Dow

Closes Above 11,000; This Rally Has Ignored Fundamentals, and Will Be Corrected

Painfully, Hussman Says … The

market rebound we've experienced is near an end, and we should have seen it

coming, according to John Hussman of Hussman Funds…

Here's a breakdown of why Hussman thinks that, even if you ignore questions

about the banking system, this market is clearly in line for a correction.

- Investors have gone through two massive loss

periods in the past 12 years, and only gained 2.4% if they tracked the

S&P.

- Returns are going to be low over the next

several years, and while there might have been a price low in March 2009,

the valuation low has yet to be found. It may take another 6-8 years.

- This low return on the S&P is not the result

of other potential crises looming in the system, including credit

problems, but simple fundamentals.

- People are now buying into the market, relying

on economic growth and the absence of another credit crisis, rather than

on fundamentals.

As such, says Hussman:

This outcome is not dependent on

whether or not we observe a second set of credit strains, but is instead baked

into the cake as a predictable result of prevailing valuations. The risk of

further credit strains simply adds an additional layer of concern here.

Investors have chased risky securities over the past year to the point where

the risk premium for default risk has eroded to the levels we saw at the peak

of the credit bubble in 2007. MY SENSE IS THAT THIS IS A MISTAKE THAT

WILL BE PAINFULLY CORRECTED. Investors now rely on a sustained economic recovery and

the absence of any additional credit strains - and even then would be likely to

achieve only tepid long-term returns from these levels…

[$$] Losing Big -- Winning Anyway Does moral hazard even exist

anymore? The list goes on -- auto companies, banks, insurance companies and now

countries.

HAL 9000s Keep Dow at 11,000: Dave's Daily Dave's Daily

By Dave Fry, founder and publisher of ETF Digest and author of the best-selling book Create Your Own ETF Hedge Fund. HAL 9000s KEEP DJIA AT

11K There's no need to make this stuff up anymore since end-of-day

stick saves are right there and in your face. No pretense or deception is

necessary anymore. When you have "other people's money," including

the taxpayers to work with; you can do what you wish and not be called-out on

it. Who's going to do that anyway, the financial media?

LOL!!! Anyway, the media got the headline number they wanted and Main Street is

no doubt impressed. Now to the hard part--earnings. Starting with Alcoa

(which just reported a miss) will be followed by important companies like Intel

and Bank of America. There

isn't much in the way of economic news until Retail Sales and the Fed Beige

Book on Wednesday. Monday's volume was pathetically light; so managing the

market higher was easy for those who could … Per Investopedia: The

McClellan Summation Index is a long-term version of the McClellan Oscillator.

It is a market breadth indicator, and interpretation is similar to that of the

McClellan Oscillator, except that it is more suited to major trends. I

believe readings of +1000/-1000 reveal markets as much extended (charts show

+1250) …

Exciting Week for Stocks, ETFs but Economic Indicators (of which

the boot-strap bubble stock market is a significant component inflating /

obfuscating same) Tell Different Story … This week I read some truly remarkable and conflicting facts

that make things all the more interesting and confusing. On the up side, the

March Institute of Supply Management report was positive, as was the February

Pending Home Sales and Wholesale Sales, while Consumer Credit unexpectedly

contracted by a whopping -$11.5 Billion. Also this week, it barely made the

news that weekly unemployment claims unexpectedly rose by 18,000, and the four

week moving average was up from the previous week as well. Underemployment remains near 20%. We have

approximately 5 million non current home mortgages in the US and a record 40

million people on food stamps, a number which has steadily been rising over the

last year. In the housing sector, mortgages reached an eight month high this

week and even Chairman Bernanke said in a speech that we’re “far from being out

of the woods,” which is a chilling comment from one of the chief cheerleaders

and architects of the recovery. Looking at the all important housing and

employment markets, the FOMC meeting minutes released this week were even more

chilling.

Regarding

general conditions, the FOMC said:

Household spending going forward was

likely to remain constrained by weak labor market conditions, lower housing

wealth, tight credit, and modest income growth.

The employment outlook was not

particularly bright, in their opinion, as the minutes said:

Participants were concerned about the

scarcity of job openings, the elevated level of unemployment, and the extent of

longer-term unemployment .... Moreover the downward trend in initial

unemployment claims appeared to have leveled off in recent weeks ...

Regarding the all important housing

market, the minutes said:

Participants were also concerned that

activity in the housing sector appeared to be leveling off in most regions

despite various forms of government support, and they noted that commercial and

industrial real estate markets continued to weaken. Indeed, housing sales and

starts had flattened out at depressed levels, suggesting that previous improvements

in these indicators may have largely reflected transitory effects from the

first-time homebuyer tax credit rather than a fundamental strengthening of

housing activity.

It’s just hard to see any good news in

this report but somehow the markets have managed to ignore what clearly are

scary facts. Looking abroad, the Greek Tragedy continued to unfold with Greece

bonds crashing last week and requiring a 442 basis point premium to German

bonds to be sold which Prime Minister George Papandreou labeled as unsustainable.

Clearly Greece needs help from the European Union and probably the IMF and a

plan could be announced as early as this weekend to stave off Greece’s default.

Greece needs more than eleven billion eurodollars to cover debt between now and

the end of May and last week, ratings agency Fitch cut both the nation’s and

its banks’ credit ratings with a negative outlook. The problem here, of course,

is that it isn’t just Greece that is in trouble but the other so called “PIGS”

or Club Med states. Global contagion and sovereign defaults remain a real

concern in the months ahead. Looking to Asia, China had a failed bond auction

last week which went largely unnoticed in the US financial press. They offered

91 day and 273 day paper and neither offering was fully subscribed as they

tighten their money supply in an attempt to slow potential inflation. Finally,

earnings season starts Monday with Alcoa (AA), and late last week the company was hit with

analyst downgrades, perhaps to make their results “exceed expectations” in

spite of deteriorating earnings. What It All Means Adding it all up, we see an

overbought, complacent market on a technical basis and a relatively high risk

environment on a fundamental basis both at home and abroad …

Listen here and listen well: The frauds on wall

street know all the tricks, mechanized trading trendline buy signals, chart buy

signals, confirmation of trendlines, technical analysis, and other very

mechanically applied strategies, etc., and can, and do manipulate by

computerized buy programs (previously described in part on this website)

accordingly. Everything purporting to account for the rise has already been

discounted many times over to the upside over the past year and even that which

purports to be must be discounted along with the looming reality of

insurmountable debt crisis / debacle in this country, the GDP of which has

already begun to suffer from debt service / costs. Sell while you can / take

profits, gains / sell into strength / preserve principal / don’t be

caught holding their bag as in prior crashes.

This

is a secular bear market. This is a bull (s***) cycle in a secular bear market.

This is a manipulated bubble as has preceded the prior crashes with great

regularity that the wall street frauds and insiders commission and sell into.

Calm Before Another Global Market

Storm Cooper ’…And given

just how far this market appears to be manipulated it will have to be the bank

trading desks who decide to put on their short positions and catch the rest of

the market snoozing. Market timing How long will that take? If

only we knew. But being positioned away from a crash is more sensible than

being in the middle of it, unless you go short too. Realistically this should

not take too much longer. We know from past crashes like the one seen in 2008-9

that a rally is followed by a sharp correction, and the longer the rally the

sharper should be the correction. When the bank trading desks have killed every

short then they will go short and kill the bulls. It will not be a pretty

sight.’

Why Stocks are Extremely Overbought … On

borrowed time No doubt, extremes can go on for a while.

Nevertheless, it is interesting to note the common denominator between all

extremes - the year they last occurred are 1987, 2000, and 2007. All those

years had one thing in common - major declines.…To a larger degree than in the

past and at all cost, the government is doing all it can to prop up the economy

(see related article 'What or Who is Driving Up Prices').

