17

Reasons To Be EXTREMELY Concerned About The Second

Half Of 2012

http://theeconomiccollapseblog.com

http://17reasonssecondhalfworse.htm

What is the second half of 2012 going to

bring? Are things going to get even worse than they are right now?

Unfortunately, that appears more likely with each passing day. I will

admit that I am extremely concerned about the second half of 2012.

Historically, a financial crisis is much more likely to begin in the fall than

during any other season of the year. Just think about it. The stock

market crash of 1929 happened in the fall. "Black Monday"

happened on October 19th, 1987. The financial crisis of 2008 started in

the fall. There just seems to be something about the fall that brings out

the worst in the financial markets. But of course there is not a stock

market crash every year. So are there specific reasons why we should be

extremely concerned about what is coming this year? Yes, there are.

The ingredients for a "perfect storm" are slowly coming together, and

in the months ahead we could very well see the next wave of the economic

collapse strike. Sadly, we have never even come close to recovering from

the last recession, and this next crisis might end up being even more painful

than the last one.

What is the second half of 2012 going to

bring? Are things going to get even worse than they are right now?

Unfortunately, that appears more likely with each passing day. I will

admit that I am extremely concerned about the second half of 2012.

Historically, a financial crisis is much more likely to begin in the fall than

during any other season of the year. Just think about it. The stock

market crash of 1929 happened in the fall. "Black Monday"

happened on October 19th, 1987. The financial crisis of 2008 started in

the fall. There just seems to be something about the fall that brings out

the worst in the financial markets. But of course there is not a stock

market crash every year. So are there specific reasons why we should be

extremely concerned about what is coming this year? Yes, there are.

The ingredients for a "perfect storm" are slowly coming together, and

in the months ahead we could very well see the next wave of the economic

collapse strike. Sadly, we have never even come close to recovering from

the last recession, and this next crisis might end up being even more painful

than the last one.

The

following are 17 reasons to be extremely concerned about the second half of

2012....

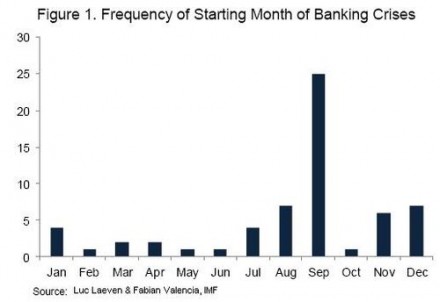

#1 Historical Trends

A

recent IMF research paper by Luc Laeven and Fabián

So

what will this September bring?

#2 JP Morgan

Do

you remember back in May when JP Morgan announced that it would be taking a 2 billion dollar trading loss on some

derivatives trades gone bad? Well, the New York Times is now reporting

that the real figure could reach 9 billion dollars, but nobody

really knows for sure. At some point is JP Morgan going to need a

bailout? If so, what is that going to do to the

#3 Derivatives

Last

week, Moody's downgraded the credit ratings of 15 major global banks.

As a result, a number of them have been required to post billions of dollars in additional collateral

against derivatives exposures....

Citigroup’s

two-notch long-term rating downgrade from A3 to Baa2 could have led to US$500m

in additional liquidity and funding demands due to derivative triggers and

exchange margin requirements, according to the bank’s 10Q regulatory filing at

the end of the first quarter.

Morgan

Stanley – which Moody’s downgraded from A2 to Baa1 – said a two-notch downgrade

from both Moody’s and Standard and Poor’s could spur an additional US$6.8bn of

collateral requirements in its latest 10Q. The bank did not break down its

potential collateral calls under a scenario where only Moody’s downgraded the

bank below the Single A threshold.

Royal

Bank of

The

worldwide derivatives market is starting to show some

cracks, and at some point this is going to become a major disaster.

Remember,

the 9 largest

#4 LEAP/E2020 Warning

LEAP/E2020

has issued a red alert for the global financial

system for this fall. They are warning that the "second half of

2012" will represent a "major inflection point" for the global

economic system....

The

shock of the autumn 2008 will seem like a small summer storm compared to what

will affect planet in several months.

In

fact LEAP/E2020 has never seen the chronological convergence of such a series

of explosive and so fundamental factors (economy, finances, geopolitical…)

since 2006, the start of its work on the global systemic crisis. Logically, in

our modest attempt to regularly publish a “crisis weather forecast”, we must

therefore give our readers a “Red Alert” because the upcoming events which are

readying themselves to shake the world system next September/ October belong to

this category.

#5 Increasing Pessimism

One

recent survey of corporate executives found that only 20 percent of them expect the global

economy to improve over the next 12 months and 48 percent of them expect the global

economy to get worse over the next 12 months.

#6

The

Spanish financial system is basically a total nightmare at this point.

Moody's recently downgraded Spanish debt to one level above junk status, and

earlier this week Moody's downgraded the credit ratings of 28 major Spanish banks.

According

to CNBC,

The

yield paid on a 3-month bill was 2.362 percent, up from just 0.846 percent a

month ago. For six-month paper, it leapt to 3.237 percent from 1.737 percent in

May.

