Breaking Bad

Submitted by Tyler Durden on

04/10/2013

‘With

earnings season underway, perhaps pulling back to 30,000 feet is worthwhile to

glance at the macro environment that is backing these new all-time high

nominal stock prices. These six charts say it all...

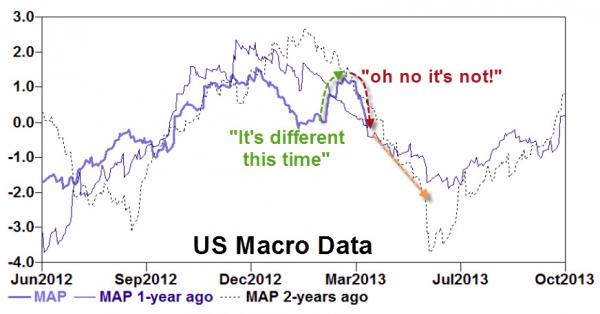

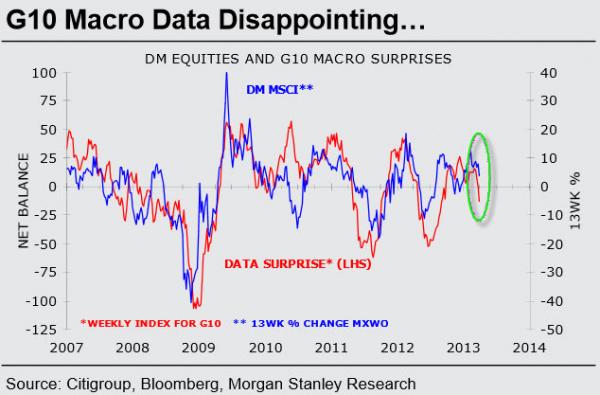

Macro-economic data (levels and beats/misses) have rolled over after looking like it was different this

time...

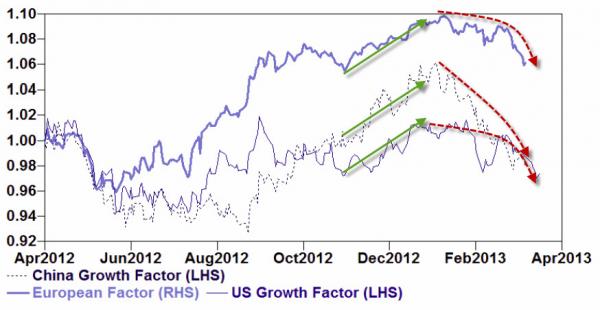

And

all three global risk factors are becoming increasingly worrisome

- from US growth, European 'risk', and China growth...

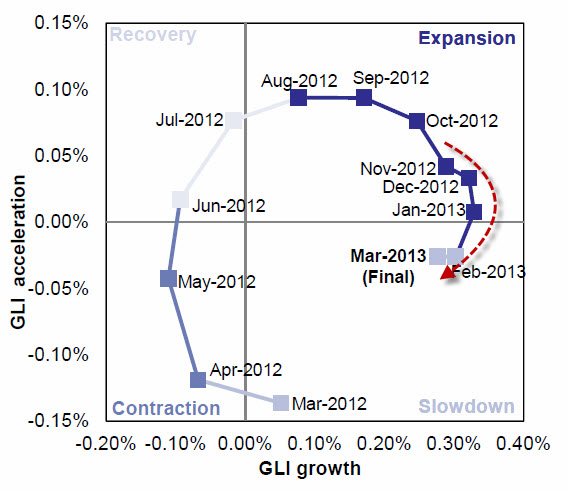

The

business cycle has turned into slowdown...

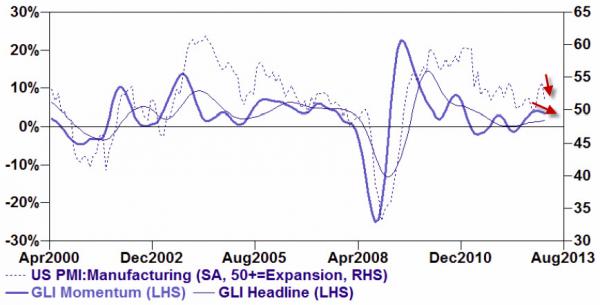

as

Global PMIs and Goldman's Leading Indicator roll over...

but,

of course, stocks continue to levitate. It is worth noting the last

time the difference between a 'macro-based' S&P and the market was this big

was the nonchanlence leading into the debt-ceiling debacle in 2011...

and

it would seem DM markets are more than due to realize these disappointments...’

Charts: Goldman Sachs and Morgan Stanley