And even though this might be working right now, we know that the government's

actions usually accomplish the opposite of what they intend…Take the

Glass-Steagall Act as an example. It was a law designed to control speculation.

This law was established in 1933, the year the Great Depression ended and was

repealed in 1999, just before the tech bubble burst…Two extremes we haven't

mentioned yet are P/E ratios and divided yields. Market bottoms are signaled by

low P/E ratios and high dividend yields. Just a few months ago, Standard &

Poor's pegged the P/E ratio based on reported earnings at 143, more than 10

times its historic average. Dividend yields have fallen close to the 1999

all-time low. This is not what a new bull market is made of…

Stocks:

A Rally That Defies Gravity (at BusinessWeek) … All

good things must come to an end, though, so investing pros naturally wonder how

long the market can keep up its winning streak. The market hit its 18-month

high in the face of widespread skepticism among both investors and the American

public.…Most individual retail investors have not been participating in the

rally. According to Morningstar (MORN),

investors pulled $3.7 billion out of U.S. stock funds in February, the fifth

month of outflows in the last six months. A Mar. 25 survey by the American

Association of Individual Investors showed 34.7% of respondents are bearish,

which is more than the 32.4% who are bullish and up from a 23% bearish reading

at the end of 2009. Many Americans seem unaware of the stock market's success

and gloomy about the economy, according to a Bloomberg

National Poll released Mar. 24. The broad S&P 500 rose 72.4% from Mar.

9, 2009, to Mar. 26, 2010. Yet the Bloomberg poll found only 31% of American

investors said the value of their investments had improved in the past year. By

contrast, 22% believe their investments' value has held steady and 46% believe

their value has fallen…

Dow 11,000 - How Much Upside is Left? - …Wall Street is always recommending

to buy and advocating higher prices, so it behooves us to dig a little deeper…According to Professor Shiller, the S&P (NYSEArca: SPY

- News)

is 30% overvalued. According to ETFguide's research, the extent of

overvaluation is even worse. Regardless of which analysis you chose, stocks

will eventually turn into a hot potato. Will you get burned?…

Fed Inflates Stock Bubble: Dave's Daily …The Fed minutes revealed the stunning conclusion interest rates will

stay low for an extended period if the economic outlook worsens or inflation

drops. Wow, that's surprising logic! With those mighty words stocks picked up

steam some and closed higher overall. Not mentioned by many mainstream media

talking heads is the building stock market bubble which, of course, few would

care to see or discuss. It's what the Fed does--

Fed Governor Dares Say 'Bubble': Dave's Daily HOENIG SEES A BUBBLE & STOCKS SEE RED …Hoenig stated: "In particular, what are the hazards of

holding the Federal Funds rate target close to zero? The risks of raising too

soon are clear and compelling. My comments, however, concern the risks of

raising rates too late. Such risks also can be significant but all too often

seem more distant and less compelling, and therefore hold great long-term

danger for us all...I have dissented at the last two FOMC meetings specifically

because I believe the 'extended period' language is no longer warranted and I

am concerned about the buildup of financial imbalances creating long-run

risks....And, the market appears to interpret the extended period as at least

six months. Such actions, moreover, have the effect of encouraging investors to

place bets that rely on the continuance of exceptionally easy monetary

policy. I have no doubt that many on Wall Street are looking at this as a

rare opportunity." At least he's articulating what many are

thinking--an asset bubble is brewing and it's being fed by current easy money policies. Lacking

other news and with volume light before his remarks, investors took his words

to heart Wednesday and started selling…

THE FED'S SHELL GAME

CONTINUES... Chris Martenson - Executive Summary

- Record-breaking Treasury auctions continue to go

off without a hitch, thanks to massive foreign participation.

- However, the amounts reported to be bought in

the auction results do not match the Custody Account or TIC report

amounts.

- The Fed is allegedly all done buying MBS and

Treasury paper. This cuts off an important source of liquidity for the

Treasury, commodity, and stock markets.

- How will these markets respond to a liquidity

drought?

April is upon us. I need to take a

moment to re-analyze the data to see what might happen now that the stimulus

money has worn off, and, more importantly, now that the Federal Reserve's

massive Mortgage Backed Security [MBS] purchase program is over. This is

important for a variety of reasons.

·

The

first is that the enormous flood of liquidity that the Federal Reserve injected

into the financial system has found its way into the Treasury market,

supporting government borrowing and also lowering interest rates for the

housing market. How will the Treasury market respond once the liquidity spigot

is turned off?

·

The

second is that this flood of liquidity has supported all sorts of other asset

markets along the way, including the stock and commodity markets.

·

What

will happen to these when the flood stops? Will the base economy have recovered

enough that the financial markets can operate on their own? Will stocks falter

after an amazing run? Or will the whole thing shudder to a halt for a

double-dip recession?

Back in August of 2009, I wrote that the

Federal Reserve was basically just directly monetizing U.S. government debt by

buying recent Treasury issuances as well as Mortgage Backed Securities [MBS].

Here's the conclusion from that report:

·

The

Federal Reserve has effectively been monetizing far more US government debt

than has openly been revealed, by cleverly enabling foreign central banks to

swap their agency debt for Treasury debt. This is not a sign of strength and

reveals a pattern of trading temporary relief for future difficulties.

·

This is

very nearly the same path that Zimbabwe took, resulting in the complete

abandonment of the Zimbabwe dollar as a unit of currency. The difference is in

the complexity of the game being played, not the substance of the actions

themselves.

·

When

the full scope of this program is more widely recognized, ever more pressure

will fall upon the dollar, as more and more private investors shun the dollar

and all dollar-denominated instruments as stores of value and wealth. This will

further burden the efforts of the various central banks around the world, as

they endeavor to meet the vast borrowing desires of the US government.

My surprise at all of this has been

twofold. The shell game has continued this long without the bond market calling

the bluff, and I am baffled by the extent to which the other world central

banks have both enabled and participated in this game. Part of the explanation

behind this unwavering support for the dollar and U.S. deficit spending by

other central banks lies in the fact that other Western and Eastern governments

are equally insolvent…

Seeking Alpha/Tradermark/Ritholtz “… Yes, there is an

insanity to the markets that can make you mad if you let it. Instead, learn to

see the delightful absurdity of it all. Revel in the stupidity, learn to read when the "wisdom of the

crowd" turns into an angry mob. Find some Zen in the foolishness of

others. Step back and look for the variant perception ... Consider this was an

issue from 1996 or '97 until the collapse in 2000, and from 2005 to the

collapse in 2008-09 …”

All Just a Big Bubble … this

is the end of the road. That is, if the last forty years were all just one big

money and credit bubble, temporarily misinterpreted as prosperity, that can

produce no more bubbles except for the one that is most feared - another

massive bubble in natural resources as a relatively fixed supply of goods meets

up with an unlimited supply of paper money. It's no coincidence that the almost

non-stop sequence of financial bubbles over the last forty years followed the

abandonment of anything resembling a system of sound money. Contemporary

economic thought posits that money is simply a "unit of account" and

that there is no longer any need for it to maintain an intrinsic value of any

sort. They say it's just "notations on paper" and that the world's

economic and financial wizards, though set back a bit by their latest failure,

have things squarely under control. If you're anything like me, you don't

believe that for a second. In the fullness of time, the last forty years will

likely be seen as an aberration - just one big bubble - as theories are

abandoned and a more enlightened approach ultimately prevails. Unfortunately,

between now and then, things are likely to get worse before they get better.

