An Artificial Recovery The

Pragmatic Capitalist's articles on Seeking Alpha

Friday's GDP report

confirmed a trend that has been persistent across the entire economy: there are

few signs of sustainable economic growth.

There's no question that

the economy has improved substantially since the 3rd quarter of 2008, but the

quality of the recovery has grown increasingly questionable.

The GDP figure was

largely driven by government spending as opposed to improvement in the

economy's primary driver - the U.S. consumer. In addition to the GDP figure we

continue to see conflicting signs in the real economy. In particular, revenues

continue to lag and the consumer data continues to be weak. In order for a

long-term recovery to develop these trends will need to change.

The most recent GDP

results were boosted 3% from government spending. Most of this did not come

from the stimulus package, however:

Most of that increase came from the defense sector, not the

nondefense sectors targeted by the American Recovery and Reinvestment

Act. Defense spending grew at a 13.3% annual rate, in part a rebound

from a 4.3 first quarter contraction. Nondefense spending grew at a 6% annual

rate, contributing 0.15 percentage points to overall growth. The economy can

use all of the help it can get, but it’s too soon to declare that federal

spending is effectively making its way into the system.

Clusterstock had an excellent chart showing the impact of the

recent government spending on the GDP:

Government spending is by no means a bad sign, but an organic

and sustainable recovery cannot develop without strength in other components of

the economy.

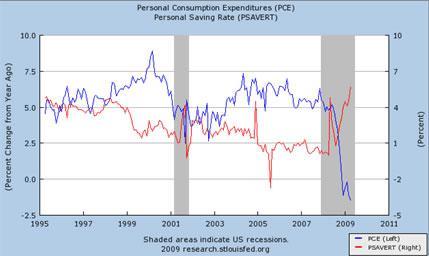

Unfortunately, there are few signs of strength outside of

government spending. The real source of long-term economic growth, the U.S.

consumer, continues to show signs of extreme weakness:

On the employment front the U.S. economy is expected to have

lost another 300,000 jobs in June - a staggering statistic this deep into a

recession.

Many of the same weak underlying fundamentals are apparent in

the Chinese stimulus plan as well. Many people have attributed the sharp global

economic rebound to China's stimulus, but the risks in the plan have become

increasingly high. Royal Bank of Scotland economist Ben Simpfendorfer said:

The risk is that the government, in chasing in an 8 per cent

growth target, is relying too heavily on public investment and private

residential investment to spur growth, rather than pushing ahead with the type

of late-1990s structural reforms that will put the economy back on a

high-single digit and, more importantly, sustainable growth trajectory.

In a recent Barrons article Arjun Divecha, portfolio manager at

GMO also believes the Chinese stimulus is largely artificial:

I believe a lot of the money is not going into productive

investment. What we are hearing anecdotally is that a lot is being lent by the

banks, which remember, are government-owned. Who are they lending to? For the

most part, this money is going to state-owned enterprises, which are not

particularly efficient companies.

We know they are buying real estate, and they are doing all

kinds of things we don’t think in the long run is particularly productive

investment.

Two things are likely to happen. First, longer term, if the

banks don’t have a problem with bad loans now, they will almost certainly have

a lot more bad loans two or three years from now. Second, from a short term

point of view, at some point the government is going to get really worried

about having too much credit-creation; that leads to a credit bubble, just like

you had in this country and everywhere else. As a result, they will start to

withdraw liquidity by tightening the gates on the money. I don’t know when that

will be. But I worry that it is coming.A fair amount of the stimulus money has

found its way into the real estate and stock markets because China has a closed

economy. So there is no way for money to leave the country. The stock market

and real estate have had huge spikes. So when that liquidity is withdrawn, it

seems inevitable that the stock market will take it badly."

In May, Stratfor released a detailed report that says the

long-term structural changes of the Chinese stimulus will be very beneficial,

but also expresses some concerns:

1.

This is not a stimulus program designed to

restart the economy in the short run. Good stimulus packages are very front-loaded

so that they can shock the system with immediate demand. China’s plan is in

actuality a five-year plan designed to help develop the country’s poor interior

provinces largely by building infrastructure.

2.

It is not actually $586 billion in cash.

Only $146 billion — about one-fourth — of the program will be funded by the

national government, and this will take the form of construction bonds. The

remaining $440 billion will be up to the regional governments to raise. This

will be a neat trick since until very recently — and by this we mean that the

idea was only even floated in March — regional governments had no

authority (much less experience) in issuing their own bonds.

3.

The Chinese government is not particularly

convinced that the package will work. If Beijing were convinced, it would be

tapping at least some of its roughly $2 trillion in currency reserves (its own

money), rather than going through the more drawn-out process of dozens of bond

issuances (getting access to other people’s money).

The Chinese government itself is growing

increasingly concerned about the impact of the stimulus package:

But while investors expect the market — up more than 80 percent

this year — to keep rising, Chinese leaders are alarmed. They worry that too

much of the $1 trillion lending binge by state banks that paid for China's

nascent revival was diverted into stocks and real estate, raising the danger of

a boom and bust cycle and higher inflation less than two years after an earlier

stock market bubble burst.

