Dave’s Daily: http://www.etfdigest.com

ALGOS FEAST ON RUMORS

May 24, 2012

‘The overall

news continues to be dreadful. In

Meanwhile

in the

Gold

(GLD) higher early gave back most gains late in the day. Oil (USO) was slightly

higher on more Iranian (them again) news. The dollar (UUP) was once again

higher and normally would see stocks head lower.

But,

in a rumor algo driven environment logic quickly becomes a thing of the past

since there’s quick bucks to be made.

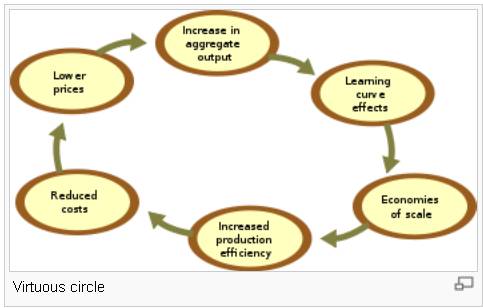

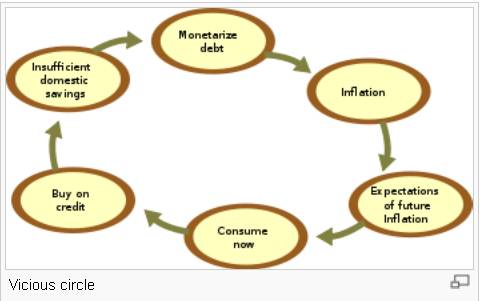

Which

path are we on as described below?

Okay,

I rest my case.

Stocks

again reversed course late in the day as the same rumors of eurozone solutions

triggered algo buying action. Leading sectors were scattered frankly and we’ll

view a few below.

Volume

was lighter Thursday and you can readily see algo activity in the 5 minute SPY

chart below. Breadth per the WSJ was mixed…’

QUIT JICKY JACKIN

AROUND

{‘…After being down nearly 200 points markets

turned around late as the infamous 2:15 PM Buy Program Express kicked-in (a few

minutes late) and stocks rallied sharply off lows as another short squeeze began…’

}

May 23, 2012

‘A

good friend of mine used to shout this when decision making became gridlocked. It’s

apt for how the world is operating nowadays. There doesn’t seem to be any

courageous or decisive leadership currently. Buying time seems the best leaders

can do and hope they’ll get reelected hanging on to power. Then we start all

over again.

I was

sitting next to an older fellow yesterday at the gym. It was his first day of

exercising after twin knee replacements. I asked, “Did you really need to have

both done now.” “Damn”, he said, “Why do I want to go back through it again?” I

think I did the same a long time ago with my wisdom teeth. The doctor said we

could take out two now and do the next in a year or two. “Are you kidding me? “

I asked. “Take ‘em all out now and give me enough drugs to last a week or so.”

So

those personal things aside, world leaders face the same choices—deal with

these problems directly and quit kidding themselves and the people. If you

really didn’t want to be president or prime minister why did you raise your

hand?

Now

there will be a Euro

The

Anyway

market participants weren’t too thrilled about the road ahead either, at least

not early. They bought the dollar (UUP) and sold stocks hard early and often on

eurozone fun and games until rumors caused a sharp reversal. Bonds (IEF, aka

“mattress money”) had rallied, commodities (USO, DBC & JJC for example) all

fell then made a comeback. Gold (GLD) saw selling on the stronger dollar and

then late day buying on QE hopes and other rumors.

Charles

Biderman of well-regarded TrimTabs utters the impossible that

After being

down nearly 200 points markets turned around late as the infamous 2:15 PM Buy

Program Express kicked-in (a few minutes late) and stocks rallied sharply off

lows as another short squeeze began. Rumors spread that France wanted a heavy

dose of QE, another suggested a broad bank euro deposit guarantee and Fed

Governor Kocherlakota suggested more

After

the close Hewlett Packard (HPQ) announced “adjusted” earnings which beat

expectations even though it posted a loss. Along with it came pink slips for

27K employees. (Yeah, it’s the mean streets of corporate

Volume

increased in both directions. Was it wasted buying power? Or, just some

insiders defending their positions and not believing in a euro breakdown? No

one really knows. Breadth per the WSJ wound up inexplicably positive…’

-----