Here’s

Why The Money Supply Has Exploded, But We Haven’t Seen Rampant Inflation Yet

One of the things

they are doing with it is buying U.S. government debt… So instead of loaning money

to American businesses and consumers who desperately need it, a

ton of this new money is being used to pump up yet another

bubble. This time the bubble is in U.S. Treasuries. Asia Times recently described how this

trillion-dollar carry trade in U.S. government securities works… Remarkably,

the most aggressive buyers of US government debt during the past several months

have been global banks domiciled in London and the Cayman Islands. They borrow

at 20 basis points (a fifth of a percentage point) and buy Treasury securities

paying 1% to 3%, depending on maturity. This is the famous “carry trade”, by

which banks or hedge funds borrow short-term at a very low rate and lend

medium- or long-term at a higher rate. This works as long as short-tem rates

remain extremely low. The moment that borrowing costs begin to rise, the

trillion-dollar carry trade in US government securities will collapse. So

what happens when this bubble collapses? Nobody knows for sure. But

anyone who has dealt with carry trades in the past knows that when carry trades

unwind they can do so very, very quickly and the results can be nightmarish.

The truth is that the U.S. financial system is a house of cards that could fall

at any time. A lot of economic pain is on the horizon – it is only a

matter of when it comes and how bad it is going to get. Trends forecaster

Gerald Celente is predicting that it could be as soon as this year…

Indicators Most Overbought Since 2000 and 2007! 2007-Like

Decline Next … A DECADE OF EXTREMES The years 1999/2000 were a time of

extremes. In the last 15 months of its rally phase, the Nasdaq (Nasdaq: QQQQ

- News)

exploded and jumped up 50%. This rally was based on expected earnings of brand new

internet and tech (NYSEArca: XLK - News)

companies with no track record. As sharp as the rally was, the decline was even

more powerful. The years 2007/2008 were another period of extremes. Financial

companies (NYSEArca: XLF - News),

never known for their hard work, found a way to make money even easier -

trading and selling financial derivatives. In retrospect, it is quite amazing

that this financially engineered house of cards did not collapse earlier. But

with the real estate sector (NYSEArca: IYR

- News)

weakening significantly, it was just a matter of time before the sub-prime

avalanche would hit the fan and Wall Street. Looking back it becomes obvious

that the last ten years are composed of a cycle of building and deflating

bubbles. The euphoria of rising markets was quickly distinguished by the pain

of bursting bubbles. One thing we should have learned by now is that euphoria

is the perfect breeding ground for problems. FOOL

ME ONCE, ...As humans we are equipped with longer-term memories than rabbits

and are generally reluctant to get burned twice. This decade has seen many get

burned three times. Once with technology, once with real estate and once more

with stocks in general (NYSEArca: TMW - News).

There seems to have been just enough time between 2000 and 2007 to forget the

tech-bubble and real estate, well real estate is a different asset class and

was supposed to go up at all times - but it didn't. TURN

ON THE GPS

It is easy to forget where we are today. Let's turn on the GPS to get a read on

our exact location. Over the past year, the Dow Jones (DJI: ^DJI), S&P 500

(SNP: ^GSPC), Nasdaq (Nasdaq: ^IXIC), small caps (NYSEArca: IWM

- News),

mid-caps (NYSEArca: MDY - News),

large caps (NYSEArca: IVV - News)

and virtually all other asset classes have gained 70% or more. This in itself

is an extreme that has never happened before. For nearly six weeks, investors

haven't seen a broad index lose more than 1%. Until yesterday, there hasn't

been more than four hours of selling pressure since the February 8 lows. THOSE EXTREMES ARE AMAZING BY THEMSELVES.

BUT WAIT, THERE IS MORE. Last

week the National Association of Active Investment Managers (NAAIM) reported

that 95% of active mutual fund managers are net long. This is the highest

reading since October 17, 2007. Investors are feeling the same way. In

December, portfolio cash allocation dropped to the lowest level since April

2000, while stock allocation rose to the highest level since September 2007

(according to AAII). Earlier this week, the Volatility Index - VIX (Chicago

Options: ^VIX) dropped to its lowest level since July 2007. On December 31,

2009, the percentage of bearish investment advisors dropped to the lowest level

since April 1987, while the percentage of bullish advisors spiked to the

highest level since December 2007 (according to II) … ON BORROWED

TIME No doubt, extremes can go on for a

while. Nevertheless, it is interesting to note the common denominator between

all extremes - the year they last occurred are 1987, 2000, and 2007. All those

years had one thing in common - major declines. Is this time different? To a

larger degree than in the past and at all cost, the government is doing all it

can to prop up the economy (see related article 'What or Who is Driving Up Prices').

And even though this might be working right now, we know that the government's

actions usually accomplish the opposite of what they intend. Take the

Glass-Steagall Act as an example. It was a law designed to control speculation.

This law was established in 1933, the year the Great Depression ended and was

repealed in 1999, just before the tech bubble burst. The current rally is as

unprecedented as it has been unexpected. A little more than a year ago, Wall Street

was bracing itself for a repeat of the Great Depression. It was at exactly that

time, on March 2, 2009, that the ETF Profit Strategy Newsletter sent out a

Trend Change Alert, recommending to sell short ETFs and buy long and leveraged

long ETFs like the Ultra S&P 500 ProShares (NYSEArca: SSO

- News)

and Ultra Financial ProShares (NYSEArca: UYG

- News).

The target for the end of this rally was Dow 9,000 - 10,000, which should be

marked by extreme levels of optimism and a 'the worst is over attitude.' The

market has certainly delivered on this outlook. You may find it interesting

that the percentage of stock market bulls reached a record-low at that time.

Once again, when it was time to buy, investors at large turned to cash. VALUATION

EXTREMES When it comes right down to it, valuations

are the only thing that really matters. After all, who wants to overpay?

Perception often drives valuations for a period of time. You may remember when

VW re-launched the Beetle or BMW unveiled the brand-new Mini Cooper. Initially

dealers were able to charge up to $5,000 on top of the MSRP simply because

buyers would pay it. Today you can pick them up on the cheap simply because

consumers won't pay a premium. What's changed? Perception. The same holds true

for the Toyota Prius, which was a hot commodity during the $5/gallon gas price

era and is plagued by recall troubles today.Just like cars or hot

Christmas toys, stocks are largely driven by perception and valuation. History,

however, shows unequivocally that profit margins, P/E ratios, and dividend

yields always trump the perception of prices and pass through fair value

eventually. Two extremes we haven't mentioned yet are P/E ratios and divided

yields. Market bottoms are signaled by low P/E ratios and high dividend yields.

Just a few months ago, Standard & Poor's pegged the P/E ratio based on

reported earnings at 143, more than 10 times its historic average. Dividend

yields have fallen close to the 1999 all-time low. This is not what a new bull

market is made of. Even though momentum still keeps prices going up, now is the

time to prepare for when they won't be. Every investor needs to know where fair

valuations are to determine the downside risk…

20 Signs That Could Mark a Top After what appears to be the call of the decade (although he

was a few weeks early) with his S&P 666 is a "generational low,"

Doug Kass remained bullish for a good long time. But late last fall he began pulling in his reigns … Now, nearly 13 months later and with

the S&P 500 almost 500 points higher, it is time to focus on a new

checklist of some potential adverse developments that could contribute to a

market top and a reversal of investors' good fortunes since March 2009.

- Interest Rates: The yield on the 10-year U.S. note might climb

to over 4% (now at 3.85%). A 4.00% to 4.25% yield would likely provide a

tipping point for increased competition to equities and produce an

interest (mortgage) rate headwind to the nascent housing recovery at a

time when stock dividend yields have nearly halved and when a large

phantom inventory of unsold homes is about to begin to enter the

residential for-sale market.

- Jobs / Economy: A more sluggish-than-expected expansion in new

jobs and the weight of higher taxes in 2011 might translate to a downturn

in consumer confidence, reduced business fixed investment and a more

shallow domestic economic recovery in the second half of this year.

- Retail:

Cautious forward comp guidance in retail could reverse the February-March

strength.

- Europe:

There could be growing signs of weakness in the European economies.

- Credit:

Over there, we might witness evidence of more sovereign (Spain?) crises,

and, over here, we could see more U.S. municipal -- the universe is large!

