if the Fed chooses to monetize

everything to hold things up, then the US Dollar collapses, inflation erupts

creating civil unrest, interest rates rise killing the banks, US corporations

and the US economy… all during an election year.

Good luck with that.

Remember, the Fed’s QE 2 program

which was a mere $600 billion (to bail out Europe the Fed would need at the

minimum $2 trillion) pushed food prices to all time highs and kicked off riots

and revolutions around the globe. Imagine what $2+ trillion would do.

Again,

If you’re not already taking steps to

prepare for the coming collapse, you need to do so now.

With that in mind, I’m already

positioning subscribers of Private Wealth

Advisory for the upcoming collapse. Already we’ve

seen gains of 6%, 9%, 10%, even

12% in less than two weeks by placing well-targeted shorts

on a number of European financials.

And we’re just getting started.

So if you’re looking for the means of

profiting from what’s coming, I highly suggest you consider a subscription

to Private Wealth

Advisory. We’ve locked in 46 straight winning

trades since late July (thanks to the timing of our trades), and haven’t closed

a single losing trade since that time.

Because of the level of my analysis

as well as my track record, my work has been featured in Fox Business, CNN Money,

Crain’s

To learn more about Private Wealth

Advisory and how we make money in any market

environment…’

Best

Graham Summers

Chief Market Strategist