Needless

to say, this is very, very bad news.

#7

The

situation in

The

euro zone’s third-biggest economy is seen as the next domino at risk of

toppling after the European Union’s June 9 deal to lend

A

recent Fortune article detailed some of

the economic fundamentals that have so many economists deeply concerned about

the Italian economy right now....

The

main glaring risk threats that could propel Italy down the path to become

Europe's next domino is the size of country's outstanding debt (at €1.9

trillion or 120% of GDP); the mountain of debt it has to roll over in the next

12 months (nearly €400 billion); and the market's cracking credibility around

Prime Minister Mario Monti's ability to reduce the

country's fiscal footprint and spur growth.

Further,

fear around Italy's creditworthiness, which has recently been expressed by near

cycle highs in sovereign CDS spreads and government yields on the 10-year bond,

follow some rather glaring negative fundamentals over recent quarters and

years: declining GDP over the last three consecutive quarters; a rising

unemployment rate (especially among its youth); deterioration in labor market

competitiveness; and increased competition for export goods to its key trading

partners.

#8

I

have written extensively about the financial

nightmare that is unfolding in

#9

The

tiny island nation of Cyprus has become the fifth member of the eurozone to formally request a bailout. This is yet

another sign that the eurozone is rapidly falling

apart.

#10

German

Chancellor Angela Merkel continues to promote an austerity path for

Merkel,

speaking to a conference in Berlin today as Spain announced it would formally

seek aid for its banks, dismissed “euro bonds, euro bills and European deposit

insurance with joint liability and much more” as “economically wrong and

counterproductive,” saying that they ran against the German constitution.

“It’s

not a bold prediction to say that in

In

fact, Merkel says that there will be no eurobonds

"as long as I live".

This means that there will be no "quick fix" for the problems that

are unfolding in

#11 Bank Runs

Every

single day, hundreds of billions of dollars is being pulled out of banks in

southern

In a previous article I included an extremely alarming

quote from a CNBC article about the unfolding banking crisis in

Financial

advisers and private bankers whose clients have accounts too large to be

covered by a Europe-wide guarantee on deposits up to 100,000 euros ($125,000), are reporting a "bank run by wire

transfer" that has picked up during May.

Much

of this money has headed north to banks in

"It's

been an ongoing process but it certainly picked up pace a couple of weeks ago

We believe there is a continuous 2-3 year bank run by wire transfer," said

Lorne Baring, managing director at B Capital, a Geneva-based pan European

wealth management firm.

How

long can these bank runs continue before banking systems start to

collapse?

#12 Preparations For

The Collapse Of The Eurozone

As I

have written about previously, the smart money has already written off southern

Visa

Chief

Commercial Officer Steve Perry said Tuesday that management at the U.K.-based

credit-card company meets weekly to explore various possible outcomes,

including a total collapse of the euro zone.

#13 Global Lending Is Slowing Down

All

over the globe the flow of credit is beginning to freeze up. In fact, the

Bank for International Settlements says that worldwide lending is contracting

at the fastest pace since the financial

crisis of 2008.

#14 Sophisticated Cyber Attacks On Banks

It is

being reported that "very sophisticated" hackers have successfully

raided dozens of banks in

Sixty

million euro has been stolen from bank accounts in a massive cyber bank raid

after fraudsters raided dozens of financial institutions around the world.

According

to a joint report by software security firm McAfee and Guardian Analytics, more

than 60 firms have suffered from what it has called an "insider level of

understanding".

What

happens someday if we wake up and all

the money in the banks is gone?

#15

All

over the

Stockton,

California, said it will file for bankruptcy after talks with bondholders and

labor unions failed, making the agricultural center the biggest U.S. city to

seek court protection from creditors.

“The

city is fiscally insolvent and must seek Chapter 9 bankruptcy protection,”

#16 The Obamacare Decision

The U.S. economy is already a complete and total mess, and

now the Obamacare

decision is going to throw a huge wet blanket on it. All over

#17 The

It is

being reported that Barack Obama is putting together an army of "thousands of lawyers" to

deal with any disputes that arise over voting procedures or results. It

certainly looks like this upcoming election is going to be extremely close, and

there is the potential that we could end up facing another Bush v. Gore

scenario where the fate of the presidency is determined in court. This

campaign season is likely to be exceptionally nasty,

and I fear what may happen if there is not a decisive winner on election

day. The possibility of significant civil unrest is certainly there.

We

definitely live in "interesting" times.

Personally,

I am deeply concerned about the September, October, November time frame.

The

other day, Joe Biden delivered a speech in which he made the following statement....

"It's A

Depression For Millions And Millions Of Americans"

And

what Biden said was right for once. Millions of Americans are out of work

right now and millions of Americans have fallen out of

the middle class in recent years. If you have lost everything, it

does feel like you are living through a depression.

When

people lose everything, they tend to get desperate. And desperate people

do desperate things - especially when they are angry.

A

whole host of recent opinion polls have shown that anger and frustration in the

Let

us hope for the best, but let us also prepare for the worst.