-- financial woes. Forced austerity measures would likely produce lower growth.

- Credit (Part Deux): Credit spreads might widen.

- Geopolitical: We could see a possible rise in geopolitical tensions or even

another terrorist act on our shore.

- Monetary Policy: We might have a less dovish Fed in words

(jawboning) and in action (through an increase in the federal funds rate).

- Tightening Abroad: It is likely that central banks around the

world will begin to clench their monetary fist, especially in China.

- Protectionism, Trade and Currency Wars: Things might get ugly, especially on the U.S. /

China front.

- Housing: A renewed leg down in home prices is possible as the spring

selling season could fail to appear. (It hasn't gotten off to a great

start.)

- Sentiment: We could witness the birth of a 5x to 10x levered bullish ETF, a

burst in bullish investor sentiment, an expansion in hedge fund net long

positions, a further drawdown in mutual fund cash positions, a meaningful

increase in retail mutual fund equity inflows and massive outflows out of

Rydex bear funds.

- Technical: Stocks could fail to respond to good news, suggesting that the

sharp corporate profit recovery has been baked into prices. A breakdown in

financials and/or transports could occur. Overseas markets might fail to

make new highs, or we could see a further contraction in NYSE / Nasdaq

exchange volume.

- Deflation: Industrial commodity prices could weaken.

- Speculation: We might see an increasingly speculative market for low-price

issues.

- Underwritings: The emergence of a record syndicate calendar is possible.

- Wall Street: A substantial increase in Wall Street industry hirings could be

announced.

- Dr. Doom vs. the Sunshine Boys: Dr. Nouriel Roubini could see green shoots,

causing bullish strategists and money managers to demonstrate even more

swagger. Reminiscent of late 1998, a sell-side analyst (perhaps the new Henry

Blodgett) might raise his 12-month Apple (AAPL) price target to $375 a share, leading

another analyst to top that target and move to $400 a share a week later.

- The Media: CNBC could throw another celebratory party. Time

magazine might declare the death of the bear market on its cover or run a

cover story offering a new bullish economic and/or stock market paradigm.

Sir Larry Kudlow could have trouble finding a single bear to appear on CNBC's

"The Kudlow Report." Record ratings might induce the management

of CNBC to expand "Squawk Box" from three hours to four

hours (6:00 a.m. to 10:00 a.m.) and add an additional anchor to join Joe,

Becky and Carl.

11 Clear Signs That The U.S. Economy Is Headed Into The

Toilet

The Economic Collapse

January 15, 2010

The vast majority of the talking heads

on television are still speaking of the current economic collapse as if it is a

temporary “recession” that will soon be over. So far, the vast majority

of the American people seem to believe this as well, although for many

Americans there is a very deep gnawing in the pit of their stomachs that is telling

them that there is something very, very wrong this time around. The

truth is that the foundations of the U.S. economy have been destroyed by

an orgy of government, corporate and individual debt that has gone on for

decades. It was the greatest party in the history of the world, but now

the party is over. The following are 11 signs from just this past

month that show that the U.S. economy is headed into the toilet and

will not be recovering….

#1) When even Wal-Mart is closing

stores you know things are bad. Wal-Mart announced on Monday that it will close 10 money-losing Sam’s Club stores

and will cut 1,500 jobs in order to reduce costs. So if even

Wal-Mart has to shut down stores, what chance do other retailers have?

#2) Americans are going broke at a

staggering pace. 1.41 million Americans filed for personal bankruptcy in

2009 – a 32 percent increase over 2008.

#3) American workers are working harder

than ever and yet making less. After adjusting for inflation, pay for

production and non-supervisory workers (80 percent of the private

workforce) is 9% lower than it was in 1973. But

those Americans who do still have jobs are the fortunate ones.

#4) Unemployment is absolutely

exploding all over the United States. Minority groups have been hit

particularly hard. For example, unemployment on many U.S. Indian

reservations is over 80 percent.

#5) Unfortunately the employment

situation is showing no signs of turning around. December was actually the worst month for U.S. unemployment

since the so-called ”Great Recession” began.

#6) So just how bad are things when

compared to past recessions? During the 2001 recession, the U.S.

economy lost 2% of its jobs and it took four years to get them back. This

time the U.S. economy has lost more than 5% of its jobs and there is

no sign that the bleeding of jobs will stop any time soon.

#7) Can you imagine trying to get your

first job in this economic climate? Our young men and women either can’t

get work or have given up on work altogether. The percentage

of Americans 16 to 24 who have jobs is 13 percent lower than ten years ago.

#8) So where did all the jobs go?

Over the past few decades we have allowed the corporate giants to ship

mountains of American jobs overseas, and there are signs that this trend is

only going to get worse. In fact, Princeton University economist Alan S.

Blinder estimates that 22% to 29% of all current U.S. jobs will be offshorable within two decades.

So get ready for even more of our jobs to be shipped off to Mexico, China and

India.

#9) All of these job losses are leading

to defaults on mortgages. Over the past couple of years we have seen the

American Dream in reverse. According to a report that was just

released, delinquent home loans at government-controlled mortgage finance

giants Fannie Mae and Freddie Mac surged 20 percent from July through September.

#10) But that is nothing compared to

what is coming. A massive “second wave” of mortgage defaults is getting

ready to hit the U.S. economy starting in 2010. In fact, this “second

wave” is so frightening that even 60 Minutes is reporting on it.

#11) Meanwhile, the Federal Reserve has announced that it made a record profit of $46.1 billion in

2009. Apparently during this economic crisis it is

a very good time to be a bankster.

I

DON'T KNOW HOW MUCH CLEAR IT GETS THAN THIS:

By Scott Lanman and Craig Torres

Jan. 7 (Bloomberg) -- U.S. regulators including the Federal

Reserve warned banks to guard against possible losses from an

end to low interest rates and reduce exposure or raise capital

if needed.

“In the current environment of historically low

short-term

interest rates, it is important for institutions to have robust

processes for measuring and, where necessary, mitigating their

exposure to potential increases in interest rates,” the Federal

Financial Institutions Examination Council, which includes the

Fed, Federal Deposit Insurance Corp. and other agencies, said in

a statement today.

Let me point

out a few things.

- We have never seen a crash and

rebound in US stock market history like what we have just experienced,

except once. That "once" was 1929/1930. What followed

next was a grueling grind - not a crash, but a grind that never ended, and

in which the market lost more than 80% of it's value. Those who

argue "the bigger the dive the bigger the bounce" forget that

the only true comparison against what we have just seen was in fact the

prelude to a grinding 90%+ overall decline.

- If you believe in "long wave" cycles -

that is, Kondratieff cycles, we have precisely followed

the several-hundred-year long pattern though its latest incarnation, with

the 1982-2000ish period being "Autumn." Winter follows fall.

These cycles seem to happen mostly because all (or essentially all) of the

people who lived through the last cycle's horrors are dead. Unless we have

found a way to break a cycle that has endured far longer than our nation,

we're right where we should be - which incidentally aligns with what

happened in 1929/30 as well. This means that while there may be ups and

downs we have not bottomed - not by a long shot - no

matter what people tell you.

- Interest rates can only go up from zero. That

should be obvious. Rising rates are not positive for equities and multiple

expansion.

- The Financials are getting a tremendous

bid the last few days, presumably on the premise that "employment is

at least somewhat stabilizing." With zero short rates and a steep

yield curve, this means they make a lot of money. But rates cannot

stay where they are if in fact the economy is recovering, and if the long

end rises it will choke off housing.

- At the same time people are rotating into a

sector The Fed and regulators just said will be forced to constrain

its profits people are fleeing the stocks (tech)

that have been on a tear. This is exactly backward based

on the news flow. Are The Fed and Regulators lying or is the

"optimism" incredibly misplaced (and even stupid if they're

rotating out of winners for what were just announced would be losers!)