Beijing is trying to tighten credit controls without derailing

the economic revival or causing a market crash — a risky path at a time when

Chinese leaders say a recovery is not firmly established.

"It's a very serious threat. The Chinese government is

walking a tightrope," said Mark Williams, Asia economist for Capital

Economics in London. "There is the question of what happens if they rein

in lending, because there is really no strong evidence that private sector

demand is picking up."

Recent economic data and the stimulus driven recovery isn't the

only place where we've been seeing artificially driven signs of recovery. This

has been nowhere more apparent than in recent earnings reports. We've recently detailed the

significant cost cutting that has led to the "better than

expected" earnings this quarter. Despite the fact that 70% of all

companies are beating earnings, revenues are still declining 15% year over

year.

The underlying driver of real organic corporate growth is still

extremely weak. At some point in the next quarter or two we will need to see

real underlying revenue growth or investors will likely grow increasingly

concerned about the real underlying strength of the economic recovery.

One of the primary sources of optimism has been the housing

market. We have been seeing very strong seasonal strength in housing, however

and Mark Hanson at Field Check Group is

quick to point out that these are more than likely weeds as opposed to green

shoots:

But the season ends now. Every year, organic sales fall

off of a cliff beginning in August primarily because kids go back to school in

Sept. If organic sales follow typical seasonality trends lower again this year

and foreclosure-related resales stay the same or rise (no reason they

shouldn't), then the average and median prices will be pulled quickly back

towards the distressed market price.

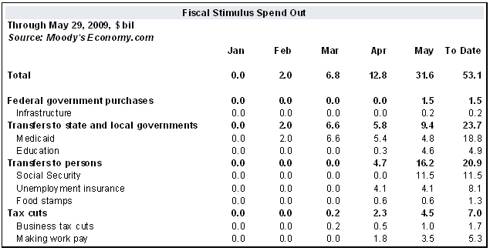

Mark Zandi at Moody's

reports that the stimulus driven economic recovery is not over yet:

The moment of truth is at hand for the U.S. fiscal stimulus

plan. The stimulus that became law in February should reach its point of

maximum economic benefit this summer. If the plan is working, retailing will

improve soon, and businesses should respond by curtailing layoffs measurably.

Early results suggest the stimulus is performing close to expectations, but

policymakers should be prepared to provide more help to the economy if things

don't work as expected in coming months.

The government has only infused about $50B of the total

stimulus:

Accounting for these lags, the maximum contribution from the

stimulus should occur in the second and third quarters of this year, when it

will add more than 3 percentage points to annualized real GDP. This suggests

that if policymakers had not been able to pass a stimulus plan, real GDP would

have declined nearly 6% in the second quarter and by more than 3% in the third.

With the stimulus, GDP is expected to fall close to 3% in the second quarter

and rise a bit in the third. The contribution of stimulus to growth fades

quickly, adding just over 1 percentage point to annualized growth in the fourth

quarter of this year and the first quarter of 2010 and actually detracting from

GDP growth by the second half of 2010. The impact on jobs and unemployment is

also significant, as the stimulus results in approximately 2.5 million more

jobs by the end of 2010 than would have been the case without it, and leaves

the unemployment rate almost 2 percentage points lower.

Despite the upcoming stimulus boost, Zandi is still skeptical of

continued economic strength in 2010:

Risks to this sanguine script are skewed to the downside. Odds

remain uncomfortably high that the economy will enjoy a bounce from the

increased stimulus this summer but then fade with the waning stimulus by the

summer of 2010. This scenario is more likely if the administration's foreclosure mitigation efforts don't quickly

begin to reap benefits. Without a measurable increase in mortgage loan

modifications, foreclosures will continue to surge, further undermining house

prices, housing wealth, the financial system, and the economy's prospects for a

sustainable recovery.

Prepare for the worst

Policymakers should thus be quietly preparing another round of

fiscal stimulus for early 2010. Effective additional stimulus might include

more help to state and local governments, whose budget problems will probably

be even worse next year; an expanded housing tax credit to address the foreclosure

crisis; and a payroll tax holiday. Delaying increases in marginal personal tax

rates, now legislated to occur at the start of 2011, would likely also make

sense. Higher-income households may begin to rein in spending in 2010 as they

prepare for the higher tax rates.

It is premature for policymakers to publicly consider all this

now; the current stimulus should be given a chance, and the nation's long-term

fiscal challenges are daunting. But if the Great Recession has taught us

anything, it is to prepare for the worst.

"Prepare for the worst" is good advice. While the

stimulus driven recovery is likely to continue into the end of the year there

are mounting signs that the underlying quality of the recovery is poor and the

sustainability of the poor fundamentals are unlikely to provide above trend

growth any time soon.

Disclosure: No positions