- P/Es are at record levels. Yes,

that's on "as reported" 12 month trailing, and it is down

materially since one of the two "disaster quarters" is now gone.

But even with the other gone (which it will be in another month) we

will be trading at somewhere around 40 or 50x earnings, an utterly

unsupportable level and above where we were in 1999 - just before the

entire market fell apart. Even on "operating earnings"

we're trading at 24 times - outrageously overvalued from a historical

perspective.

We

also have the BIS calling in bankers to warn them that they've changed nothing

in their behavior (gee, really?) and China

making a serious attempt to pop their property bubble (must be nice to

actually pay attention to such things, eh?)

For today,

"party on Garth" in equities.

Let me simply

remind people that what got me writing The Market Ticker was this

event - something that I missed the signs of because I was overly

complacent, just as people are being right now.

That was 2006

and into 2007, remember?

Straight up -

right up until it wasn't, and 60 SPX points came off in one day. That warning

(and mine when I started writing) was ignored by a whole lot of people too who

thought it was a "blip."

Uh, no, it was

a warning and those who failed to heed it got their heads handed to them.

Don't worry

folks, it can't happen again. Remember, The Fed has our back, just as they did

in 2006 when they told us there was nothing to worry about in the summer when

we got the swoon (remember that? I do - and bought into it!)

The picture

now is actually worse than it was in early 2007. In early 2007

we had solid employment, we still had a reasonable housing market although it

had slowed some, GDP was positive and we had just come off a GREAT

Christmas season with extraordinary profits and sales. In addition we were

running ~350 billion in deficits, not $1.6 trillion (estimated for FY10) nor

did we have to roll and issue over $2 trillion of treasury debt (to someone!)

in the next 12 months.

Now we have

the regulators issuing formal warnings about bank liquidity and

interest rate risk (no really, you think that might be an issue with

that sort of issue behavior?) while at the same time formal liquidity support

in the form of monetization along with stimulus spending is slipping away - the

source of the liquidity that fueled the rally from March.

Ignore all

this if you're brave - or stupid.

PIMCO isn't. Bill Gross sees the same thing I

see.

Shadowstats’ John Williams: Prepare For The

Hyperinflationary Great Depression

- S&P historical return: Using

Barsky-Delong model, to achieve an annual real return of 4.2%, the S&P

would need to be at 810. Or putting it the other way, Hussman stated that

"the conclusion is not that stocks must decline immediately, but

rather, that long-term total returns for the S&P 500 are likely to be

less than 4.2% after inflation." "Alternatively, on the

assumption that future growth rates match what we've observed over the

past two decades and indeed over most of the past century, an expected

long-term total return of 10% for the S&P 500 (what investors

generally carry in their heads as the 'typical'long-term return on stocks)

would currently be consistent with an index level of 672".

- 'Second wave' concerns begin to

appear: Hussman has been warning that the second wave of housing credit

crunching (the mortgage reset) is approaching the peak at this moment. He

quoted Meredith Whitney's interview on CNBC which was very negative on the

outlook of 2010: "which is so disturbing on so many levels to have so

many Americans be kicked out of the financial system, and the consequence

both political and economic of that is a real issue you can't get around.

It's never happened before in this country or in the modern economy. The

biggest trend in 2010 will be seeing who gets kicked out of the banking

system." …

Case-Shiller Still Predicts Massive 45% Fall from Today’s Values 11-27-09

The 10 major cities in the Standard & Poor’s/Case-Shiller home price index have

risen 5% from their April low, but the index is still predicting a massive 45%

fall from today’s values.

HERE IS WHY THE DOLLAR IS NOW EFFECTIVELY WORTHLESS Tyler

Durden Zero

HedgeTuesday, Nov 24th, 2009A picture is worth

a thousand Krugman essays, which is why we present a chart comparing the US

Monetary Base (and by subtracting Reserve Balances with Fed Reserve Banks,

Currency in Circulation), and the Fed’s holdings of MBS and Agency paper

(worthless GSE/FHA garbage). In summary: Currency in Circulation: $920 billion;

MBS/Agency Holdings: $997 billion. The dollar in your pocket is now

entirely backed only by worthless, rapidly devaluing and subsidized housing.

15 signs Wall Street pathology is

spreading By Paul B. Farrell,

MarketWatch ARROYO GRANDE, Calif. (MarketWatch) -- In "The Battle

for the Soul of Capitalism" Jack Bogle no longer sees Adam Smith's

"invisible hand" driving "capitalism in a healthy, positive

direction." …Wall Street plus co-conspirators in Washington and Corporate

America are spreading a contagious "pathological mutation of

capitalism" driven by the new "invisible hands" of this new

"mutant capitalism," serving their selfish agenda in a war to totally

control America's democracy and capitalism. The "Goldman Conspiracy" is the perfect B-school case

study of Wall Street's secret contagious pathology, with insiders like Lloyd

Blankfein, Henry Paulson and others pocketing billions more of the firm's

profits than shareholders, evidence the new "mutant capitalism" has

replaced Adam Smith's 1776 version which historically endowed the soul of American

democracy as well as our capitalistic system. Sadly for America Goldman's

disease is rapidly becoming a pandemic spreading beyond Wall Street's

too-greedy-to-fail banks, infecting our economy, markets and government as it

metastasizes globally...

Market

Reversal Already Happening ‘…First, the S&P sells on a

price-to-earnings multiple of 88 after the recent financial results. That is a

horrendous overvaluation. A reasonable p/e would be around 18-25. That leaves a

90 per cent downside! Secondly, the outlook for GDP growth is lackluster in

2010. It is therefore vulnerable to setbacks, and most particularly the impact

of a stock market decline that would undo much of the data pointing to a

recovery being in prospect. The market has been operating as a positive

feedback loop since March, it also works the other way around. Thirdly, have

markets not reached levels that would normally require a correction? Indeed,

have they not overshot those levels, and now require a bigger than average

correction?…’

.

5 DISTURBING FACTS FOR THE BULLS By Simon

Maierhofer

When seventeenth

century French dramatist Pierre Corneille said that 'danger breeds best on too

much confidence,' he wasn't talking about the stock market, but that doesn't

mean it doesn't have a practical application for investors.

On Wednesday,

October 21, 2009, the Volatility Index, also called the VIX or 'fear index',

fell to levels not seen in well over a year. In fact, the last time the VIX

dropped below Wednesday's reading of 20.10 was on August 28, 2009.

Just

a few days later the Dow Jones (DJI: ^DJI), S&P 500 (SNP: ^GSPC), and

Nasdaq (Nasdaq: ^IXIC) recorded mind boggling losses of about 30% in 30 days.

No doubt there is more to investing than just the VIX. Nevertheless, a look at

a composite of indicators shows that the party on Wall Street is close to an

end, or may have ended already.

DISTURBING

FACT NO. 1: BUYING CLIMAXES

Investors

Intelligence (II) tracks buying and selling climaxes on a weekly basis. Buying

climaxes take place when a stock makes a 12-month high, but closes the week

with a loss. They are a sign of distribution and indicate that stocks are

moving from strong hands to weak ones. According to II, investors who sell into

buying climaxes are right about 80% of the time after four months.

This

week, II recorded 253 buying climaxes and just 8 selling climaxes. The first

two weeks of October saw 597 buying climaxes and only 41 selling climaxes. In

total, there have been over 900 buying climaxes thus far in October, the most

since the October 2007 all-time highs.

DISTURBING

FACT NO. 2: DEFLATION

For

good reason, deflation is an economy's worst enemy. Falling prices create the

perception that any goods can be bought cheaper at a future time. This creates

a waiting attitude which stifles spending and demand, ultimately resulting in a

slower economy. A slower economy, on the other hand, forces consumers to turn

every penny twice before spending it.

In

September, the Producer Price Index (PPI) declined 0.6%. Even the core PPI,

which excludes food and energy, was down 0.1%. Even though investors seem more

concerned about inflation than deflation, it is deflation that has been showing

its ugly head. The 1929 onset of the depression shows what deflation can do.

This sad period of time came to be known as a deflationary depression.

DISTURBING

FACT NO. 3: FORECLOSURES

Foreclosures

used to be mainly confined to low income areas. The most recent figures from

Zillow, however, reveals a concerning development. USNews reports that at the peak

of the market, the top third of the property value spectrum made up just 16% of

foreclosures. By July of this year, this most expensive segment of the market

accounted for 30% of home foreclosures.

Based

on future projections, this isn't just a flash in the pan type problem.

Foreclosures are expected to rise from about 2 million currently, to 6.5

million by 2011. This cancer-like spreading of foreclosures even into the prior

taboo-area of prime mortgages is directly correlated with a weak job market.

Not

only is the 'official' unemployment rate quickly closing in on the foreboding

10% number, the average length of time unemployed, or without a job, has just

reached an all-time record of 26 weeks or six months.

It

seems like the real estate market is more aware of the seriousness of the issue

than the stock market. While the S&P 500 (NYSEArca: SPY - News), Dow Jones (NYSEArca: DIA - News) and Nasdaq (Nasdaq: QQQQ - News) have all reached new highs recently,

real estate ETFs like the Vanguard REIT ETF (NYSEArca: VNQ - News), iShares Cohen & Steers Reality

Majors (NYSEArca: ICF - News), and SPDR Dow Jones REIT ETF (NYSEArca: RWR - News) are still trading significantly below

their respective September recovery highs.

DISTURBING

FACT NO. 4: OIL PRICES

The

performance correlation between stocks and oil is tough to explain for

proponents of the 'business as usual' notion. High oil prices are usually the

scapegoat for a faltering economy, as we saw last year. As oil (NYSEArca: USO - News) rose to never before seen highs

($147/barrel), stock prices were plummeting.

Earlier

this year in February , however, oil prices were hovering near lows of

$30/barrel. At that time, the average price of gas was below $2 gallon.

CNNMoney asked just recently: 'But how good did you feel about the economy back

then? Fears about a massive wave of big bank failures and another depression

were running rampant. So, cheaper oil and gas were little consolation.'

At

precisely that time, when fears of another depression were running rampant, the

ETF Profit Strategy Newsletter issued a Trend Change Alert predicting the

onset of the most powerful rally since the October 2007 highs. While many were

selling at the worst time, Profit Strategy subscribers started accumulating

high octane leveraged ETFs, which racked up double and triple digit gains,

since.

Earlier

in 2008, the ETF Profit Strategy Newsletter introduced the 'red

across the board scenario'; a scenario where all asset classes should move in

the same direction. For most of 2008, the direction was down; beginning in

March 2009, the direction was up.

The

only economic environment that has the power to link the performance of various

asset classes is a deflationary depression, such as the Great Depression. Aside

from a 50% monster rally from 1929-1930 where all asset classes shot up (sound

familiar) simultaneously, the predominant trend was down, down hard.

DISTURBING

FACT NO. 5: (OVER) VALUATION

As a

consumer, chances are you're always looking for the best deal. Why overpay if

you can get the same item at a lower price elsewhere, or later on? Who, for

example, would still pay the sticker price for a gas guzzling SUV like a Chevy

Tahoe or Ford Explorer? Nobody! Even if the car served you well while you owned

it, you know that its resale value would be sub-par at best.

If

you wouldn't overpay for a car, why would you overpay for stocks?

Stocks

are way overvalued; it just hasn't sunk in yet. Based on actual reported

earnings, the P/E ratio for the S&P 500 is 138. This means that a stock

sells for 138x its actual earnings. Of course, this is the average for the

S&P. Many companies, such as Alcoa, aren't even in positive earnings

territory. The earnings picture today is worse than it was in the year 2000

when dozens of tech companies (NYSEArca: XLK - News) with no earnings saw their stock prices

soar into triple digits.

Even

though stocks still trade 30% below their 2007 levels, dividend yields are

within reach of their all-time lows. Dividends reflect a company's ability to

share its profits with shareholders. Declining dividends are caused by

declining profits. Dividend yields can increase either by a falling stock price

or rising dividends.

In

March, dividends for the broad market spiked briefly above 4%, due to the

waterfall decline in stock prices. For a short time, the Select Sector

Financial SPDRs (NYSEArca: XLF - News) offered a juicy yield of nearly 10%.

With rising prices, dividends have dropped back down towards 2% for the broad

market and only 2.52% for XLF.

Investors

with an affinity for historical data know that the stock market has never

reached a true bottom unless dividend yields are driven sky-high by falling

prices, and P/E ratios are driven down to rock-bottom readings, also due to

falling 'P' (prices). Once this valuation reset happens, the market will give a

green signal for the next bull market.

Unfortunately,

this reset did not happen at the 2002 lows. It also didn't happen in March

2009, and we are certainly far away from those levels with the Dow around

10,000 and P/E ratios of 138.

The

October issue of the ETF Profit Strategy Newsletter

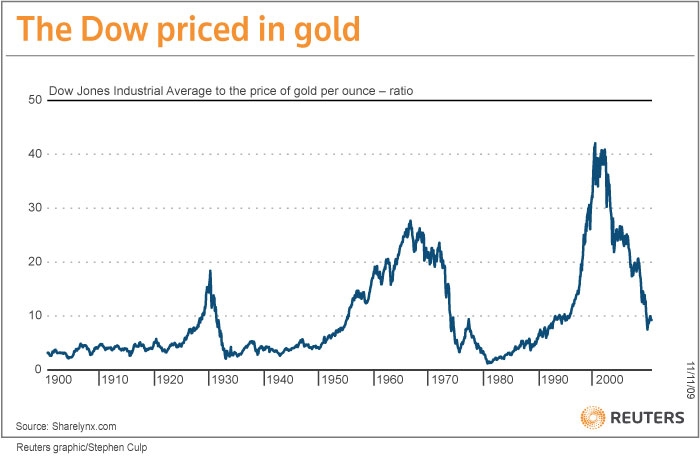

includes a detailed analysis of P/E ratios, dividend yields, and two other

indicators; mutual fund cash levels and the Dow measured in the only true

currency - gold (NYSEArca: GLD - News). Since its 1999 peak, the gold-Dow has

spearheaded the decline to new lows. If history's assessment of valuation is

correct, the dollar-Dow will soon follow.

Confidence,

reflected by the elevated investor optimism (a contrarian indicator) does not

only breed danger, it also provides opportunities for savvy investors that know

how to interpret the market's very own signals.

- MARK

BERN: It's pretty scary to me when even

companies that are significantly under-performing on revenue and earnings

are keeping up with those companies that performing well. I suspect that this

sort of action will end badly, with those companies that are undeserving

getting slaughtered when fundamentals start to matter again. It's really

kind of reminiscent of the good old dot com days when earnings didn't

really matter. All such improprieties do end. The dream will end and we

will all wake up hoping that we did pay attention to those silly things

like revenue growth and earnings after all.

- MARK ACE: This

is the most honest article I have read in along time, but there may be a few

reasons below the surface that are driving at least some of this insanity.

The charts and technicals suddenly look better to the computers doing the

trading as many of the big dips from last year have now fallen off of the

charts and stats.The ETF mania causes stocks to be grouped by industries

or indexes with little regard for individual performance or fundamentals

and ETF buying is now a market force.Pure greed is overriding too many

decisions with too many investors afraid of missing out and creating a

psychology of panic buying and still pushing some short sellers into

covering. However, I think a big driver is simply the notion

that cash is trash and so with the dollar diving holding any other asset

is a plus at the moment. Ultimately the falling dollar will cause other

problems costing investors dearly in purchasing power, but the gains look

good on paper and beat the losses possible from holding dollars and not

investing them. Unfortunately, there

are too many conflicting variables out there in the form of considerations

like:government interventions, herd mentality buying and selling, quick

moving currency valuations, artificial interest rates and potenial

inflation affecting investments decisions far more than individual

fundamentals of individual companies I used to be an avid DD guy, but have

now found it to be a waste of time.

The double dip has

begun.

Statistically, we

will see a rise in GDP in Q3 and in Q4. This is anticipated and meaningless data,

but the numbers will hit headlines.

In the real world,

the double dip has begun. Here is why - no one seems to be willing to pull

things together in one short argument, perhaps for fear of being bored by a

bull wearing green shoots. Simply put, all the core factors in driving an

economy upward are broken other than pundit comments talking about "it

must turn upward base on historical data." ..

Unemployment:

The reported unemployment number

is 9.8%; real unemployment is 20% if you include those who have stopped looking

and part time workers wanting to work full time. And the labor force

participation rate is at a 23 year low.

National

Income: Wages are falling

and work hours are stagnant, according to Friday's jobs report, and combine

these data with a shrinking work force and rising unemployment and you continue

to have a sharp downturn in national income.

Consumer

Spending: National income

drives consumer spending, which is contracting due not just due to falling

national income but rapidly contracting credit lines and a near 40% loss of

accumulated wealth in the property and equity markets. And while consumer

spending ostensibly is 70% of the economy, this includes spending on health care

- love those government statisticians - so contraction has an incredibly

outsized impact on consumer discretionary spending - luxury goods, travel,

restaurants, unnecessary goods, expensive goods - anything you can trade down

from to a lower level of price with equivalent functionality.

Credit

Contraction: The credit

contraction has been ferocious for consumers and small businesses as noted this

morning by uber analyst Meredith Whitney (one of my favorites) in the Wall

Street Journal. Depending on how you slice data, almost all increases in

consumer spending since either 2002-2003 or 1997 has been due to credit.

Trillions have been withdrawn and Ms. Whitney postulates another $1.5 trillion

dollars will disappear in the coming months due to banking caution and changes

in regulations. Given the total lack of credit to small business, and this

segment is 38% of GDP and 50% of new job creation, there cannot be a recovery

until credit begins to flow.

Zombie Banks:

Nothing has changed with

toxic assets and zombie banks - nothing, and even the IMF said this - and

another $1.5 trillion needs to be written down, at least. Just because these

assets are not in the headlines, and the Fed, the Treasury and the FASB faked

stress tests and changed accounting rules, this does not mean the banks are or

will be lending in a meaningful way in the near future. The Fed prints money,

the banks sit on it to shore up busted balance sheets.

Business Investment: There are too many factories around the world, too many

shopping malls an stores, too much commercial real estate - and at levels

beyond all historical norms or comparisons. The first several legs of a rebound

needed to absorb this capacity before we see any uptick in business investment

that materially helps the economy.

The End of

Stimulus: The buy gold and

build a bomb shelter types have been screaming about the Fed printing money -

what the Fed did was print enough money (they added a trillion to their balance

sheet) to replace what was lost in the shadow and real banking systems - but

not enough to replace what will be lost in the next 12-24 months. That being

said, there is no political support for more stimulus. Deficits and a

Congressional election preclude another stimulus package next year and the Fed

and Uncle Sam have already said they are definitely pulling back, beginning

November 1. We saw what happened to auto sales after Cash for Clunkers ended;

ditto for home sales data in the coming weeks as the $8K tax credit expires.

The bottom line: the economy will be much on its own next year.

Corporate Earnings: Corporate earnings follow the economy and they may be all

right for Q3 and perhaps Q4 but they are going to disappoint the Street in

2010, big time. You can only cut costs so much - you need some top line growth -

and it is only going to be there next year.

Markets: And one historical norm I like is the regressing of

markets to the mean of corporate earnings. Translation - the market should be

coming down next year or perhaps in 2011.

What to Do:

If you like to short,

consider the following - short the S+P (puts on the SPY), long term; short

consumer discretionary spending via puts on the XLY; short the companies making

stuff know one needs, like Harley Davidson (HOG) and Brunswick (BC);

short companies making things no one can get credit to buy, such as new homes,

via puts on the XHB ETF; short business

spending via travel companies, the first thing to be cut in a business cutback,

via puts on Avis (CAR); short retailers with

terrible balance sheets, notably Macys (M).

Obama referred to Friday's

jobs data, a loss of 263,000 jobs (roughly 100,000 more than economists

expected) as sobering.

Well, I agree, but to say it was unexpected is to buy into those that thinks we

are in recovery phase. To me we are in the lull before the storm. By the way,

of over 80 economists surveyed, none, not one, predicted the number to be as

high as 263,000. That reality is sobering.

But if you really

want something sobering, I suggest the following link. As

the author points out, if you are expecting consumers to start spending more

money for an economic rebound then you are sadly mistaken. They are already

spending at very high (record) levels in terms of a percentage of personal

income and as a percentage of GDP. And even that is not really lifting us out

of this recession absent government support. Even though consumers are pretty

much spending as much as they can, the economy is still struggling. So I don't

expect things to improve from here.

And as this

piece points out, we are in for a world of hurt due to the size of the

private debt that has built up. We may do well in the short to medium term

while government spending/stimulus props us up, but that will in time end and

then we are all in for a world of hurt.

Now I hate

repeating myself so much, but let's consider the math and see where it leads us:

- The

unemployment rate is nearing a two decade high;

- Those with

jobs are working the these least number of hours per week ever (roughly

33);

- Adjusted

for inflation, hourly wages are at their lowest in three decades;

- Overall

debt, government and private, is at record levels;

- Foreclosures

are mounting on both a residential and commercial level;

- There

are an estimated 13 months worth of shadow inventory of houses, i.e. those

that will be for sale but are being held off the market for one reason or

another;

- When

closing costs are considered, nearly 50% of all homes are under water on

their mortgages;

- We

have now reached a record in terms of unemployed people who are staying

unemployed beyond their unemployment benefits;

- We

also have a record in terms of job availability for the unemployed with

job openings only there for one in six who are unemployed;

- Our

economy is over two thirds reliant on consumer spending, which is a

totally unsustainable model going forward;

- Financial

companies have doubled their GDP contribution in the past decade or so,

though it is now obvious that they are not adding any benefit to the

economy; and

- I am

tired of repeating all this bad news with seemingly no one paying

attention.

Folks,

I am not saying when the problems will sink in and take hold, but they have to

at some point. At the very best, our economy will be stagnant for years to

come, probably over a decade. More likely, in my opinion, we have a world of

hurt on the way with the only question in my mind being when will this reality

sink in?

PREPARE

FOR A LOWER DOW TO GOLD RATIO…by Moses Kim – Seeking Alpha…That era of paper

wealth is gone for now, as evidenced by the mass failure of financial

institutions last fall, and we have entered into a period when hard assets are

in vogue. The Dow to Gold ratio is a useful tool to track this process of asset

reallocation, since gold is the ultimate hard asset. Usually, when hard assets

enter into a bull market, the Dow to Gold ratio goes to under 5. For example,

the ratio hit 1 in 1896, 2 in 1932, 3 in 1974, and 1 again in 1980. The current

bull market in gold has brought the ratio from a high of 44 in 1999, to its

current reading of 10. In addition, there seems to be a tendency for the ratio

to "overshoot" on the downside based on how overextended the ratio

becomes. For example, an 18 Dow:Gold ratio eventually fell to 2 in 1932, and a

27 Dow:Gold ratio eventually fell to 1 in 1980. Considering that the Dow:Gold

ratio was at 44 prior to this move, it looks like we still have a long way to

go on the downside… With stocks overpriced at over 100 times reported earnings,

a decent-sized pullback is in order. Therefore, I expect the Dow to Gold ratio

to decrease in the coming months and years…

CALPERS IS UNSUSTAINABLE

Jeff Nielsen The mainstream, U.S. media continue to ignore a

steadily worsening pension crisis, most likely because it is one more huge

contradiction of all their “U.S. economic recovery” propaganda. Unlike the $70

trillion or so in “unfunded liabilities” which is certain to bankrupt the U.S.

federal government – but not today, the U.S. pension-crisis is already here.

When the chief actuary of the nation's largest, state pension plan (CalPERS) bluntly states, “We are facing

decades...of...unsustainable pension costs”, this should have attracted the

attention of journalists across the U.S. Unfortunately, they all appear to be

much too busy handing out their “U.S. economic recovery” party-hats to be

paying attention. Some people may not see a direct connection between the

health of U.S. pension plans and the health of the overall economy, however the

connection is clear – and has never been greater than it is today. The huge,

demographic bulge known as “the baby-boomers” are beginning to retire. After

plundering government coffers for their entire lives by demanding exorbitant

social programs which they were unwilling to pay for with their own taxes, they

have literally mortgaged the futures of their own children and grand-children.

But the “plague” these “locusts” have inflicted on the U.S. economy goes well

beyond that. These are the same baby-boomers who dismantled the U.S.

manufacturing sector, and shipped it to Asia – so that they could pay less for

the ever-increasing hoard of consumer-goods which they have accumulated with

manic zeal. In the process, they have also eliminated most of the well-paying

jobs which they benefited from, but which they have taken away from their

children and grandchildren. Despite the baby-boomers having the best-paying

jobs of any generation in history, and ridiculously low taxes (relative to the

gold-plated social programs they demanded), these pampered prima donnas have

been so recklessly irresponsible with their own spending that this generation

has less in savings than previous generations. As a result, this bloc of

selfish spendthrifts is more dependent on lavish pensions (and pie-in-the-sky

medical benefits for seniors) than their own parents. The problem is that this

group has mismanaged their own pension-plans just as badly as they have

mismanaged the overall economy and government finances. In other words, just as

they have doing all their lives, U.S. baby-boomers are planning on spending

money they don't have all through their retirements – in order to fund their

lavish lifestyles. However, having squeezed all of the wealth out of the U.S.

economy, and squeezed all the wealth out of their children and grandchildren,

there is no money to top-up their mismanaged, under-funded pension plans (along

with the equally generous retirement medical plans which accompany them). The

bottom line is that this generation of financial-failures is already facing a

multi-trilllion dollar shortfall - which is totally separate from the $70

trillion funding-gap in Social Security and Medicare (see “U.S. Pension Crisis: the $3 TRILLION question”).

This is a crisis which is developing from the bottom up. Vallejo, the one-time

state capital of California, was already forced into bankruptcy due to the

unsustainable retirement benefit plans of its municipal workers. Meanwhile, on

the opposite coast, municipal leaders lament that they only have enough funds

to pay for either the pension/medical plans of their former police officers and

firefighters, or the salaries of the current police and firefighters. Further

aggravating this crisis at the local level, many municipal governments were

severely “burned” through being conned into various forms of “exotic financing”

by Wall Street scam-artists. Municipalities and public institutions not just in

the U.S., but all over the world, have been crippled by countless billions in

losses – while paying these financial predators fat fees to ruin them. It is

within this context that we can begin to examine the problems of the

pension-plans, themselves. To start with, the “financial model” (and solvency)

of most of these pension funds is based on the premise of a rate of return far

in excess of the historical, average rate of return in the U.S. economy. This

is despite the fact that the U.S.'s steadily growing mountain of

never-to-be-repaid debt requires an ever-greater percentage of the U.S.'s GDP

just to service the interest payments on this debt…

Is It a Stock Market Rally or a Dollar Devaluation Seeking

Alpha…A cheaper dollar means higher stock prices (temporaily), as US assets are

marked down for global investors. What we have is not a stock market rally but

an adjustment to global market prices. Fully 80% of the movement in the S&P

can be explained by the movement in the dollar index. That is a profile well

known to emerging market investors. Whenever the Brazilians would pull another

currency devaluation, stock prices rose to compensate, as tradeable assets

floated up to world market prices. The bank bailout has made Americans poorer

relative to the rest of the world and created the illusion of a stock market

recovery…

Wall Street was all in at the bottom, they caused the

reversal and resulting rally on declining volume, they held up the market all

on their own until institutional money managers fear ful of being accused of

missing the boat climbed aboard a few months later and now appear to be fully

invested, all that is left is for the fearful retail investor to be convinced

by Wall Street thats its safe for them to get on board as well. Based on Wall

Streets history for sacrificing the retail investor for the good of the market,

it seems that another black Oct is a forgone conclusion and then it starts all

over again. Aug 22 2009

Let me

put it this way, if the market goes down 50%, then goes up 50%, are you happy?

If that became a trend and happened 4 more times,

over say the next 3 years or so, you know what is left of your $1,000,000

investment?

Answer = $237,304

This

bull looks like BS to me. Low volume, high P/E. The market was oversold in

March and overbought now, but that doesn't mean it won't go higher or another

panic might not test the March lows. The important lesson for investors is that

you cannot time the market and must stay in the market to catch the upward

movements. Diversification is the key. Exposure to different asset classes,

including stocks, bonds, property, gold and cash. Don't be greedy.

Hypothetical scenario

start with $1 to invest in 1990 by 1999 you have

$2, now the dotcom bubble bursts your portfolio drops 50% and your left with

$1, back to square one, well then you hang in there and your investment grows

by 50% through 2008 so your up to $1.50, better then nothing though your only

up 50% in 2 decades, then we get the 2008 collapse down another 50% in 6 months

to $.75, so now your down 25% from your initial investment of $1 in 1990, but

wait if you can stay fully invested and all your positions move with the market

your up 50% in six months so you would now have $1.125 in your account, so

since 1990 your original investment of $1 has grown by 1/8 in just under 2

decades. Thats is reality for most investors and to think they dont know is

foolish and to think they will run back into the market again is also foolish,

without the Retail Pawns it will be hard for Wall Street to continue playing

the market manipulation game much longer

This

latest Bernanke-fueled rally confirmed--it's a pro market for technicians

driven by momentum based off Bernanke's cues. You can write the script--the

pro's drive another 300-500 points on the Dow, then small investors move in.

It's all good--until Jan/Feb/Mar. 2010 when consumer spending craters (then

back to Dow 8000) or when Israel bombs Iran (then back to Dow 6000).

I do not

know if this is a beginning of a bull or a bear. But, certainly, at these level

the US market is not a buy. Even in the positive scenario that the S&P

earns its 10 year average of 50 in 2010 it would stillbe a P/E of 20. Then

consider that the consumer will not return and that the government cannot

forever sustain its current cost to income ratio of 180% and you will have to

come to the conclusion to sell.

analysis try a qualitative analysis.

1. Volume is low over all and historically.

2. NDX typically leads any lasting rally,

3. The underlying economy is not likely to produce

the earnings projected (high probably multiple expansion is unwarranted).

4. The depth of the retraction into March was over

sized expect the bounces to be equally exotic.

5. The liquidity poured into the market is 7-10

times the amount seen in any other recession - where did it go beside bank

values? stocks.

6. Be patient and careful, momentum is fading the

market may be out of fuel.

As per Doug Short's great summary, it does not

mean the market cannot go higher temporarily - based on the momentum and

liquidity trading that is apparently happening - but it does clearly show that

the market is significantly overvalued by any historical comparisons with

previous recessions. Thus the only logical

conclusion is that (unless the market is somehow different this time-and it

never has been different before-despite bull and commentator claims to the

contrary) the market will endure at least one more very serious selloff at some

point in the relatively near future(or alternatively there will be some magical

hugh increase in corporate earnings, which is highly unlikely). Thus maybe one

can trade this market and make some money, but past historical comparisons

indicate there will be much better buying opportunites at much better